Securing your family’s future with life insurance is a crucial step in responsible financial planning. Understanding the cost, however, can feel daunting. This guide demystifies the process by exploring the functionality of term life insurance premium calculators, the factors influencing premiums, and how to effectively use these tools to find the best coverage for your needs. We’ll delve into the intricacies of these calculators, empowering you to make informed decisions about your life insurance.

From understanding the key variables—age, health, smoking status, and desired coverage amount—to interpreting the results and comparing quotes from different providers, we will equip you with the knowledge to navigate the world of term life insurance with confidence. We’ll also discuss the benefits of consulting a financial advisor to ensure your policy aligns perfectly with your financial goals.

Understanding Term Life Insurance Premium Calculators

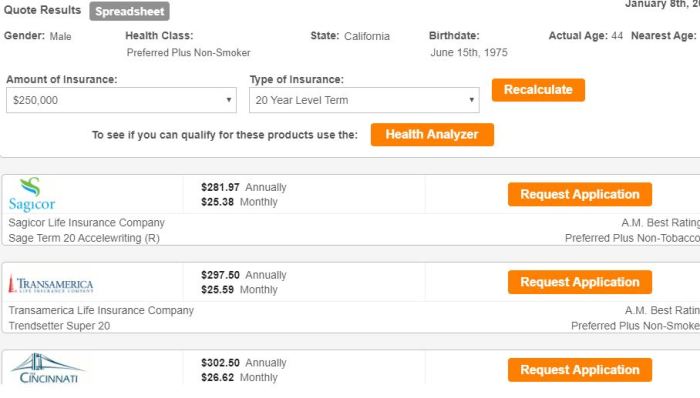

Term life insurance premium calculators are invaluable tools for quickly estimating the cost of life insurance. They simplify a complex process, allowing individuals to explore different coverage options and understand the factors that influence their premiums before contacting an insurance agent. This understanding empowers consumers to make informed decisions about their financial protection.

Core Functionality of Term Life Insurance Premium Calculators

At their core, term life insurance premium calculators use algorithms based on actuarial data to estimate the cost of a term life insurance policy. They take several key pieces of information as input and then process them to provide an estimated monthly or annual premium. The calculation considers the risk associated with insuring a particular individual, balancing the probability of a claim against the cost of providing coverage. The output is an approximate premium, and the actual premium offered by an insurance company might vary slightly due to underwriting processes and specific policy details.

Input Variables Used in Premium Calculations

Several factors influence the calculated premium. These input variables are typically requested by the calculator and include:

| Variable | Description | Impact on Premium |

|---|---|---|

| Age | Applicant’s age | Premiums generally increase with age, reflecting the higher risk of mortality. |

| Gender | Applicant’s gender | Historically, premiums have differed based on gender due to differing life expectancies, although this is subject to regulatory changes. |

| Health Status | Pre-existing conditions, current health | Individuals with pre-existing conditions or poor health generally face higher premiums. |

| Smoking Status | Whether the applicant smokes | Smokers typically pay significantly higher premiums due to increased health risks. |

| Coverage Amount | Desired death benefit | Higher coverage amounts result in higher premiums. |

| Policy Term Length | Length of the insurance policy (e.g., 10, 20, 30 years) | Longer terms generally lead to higher premiums per year, but the total cost may be lower compared to shorter terms with higher annual premiums. |

Examples of Variable Influence on Premiums

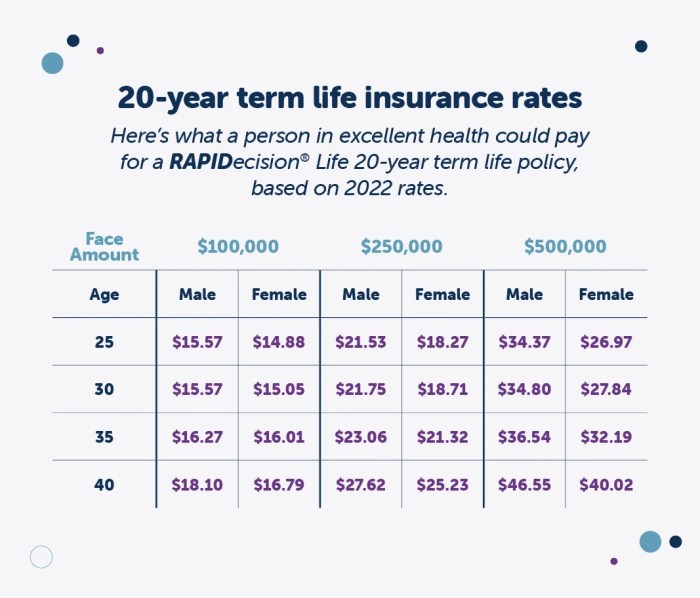

For example, a 30-year-old non-smoking male seeking a $500,000, 20-year term policy might receive a significantly lower premium than a 50-year-old smoker with a history of heart disease seeking the same coverage. Similarly, increasing the coverage amount from $250,000 to $500,000 will result in a higher premium, even if all other factors remain constant. The impact of each variable is complex and intertwined; the calculator uses sophisticated algorithms to weigh these factors appropriately.

Comparison of Online Term Life Insurance Premium Calculators

The accuracy and features of online calculators can vary. Below is a comparison of three hypothetical calculators to illustrate potential differences. Note that these are examples and do not reflect any specific real-world calculators.

| Calculator | Features | Accuracy | User Experience |

|---|---|---|---|

| Calculator A | Basic inputs, limited customization | Approximate | Simple and easy to use |

| Calculator B | Comprehensive inputs, multiple policy options | More precise | More complex, may require more user input |

| Calculator C | Includes riders and add-ons, detailed reports | Highly accurate (within a range) | Advanced, may be overwhelming for some users |

Factors Affecting Term Life Insurance Premiums

Several key factors influence the cost of your term life insurance premiums. Understanding these factors can help you make informed decisions when comparing policies and securing the best coverage for your needs. These factors interact in complex ways, so it’s advisable to obtain personalized quotes from multiple insurers.

Age’s Impact on Premium Costs

Age is a significant determinant of term life insurance premiums. As you get older, your risk of death increases, leading to higher premiums. This relationship is generally represented by an upward-sloping curve. Imagine a graph with “Age” on the horizontal (x) axis and “Premium Cost” on the vertical (y) axis. The line representing premium cost would start relatively low at younger ages (e.g., 25-30), gradually increase as age progresses, and then rise more steeply in later years (e.g., 50 and above). The exact shape of the curve will vary based on factors such as gender and health status, but the overall trend of increasing premiums with age remains consistent. For example, a 30-year-old might pay significantly less than a 50-year-old for the same coverage amount.

Health Conditions and Medical History

Pre-existing health conditions and medical history substantially influence premium calculations. Individuals with conditions like heart disease, diabetes, or cancer will typically face higher premiums than those in excellent health. This is because insurers assess the increased risk of mortality associated with these conditions. The severity and type of condition will also affect the premium increase. For instance, a well-managed case of type 2 diabetes might result in a smaller premium increase compared to a more severe condition requiring extensive treatment. A thorough medical underwriting process is used to assess these risks.

Smokers versus Non-Smokers

Smoking significantly increases the risk of various health problems, including lung cancer, heart disease, and stroke. Consequently, smokers generally pay considerably higher premiums than non-smokers. This difference can be substantial, often amounting to hundreds or even thousands of dollars annually depending on the policy’s details and the smoker’s habits. Insurers often categorize smokers based on the number of cigarettes smoked daily and may even consider the duration of smoking habits. Quitting smoking can lead to lower premiums in the future, sometimes even after a specified period of abstinence.

Other Factors Affecting Premiums

Several other factors can impact your term life insurance premiums. Your occupation plays a role; high-risk occupations, such as those involving dangerous machinery or extensive travel, might result in higher premiums due to an increased risk of accidental death. Family history of certain diseases can also influence premiums, as a family history of heart disease or cancer might suggest a higher genetic predisposition to these conditions. Finally, factors like your gender and the amount of life insurance coverage you seek will also affect your premiums. Generally, men tend to pay slightly higher premiums than women for comparable coverage.

The Role of a Financial Advisor

Navigating the world of term life insurance can feel overwhelming, especially with the numerous policy options and complex terminology involved. A financial advisor can provide invaluable assistance in this process, ensuring you choose a policy that aligns with your specific needs and financial goals. Their expertise simplifies the decision-making process and helps avoid potential pitfalls.

Financial advisors offer a multifaceted approach to securing appropriate life insurance coverage. They act as a guide, helping you understand the intricacies of different policy types, benefits, and limitations. This understanding is crucial for making informed decisions about your future financial security.

Benefits of Consulting a Financial Advisor

A financial advisor’s expertise goes beyond simply comparing premiums. They consider your overall financial picture, including assets, liabilities, and future financial goals, to recommend a policy that fits seamlessly into your financial plan. This holistic approach ensures the life insurance policy complements, rather than conflicts with, your other financial objectives. For example, a young family starting a business might need a higher coverage amount than a single individual nearing retirement. A financial advisor would help determine the appropriate coverage based on their unique circumstances.

Navigating Insurance Options with Professional Guidance

The insurance market offers a wide array of policies with varying features and costs. A financial advisor can help decipher this complexity by comparing policies from different providers, explaining the nuances of each, and identifying the best fit for your circumstances. This includes understanding the differences between term life insurance and whole life insurance, and choosing appropriate riders or add-ons. For instance, a financial advisor could explain the benefits of a return of premium rider, which refunds premiums if the policyholder outlives the term, or the value of adding a waiver of premium rider for added protection against unexpected events.

Aligning Insurance with Financial Goals

A key role of a financial advisor is to integrate life insurance into a comprehensive financial plan. This means considering how the policy will address potential future needs, such as paying off a mortgage, funding children’s education, or providing for a spouse’s retirement. The advisor can help determine the appropriate death benefit amount based on these specific goals. For example, if a family’s primary goal is to ensure their children’s college education is funded in case of a parent’s death, the advisor will work to determine the necessary coverage amount based on projected education costs. This personalized approach ensures the insurance policy effectively protects against potential financial hardship.

Closing Notes

Choosing the right term life insurance policy is a significant financial decision, and understanding how premium calculators work is a vital first step. By carefully considering the factors influencing premiums, utilizing online calculators effectively, and comparing offers from multiple providers, you can confidently secure the coverage that best protects your loved ones. Remember to consult with a financial advisor to personalize your plan and ensure it aligns with your broader financial objectives. Taking control of your life insurance planning is a testament to your commitment to financial responsibility and family security.

FAQ Overview

What is the difference between term and whole life insurance?

Term life insurance provides coverage for a specific period (term), while whole life insurance offers lifelong coverage, typically at a higher premium.

Can I use a calculator if I have pre-existing health conditions?

Yes, most calculators allow you to input health information, though the accuracy may vary. It’s crucial to speak with an insurance agent for personalized advice if you have pre-existing conditions.

How often are premiums recalculated?

Premiums for term life insurance are typically fixed for the duration of the policy term. They do not change unless you renew the policy at the end of the term.

What happens if I die during the term?

The death benefit, the amount specified in your policy, will be paid to your beneficiaries.