Securing your family’s financial future through term life insurance is a crucial step, but understanding the often-complex world of term insurance premiums can feel daunting. This guide demystifies the process, exploring the key factors that influence your premium, allowing you to make informed decisions about your coverage and budget.

From the impact of age and health to the role of policy duration and provider choices, we’ll navigate the intricacies of premium calculation and offer strategies to potentially lower your costs. We’ll also examine the various components that make up your premium, ensuring transparency and empowering you with the knowledge to choose the best policy for your needs.

Factors Influencing Term Insurance Premiums

Several key factors determine the cost of your term life insurance premiums. Understanding these factors can help you make informed decisions when choosing a policy. These factors are primarily based on the insurer’s assessment of your risk profile. The higher the perceived risk, the higher the premium.

Age

Age is a significant factor in premium calculations. As you get older, your risk of death increases, leading to higher premiums. Insurers use actuarial tables that reflect the average mortality rates for different age groups. A 30-year-old will generally pay significantly less than a 50-year-old for the same coverage amount, reflecting the statistically lower risk associated with younger ages. This increase in premiums is generally gradual but accelerates as you approach older ages.

Health Conditions

Pre-existing health conditions significantly impact premium costs. Individuals with conditions like heart disease, diabetes, or cancer will typically pay higher premiums, or may even be denied coverage altogether, depending on the severity and type of condition. Insurers conduct thorough medical underwriting to assess the risk associated with these conditions. The more serious or chronic the condition, the greater the impact on the premium. For example, a person with a history of heart attacks would likely face substantially higher premiums than a person with a clean bill of health.

Smoking Habits

Smoking is a major health risk and significantly increases mortality rates. Consequently, smokers typically pay considerably higher premiums than non-smokers. This is because smoking is linked to numerous health problems, including lung cancer, heart disease, and respiratory illnesses, all of which increase the likelihood of an early death. The extent of the premium increase varies depending on the insurer and the extent of the smoking habit (e.g., number of cigarettes smoked per day). Quitting smoking can often lead to lower premiums over time, demonstrating the financial benefits of a healthy lifestyle.

Policy Duration

The length of your term life insurance policy also affects the premium. Shorter-term policies (e.g., 10-year terms) generally have lower premiums than longer-term policies (e.g., 20-year or 30-year terms). This is because the insurer is covering a shorter period of risk. While the premium per year might be lower for a shorter term, the total cost over the policy’s lifetime might be higher compared to a longer-term policy with a higher annual premium but lower overall cost if you maintain the policy to its end.

Premium Variations Based on Coverage Amount, Age, Health, and Smoking Status

The following table illustrates how premiums can vary based on several key factors. These are illustrative examples and actual premiums will vary depending on the specific insurer and individual circumstances.

| Coverage Amount | Age | Health Status | Smoking Status | Annual Premium (USD) |

|---|---|---|---|---|

| $250,000 | 35 | Excellent | Non-smoker | $500 |

| $250,000 | 45 | Excellent | Non-smoker | $750 |

| $250,000 | 35 | Good (managed diabetes) | Non-smoker | $650 |

| $500,000 | 35 | Excellent | Smoker | $1000 |

| $250,000 | 55 | Good | Smoker | $1500 |

Understanding Term Insurance Premium Components

Understanding the components of your term insurance premium is crucial for making informed decisions about your coverage. Several factors contribute to the final price you pay, and knowing these elements allows you to better understand the value you’re receiving. This section breaks down the key components that determine your premium.

Mortality Rates

Mortality rates play a significant role in determining term insurance premiums. These rates reflect the probability of death within a specific age group over a given period. Insurers use actuarial tables, which are statistical representations of mortality data, to predict the likelihood of policyholders passing away during the policy term. Higher mortality rates, typically associated with older age groups or those with pre-existing health conditions, result in higher premiums because the insurer faces a greater risk of paying out a death benefit. Conversely, lower mortality rates lead to lower premiums. For example, a 30-year-old applying for a term insurance policy will generally pay a lower premium than a 60-year-old, reflecting the lower probability of death within the policy term for the younger applicant.

Administrative Costs

Administrative costs encompass the expenses incurred by the insurance company in managing and operating the policy. These include salaries for administrative staff, IT infrastructure costs, marketing expenses, claims processing fees, and regulatory compliance costs. These costs are factored into the premium to ensure the insurer can cover its operational expenses and remain financially viable. A company with higher operational efficiency might have lower administrative costs, potentially leading to slightly lower premiums compared to a less efficient competitor.

Insurer’s Profit Margin

The insurer’s desired profit margin is another key component of the premium. Insurance companies are businesses, and they need to generate profits to remain sustainable. The profit margin represents the percentage of the premium that the insurer aims to retain as profit after covering all costs, including mortality, administrative expenses, and reinsurance costs. A higher profit margin translates to a higher premium, while a lower profit margin results in a lower premium. Competition within the insurance market can influence the profit margins insurers are willing to accept.

Reinsurance Costs

Reinsurance is a risk management strategy employed by insurance companies to transfer a portion of their risk to another insurer, known as a reinsurer. This helps insurers manage their exposure to potentially large claims. The cost of reinsurance, which depends on factors such as the risk profile of the insured population and market conditions, is factored into the premium. If the reinsurer assesses a higher risk, the reinsurance costs will increase, leading to higher premiums for the policyholder. For example, policies covering individuals with high-risk profiles may require higher reinsurance costs, thus leading to increased premiums for those individuals.

Components of a Term Insurance Premium

The following points summarize the key elements that constitute a term insurance premium:

- Mortality Costs: The projected cost of paying death benefits based on mortality rates and the insured’s age and health.

- Administrative Expenses: Costs associated with running the insurance company, including salaries, IT, marketing, and claims processing.

- Profit Margin: The percentage of the premium retained by the insurer as profit.

- Reinsurance Costs: The cost of transferring some risk to a reinsurer.

- Contingency Reserves: Funds set aside to cover unexpected losses or fluctuations in mortality rates.

Strategies for Reducing Term Insurance Premiums

Securing affordable term life insurance is a crucial step in financial planning. Several strategies can significantly reduce your premiums, allowing you to obtain the coverage you need without straining your budget. By understanding these strategies and implementing them, you can optimize your insurance costs and achieve greater financial security.

Maintaining a Healthy Lifestyle

Adopting a healthy lifestyle can lead to lower term insurance premiums. Insurance companies assess risk based on various factors, and a healthy lifestyle demonstrates a lower risk profile. This translates to lower premiums. Regular exercise, a balanced diet, and avoiding smoking and excessive alcohol consumption are key components of a healthy lifestyle that insurers recognize favorably. For example, a non-smoker will typically receive a significantly lower premium compared to a smoker, reflecting the lower risk of premature death associated with smoking. Similarly, maintaining a healthy weight and regular checkups with a doctor can positively influence your premium.

Choosing a Longer Policy Term

Opting for a longer policy term can result in lower annual premiums. While the total cost over the life of the policy will be higher, spreading the cost over a longer period (e.g., 30 years versus 20 years) reduces the annual premium. This is because the insurer spreads the risk assessment over a longer timeframe. However, it’s crucial to weigh the cost savings against the increased total cost and your long-term financial goals. For instance, a 30-year term policy might offer lower annual payments but will ultimately cost more than a 20-year policy.

Increasing the Deductible

Increasing your deductible can reduce your premiums. The deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible signifies a greater willingness to absorb initial costs, reducing the insurer’s risk and subsequently lowering your premium. This strategy is suitable for individuals with a higher risk tolerance and sufficient emergency funds to cover potential out-of-pocket expenses. For example, increasing your deductible from $1,000 to $2,000 could result in a noticeable decrease in your annual premium.

Bundled Insurance Packages

Bundling insurance policies, such as combining your term life insurance with other policies like home or auto insurance from the same provider, can sometimes lead to cost savings through discounts or bundled rates. However, it’s essential to compare the individual costs of each policy separately against the bundled price to ensure you are actually saving money. The advantage is potential cost reduction; the disadvantage is reduced flexibility if you wish to change one policy but not the others. A detailed comparison is crucial before opting for a bundled package.

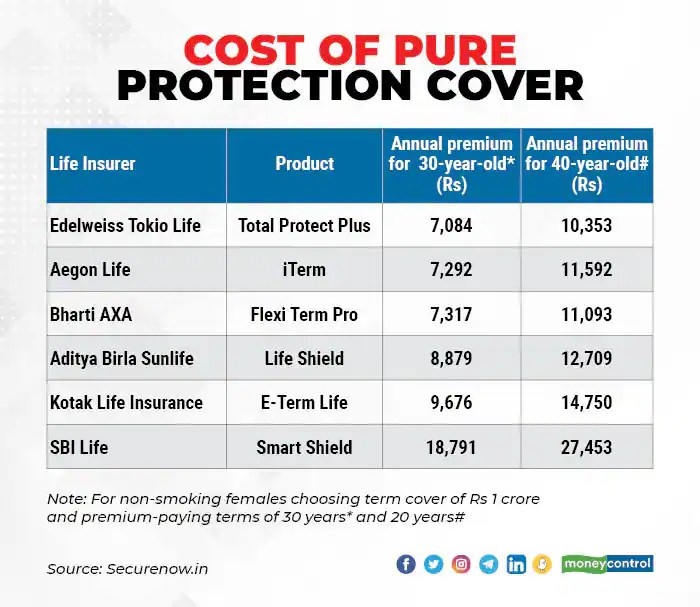

Comparing Different Policy Options

Comparing term life insurance policies from multiple providers is essential to securing the most competitive premium. Different insurers use varying underwriting criteria and pricing models, leading to significant variations in premiums. Utilizing online comparison tools or consulting with an independent insurance agent can help you compare policies efficiently and identify the most cost-effective option for your specific needs and risk profile. This proactive approach can often save hundreds or even thousands of dollars over the life of your policy.

Illustrative Examples of Term Insurance Premium Calculations

Understanding how term insurance premiums are calculated is crucial for making informed decisions about your coverage. This section provides a detailed example and illustrates how various factors influence the final premium.

Let’s consider a hypothetical individual, Sarah, a 30-year-old non-smoker in good health, applying for a 20-year term life insurance policy with a coverage amount of $500,000. Several factors will influence her premium:

Premium Calculation Example for Sarah

Several factors contribute to Sarah’s premium. Insurance companies use complex actuarial models, but we can simplify the process to understand the key elements. These include:

- Age: Younger individuals generally pay lower premiums because they have a statistically lower risk of death within the policy term.

- Health Status: Sarah’s good health reduces her risk profile, leading to a lower premium. Pre-existing conditions or health concerns would increase her premium.

- Smoking Status: As a non-smoker, Sarah benefits from lower premiums. Smokers face significantly higher premiums due to increased health risks.

- Policy Term: A 20-year term is a common choice. Longer terms generally lead to higher premiums per year, although the total cost may vary.

- Coverage Amount: Sarah’s choice of $500,000 coverage directly impacts the premium. Higher coverage amounts mean higher premiums.

- Gender: While this is becoming less common due to regulations, historically, gender has been a factor. Currently, many insurers use more inclusive risk assessment methods.

Let’s assume, for illustrative purposes, that based on these factors and the insurer’s risk assessment, Sarah’s annual premium is calculated to be $500.

Visual Representation of Factor Influence

We can represent the influence of these factors on the premium using a text-based table. This table shows how changing a single factor affects the premium, while keeping others constant. The numbers are illustrative and should not be taken as actual premium quotes.

| Factor | Value | Premium ($) |

|---|---|---|

| Age | 30 | 500 |

| Age | 40 | 700 |

| Health Status | Good | 500 |

| Health Status | Fair (with condition) | 750 |

| Smoking Status | Non-smoker | 500 |

| Smoking Status | Smoker | 1000 |

| Policy Term | 20 years | 500 |

| Policy Term | 30 years | 650 |

| Coverage Amount | $500,000 | 500 |

| Coverage Amount | $1,000,000 | 1000 |

This table demonstrates how each factor influences the final premium. For example, increasing age or choosing a longer term significantly increases the premium. Similarly, pre-existing conditions or smoking habits lead to higher costs. The coverage amount has a direct proportional relationship with the premium.

Significance of Understanding Premium Calculation

Understanding the factors influencing term insurance premiums empowers consumers to make informed decisions. By recognizing how age, health, lifestyle choices, and coverage amount affect the cost, individuals can compare different policies effectively. This knowledge enables them to choose a plan that best suits their needs and budget, ensuring adequate coverage without unnecessary expense. It also encourages healthier lifestyle choices to potentially lower future premiums.

Outcome Summary

Understanding your term insurance premium isn’t just about numbers; it’s about securing peace of mind. By carefully considering the factors influencing your premium and employing the strategies Artikeld above, you can navigate the insurance landscape with confidence. Remember, comparing quotes, maintaining a healthy lifestyle, and understanding policy features are key steps toward securing affordable and appropriate life insurance coverage.

Questions and Answers

What is the difference between term and whole life insurance premiums?

Term life insurance premiums are generally lower than whole life insurance premiums because term insurance provides coverage for a specific period, while whole life insurance offers lifelong coverage and a cash value component.

Can I change my term insurance policy after it’s issued?

Typically, you cannot change the coverage amount or term length after your policy is issued, although some insurers may offer limited options for adjustments. It’s crucial to review your policy details carefully before purchasing.

What happens if I miss a premium payment?

Missing a premium payment can result in your policy lapsing. Most insurers offer grace periods, but it’s crucial to contact your insurer immediately if you anticipate difficulty making a payment to avoid policy cancellation.

How often are term insurance premiums paid?

Premiums are typically paid annually, semi-annually, quarterly, or monthly. The payment frequency can influence the overall cost due to potential interest charges.