Term life insurance offers a crucial safety net for families, but what if you could receive your premiums back? Term life insurance with a Return of Premium (ROP) rider introduces a unique twist, promising a full refund of premiums paid if you outlive the policy term. This intriguing concept blends life insurance protection with a potential long-term financial benefit, but understanding its intricacies is key to determining if it’s the right choice for your financial landscape. This guide delves into the mechanics of ROP term life insurance, comparing it to traditional policies and exploring its potential advantages and disadvantages.

We will dissect the factors impacting cost, analyze the return of premium feature, and compare ROP to other investment vehicles. Through detailed examples and hypothetical scenarios, we aim to equip you with the knowledge to make an informed decision about whether ROP term life insurance aligns with your financial goals and risk tolerance.

What is Term Life Insurance with Return of Premium (ROP)?

Term life insurance with Return of Premium (ROP) is a type of life insurance policy that offers a death benefit for a specified term, like traditional term life insurance. However, the key differentiator is the inclusion of a return of premium rider, which guarantees the return of all or a portion of the premiums paid if the insured survives the policy term. This essentially transforms the policy into a form of savings vehicle alongside the death benefit protection.

ROP term life insurance policies provide a death benefit during the policy term, just as traditional term life insurance does. If the insured passes away within the term, the designated beneficiary receives the death benefit. The crucial distinction lies in the return of premiums upon policy expiration if the insured is still alive. This return is typically paid out as a lump sum.

Premium Return Circumstances

The premium is returned to the policyholder only if they survive the entire policy term. No premiums are returned if the insured dies during the policy term, as the death benefit would have already been paid to the beneficiary. The specific terms and conditions regarding the return of premium, including any potential adjustments or deductions, are clearly Artikeld in the policy contract. For instance, some policies might deduct administrative fees or other charges before returning the premium.

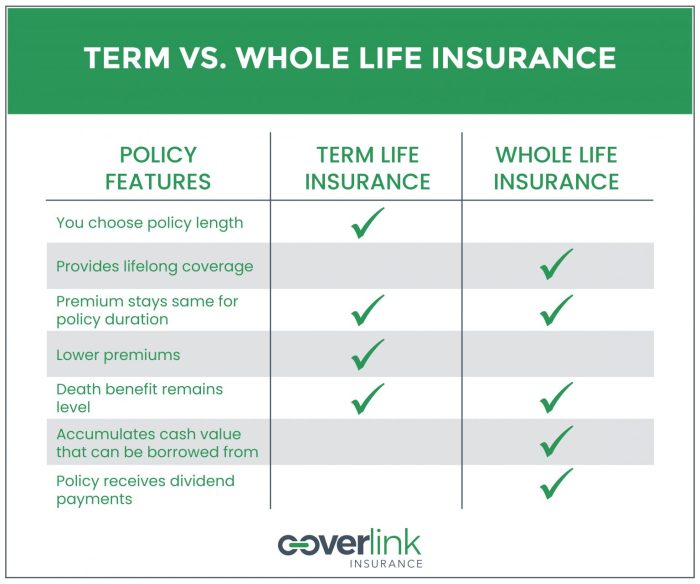

ROP Term Life Insurance Compared to Traditional Term Life Insurance

The primary difference between ROP and traditional term life insurance is the return of premiums feature. Traditional term life insurance offers a death benefit for a specified term but doesn’t provide a refund of premiums if the insured survives the term. In essence, ROP policies offer a combination of life insurance protection and a savings element, while traditional term life insurance solely focuses on providing a death benefit. This makes ROP policies generally more expensive than traditional term life insurance policies with equivalent coverage.

Examples of ROP Term Life Insurance Policy Structures

Several variations exist in the structure of ROP term life insurance policies. For example, one policy might return 100% of the premiums paid, while another might return only a percentage, say 90%, after deducting administrative fees or other charges. The length of the term can also vary significantly, ranging from 10 to 30 years, influencing the overall cost and the potential return. Furthermore, some policies might offer different premium return options based on the age of the insured at the time of policy purchase. For instance, a younger insured might receive a higher percentage return than an older insured, reflecting the actuarial risk. A 20-year ROP policy, for example, could return 100% of premiums paid if the policyholder survives the 20-year term, whereas a 10-year policy might return a smaller percentage, or a higher percentage for a younger applicant. These variations illustrate the need for careful comparison shopping to find a policy that best suits individual needs and financial goals.

Cost and Value of ROP Term Life Insurance

Return of Premium (ROP) term life insurance offers a unique value proposition, but understanding its cost is crucial to determining its overall worth. The added benefit of premium return at the end of the term comes at a price, and careful consideration is needed to weigh the benefits against the higher premiums.

Several factors influence the cost of ROP term life insurance. The most significant is the length of the term. Longer terms naturally lead to higher premiums, reflecting the increased risk the insurer assumes over a longer period. Age and health also play a substantial role. Younger, healthier individuals typically qualify for lower premiums compared to older applicants or those with pre-existing health conditions. The amount of coverage desired is another key factor; larger death benefit amounts translate to higher premiums. Finally, the specific insurer and policy features can also affect the cost. Different insurers have different underwriting guidelines and pricing structures.

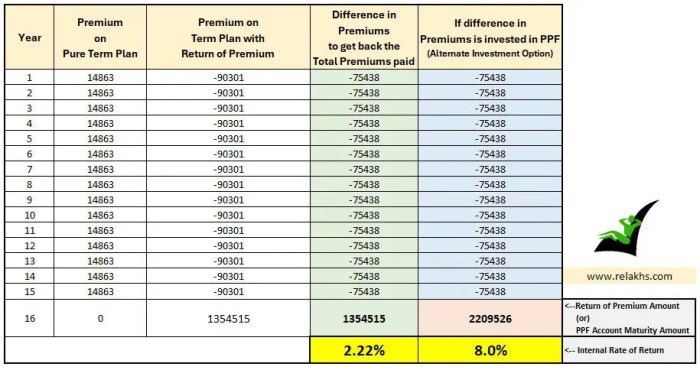

ROP Term Life Insurance Cost Compared to Traditional Term Life Insurance

The following table illustrates a hypothetical comparison between ROP and traditional term life insurance premiums and total costs over a 20-year term for a 35-year-old male seeking $500,000 in coverage. These figures are for illustrative purposes only and actual premiums will vary based on the factors mentioned above. It’s crucial to obtain personalized quotes from multiple insurers for accurate cost comparisons.

| Policy Type | Premium per year | Total Premium Paid | Net Cost (after return of premium) |

|---|---|---|---|

| Traditional Term Life Insurance | $1,000 | $20,000 | $20,000 |

| ROP Term Life Insurance | $1,500 | $30,000 | $0 |

Long-Term Financial Benefits and Drawbacks of ROP Term Life Insurance

The primary benefit of ROP is the return of all premiums paid at the end of the policy term, provided the policy remains in force. This can provide a significant financial boost, essentially acting as a forced savings plan. However, this benefit comes at the cost of significantly higher premiums compared to traditional term life insurance. Over the policy term, the total premiums paid for ROP will be substantially more. Therefore, a thorough cost-benefit analysis is essential to determine if the return justifies the higher upfront cost.

Consider this scenario: If the policyholder dies during the policy term, the beneficiary receives the death benefit, and there is no return of premiums. Conversely, if the policyholder lives to the end of the term, they receive the accumulated premiums. The financial outcome depends entirely on whether the policyholder survives the policy term. Therefore, the financial advantage is not guaranteed.

Scenarios Where ROP Term Life Insurance Might Be Worthwhile

ROP term life insurance might be a worthwhile investment for individuals who prioritize guaranteed return of premiums and have a strong aversion to losing any money invested in life insurance. For example, someone with a strong preference for financial security and a disciplined savings approach might find ROP appealing. It can be a suitable option for individuals who struggle with consistent saving and need the built-in structure of premium payments to ensure they have a substantial sum at the end of the term. However, this should always be weighed against the higher cost compared to traditional term life insurance.

Understanding the Return of Premium Feature

Return of Premium (ROP) term life insurance offers a unique benefit: the return of your premiums if you outlive the policy term. This isn’t a guaranteed profit, but rather a feature designed to mitigate the financial risk associated with purchasing a term life insurance policy that ultimately doesn’t pay a death benefit. Understanding the conditions under which this return is triggered and how it’s calculated is crucial before purchasing an ROP policy.

The return of premium is triggered simply by outliving the policy term. If you maintain the policy in good standing (meaning you continue to make premium payments on time) until the policy’s expiration date without filing a death benefit claim, the insurance company will return the premiums you’ve paid, usually in a lump sum. There are no other specific events that trigger this payout; it’s solely contingent on surviving the policy’s duration. It’s important to note that some policies may have stipulations regarding the timing of the return; for example, the return might be slightly delayed after the policy’s end date.

Return of Premium Calculation and Disbursement

The calculation of the returned premium is generally straightforward. It’s typically the total amount of premiums paid over the life of the policy. However, some policies might deduct certain fees or charges before issuing the return. The policy document will clearly Artikel any deductions. Disbursement is usually made directly to the policyholder via check or direct deposit, once again as detailed in the policy’s terms and conditions. For example, if a policyholder paid $10,000 in premiums over ten years and the policy contained no deductions, they would receive a $10,000 return.

Policy Language Examples Regarding Return of Premium

Policy language concerning the return of premium varies among insurers, but the core concept remains the same. Here are a few examples of how this clause might be worded:

“Upon the expiration of this policy, provided all premiums have been duly paid and no death benefit claim has been made, the Company shall return to the policyowner the total amount of premiums paid under this policy, less any applicable deductions as specified herein.”

“If the insured survives the policy term and all premiums are paid in full, the Company will refund 100% of the premiums paid, excluding any applicable policy fees, within [number] days of the policy’s expiration date.”

The precise wording may differ, but the essential components – surviving the term, maintaining premium payments, and the return of premiums (with or without deductions) – will always be clearly stated.

Tax Implications of Return of Premium

The tax implications of an ROP policy’s return are generally favorable. The returned premiums are usually considered a return of capital, meaning they are not taxed as income. However, it’s crucial to consult with a tax professional to understand the specific tax implications in your jurisdiction, as tax laws can be complex and vary. For instance, if the return includes interest or other earnings, these components might be subject to taxation. The specific tax treatment will depend on individual circumstances and the details Artikeld in the policy. Consulting a tax advisor is highly recommended to avoid any unforeseen tax liabilities.

Illustrative Examples of ROP Term Life Insurance

Understanding the practical implications of Return of Premium (ROP) term life insurance requires examining various scenarios. The following examples illustrate how ROP policies perform under different circumstances, highlighting both their advantages and potential disadvantages.

Scenario 1: Early Death

Imagine Sarah, a 35-year-old mother, purchases a 20-year ROP term life insurance policy with a death benefit of $500,000. Annual premiums are $2,000. Sadly, Sarah passes away unexpectedly after five years. Her beneficiaries receive the full $500,000 death benefit, irrespective of the premiums paid. This illustrates the core purpose of life insurance – providing financial protection for loved ones in the event of the policyholder’s death. The ROP feature is irrelevant in this scenario, as the focus is on the death benefit payout.

Scenario 2: Policy Surrender Before Term Completion

Let’s consider John, a 40-year-old who purchased a 30-year ROP term life insurance policy with a death benefit of $750,000 and annual premiums of $3,000. After 15 years, John decides to surrender his policy. Since he hasn’t reached the policy’s maturity, he won’t receive the full return of premiums. Instead, he might receive a smaller cash value, reflecting the premiums paid, minus any applicable fees or surrender charges. This amount will be significantly less than the total premiums paid over the 15 years. The exact amount would depend on the specific policy terms and the insurer’s surrender value calculation.

Scenario 3: Full Term Completion

Consider Maria, a 30-year-old who purchases a 20-year ROP term life insurance policy with a death benefit of $1,000,000 and annual premiums of $4,000. Maria remains healthy and lives to the end of the 20-year term. At the end of the policy term, she receives the full return of premiums paid, totaling $80,000 ($4,000 x 20 years). This scenario demonstrates the key benefit of an ROP policy: the return of premiums invested if the policyholder survives the policy term. The policy provided no death benefit payout, but the policyholder receives a significant financial return.

Illustrative Policyholder Experience: David’s ROP Policy

David, age 45, purchased a 20-year ROP term life insurance policy with a $1 million death benefit. His annual premium was $5,000. Over 20 years, his total premium payments amounted to $100,000. He remained healthy and lived past the policy’s term. At the end of the 20 years, David received a lump-sum payment of $100,000, representing the full return of his premiums. His net cost of the policy was zero. This illustrates a successful outcome for a policyholder choosing an ROP policy.

Impact on Financial Planning: The Case of Emily

Emily, age 38, is planning for her retirement. She considers purchasing a 20-year ROP term life insurance policy. She projects that by the time she retires, the return of premium could serve as a supplementary retirement fund, offsetting some of her retirement expenses. This potential supplemental income adds an additional layer of security to her financial plan. However, she also acknowledges that the higher premiums of an ROP policy compared to a standard term life insurance policy might impact her ability to invest in other retirement vehicles during the policy’s term. This highlights the trade-off between the guaranteed return of premiums and potentially higher investment returns from alternative savings options.

Closure

Ultimately, the decision of whether to opt for term life insurance with a return of premium rider hinges on individual circumstances and financial priorities. While the potential for a premium refund offers an attractive incentive, it’s crucial to weigh the higher premiums against the long-term financial benefits. By carefully considering your risk tolerance, financial goals, and the potential alternatives, you can determine if ROP term life insurance provides the optimal balance of protection and investment potential for your unique needs. A thorough understanding of the policy’s terms and conditions, as well as seeking professional financial advice, is paramount before making a commitment.

Questions and Answers

What happens if I die during the policy term?

Your beneficiaries receive the death benefit, regardless of whether premiums have been fully returned.

Can I surrender my ROP policy early?

Generally, surrendering early means forfeiting the return of premium, though you may receive a cash value, which is typically less than the premiums paid.

Are there any health requirements to qualify for ROP term life insurance?

Yes, insurers assess applicants’ health status, just like traditional term life insurance. Pre-existing conditions may impact eligibility or premiums.

How does inflation affect the value of the returned premium?

The returned premium’s purchasing power will be affected by inflation. It’s essential to consider this when evaluating the long-term value.