Navigating the complexities of tax deductions can be daunting, especially when it comes to healthcare costs. Understanding whether you can

Tag: Tax Planning

Is Your Life Insurance Premium Tax Deductible? A Comprehensive Guide

Navigating the complexities of tax deductions can feel like traversing a dense forest. One area often shrouded in uncertainty is

Is Life Insurance Premium Tax Deductible in Canada? A Comprehensive Guide

Navigating the Canadian tax system can be complex, especially when it comes to insurance. A common question for many Canadians

Can Health Insurance Premiums Be Deducted From Taxes? A Comprehensive Guide

Navigating the complexities of tax deductions can be daunting, especially when it comes to healthcare expenses. The question of whether

Can I Claim My Life Insurance Premiums on My Taxes? A Comprehensive Guide

Navigating the complex world of tax deductions can be daunting, especially when it comes to specialized financial products like life

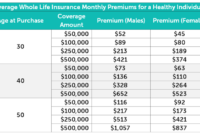

Are Whole Life Insurance Premiums Tax Deductible? A Comprehensive Guide

The question of whether whole life insurance premiums are tax deductible is a complex one, impacting the financial planning of

What Percent of Personal Life Insurance Premiums is Usually Deductible? A Comprehensive Guide

Navigating the complexities of tax deductions can feel like deciphering a secret code, especially when it comes to personal life

Is Life Insurance Premium Deductible? A Comprehensive Guide

Navigating the complexities of tax deductions can be a daunting task, especially when dealing with financial instruments like life insurance.

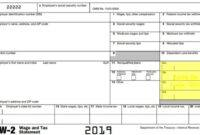

Decoding Your W-2: Understanding Health Insurance Premium Reporting

Navigating the complexities of your W-2 form can feel like deciphering a secret code, especially when it comes to understanding

Maximizing Tax Benefits: A Guide to Deducting Health Insurance Premiums

Navigating the complexities of healthcare costs and tax deductions can feel overwhelming. Understanding the rules surrounding deducting health insurance premiums