Securing your financial future and the well-being of your loved ones is a paramount concern. Single premium life insurance offers a powerful tool to achieve these goals, providing a unique blend of financial protection and potential long-term growth. This comprehensive guide delves into the intricacies of single premium life insurance, exploring its various types, benefits, drawbacks, and application process. We aim to equip you with the knowledge necessary to make informed decisions regarding this significant financial instrument.

Understanding the nuances of single premium life insurance requires careful consideration of several key factors. From the initial premium payment and the selection of the appropriate policy type to the long-term implications for estate planning and wealth accumulation, navigating this landscape demands a thorough understanding of its complexities. This guide will clarify the essential aspects, empowering you to make choices aligned with your specific financial objectives and risk tolerance.

Definition and Types of Single Premium Life Insurance

Single premium life insurance (SPLI) offers a straightforward approach to securing life insurance coverage. It requires a single, lump-sum payment upfront, eliminating the need for recurring premium payments throughout the policy’s duration. This makes it a potentially attractive option for individuals with significant capital seeking long-term coverage or those who prefer a simplified payment structure. The policy’s benefits remain in effect until the insured’s death, providing a guaranteed payout to beneficiaries.

Types of Single Premium Life Insurance Policies

Several types of life insurance policies can be purchased with a single premium payment. Understanding the distinctions between these options is crucial for choosing the policy that best aligns with individual financial goals and risk tolerance.

Whole Life Insurance (Single Premium)

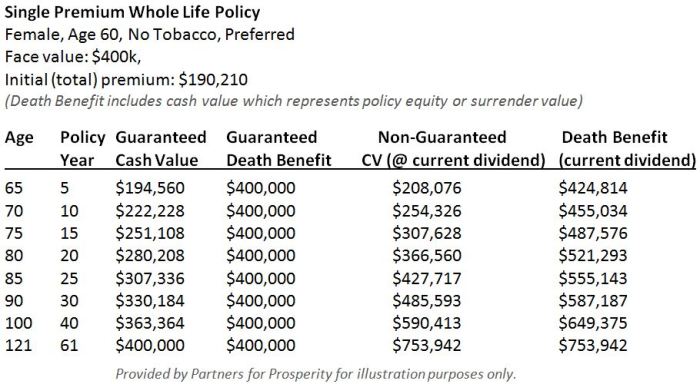

Whole life insurance, purchased with a single premium, provides lifelong coverage and builds a cash value component that grows tax-deferred. The death benefit remains constant throughout the policy’s term. Key features include guaranteed death benefits, fixed premiums, and cash value accumulation. The cash value can be borrowed against or withdrawn, but this will reduce the death benefit and may impact the overall growth.

Universal Life Insurance (Single Premium)

Universal life insurance, also available with a single premium payment, offers more flexibility than whole life. It typically features a death benefit that can be adjusted, and the cash value component earns interest at a rate that can fluctuate based on market performance. This flexibility comes with the potential for higher returns but also carries greater risk compared to whole life insurance. Policyholders have some control over premium payments (though initially, it’s a single premium), and the death benefit can be increased or decreased based on individual needs.

Variable Universal Life Insurance (Single Premium)

Variable universal life (VUL) insurance, purchased with a single premium, provides even greater flexibility than universal life. The cash value component is invested in sub-accounts, similar to mutual funds, offering the potential for higher returns but also greater risk. The death benefit can fluctuate depending on the performance of the chosen sub-accounts. This option requires a higher degree of financial understanding and risk tolerance.

Comparison of Single Premium Life Insurance Policies

| Policy Type | Premium Payment | Death Benefit | Cash Value Growth |

|---|---|---|---|

| Whole Life (Single Premium) | One-time lump sum | Fixed, guaranteed | Guaranteed, tax-deferred |

| Universal Life (Single Premium) | One-time lump sum | Adjustable, may fluctuate | Variable, based on interest rates |

| Variable Universal Life (Single Premium) | One-time lump sum | Adjustable, may fluctuate significantly | Variable, based on investment performance |

Benefits and Advantages

Single premium life insurance offers a compelling blend of financial security and tax efficiency, making it an attractive option for many individuals seeking long-term financial planning. Its advantages stem from the immediate, lump-sum payment and the subsequent growth of the policy’s cash value. Understanding these benefits is crucial for determining its suitability within a broader financial strategy.

Tax Advantages

The tax advantages of single premium life insurance are significant. Premiums paid are not tax-deductible, however, the death benefit paid to beneficiaries is generally received income tax-free. This is a crucial distinction, offering substantial tax savings compared to other investment vehicles where capital gains taxes might apply. Furthermore, the cash value accumulated within the policy often grows tax-deferred, meaning you won’t pay taxes on the gains until you withdraw them. This tax-deferred growth can significantly enhance the long-term value of your investment. For example, if you invest $100,000 and it grows to $200,000 over 20 years, you would only pay taxes on the growth ($100,000) upon withdrawal, rather than on the entire $200,000 if it were held in a taxable account. Specific tax implications can vary based on individual circumstances and applicable legislation, so consulting a financial advisor is recommended.

Guaranteed Death Benefits and Cash Value Accumulation

Single premium life insurance policies provide a guaranteed death benefit, meaning a predetermined amount will be paid to your beneficiaries upon your death. This offers peace of mind knowing your loved ones will receive a specific sum, regardless of market fluctuations or economic downturns. In addition to the death benefit, the policy builds cash value over time. This cash value grows tax-deferred and can be accessed through loans or withdrawals (subject to policy terms and potential tax implications). This liquidity can be advantageous for unforeseen expenses or financial opportunities. For instance, a policyholder could borrow against the cash value to fund a child’s education or a home renovation without surrendering the policy.

Situations Where Single Premium Life Insurance is Advantageous

Single premium life insurance proves particularly beneficial in specific financial situations. High-net-worth individuals often utilize it as a means of estate planning, leveraging the tax-advantaged growth and guaranteed death benefit to minimize estate taxes and ensure a smooth transfer of wealth to heirs. It also provides a secure, long-term investment for those seeking a stable, predictable return, particularly those nearing retirement and desiring a legacy for their family. Business owners may use it for key-person insurance, protecting the company from financial losses in the event of the unexpected death of a crucial employee.

Financial Benefits Across Life Stages

The financial advantages of single premium life insurance adapt to different life stages:

- Early Career: Establishing a solid financial foundation, building long-term wealth, and securing a legacy for future generations.

- Mid-Career: Protecting against unexpected events, providing for family financial security, and maximizing tax efficiency through tax-deferred growth.

- Pre-Retirement: Supplementing retirement income, securing a guaranteed death benefit, and providing a tax-efficient way to leave a legacy.

- Retirement: Providing a steady income stream, protecting against longevity risk, and transferring wealth to heirs tax-efficiently.

Illustrative Examples and Scenarios

Single premium life insurance offers several unique applications in financial planning. Understanding these applications through real-world examples can clarify its potential benefits and limitations. The following scenarios illustrate its use in different contexts.

Estate Planning with Single Premium Life Insurance

A high-net-worth individual, let’s call him Mr. Jones, owns a successful business and significant assets. He wants to ensure a smooth transfer of wealth to his heirs while minimizing estate taxes. A substantial single premium life insurance policy provides a tax-advantaged way to cover potential estate taxes. Upon Mr. Jones’s death, the death benefit, free from estate taxes (depending on local regulations), is paid to his beneficiaries, providing liquidity to cover tax liabilities and ensuring his family receives the intended inheritance. This prevents the forced sale of assets to meet tax obligations, preserving the family’s financial stability.

Funding Future Expenses with Single Premium Life Insurance

Ms. Smith, nearing retirement, has a significant lump sum she wishes to invest conservatively while ensuring long-term financial security for her healthcare expenses. A single premium life insurance policy, particularly a whole life policy with a cash value component, can serve this purpose. The cash value grows tax-deferred, providing a source of funds accessible through loans or withdrawals to cover future medical bills or other retirement expenses without depleting her principal investment. This strategy offers both security and potential for growth.

Long-Term Growth of a Single Premium Whole Life Insurance Policy

Imagine a young professional, Mr. Lee, investing a substantial single premium into a whole life insurance policy. Over time, the policy’s cash value grows, accumulating interest and dividends (depending on the policy type and insurer). Assuming a consistent, moderate rate of return of 4% annually (this is a hypothetical example, and actual returns vary), and a starting investment of $100,000, the cash value could substantially increase over several decades. This long-term growth potential, combined with the death benefit, offers a powerful tool for wealth accumulation and legacy planning. This is not a guaranteed return, and market fluctuations can impact growth.

Scenario Where Single Premium Life Insurance Might Be Less Suitable

Consider a young individual with limited financial resources and a fluctuating income. Purchasing a single premium life insurance policy requires a significant upfront investment. For someone with unstable finances, this large outlay could strain their budget and leave them vulnerable to unforeseen expenses. In this instance, a term life insurance policy, offering lower premiums and a shorter coverage period, might be a more prudent choice, allowing them to secure life insurance coverage without excessive financial burden. They can later consider a single premium policy as their financial situation improves.

Summary

Single premium life insurance presents a compelling option for individuals seeking a streamlined approach to life insurance and long-term financial planning. While it offers significant advantages in terms of tax efficiency and guaranteed death benefits, careful consideration of its limitations and suitability within one’s overall financial strategy is crucial. By understanding the diverse policy types, associated costs, and potential market influences, you can make an informed decision that aligns with your unique circumstances and financial aspirations. Remember to consult with a qualified financial advisor to tailor a plan that best suits your individual needs.

Common Queries

What is the minimum amount I can invest in a single premium life insurance policy?

The minimum investment varies significantly depending on the insurer and the specific policy type. It’s advisable to contact insurance providers directly to inquire about their minimum premium requirements.

Can I withdraw from my cash value before the policy matures?

Many single premium life insurance policies allow for partial withdrawals of cash value, but this often incurs surrender charges, especially during the early years of the policy. The specifics are Artikeld in your policy contract.

How are the death benefits taxed?

Death benefits are generally received income tax-free by the beneficiary. However, this is subject to certain conditions and regulations, and it’s important to consult a tax professional for specific guidance.

What happens if I need to surrender my policy early?

Surrendering a policy early typically results in significant surrender charges and may result in a return of less than the total premiums paid. It’s crucial to understand these potential penalties before making a decision.