Securing your family’s financial future through life insurance is a crucial step, but understanding the intricacies of term life insurance premiums can feel overwhelming. This guide unravels the complexities, offering a clear and concise explanation of the factors influencing your costs. We’ll explore how age, health, lifestyle choices, and policy features all contribute to the final premium, empowering you to make informed decisions.

From comparing premiums across different insurers to understanding the impact of policy length and riders, we aim to demystify the process. By the end, you’ll have a solid grasp of how term life insurance premiums are calculated and how to find the best policy for your individual needs and budget.

Factors Influencing Term Life Insurance Premiums

Several key factors influence the cost of term life insurance premiums. Understanding these factors allows you to make informed decisions when securing coverage. This section will detail the impact of age, health, smoking habits, and gender on your premium.

Age’s Influence on Term Life Insurance Premiums

Age is a significant determinant of term life insurance costs. As you get older, your risk of death increases, leading to higher premiums. Younger individuals generally qualify for lower rates due to their statistically lower mortality risk. The following table illustrates premium differences across various age groups for a healthy non-smoker, assuming a 10-year term policy. Note that these are illustrative examples and actual premiums will vary based on other factors and the specific insurer.

| Age | Premium for $250,000 policy | Premium for $500,000 policy | Premium for $1,000,000 policy |

|---|---|---|---|

| 30 | $150 | $250 | $450 |

| 35 | $175 | $300 | $550 |

| 40 | $250 | $450 | $800 |

| 45 | $400 | $700 | $1200 |

| 50 | $600 | $1000 | $1800 |

Health Status and Term Life Insurance Premiums

Your health status plays a crucial role in premium calculations. Insurers assess your health risk based on medical history, current conditions, and lifestyle choices. Individuals with pre-existing conditions or a family history of certain diseases may face higher premiums. For example, someone with a history of heart disease or cancer would likely pay more than someone with a clean bill of health. Similarly, individuals with high blood pressure or high cholesterol might see elevated premiums. Conversely, maintaining a healthy lifestyle can lead to lower premiums.

Smoking Habits and Term Life Insurance Premiums

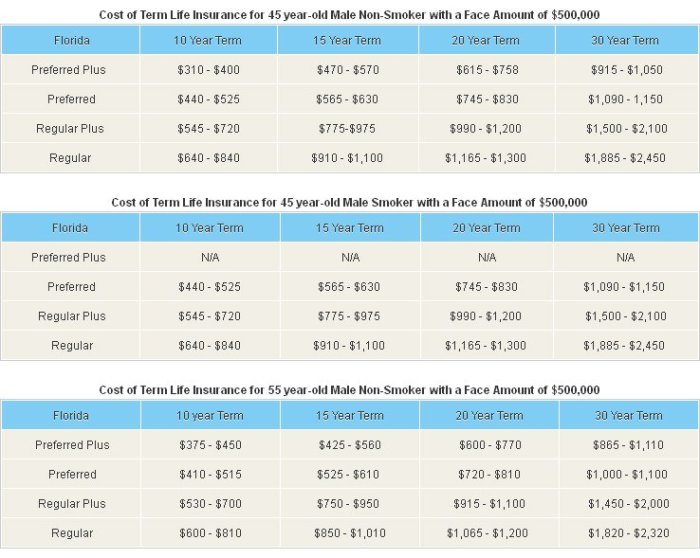

Smoking significantly increases your risk of various health problems, including heart disease, lung cancer, and stroke. Consequently, smokers typically pay substantially higher premiums than non-smokers.

- Non-Smokers: Generally receive the lowest premiums due to their lower risk profile.

- Smokers: Face significantly higher premiums, often double or even triple the cost for non-smokers, reflecting the increased risk associated with smoking.

Gender’s Influence on Term Life Insurance Premiums

Historically, women have tended to pay lower premiums than men for term life insurance. This is partly due to statistical differences in life expectancy. However, this gap is narrowing as insurers refine their risk assessment models and consider a broader range of factors. While women might still benefit from slightly lower rates in some cases, the difference is often less pronounced than in the past.

Length of Term and Premium Costs

The length of your term life insurance policy significantly impacts your monthly and overall premium payments. Generally, longer terms mean higher premiums per year, but lower average annual premiums due to the longer payment period. Understanding this relationship is crucial for choosing a policy that aligns with your financial goals and life stage.

Longer term policies, while having higher total premiums, distribute the cost over a longer period, resulting in lower annual payments. Conversely, shorter-term policies have lower total premiums but higher annual payments. The optimal choice depends on individual circumstances and risk tolerance.

Premium Costs for Different Policy Lengths

The following table illustrates how premiums vary based on policy length. These are sample figures and actual premiums will vary based on several factors discussed later. Remember, these figures represent premiums for $100,000 of coverage.

| Term Length | Premium per $100,000 | Total Premium Paid | Average Annual Premium |

|---|---|---|---|

| 10-year | $150 | $15,000 | $1,500 |

| 20-year | $200 | $40,000 | $2,000 |

| 30-year | $250 | $75,000 | $2,500 |

As you can see, the total premium paid increases significantly with longer term lengths. However, the average annual premium remains relatively manageable, making longer terms potentially attractive for those seeking long-term coverage at a lower annual cost. It’s important to note that these are illustrative examples, and actual premiums will vary considerably.

Factors Influencing Premium Costs Beyond Term Length

Several factors beyond the term length influence the cost of your annual premiums. These include your age, health, gender, smoking habits, and the type of policy you choose.

For example, a younger, healthier non-smoker will generally receive lower premiums than an older smoker with pre-existing health conditions. Similarly, the inclusion of riders or additional benefits can increase the overall cost. It is important to compare quotes from multiple insurers to find the best rate for your specific circumstances.

Illustrative Examples of Premium Calculations

Understanding how term life insurance premiums are calculated involves considering several interconnected factors. The following examples illustrate how variations in age, health, policy features, and term length can significantly impact the final premium. These are hypothetical examples and actual premiums will vary based on the specific insurer and individual circumstances.

Example 1: A Healthy, Young Applicant

Let’s consider a 30-year-old non-smoker, male, with a clean bill of health applying for a $500,000, 20-year term life insurance policy. This individual leads an active lifestyle, maintains a healthy weight, and has no family history of significant health issues. Due to his favorable risk profile, the insurer assesses him as a low-risk applicant. Consequently, his premium might be relatively low, perhaps around $30 per month. This reflects the lower likelihood of a claim being filed within the 20-year policy term.

Example 2: An Applicant with Pre-existing Conditions

Now, consider a 45-year-old female smoker with a history of high blood pressure. She is applying for the same $500,000, 20-year term life insurance policy. Her age, smoking habit, and pre-existing condition place her in a higher-risk category. The insurer will likely assess a higher premium to account for the increased probability of a claim within the policy term. Her monthly premium could be significantly higher, potentially exceeding $100 per month. This demonstrates how pre-existing health conditions and lifestyle choices directly impact premium costs.

Example 3: Impact of Policy Term Length

Let’s examine the effect of term length on premium costs. Imagine a 35-year-old healthy male applying for a $250,000 term life insurance policy. If he chooses a 10-year term, the insurer’s risk is lower, resulting in a lower premium. This might be around $20 per month. However, if he opts for a 30-year term, the insurer’s risk increases, leading to a higher premium, potentially around $40 per month or more. This highlights the trade-off between a longer coverage period and higher monthly payments. The longer the term, the greater the chance of a claim occurring, therefore justifying the increased cost.

Final Thoughts

Navigating the world of term life insurance premiums requires careful consideration of numerous factors. While price is undoubtedly important, remember that financial stability and the reputation of the insurer are equally crucial. By understanding the interplay between age, health, lifestyle, policy features, and insurer selection, you can confidently choose a policy that provides adequate coverage without unnecessary expense. This informed approach ensures you’re securing your family’s future with peace of mind.

Essential Questionnaire

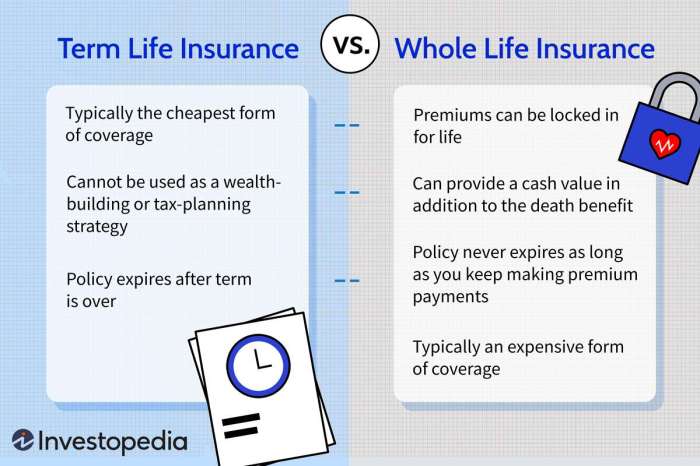

What is the difference between term and whole life insurance premiums?

Term life insurance premiums are generally lower than whole life insurance premiums because term life insurance provides coverage for a specific period, while whole life insurance offers lifelong coverage and a cash value component.

Can I change my term life insurance policy after it’s issued?

You may be able to increase your coverage amount, but decreasing it or changing the term length might not be possible. Check your policy for specifics.

How often are term life insurance premiums paid?

Premiums are typically paid annually, semi-annually, quarterly, or monthly. The payment frequency can affect the overall cost due to potential interest charges.

What happens if I miss a premium payment?

Your policy may lapse if premiums aren’t paid on time. Grace periods are usually offered, but contact your insurer immediately if you anticipate a missed payment.

Does my term life insurance premium increase over time?

No, term life insurance premiums are generally level, meaning they remain the same throughout the policy term. However, if you renew your term policy after it expires, the premiums will likely be higher.