Single premium whole life insurance presents a compelling financial strategy, offering a unique blend of life insurance coverage and long-term investment growth. Unlike traditional whole life policies requiring ongoing premium payments, a single, upfront payment secures lifelong coverage and a steadily accumulating cash value component. This approach provides a potentially powerful tool for wealth preservation and estate planning, but understanding its intricacies is crucial for making an informed decision.

This guide delves into the core aspects of single premium whole life insurance, exploring its benefits, risks, and suitability for various financial profiles. We’ll examine the tax advantages, compare it to other insurance and investment options, and provide practical guidance on policy selection and considerations. By the end, you’ll possess a clear understanding of whether this powerful financial instrument aligns with your individual circumstances.

Definition and Characteristics of Single Premium Whole Life Insurance

Single premium whole life insurance (SPWL) is a type of permanent life insurance policy that requires a single, lump-sum payment upfront to secure lifelong coverage. This contrasts with traditional whole life insurance, which involves regular premium payments over the policyholder’s lifetime. Its core appeal lies in the simplicity of a one-time payment and the guaranteed lifelong protection it offers.

Core Features of Single Premium Whole Life Insurance

SPWL policies offer several key features. The most significant is the guaranteed lifelong coverage, meaning the death benefit is paid to the beneficiary upon the insured’s death, regardless of when that occurs. Another crucial feature is the cash value component, which grows tax-deferred over time. This cash value can be borrowed against or withdrawn, although withdrawals and loans can impact the death benefit and cash value accumulation. The policy also typically includes a fixed death benefit, meaning the payout amount is predetermined at the policy’s inception. Finally, SPWL policies generally offer a guaranteed minimum rate of return on the cash value, providing a degree of predictability.

Differences Between Single Premium and Traditional Whole Life Insurance

The primary difference lies in the payment schedule. SPWL requires a single, large upfront payment, while traditional whole life insurance involves regular premium payments throughout the insured’s life. This difference impacts the overall cost; a single premium will be significantly higher upfront but eliminates the need for future payments. Traditional whole life insurance, while offering flexibility in payment amounts, carries the risk of policy lapse if payments are missed. Furthermore, the cash value accumulation may differ slightly between the two, depending on the specific policy terms and the insurer’s investment performance. However, both types provide lifelong coverage and a cash value component.

Typical Policy Components

A typical SPWL policy comprises several key components. The death benefit is the amount paid to the beneficiary upon the insured’s death. This amount is usually fixed at the policy’s inception, though some policies may offer options for adjustments. The cash value component represents the policy’s savings element. This grows tax-deferred over time and can be accessed through loans or withdrawals. The premium, in this case, is a single, lump-sum payment made at the policy’s outset. Finally, the policy fees and expenses are deducted from the cash value over time. Understanding these components is vital for assessing the overall value and cost-effectiveness of the policy.

Comparison of Single Premium Whole Life Insurance with Other Life Insurance Types

The following table compares SPWL with term life and universal life insurance:

| Feature | Single Premium Whole Life | Term Life | Universal Life |

|---|---|---|---|

| Premium Payments | Single, lump-sum | Periodic payments for a specified term | Flexible periodic payments |

| Coverage Period | Lifelong | Specified term (e.g., 10, 20, 30 years) | Lifelong, subject to premium payments |

| Cash Value | Yes, grows tax-deferred | No | Yes, grows based on investment performance |

| Death Benefit | Fixed or potentially adjustable | Fixed | Adjustable, potentially based on cash value |

Financial Implications and Benefits

Single Premium Whole Life (SPWL) insurance offers a unique blend of life insurance coverage and a tax-advantaged savings vehicle. Understanding its financial implications and potential benefits is crucial for determining its suitability within a broader financial plan. This section will delve into the tax advantages, long-term growth potential, and comparative returns of SPWL, while also addressing potential risks.

Tax Advantages

SPWL insurance policies often offer significant tax advantages. Premiums paid are generally not tax-deductible, however, the cash value accumulation within the policy grows tax-deferred. This means you won’t pay taxes on the earnings until you withdraw them. Furthermore, death benefits paid to beneficiaries are typically tax-free, providing a substantial estate planning benefit. It’s important to consult with a qualified financial advisor to understand the specific tax implications in your jurisdiction, as tax laws can be complex and vary. The tax benefits alone can significantly enhance the long-term financial return.

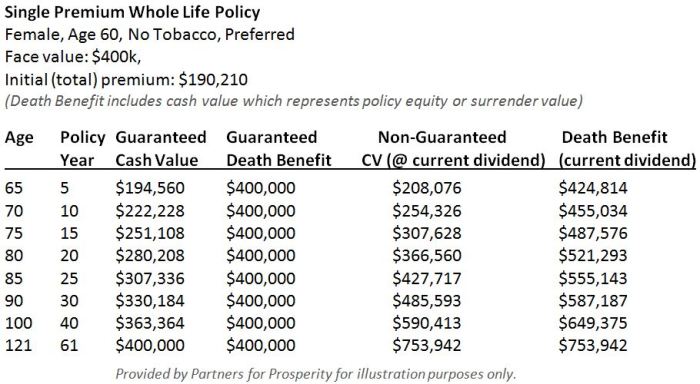

Long-Term Growth Potential of Cash Value

The cash value component of a SPWL policy grows over time, typically at a rate determined by the insurance company’s investment performance and the policy’s credited interest rate. This growth is tax-deferred, as mentioned previously, allowing for compounding returns. While the growth rate isn’t guaranteed and may vary, the long-term nature of the policy allows for consistent accumulation, potentially providing a substantial nest egg for retirement or other long-term financial goals. For example, a policy with a modest growth rate of 4% annually can see significant cash value accumulation over several decades. The actual growth will depend on various factors, including the insurer’s investment performance and the policy’s specific terms.

Comparison with Other Investment Options

SPWL insurance offers a different investment profile compared to other options like stocks, bonds, or mutual funds. While the returns may not be as potentially high as those of some higher-risk investments, SPWL provides a guaranteed minimum death benefit and a relatively stable, tax-advantaged growth environment for the cash value. The lower risk profile comes with a trade-off of potentially lower returns compared to higher-risk investments. A direct comparison requires considering individual risk tolerance, financial goals, and time horizon. For instance, a conservative investor seeking long-term security and tax advantages might find SPWL preferable to a volatile stock portfolio.

Potential Risks and Downsides

It is essential to acknowledge the potential risks and downsides associated with SPWL insurance.

- Lower Potential Returns Compared to Other Investments: SPWL typically offers lower potential returns than higher-risk investments like stocks.

- Limited Liquidity: Accessing the cash value may involve surrender charges, especially in the early years of the policy, reducing the liquidity of the investment.

- Insurance Company Risk: The financial stability of the insurance company issuing the policy is a crucial factor. A company’s failure could impact the policy’s value and death benefit.

- High Initial Investment: The single premium payment can be substantial, requiring a significant upfront capital commitment.

- Fees and Expenses: SPWL policies often involve various fees and expenses, including mortality charges and administrative fees, which can impact the overall return.

Suitability and Ideal Client Profile

Single premium whole life insurance, while offering significant benefits, isn’t a one-size-fits-all solution. Understanding the ideal client profile and carefully considering individual circumstances is crucial for determining suitability. This section will explore the characteristics of individuals who might find this type of insurance particularly advantageous, and the factors that should be weighed before purchasing a policy.

The ideal client for single premium whole life insurance typically possesses a high net worth, a long-term financial planning horizon, and a low risk tolerance. They are often looking for a guaranteed death benefit, tax-advantaged growth, and a legacy planning tool, rather than a short-term investment.

Ideal Client Profile Characteristics

Several key characteristics define the ideal client for single premium whole life insurance. These characteristics contribute to a successful and beneficial insurance strategy.

| Characteristic | Description | Example |

|---|---|---|

| High Net Worth | Significant financial resources available for a substantial upfront premium payment. | An individual with a substantial investment portfolio and significant savings. |

| Long-Term Financial Goals | A focus on long-term financial security and legacy planning, rather than short-term gains. | Planning for the financial security of future generations or providing a lasting inheritance. |

| Low Risk Tolerance | A preference for guaranteed returns and stable investments over higher-risk, potentially higher-return options. | An individual who prioritizes capital preservation over speculative investment strategies. |

| Tax Optimization Needs | A desire to leverage tax advantages offered by whole life insurance policies. | An individual seeking to minimize their estate tax liability or maximize their after-tax returns. |

Beneficial Scenarios

Single premium whole life insurance offers distinct advantages in specific financial situations. Understanding these scenarios helps clarify its utility.

For example, a successful entrepreneur might use a single premium whole life policy to secure a substantial death benefit for their family, while simultaneously benefiting from the tax-advantaged growth of the cash value component. This approach provides both financial protection and a long-term investment vehicle.

Another scenario involves estate planning. High-net-worth individuals often utilize single premium whole life insurance to minimize estate taxes and ensure a smooth transfer of wealth to heirs. The death benefit, paid tax-free to beneficiaries, can significantly reduce the overall estate tax burden.

Factors to Consider When Determining Suitability

Several crucial factors must be considered to determine the suitability of single premium whole life insurance for a particular client. A comprehensive assessment is essential.

| Factor | Description | Impact on Suitability |

|---|---|---|

| Risk Tolerance | The client’s comfort level with investment risk. | Low risk tolerance is generally suitable, as single premium whole life offers guaranteed returns. |

| Financial Goals | Long-term financial objectives, such as legacy planning or estate tax mitigation. | Alignment with long-term goals increases suitability. |

| Time Horizon | The length of time the client needs the policy to be in effect. | A long time horizon aligns well with the long-term nature of the policy. |

| Liquidity Needs | The client’s need for access to funds during the policy’s term. | Limited liquidity is a consideration, as accessing cash value may incur penalties. |

Client Profile Suitability Matrix

The following table provides a simplified illustration of how different client profiles might align with the suitability of single premium whole life insurance. It is important to remember that this is a general guideline and individual circumstances should always be thoroughly assessed.

| Client Profile | Net Worth | Risk Tolerance | Suitability |

|---|---|---|---|

| High-net-worth individual, legacy planning focus | High | Low | Highly Suitable |

| Young professional, moderate savings | Moderate | Moderate | Potentially Suitable (depending on specific goals and financial situation) |

| Retiree, limited savings | Low | Low | Likely Unsuitable (due to limited resources and potential for outliving funds) |

| High-income earner, short-term financial goals | High | High | Likely Unsuitable (alternative investments may be more appropriate) |

Final Thoughts

Single premium whole life insurance offers a unique path to financial security, combining lifelong coverage with the potential for substantial long-term growth. While it requires a significant upfront investment and may not be suitable for everyone, careful consideration of its benefits and risks, alongside a thorough understanding of your financial goals and risk tolerance, can illuminate whether it represents a sound investment strategy for your future. Remember to consult with a qualified financial advisor to determine the best course of action tailored to your specific needs.

Frequently Asked Questions

What are the potential downsides of single premium whole life insurance?

The primary downside is the significant upfront investment required. Returns are generally lower than some other investment options, and the cash value growth is not guaranteed. Furthermore, policy surrender charges can significantly impact returns if the policy is cashed out early.

Can I borrow against the cash value of my single premium whole life insurance policy?

Yes, most single premium whole life insurance policies allow you to borrow against the accumulated cash value. However, interest will accrue on these loans, and failure to repay could impact your death benefit or cash value.

How is the cash value taxed upon withdrawal or death?

Withdrawals from the cash value are generally taxed as ordinary income, subject to applicable tax brackets. However, the death benefit paid to beneficiaries is typically tax-free.

How do I choose the right death benefit amount?

The ideal death benefit depends on your individual circumstances, including your family’s financial needs, outstanding debts, and desired legacy. It’s crucial to consider future inflation and potential changes in your financial situation.