Securing life insurance is a crucial step in financial planning, offering peace of mind for your loved ones. But understanding

Tag: Life Insurance Premiums

Does Whole Life Insurance Premium Increase With Age? A Comprehensive Guide

Securing your family’s financial future through life insurance is a significant decision, and understanding the nuances of premium structures is

Factors Affecting Life Insurance Premium: A Comprehensive Guide

Securing life insurance is a crucial financial decision, offering peace of mind for loved ones. However, understanding the intricacies of

Can I Deduct Life Insurance Premiums? A Comprehensive Guide

The question of whether life insurance premiums are tax-deductible is a complex one, varying significantly depending on individual circumstances and

Which Type of Life Insurance Offers Flexible Premiums? A Comprehensive Guide

Navigating the world of life insurance can feel overwhelming, especially when faced with the diverse range of policies available. One

Securing Your Future: A Comprehensive Guide to Permanent Life Insurance Policies with Premium Payments

Permanent life insurance, characterized by its lifelong coverage and cash value accumulation, offers a powerful tool for long-term financial security.

What is the Premium for Life Insurance? A Comprehensive Guide

Securing your family’s financial future is a paramount concern, and life insurance plays a vital role in achieving this. Understanding

What Affects Life Insurance Premiums: A Comprehensive Guide

Securing life insurance is a crucial step in financial planning, offering peace of mind for your loved ones. However, the

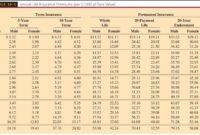

Life Insurance Premiums: Computed on What Three Key Factors?

Securing life insurance is a crucial step in financial planning, offering peace of mind for loved ones. But understanding how

Why Did My Life Insurance Premium Go Up? Understanding the Factors Affecting Your Cost

Life insurance premiums, while designed to protect your loved ones, can sometimes seem mysterious, especially when they unexpectedly increase. This