The cost of healthcare is a significant concern globally, and health insurance plays a crucial role in mitigating these expenses. However, the way governments tax health insurance premiums significantly impacts both individual finances and the overall health insurance market. This exploration delves into the complexities of health insurance premium taxation, examining its effects on affordability, market growth, and the choices individuals and employers make regarding health coverage.

We will analyze how tax policies influence the cost of health insurance, exploring the deductibility of premiums for individuals and employers, the unique challenges faced by the self-employed, and the varying tax implications of different health insurance plan types. Further, we will examine the government’s role in regulating this complex area and its impact on the broader healthcare landscape.

Tax Deductibility of Health Insurance Premiums

The deductibility of health insurance premiums varies significantly across countries, impacting both individuals and employers. Understanding these differences is crucial for effective financial planning and compliance with tax regulations. This section will explore the current landscape of tax laws related to health insurance premium deductibility, highlighting key distinctions and criteria.

Tax Laws Regarding Health Insurance Premium Deductibility

The deductibility of health insurance premiums is governed by individual country’s tax codes. In some countries, like the United States, individuals can deduct premiums only under specific circumstances, often related to self-employment or participation in a health savings account (HSA). The specifics depend on factors like income level and the type of health insurance plan. In contrast, other countries may offer broader deductibility, allowing a larger portion or even all premiums to be deducted from taxable income. For instance, some European countries often integrate health insurance into their social security systems, resulting in different tax implications than in countries with predominantly private health insurance markets. The availability and extent of deductions frequently change with revisions to tax laws, requiring consistent monitoring of official government sources for the most up-to-date information.

Tax Benefits: Individuals vs. Employers

The tax benefits associated with health insurance premiums differ significantly between individuals and employers. In many countries, employers can deduct the cost of employee health insurance premiums as a business expense, reducing their overall tax liability. This provides a significant financial incentive for companies to offer health insurance benefits to their employees. For individuals, the deductibility of premiums is often more limited, and the specific rules depend heavily on the nation’s tax system and the individual’s circumstances. The contrast between these two scenarios highlights the differing treatment of health insurance costs within the broader framework of tax policy.

Criteria for Claiming Deductions on Health Insurance Premiums

Claiming deductions on health insurance premiums usually requires meeting specific criteria. These often include providing proof of payment, demonstrating eligibility for the deduction under applicable tax laws, and accurately completing the relevant tax forms. For self-employed individuals, this typically involves maintaining meticulous records of all premium payments and related expenses. Employers, on the other hand, usually need to demonstrate that the payments were made for bona fide employees and that the expenses are directly related to business operations. The precise documentation required can vary based on the country and the specific tax rules in place. Failure to meet these criteria can result in the disallowance of the deduction, leading to a higher tax burden.

Deductibility Limits in Various Countries

| Country | Deductibility Limit (Individual) | Deductibility Limit (Employer) | Notes |

|---|---|---|---|

| United States | Varies depending on income and plan type; may be limited or unavailable | Fully deductible as a business expense | Deductibility often tied to HSAs or self-employment |

| Canada | Limited deductibility for self-employed individuals, based on medical expenses exceeding a threshold | Fully deductible as a business expense | Specific medical expense receipts required for claiming deductions |

| United Kingdom | Generally not directly deductible; may be indirectly covered through tax credits or other social programs | Fully deductible as a business expense | National Health Service (NHS) largely covers healthcare costs |

| Germany | Premiums are typically deducted from income before tax calculation; exact deduction varies based on income and plan | Deductible as a business expense | Statutory health insurance system with mandatory contributions |

Last Recap

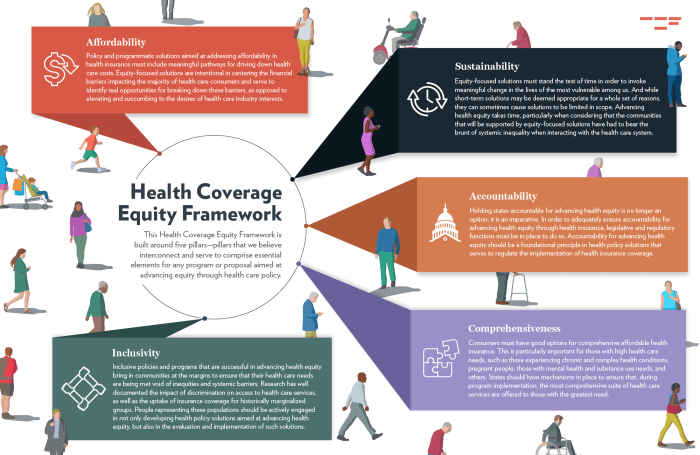

Navigating the taxation of health insurance premiums requires a comprehensive understanding of diverse national regulations and their implications. This analysis has highlighted the significant influence of tax policies on healthcare affordability, market dynamics, and individual financial planning. From tax deductions and subsidies to the unique considerations for the self-employed and variations across different insurance plans, the intricacies are considerable. Ultimately, a clear grasp of these complexities is crucial for both individuals and policymakers seeking to create a more equitable and accessible healthcare system.

Top FAQs

What are the tax implications of changing health insurance plans mid-year?

Tax implications of mid-year changes vary depending on the specific plans and your country’s tax laws. Generally, you may need to adjust your tax withholdings or file an amended return to reflect the change in premiums. Consult a tax professional for personalized advice.

Can I deduct health insurance premiums if I’m covered under my spouse’s plan?

This depends on your country’s tax laws and your specific circumstances. In some countries, you may not be able to deduct premiums if you are already covered under another plan. Check your local tax regulations or consult a tax advisor.

Are there tax benefits for contributing to a Health Savings Account (HSA)?

In many countries, contributions to HSAs are tax-deductible, and withdrawals for qualified medical expenses are tax-free. However, eligibility requirements and contribution limits vary. Consult a tax professional or refer to your country’s IRS guidelines.