The efficient and compliant handling of insurance premiums is paramount to the financial health and legal standing of any insurance provider. This process, encompassing everything from initial receipt to secure holding, involves a complex interplay of legal regulations, accounting practices, internal controls, and customer service protocols. Understanding these intricacies is crucial for maintaining operational efficiency, minimizing risk, and ensuring regulatory compliance.

This guide delves into the multifaceted world of premium management, providing a detailed examination of the legal framework, accounting procedures, risk mitigation strategies, and technological solutions employed in this critical area of insurance operations. We will explore best practices, address common challenges, and offer insights to help insurance companies optimize their premium handling processes.

Legal and Regulatory Framework for Premium Handling

Insurance companies operate under a strict legal and regulatory framework governing how they handle premiums received from policyholders. These regulations aim to protect policyholders’ funds and ensure the solvency of insurance businesses. Failure to comply can result in significant penalties and reputational damage.

Legal Requirements for Premium Receipt and Holding

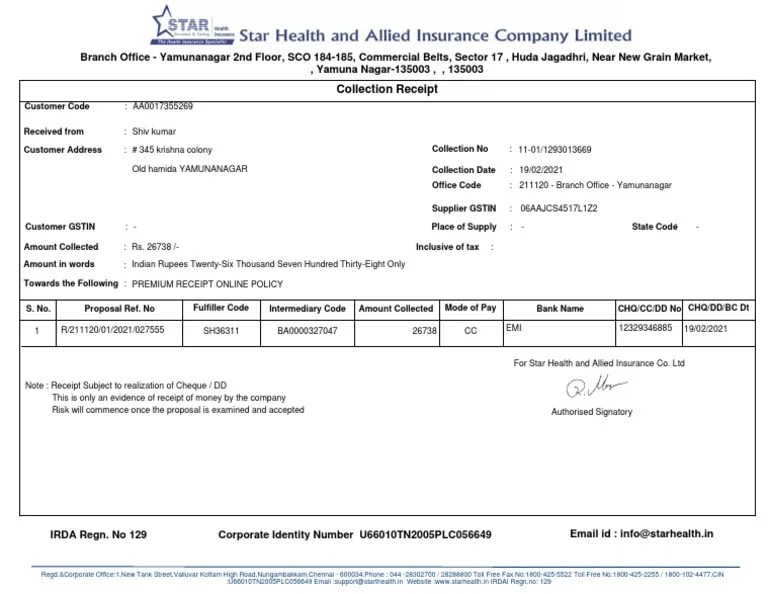

Insurance companies are legally obligated to maintain accurate records of all premium receipts. This includes detailed information about the policyholder, the policy, the date of receipt, and the payment method. These records must be readily accessible for audits by regulatory bodies. Furthermore, companies must have established procedures for promptly acknowledging premium payments to policyholders and providing clear and accurate statements reflecting their premium payments and policy status. Specific requirements regarding record-keeping vary by jurisdiction, often stipulating the format, storage duration, and accessibility of these records. For example, many jurisdictions require electronic record-keeping systems with robust security measures to ensure data integrity and prevent unauthorized access.

Regulations Surrounding the Segregation of Premium Funds

A crucial aspect of premium handling is the segregation of premium funds from the insurer’s general operating funds. This segregation is mandated to protect policyholders’ money in case of the insurer’s insolvency. Regulations typically require premiums to be held in separate accounts, often in trust accounts or similar vehicles, preventing their use for general business expenses. The specific requirements for segregation, including the type of account and the level of oversight, vary considerably across different jurisdictions. For instance, some jurisdictions may permit the use of certain investment vehicles for segregated premium funds, while others may restrict investments to highly liquid and low-risk assets. Regular audits are often mandated to ensure compliance with segregation rules.

Potential Legal Ramifications for Non-Compliance

Non-compliance with premium handling regulations can lead to a range of severe consequences. These can include hefty fines, suspension or revocation of operating licenses, legal action from policyholders, and reputational damage impacting the insurer’s ability to attract and retain clients. In some cases, non-compliance may even result in criminal charges against company officers or directors. For example, misappropriation of premium funds constitutes a serious breach of trust and is subject to significant penalties, both civil and criminal. Furthermore, failure to maintain accurate records can hinder the ability of regulators to oversee the insurer’s financial stability, leading to further regulatory action.

Comparison of Premium Handling Regulations Across Jurisdictions

Premium handling regulations differ significantly across jurisdictions due to variations in legal systems, economic conditions, and regulatory priorities. For instance, the level of detail in record-keeping requirements, the permitted investment vehicles for segregated funds, and the penalties for non-compliance can all vary substantially. The European Union, for example, has a harmonized regulatory framework for insurance, while the United States has a more decentralized system with state-level regulation playing a significant role. Understanding these jurisdictional differences is crucial for multinational insurance companies operating in multiple markets.

Key Legal Aspects of Premium Handling

| Jurisdiction | Relevant Legislation | Segregation Requirements | Penalties for Violations |

|---|---|---|---|

| United States (Example: State of New York) | New York Insurance Law | Separate trust accounts; restrictions on investments | Fines, license suspension/revocation, legal action |

| United Kingdom | Financial Conduct Authority (FCA) regulations | Strict segregation; detailed reporting requirements | Fines, restrictions on business activities, reputational damage |

| European Union (Example: Solvency II) | Solvency II Directive | Detailed requirements for capital adequacy and risk management | Significant fines, operational restrictions, potential insolvency |

| Canada (Example: OSFI) | Office of the Superintendent of Financial Institutions (OSFI) regulations | Specific requirements for trust accounts and reporting | Fines, license suspension, corrective action plans |

Accounting and Financial Reporting of Premiums

Accurate accounting and financial reporting of insurance premiums are crucial for maintaining solvency, complying with regulatory requirements, and providing stakeholders with a clear picture of the insurer’s financial health. This section details the accounting treatment of premiums, encompassing their recording, adjustments, and the maintenance of auditable records.

Accounting Treatment of Premiums Received

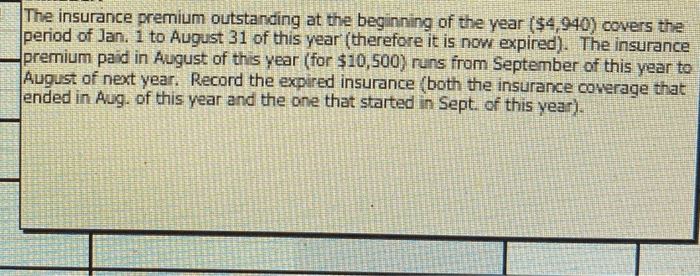

Premiums received represent a liability for the insurer until the services promised (insurance coverage) are rendered. Initially, premiums are recognized as unearned premium reserves (liability) on the balance sheet. As time passes and coverage is provided, a portion of the unearned premium is recognized as earned premium (revenue) on the income statement. This process is often referred to as the “unearned premium reserve” method. Appropriate accounts might include “Unearned Premiums,” with sub-accounts for different lines of business or policy types, and “Premium Revenue.”

Recording Premium Payments and Adjustments

Premium payments are recorded upon receipt. This involves debiting the cash account (or the relevant bank account) and crediting the “Unearned Premiums” account. Adjustments to premium payments, such as cancellations, refunds, or short-rate calculations, require specific entries. Cancellations reduce the unearned premium liability, while refunds require a debit to “Unearned Premiums” and a credit to “Cash.” Short-rate calculations (where a portion of the premium is refunded based on the period of coverage) involve a debit to “Unearned Premiums” and a credit to “Premium Revenue” for the earned portion, and a credit to “Cash” for the refunded amount.

Best Practices for Maintaining Accurate and Auditable Records

Maintaining accurate and auditable records is paramount. This involves a robust system of internal controls, including segregation of duties, regular reconciliation of bank statements and premium records, and the use of automated accounting software. A detailed audit trail, showing the origin and movement of every premium payment, is crucial for compliance and transparency. Regular internal audits and external financial statement audits are essential to ensure accuracy and reliability.

Flowchart Illustrating the Accounting Cycle for Premium Receipts

The following flowchart illustrates a simplified accounting cycle for premium receipts:

[Description of Flowchart: The flowchart would begin with “Premium Payment Received,” leading to “Verify Payment and Policy Information.” This would branch to “Correct Policy Information? Yes” which goes to “Record Premium Receipt in Accounting System” and then to “Update Unearned Premium Reserve.” The “Correct Policy Information? No” branch would lead to “Correct Policy Information” and then back to “Verify Payment and Policy Information.” From “Update Unearned Premium Reserve,” the flow would go to “Generate Financial Reports” and finally to “Archiving Records.”]

Sample Journal Entries

Journal Entry for Recording Premium Payments:

Date | Account Name | Debit | Credit

——- | ——– | ——– | ——–

[Date] | Cash | [Premium Amount] |

| Unearned Premiums | | [Premium Amount]

| *To record premium payment received* | |

Journal Entry for Premium Refunds:

Date | Account Name | Debit | Credit

——- | ——– | ——– | ——–

[Date] | Unearned Premiums | [Refund Amount] |

| Cash | | [Refund Amount]

| *To record premium refund* | |

Internal Controls and Risk Management for Premium Handling

Effective internal controls are crucial for mitigating the inherent risks associated with handling insurance premiums. The financial nature of premiums, coupled with the potential for large sums of money to flow through an insurance company, makes it a prime target for fraudulent activities and operational errors. Robust controls ensure the accuracy, completeness, and security of premium transactions, protecting both the insurer and its policyholders.

Key Risks Associated with Premium Handling

The handling of insurance premiums exposes insurance companies to a range of risks, primarily centered around financial loss and reputational damage. These risks stem from both internal and external sources. Internal risks include employee fraud, errors in recording and processing premiums, and inadequate segregation of duties. External risks encompass issues such as payment fraud (e.g., counterfeit checks, fraudulent wire transfers), data breaches leading to unauthorized access to premium information, and regulatory non-compliance. Misappropriation of funds, whether through embezzlement or other forms of theft, is a significant concern, potentially leading to substantial financial losses and legal repercussions.

Importance of Internal Controls in Mitigating Risks

Internal controls act as a safeguard against these risks, providing reasonable assurance that premiums are handled accurately, efficiently, and ethically. A strong internal control system reduces the likelihood of errors and fraud, protects the company’s assets, and ensures compliance with regulatory requirements. This not only minimizes financial losses but also maintains the insurer’s reputation and fosters trust with policyholders and stakeholders. A well-designed system promotes accountability and transparency in premium handling processes.

Examples of Effective Internal Controls for Premium Receipt, Recording, and Reconciliation

Effective internal controls encompass various measures implemented at different stages of premium handling. For premium receipt, this could involve using secure payment methods, such as electronic funds transfers or dedicated payment portals, rather than relying solely on cash or checks. For recording, double-entry bookkeeping and automated data entry systems can minimize manual errors. Regular reconciliation of bank statements with premium records, performed by individuals independent of the initial recording process, ensures the accuracy of financial reporting. Segregation of duties, where different individuals are responsible for receiving payments, recording transactions, and reconciling accounts, prevents collusion and fraud. Regular audits, both internal and external, further strengthen the control environment. For example, a company might implement a system where premium payments are scanned and uploaded into a centralized database, automatically generating accounting entries. Discrepancies are flagged immediately, triggering investigation and resolution.

Comparison of Different Internal Control Frameworks Applicable to Premium Handling

Several internal control frameworks provide guidance for designing and implementing effective controls. COSO (Committee of Sponsoring Organizations of the Treadway Commission) is a widely recognized framework that emphasizes the importance of control environment, risk assessment, control activities, information and communication, and monitoring activities. The ISO 27001 standard focuses on information security management, offering a structured approach to managing risks related to data breaches and unauthorized access to premium information. Insurance-specific regulations and guidelines, such as those from NAIC (National Association of Insurance Commissioners) in the United States, also provide a framework for internal controls related to premium handling. The choice of framework often depends on the size and complexity of the insurance company, as well as the specific regulatory environment in which it operates.

Checklist of Internal Control Procedures for Verifying Premium Payments and Ensuring Their Accurate Recording

Implementing a comprehensive checklist ensures all necessary steps are followed consistently.

- Verify the payer’s identity and policy information against company records.

- Confirm the payment amount against the policy premium due.

- Record the payment date and method accurately.

- Match the payment received with the corresponding premium invoice.

- Reconcile premium payments with bank statements on a regular basis (e.g., monthly).

- Conduct regular reviews of premium accounting records for discrepancies or unusual patterns.

- Implement access controls to restrict access to premium information to authorized personnel only.

- Regularly update and test internal control procedures to ensure their effectiveness.

- Maintain audit trails for all premium transactions.

- Establish a process for reporting and investigating suspected fraud.

Customer Service Aspects of Premium Handling

Effective customer service is paramount in premium handling, ensuring policyholder satisfaction and fostering strong client relationships. A well-structured approach to communication, proactive measures, and efficient dispute resolution are crucial for maintaining trust and smooth operations. This section details strategies for enhancing the customer experience related to premium payments.

Effective Communication Strategies for Acknowledging Premium Payments

Prompt and clear acknowledgment of premium payments is essential for building trust and minimizing inquiries. This involves sending automated payment confirmations via email or SMS immediately after a payment is processed. These confirmations should include the policy number, payment amount, payment date, and method of payment. For payments made through less automated channels, such as mail, manual confirmation within 24-48 hours is crucial. Personalization, such as addressing the policyholder by name, adds a positive touch. A clear and concise message avoids confusion and reassures the customer that their payment has been received and processed correctly.

Handling Premium Payment Inquiries and Resolving Discrepancies

A dedicated customer service team should be readily available to address premium payment inquiries. This team should be well-trained to access policy information quickly and efficiently. When discrepancies arise, a systematic investigation is necessary, involving verifying payment records, confirming payment methods, and reviewing policy details. Transparent and timely communication with the policyholder throughout the investigation process is critical, keeping them informed of the progress and expected resolution timeframe. Documentation of all communication and actions taken is vital for audit trails and accountability. In cases of payment failures, clear instructions on how to rectify the situation should be provided.

Proactive Measures to Ensure Timely Premium Payments

Proactive measures significantly reduce late payments and associated administrative burdens. This includes implementing automated payment reminders sent via email or SMS a few days before the due date. Offering multiple payment options, such as online portals, mobile apps, bank transfers, and direct debit, caters to various customer preferences and enhances convenience. Personalized communication highlighting potential payment difficulties, based on historical data or observed trends, allows for proactive intervention. For example, if a customer consistently pays late, a personalized email offering payment plan options could prevent future late payments. Furthermore, clearly outlining payment due dates and methods on all policy documents and communication materials minimizes confusion.

Customer Communication Plan for Addressing Premium-Related Issues

A comprehensive communication plan Artikels procedures for handling various premium-related issues. This plan should include clearly defined roles and responsibilities, escalation procedures for complex issues, and standardized communication templates. It should also address communication channels, response times, and procedures for documenting all interactions. The plan should be regularly reviewed and updated to reflect changes in processes or regulatory requirements. This proactive approach ensures consistent and efficient handling of premium-related issues, minimizing customer frustration and maintaining a positive relationship.

Sample Email Templates for Communicating with Policyholders

Below are examples of email templates for different scenarios. These templates can be adapted to specific situations and company branding.

Template 1: Payment Confirmation

Subject: Your Premium Payment Confirmation – Policy [Policy Number]

Dear [Policyholder Name],

This email confirms receipt of your premium payment of [Amount] for policy [Policy Number] on [Date]. Thank you for your timely payment.

Sincerely,

[Company Name]

Template 2: Payment Reminder

Subject: Gentle Reminder: Your Premium Payment is Due Soon – Policy [Policy Number]

Dear [Policyholder Name],

This is a friendly reminder that your premium payment of [Amount] for policy [Policy Number] is due on [Date]. You can make your payment through [link to payment portal].

Sincerely,

[Company Name]

Template 3: Payment Discrepancy Notification

Subject: Inquiry Regarding Your Premium Payment – Policy [Policy Number]

Dear [Policyholder Name],

We have noticed a discrepancy in your recent premium payment for policy [Policy Number]. Please contact us at [phone number] or reply to this email to discuss this further.

Sincerely,

[Company Name]

Closure

Effective management of insurance premiums is not merely a matter of compliance; it’s a cornerstone of operational excellence and financial stability. By adhering to legal requirements, implementing robust internal controls, leveraging technological advancements, and prioritizing customer service, insurance companies can ensure the secure and efficient handling of premium funds. This comprehensive approach fosters trust with policyholders, mitigates financial risks, and contributes to the long-term success of the organization.

Question & Answer Hub

What happens if a premium payment is lost or delayed in the mail?

Insurance companies typically have procedures in place to handle lost or delayed payments. Policyholders should contact their insurer immediately to report the issue. Proof of mailing may be required. The insurer will likely investigate and work with the policyholder to resolve the situation.

How are premium refunds handled?

Premium refunds are typically processed according to the insurer’s established procedures, often Artikeld in the policy documents. This usually involves verifying the reason for the refund and processing the payment through the original payment method or a designated alternative. Detailed records are maintained to ensure accurate accounting.

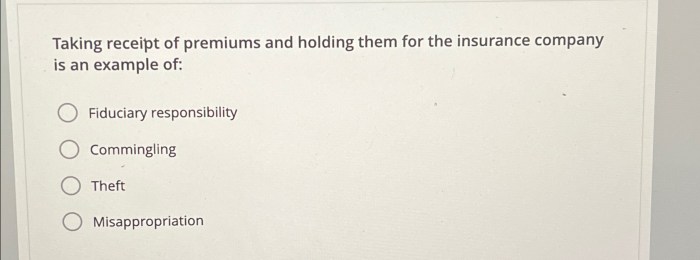

What are the implications of commingling premium funds with other company funds?

Commingling premium funds is a serious violation of regulatory requirements and can result in significant penalties, including fines and legal action. It erodes trust with policyholders and can jeopardize the financial stability of the insurance company.