Navigating the complexities of health insurance can be daunting, especially when dealing with state employee benefits. This guide delves into the intricacies of South Carolina PEBA (Public Employee Benefit Authority) health insurance premiums, providing a clear and concise understanding of the factors influencing costs, available plan options, and payment methods. We’ll explore how demographics, geographic location, and future trends impact your premium, offering valuable insights to help you make informed decisions about your healthcare coverage.

Understanding your SC PEBA health insurance premiums is crucial for effective budget planning and ensuring you have the appropriate level of healthcare coverage. This guide aims to demystify the process, providing you with the tools and knowledge to confidently manage your health insurance costs and make the best choices for your individual needs and circumstances.

Understanding SC PEBA Health Insurance Premiums

Choosing the right health insurance plan can be a complex process, especially when navigating the options offered through the South Carolina Public Employee Benefit Authority (SC PEBA). Understanding the factors that influence premium costs and the various plan options available is crucial for making an informed decision that best suits your individual needs and budget. This section will provide a clear overview of SC PEBA health insurance premiums.

Factors Influencing SC PEBA Health Insurance Premium Costs

Several factors contribute to the cost of SC PEBA health insurance premiums. These include the type of plan selected (e.g., HMO, PPO), the level of coverage (e.g., deductible, out-of-pocket maximum), the employee’s age, and the number of dependents covered. Geographic location can also play a role, as healthcare costs vary across the state. Additionally, the overall health claims experience of the plan’s members influences premium adjustments year to year. Increased utilization of healthcare services generally leads to higher premiums.

SC PEBA Health Plan Options and Premium Structures

SC PEBA offers a range of health plans designed to cater to different needs and budgets. These plans typically include Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and potentially other options like Point of Service (POS) plans. Each plan has a unique premium structure, with costs varying based on the chosen coverage level and the number of individuals covered under the plan (single, family, etc.). HMO plans generally have lower premiums but restrict access to care to a specific network of providers. PPO plans offer greater flexibility in choosing healthcare providers but usually come with higher premiums. Specific plan details and costs are available on the SC PEBA website and should be consulted for the most up-to-date information.

Premium Costs for Various Employee Categories

Premium costs differ significantly based on the employee category (single, family, etc.). A single employee will generally pay a lower premium than an employee with a family. The addition of dependents, such as a spouse and children, increases the overall cost of the plan. For example, a single employee might pay approximately $300 per month for a particular plan, while a family plan covering a spouse and two children could cost upwards of $1200 per month. These are illustrative figures and actual costs will vary depending on the specific plan and year.

Comparison of SC PEBA Health Plan Premiums

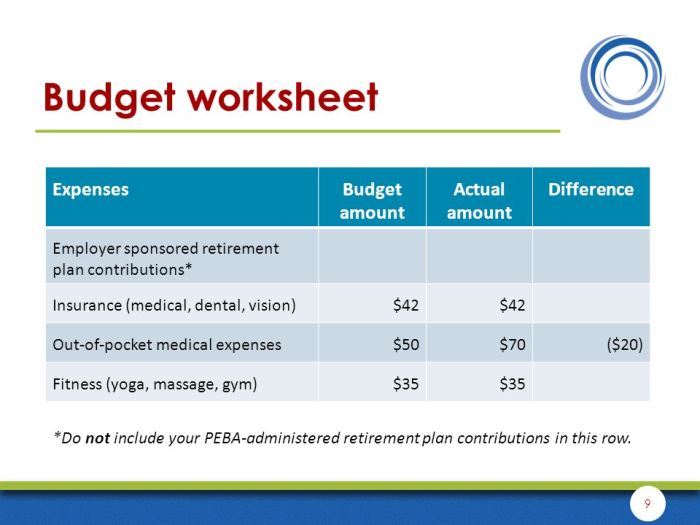

The following table provides a sample comparison of premium costs across different SC PEBA health plans. Remember that these figures are for illustrative purposes only and may not reflect current rates. It is crucial to consult the official SC PEBA website for the most accurate and updated information.

| Plan Type | Single | Family | Deductible | Out-of-Pocket Maximum |

|---|---|---|---|---|

| HMO Plan A | $300 | $1200 | $1000 | $5000 |

| PPO Plan B | $450 | $1500 | $2000 | $7000 |

| HMO Plan C | $250 | $1000 | $500 | $3000 |

| PPO Plan D | $500 | $1800 | $3000 | $10000 |

Impact of Employee Demographics on Premiums

Your SC PEBA health insurance premium isn’t a one-size-fits-all price. Several demographic factors significantly influence the final cost. Understanding these factors can help you better anticipate and manage your healthcare expenses. This section will explore how age, tobacco use, and geographic location impact your premium, along with other relevant demographic considerations.

Age and Premium Costs

Age is a major factor in determining SC PEBA health insurance premiums. Generally, older employees tend to have higher premiums than younger employees. This is because older individuals statistically have a higher likelihood of needing more frequent and extensive healthcare services. The increased risk associated with aging translates directly into higher insurance costs to cover potential claims. For example, a 60-year-old employee might pay significantly more than a 30-year-old employee for the same plan, even if both maintain a healthy lifestyle. This is not a discriminatory practice but rather a reflection of actuarial science and risk assessment.

Tobacco Use and Premium Rates

Using tobacco products, including cigarettes, cigars, and chewing tobacco, substantially increases your SC PEBA health insurance premiums. This is because tobacco use is strongly linked to numerous serious health conditions, such as lung cancer, heart disease, and respiratory illnesses. These conditions often require extensive and costly medical treatments. Insurance companies account for this increased risk by charging higher premiums to tobacco users to offset the potential for higher claims. The exact increase varies depending on the plan and the extent of tobacco use, but it can be a substantial amount. Quitting smoking is not only beneficial for your health but can also lead to significant savings on your insurance premiums.

Geographic Location and Premium Costs

The cost of your SC PEBA health insurance can also vary depending on your location within South Carolina. Premiums are often adjusted to reflect differences in healthcare costs across the state. Areas with higher concentrations of specialists, advanced medical facilities, and higher overall healthcare expenses will typically have higher premiums. Conversely, areas with lower healthcare costs may have lower premiums. This reflects the principle of cost-sharing, ensuring that premiums are aligned with the actual cost of providing healthcare services in different regions of the state. For instance, someone living in a major metropolitan area might pay more than someone in a more rural area.

Other Demographic Factors Affecting Premium Costs

Several other demographic factors can influence your SC PEBA health insurance premium costs. These factors are often considered in the overall risk assessment used to calculate premiums. It’s important to note that the specific impact of these factors can vary depending on the insurance plan.

- Family Status: Adding dependents to your plan, such as a spouse or children, will generally increase your premium. This is because you are extending coverage to more individuals, increasing the potential for claims.

- Health Status: Pre-existing conditions can sometimes affect premiums, although the Affordable Care Act (ACA) places restrictions on how insurers can use pre-existing conditions to deny coverage or raise rates. However, the severity and treatment of pre-existing conditions could still influence the cost.

- Plan Choice: The type of plan you choose (e.g., HMO, PPO) directly impacts your premium. Plans with lower deductibles and co-pays generally have higher premiums.

Comparing SC PEBA Premiums to Other State Plans

Understanding the cost-effectiveness of South Carolina’s Public Employee Benefit Authority (SC PEBA) health insurance requires comparing its premiums and coverage to similar plans in neighboring states. This comparison helps state employees make informed decisions about their health insurance options and allows for a broader understanding of the relative value of SC PEBA. This analysis will focus on premium costs and key coverage differences, acknowledging that a comprehensive comparison would require a far more extensive study.

Direct comparison of state employee health insurance plans is challenging due to variations in plan designs, benefit packages, and employee demographics. Factors like the age and health status of the employee population, the types of plans offered (e.g., HMO, PPO, POS), and the negotiation power of the state with insurance providers all influence premium costs and benefits. Therefore, the following analysis provides a general overview and should not be considered a precise, apples-to-apples comparison.

Premium and Coverage Comparison of Selected State Employee Health Plans

| State | Plan Type | Average Monthly Premium (Example: Employee Only) | Key Coverage Differences |

|---|---|---|---|

| South Carolina (SC PEBA) | (Specify Plan Type, e.g., PPO) | (Insert Example Dollar Amount, cite source) | (Describe key features, e.g., network size, prescription drug formulary, out-of-pocket maximums) |

| North Carolina (Example State Plan) | (Specify Plan Type) | (Insert Example Dollar Amount, cite source) | (Describe key features, highlighting differences from SC PEBA) |

| Georgia (Example State Plan) | (Specify Plan Type) | (Insert Example Dollar Amount, cite source) | (Describe key features, highlighting differences from SC PEBA) |

| (Another Neighboring State) | (Specify Plan Type) | (Insert Example Dollar Amount, cite source) | (Describe key features, highlighting differences from SC PEBA) |

Note: The premium amounts shown are examples only and may vary based on plan selection, employee contribution levels, and other factors. It is crucial to consult the official websites of each state’s employee health plan for the most up-to-date and accurate information. Sources for premium data should be clearly cited.

Wrap-Up

Successfully navigating the world of SC PEBA health insurance premiums requires careful consideration of various factors, from plan options and demographic influences to payment methods and future trends. By understanding these elements and utilizing the resources available, South Carolina state employees can make informed decisions about their healthcare coverage, ensuring both financial stability and access to quality care. This guide serves as a starting point for a more thorough exploration of your options, encouraging you to engage directly with SC PEBA for personalized guidance and the most up-to-date information.

FAQ Guide

What happens if I miss a premium payment?

Late payments may result in penalties, interruption of coverage, and potential impact on your credit score. Contact SC PEBA immediately if you anticipate difficulty making a payment.

Can I change my health plan during the year?

Generally, changes to your health plan are only permitted during open enrollment periods. However, qualifying life events (marriage, birth, etc.) may allow for exceptions. Check with SC PEBA for specific eligibility criteria.

Where can I find the most up-to-date information on premium costs?

The official SC PEBA website is the best source for current premium information, plan details, and any updates to the benefit program.

How do I estimate my future premium costs?

While precise prediction is impossible, SC PEBA usually publishes projected premium increases or decreases based on anticipated healthcare costs and other relevant factors. Review their annual reports and communications for guidance.