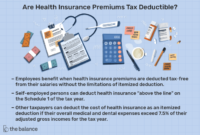

Navigating the complexities of health insurance and taxes can be daunting. Understanding whether your health insurance premiums are taxable significantly

Tag: tax implications

Can I Use My HSA to Pay Health Insurance Premiums? A Comprehensive Guide

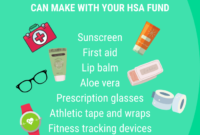

The question of whether you can use your Health Savings Account (HSA) to pay health insurance premiums is a common

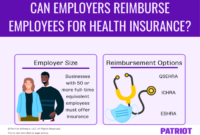

Understanding Employer Reimbursement for Health Insurance Premiums: A Comprehensive Guide

Navigating the complexities of employee benefits can be challenging, particularly when it comes to health insurance. Employer reimbursement for health

Can I Use HSA to Pay for Health Insurance Premiums? A Comprehensive Guide

The question of whether you can use your Health Savings Account (HSA) to pay health insurance premiums is a common

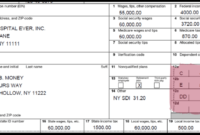

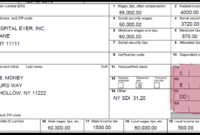

Where to Find Health Insurance Premiums on Your W-2: A Comprehensive Guide

Understanding your W-2 form can be crucial for managing your finances, especially when it comes to employer-sponsored health insurance. While

Can I Pay Insurance Premiums with My HSA? A Comprehensive Guide

The question of whether you can use your Health Savings Account (HSA) to pay insurance premiums is a common one,

Are Health Insurance Premiums Paid by Employer Taxable Income? A Comprehensive Guide

The question of whether employer-paid health insurance premiums constitute taxable income for employees is a common one, fraught with complexities

Is Insurance Premium a Capital Expenditure? A Comprehensive Guide

The question of whether an insurance premium constitutes a capital expenditure or an operating expense is a nuanced one, impacting

Decoding Your W-2: Understanding Health Insurance Premiums

Navigating the complexities of health insurance is a common challenge, and understanding how those costs appear on your W-2 form

Can Employers Offer Post-Tax Health Insurance Premiums? A Comprehensive Guide

Navigating the complexities of employer-sponsored health insurance can be challenging, particularly when considering the option of post-tax premiums. While pre-tax