Securing your family’s financial future is a paramount concern, and life insurance plays a crucial role in achieving this goal. Among the various life insurance options available, single premium life insurance stands out for its unique structure and potential benefits. This comprehensive guide delves into the intricacies of single premium life insurance rates, exploring the factors that influence them, comparing rates across providers, and ultimately empowering you to make informed decisions about your financial protection.

Understanding single premium life insurance rates requires navigating several key aspects. This includes grasping the core differences between single premium and traditional annual premium policies, identifying the demographic and policy-specific factors that impact costs, and comparing offerings from different insurance providers. By examining these elements, we aim to provide you with a clear understanding of how single premium life insurance works and how to find the best policy to meet your specific needs.

Defining Single Premium Life Insurance

Single premium life insurance is a type of permanent life insurance policy that requires a single, lump-sum payment upfront to secure coverage for the policyholder’s entire life. Unlike traditional life insurance policies that require recurring premium payments, a single premium policy offers lifelong coverage with just one payment. This makes it a potentially attractive option for individuals with significant capital seeking long-term financial security for their beneficiaries.

Single premium life insurance policies offer several key features. These policies typically accumulate cash value over time, which grows tax-deferred. Policyholders can borrow against this cash value or withdraw a portion of it, though this will reduce the death benefit. The death benefit, the amount paid to the beneficiaries upon the policyholder’s death, remains fixed throughout the policy’s life, providing a guaranteed amount of financial protection. Furthermore, single premium policies often offer a fixed interest rate on the cash value, providing a level of predictability in the growth of the policy’s value.

Single Premium vs. Traditional Term Life Insurance

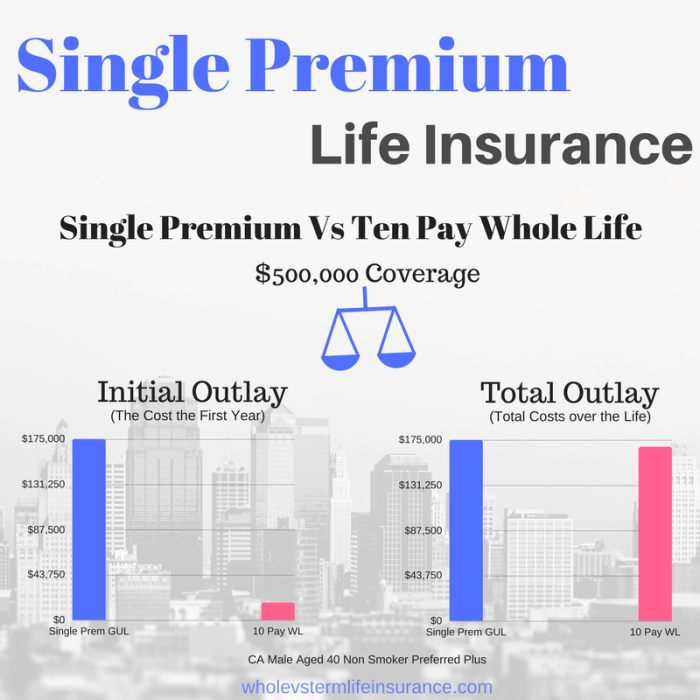

Single premium and traditional term life insurance differ significantly in their payment structure, coverage duration, and overall cost. Term life insurance, often more affordable initially, provides coverage for a specific period (term), such as 10, 20, or 30 years. Premiums are paid annually or semi-annually during this term. If the policyholder dies within the term, the death benefit is paid out. If the policyholder survives the term, the coverage expires, and no further death benefit is payable unless the policy is renewed (often at a higher premium). In contrast, single premium life insurance provides lifelong coverage with a one-time payment, offering a guaranteed death benefit for the life of the insured. The cost of a single premium policy is significantly higher upfront but eliminates the need for future premium payments.

Situations Where Single Premium Life Insurance Might Be Suitable

A single premium life insurance policy can be a suitable choice in several situations. For instance, individuals who have received a large sum of money, such as an inheritance or lottery winnings, might use it to secure permanent life insurance coverage without ongoing premium payments. High-net-worth individuals might find it advantageous for estate planning purposes, as the death benefit can help offset estate taxes. It can also be appropriate for those seeking a fixed, guaranteed death benefit without the uncertainty of fluctuating premiums over time. Finally, individuals nearing retirement who want to leave a legacy for their heirs might find this option attractive, ensuring a guaranteed amount is available upon their passing regardless of their future financial situation.

Comparison of Single Premium and Annual Premium Life Insurance Policies

| Feature | Single Premium | Annual Premium | Key Differences |

|---|---|---|---|

| Premium Payment | One-time lump sum | Recurring annual (or more frequent) payments | Significant upfront cost vs. smaller, ongoing payments. |

| Coverage Duration | Lifelong | Specific term (e.g., 10, 20, 30 years) | Permanent coverage vs. temporary coverage. |

| Cash Value Accumulation | Typically accumulates tax-deferred cash value | May or may not accumulate cash value (depending on the type of policy) | Potential for long-term growth and access to funds vs. limited or no cash value growth. |

| Cost | Higher initial cost | Lower initial cost, but higher overall cost over time | Significant difference in overall cost depends on the length of the policy and the individual’s lifespan. |

Factors Influencing Single Premium Life Insurance Rates

Several key factors interact to determine the cost of a single premium life insurance policy. Understanding these elements is crucial for making an informed decision. These factors broadly fall into categories relating to the applicant’s personal characteristics, the policy’s features, and the level of risk assumed by the insurer.

Demographic Factors

Age, gender, and health status significantly influence single premium life insurance rates. Older applicants generally pay higher premiums because their life expectancy is shorter, increasing the insurer’s risk of paying out the death benefit sooner. Similarly, individuals with pre-existing health conditions or a family history of certain illnesses typically face higher rates due to a heightened risk of early death. Generally, women tend to receive slightly lower rates than men due to their statistically longer life expectancy. The insurer uses this data, combined with medical information provided during the application process, to assess risk.

Policy Type

The type of policy chosen – term life insurance or whole life insurance – dramatically impacts the premium. Term life insurance provides coverage for a specified period (e.g., 10, 20, or 30 years), and premiums are generally lower than for whole life insurance. Whole life insurance, on the other hand, offers lifelong coverage and often includes a cash value component that grows over time. This longer-term commitment and additional benefits result in significantly higher single premiums. For example, a 40-year-old male purchasing a $500,000 term life insurance policy might pay a substantially lower single premium than if he were to purchase a $500,000 whole life policy.

Death Benefit Amount

The death benefit – the amount paid to beneficiaries upon the insured’s death – is directly proportional to the premium. A larger death benefit requires a larger single premium to cover the increased risk for the insurer. This is a simple relationship: a higher payout necessitates a higher upfront cost. For instance, a $1 million death benefit policy will invariably cost more than a $500,000 death benefit policy, all other factors being equal.

Underwriting Classes

Insurance companies categorize applicants into underwriting classes based on their health and risk profiles. Applicants in preferred classes, demonstrating excellent health and low risk, receive the lowest rates. Standard classes represent average risk, while substandard classes encompass those with higher-than-average risk factors. For example, a non-smoker with a clean bill of health might fall into the preferred class, receiving a substantially lower premium than a smoker with a history of heart disease who might be placed in a substandard class. The differences in premiums between these classes can be significant, potentially doubling or tripling the cost for those in substandard classes.

Comparing Rates Across Different Providers

Obtaining single premium life insurance quotes from multiple providers is crucial for securing the best value. While policy features can vary, a direct comparison of premiums allows for a clear understanding of cost differences. This section analyzes rates from three hypothetical major providers, highlighting key variations and contributing factors.

Rate Comparison Across Three Providers

The following table compares hypothetical single premium life insurance rates for a $1,000,000 death benefit, illustrating potential differences between providers. Note that these are illustrative examples and actual rates will vary based on individual circumstances.

| Provider | Policy Type | Death Benefit | Premium |

|---|---|---|---|

| Provider A | Whole Life | $1,000,000 | $250,000 |

| Provider B | Whole Life | $1,000,000 | $275,000 |

| Provider C | Whole Life | $1,000,000 | $230,000 |

Factors Influencing Rate Variations

Several factors contribute to the variations observed in single premium life insurance rates across providers. These include the provider’s investment performance, risk assessment models, administrative costs, and the specific features included in the policy. For example, Provider A’s lower premium might reflect a more conservative investment strategy, while Provider B’s higher premium could incorporate additional benefits or a more comprehensive risk assessment. Provider C’s competitive pricing may be a result of efficient operational costs or a different risk profile.

Hypothetical Scenario: Age and Health Impact

To further illustrate the impact of individual factors on premiums, consider the following hypothetical scenario. Three individuals – a 35-year-old male in excellent health (Individual X), a 50-year-old female with a minor health condition (Individual Y), and a 60-year-old male with pre-existing conditions (Individual Z) – each seek a $1,000,000 whole life policy. Their hypothetical premiums from Provider A might be: Individual X: $220,000; Individual Y: $300,000; Individual Z: $450,000. This demonstrates how age and health status significantly influence the cost of single premium life insurance. Younger, healthier individuals generally qualify for lower premiums due to lower mortality risk.

Understanding Policy Features and Their Impact on Cost

The cost of a single premium life insurance policy isn’t solely determined by the amount of coverage. Several policy features significantly influence the final premium, impacting the overall value and cost-effectiveness of the policy. Understanding these features and their implications is crucial for making an informed decision. This section details how riders, cash value accumulation, payout options, and policy terms affect the premium.

Riders and Premium Influence

Adding riders to a single premium life insurance policy enhances coverage but typically increases the premium. A common example is an accelerated death benefit rider, which allows access to a portion of the death benefit while the policyholder is still alive, usually for terminal illnesses. This added flexibility comes at a cost, increasing the initial premium compared to a policy without this rider. Other riders, such as long-term care riders or disability waivers, also contribute to higher premiums. The extent of the premium increase depends on the specific rider chosen and the level of coverage provided. For instance, a rider offering 50% of the death benefit early might increase the premium by 10-15%, while a more comprehensive rider could lead to a larger increase.

Cash Value Accumulation and Overall Cost

Some single premium life insurance policies accumulate cash value over time. This cash value grows tax-deferred and can be borrowed against or withdrawn under certain circumstances. While the cash value component can seem beneficial, it’s important to remember that it’s funded by a portion of the premium. Therefore, policies with significant cash value accumulation will generally have higher initial premiums compared to term life insurance policies, which don’t build cash value. The ultimate cost-effectiveness depends on individual circumstances and long-term financial goals. A policy with a high cash value component might be preferable for those aiming to build wealth alongside life insurance coverage, but it will result in a higher initial premium.

Payout Options and Final Cost

The choice of payout option influences the way the death benefit is distributed to beneficiaries. Options typically include a lump-sum payment, a period certain annuity (guaranteed payments for a specific period), or a life annuity (payments for the lifetime of the beneficiary). While the total death benefit remains the same, the chosen payout option doesn’t directly affect the initial premium. However, selecting an annuity option might indirectly influence the perceived cost, as the total amount received over time may be lower than the lump-sum equivalent due to interest rates and the mortality experience of the beneficiary.

Policy Term Length and Premium

The length of coverage significantly impacts the premium. A whole life policy, offering lifetime coverage, naturally demands a higher single premium than a limited-pay whole life policy (where premiums are paid for a shorter, specified period) or a term life policy, which covers a defined period (e.g., 10, 20, or 30 years). For example, a $1 million single premium whole life policy might cost significantly more than a $1 million single premium 20-year term life policy. The longer the coverage period, the higher the risk for the insurer, resulting in a higher premium. A shorter term policy reflects a lower risk and therefore a lower premium.

Illustrative Examples of Single Premium Life Insurance Rates

Understanding the cost of single premium life insurance requires examining specific examples. The following illustrations demonstrate how factors such as age, health, and policy features impact premiums. Remember that these are illustrative examples and actual rates will vary depending on the insurer and individual circumstances. It’s crucial to obtain personalized quotes from multiple providers.

Single Premium Whole Life Insurance: 45-Year-Old Male, Non-Smoker

This example details a hypothetical single premium whole life insurance policy for a 45-year-old male non-smoker seeking a $500,000 death benefit. Assuming a healthy applicant with no significant family history of disease, a reputable insurer might offer a premium in the range of $70,000 to $90,000. This wide range reflects the variations in underwriting practices and product offerings among different insurance companies. The exact cost would depend on the specific policy features and the insurer’s underwriting assessment. The premium is a one-time payment, covering the death benefit for the policyholder’s lifetime.

Single Premium Whole Life Insurance: 60-Year-Old Female with Pre-existing Conditions

This illustration examines a $250,000 single premium whole life insurance policy for a 60-year-old female with pre-existing health conditions. Let’s assume she has a history of hypertension and elevated cholesterol. Due to these health factors, the insurer will likely apply rate adjustments. The premium could be significantly higher than for a healthy individual of the same age and benefit amount. A reasonable estimate might range from $60,000 to $100,000 or even more, depending on the severity of the pre-existing conditions and the insurer’s specific underwriting guidelines. The increased premium reflects the higher risk associated with insuring an individual with pre-existing health conditions. The insurer will thoroughly assess the applicant’s medical history and current health status to determine the appropriate premium.

Impact of an Accelerated Death Benefit Rider

Adding an accelerated death benefit rider allows the policyholder to access a portion of the death benefit while still alive, typically to cover terminal illness expenses. Including this rider will increase the overall premium. For instance, if the 45-year-old male from the first example added an accelerated death benefit rider, his single premium might increase by 10-20%, raising the premium from a range of $70,000-$90,000 to potentially $77,000-$108,000. The exact increase depends on the specific terms of the rider, such as the percentage of the death benefit accessible and any limitations on its use. This increased cost reflects the additional risk assumed by the insurer.

Final Summary

In conclusion, navigating the landscape of single premium life insurance rates requires careful consideration of numerous factors. From your age and health to the policy type and death benefit amount, each element plays a significant role in determining the final premium. By comparing offers from multiple providers and understanding the impact of various policy features, you can confidently select a policy that provides adequate coverage while aligning with your financial goals. Remember to consult with a financial advisor to personalize your strategy and ensure the chosen policy effectively addresses your individual circumstances.

FAQ

What is the difference between a single premium and an annual premium life insurance policy?

A single premium policy requires one upfront payment, while an annual premium policy involves recurring payments over the policy’s term.

Can I change my single premium life insurance policy after purchase?

The ability to make changes varies by policy and provider. Some modifications might be possible, but others may be restricted. Review your policy documents carefully or contact your insurer.

What happens to the cash value in a single premium whole life insurance policy?

The cash value grows tax-deferred over time and can be borrowed against or withdrawn, though this may impact the death benefit.

How does my health status affect single premium life insurance rates?

Individuals with pre-existing health conditions typically face higher rates due to increased risk for the insurer. Underwriting involves a thorough assessment of your health.