Return of premium term life insurance offers a unique proposition in the world of financial planning. Unlike traditional term life insurance, which provides coverage for a specified period, return of premium policies promise to refund all or a significant portion of the premiums paid if the insured survives the policy term. This intriguing feature makes it a compelling option for those seeking both life insurance protection and a potential financial return. This guide delves into the mechanics, costs, benefits, and considerations of this increasingly popular insurance product.

We’ll explore the intricacies of how these policies work, comparing them to standard term life insurance and examining the factors that influence their cost. We’ll also analyze the value proposition, considering various scenarios to determine when a return of premium policy might be the most advantageous choice. By understanding the eligibility criteria, application process, and potential tax implications, you can make an informed decision about whether this type of insurance aligns with your individual financial goals.

Definition and Mechanics of Return of Premium Term Life Insurance

Return of Premium (ROP) term life insurance offers a unique twist on traditional term life insurance by promising to return all or a significant portion of your premiums if you outlive the policy term. It combines the affordability and simplicity of term life insurance with the potential for a financial benefit at the end of the policy’s duration. This makes it an attractive option for those seeking life insurance coverage and a potential return on their investment.

Return of Premium term life insurance operates by adding a savings component to a standard term life insurance policy. While providing the same death benefit as a traditional term policy – a payout to your beneficiaries if you die during the policy term – it also guarantees a refund of the premiums paid if you survive the entire term. This refund is typically paid out as a lump sum at the end of the policy period.

Premium Return Mechanisms

The method of premium return varies among insurance providers. Some policies return 100% of the premiums paid, while others may return a percentage, perhaps 90% or 80%, depending on the specific policy terms and conditions. The exact amount returned is clearly defined in the policy contract. It’s crucial to review the policy documents carefully to understand the precise terms of the return. The return is usually tax-free, although this should be verified with a tax professional.

Step-by-Step Return Process

The return of premiums is typically an automatic process. Once the policy term ends and the policyholder is still alive, the insurance company will initiate the return of the premiums as stipulated in the policy. There is usually no need for the policyholder to submit a claim. The payment is made directly to the policyholder, usually through a check or direct deposit, depending on the insurer’s preferred method. Some companies may require the completion of a simple form to confirm the policyholder’s current contact information.

Comparison with Traditional Term Life Insurance

Traditional term life insurance provides a death benefit only. If the insured survives the policy term, there is no monetary return of premiums. ROP policies, on the other hand, offer both a death benefit and a potential return of premiums. The trade-off is that ROP policies generally have higher premiums than traditional term life insurance policies with equivalent coverage. This is because the insurance company is setting aside funds to cover the potential return of premiums to surviving policyholders. The higher premiums reflect the added financial commitment of the return of premium feature. Consider this trade-off carefully when comparing ROP and traditional term life insurance options. A thorough cost-benefit analysis, considering your individual financial situation and risk tolerance, is crucial in making an informed decision.

Cost and Value Proposition

Return of premium (ROP) term life insurance policies offer a unique value proposition, but understanding their cost and comparing it to traditional term life insurance is crucial for making an informed decision. The higher premiums reflect the guaranteed return of premiums at the end of the term, but this added benefit comes at a price.

Factors Influencing the Cost of Return of Premium Term Life Insurance

Several factors contribute to the higher cost of ROP policies compared to traditional term life insurance. These include the insurer’s need to account for the guaranteed return of premiums, administrative costs associated with managing the return of premiums, and the underlying mortality risk associated with providing life insurance coverage. Higher premiums are also influenced by the insured’s age, health, smoking status, and the length of the policy term. A younger, healthier non-smoker will generally receive lower premiums than an older, less healthy smoker for the same coverage amount. The length of the policy term also plays a significant role; longer terms typically result in higher premiums.

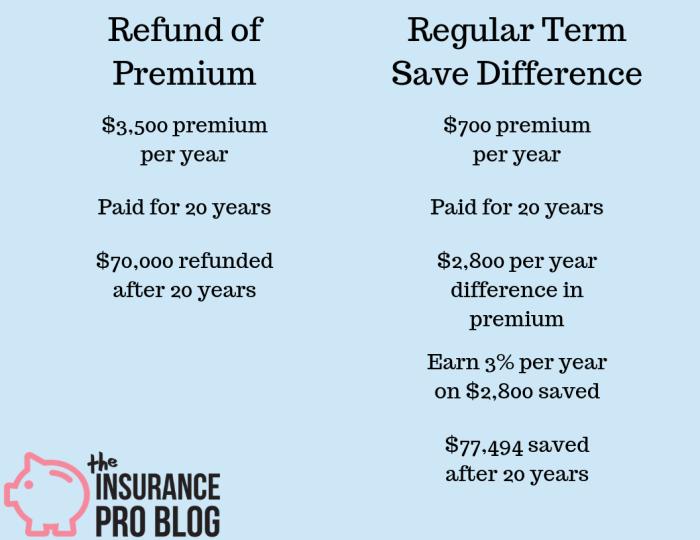

Comparison of Total Cost: ROP vs. Traditional Term Life Insurance

Over the policy term, the total cost of an ROP policy will significantly exceed that of a traditional term life insurance policy. This is because the ROP policy includes the cost of the guaranteed premium return. While a traditional term life policy only requires premium payments during the policy term, an ROP policy’s premiums are substantially higher. However, at the end of the term, the policyholder receives a lump-sum payment equal to all premiums paid. This means the total *out-of-pocket* cost is zero, unlike a traditional term policy.

Scenarios Where a Return of Premium Policy Offers Superior Value

ROP policies may be advantageous in situations where the insured prioritizes the guaranteed return of premiums over lower premiums. For example, an individual with a high degree of risk aversion who values the certainty of recovering their premium payments might find an ROP policy more appealing. Similarly, individuals who might struggle to maintain consistent life insurance coverage over time might see the ROP as a forced savings plan that also provides death benefit protection. However, it’s important to weigh this against the higher cost and opportunity cost of investing the premium difference elsewhere.

Premium and Total Payout Comparison

The following table illustrates a comparison of premiums and total payouts for similar coverage amounts in both ROP and traditional term life insurance policies. These are illustrative examples and actual premiums will vary based on individual circumstances.

| Policy Type | Premium (Annual) | Total Paid (Over 20 Years) | Total Payout |

|---|---|---|---|

| Traditional Term Life ($500,000 Coverage) | $1,000 | $20,000 | $0 (unless death benefit is paid) |

| ROP Term Life ($500,000 Coverage) | $1,500 | $30,000 | $30,000 (at end of term) |

Comparison with Other Insurance Products

Return of premium (ROP) term life insurance occupies a unique space in the life insurance market. Understanding its strengths and weaknesses requires comparing it to other popular insurance and investment options. This comparison will highlight the key differences in cost, risk, and potential financial outcomes.

Return of Premium Term Life Insurance Compared to Whole Life Insurance

Whole life insurance provides lifelong coverage, accumulating cash value that grows tax-deferred. ROP term life insurance, conversely, offers coverage for a specified term, returning premiums if the insured survives the term. The key difference lies in the duration of coverage and the presence of cash value. Whole life insurance offers permanent coverage but at a significantly higher premium than ROP term life. ROP term life provides a more affordable option for a specific period, with the added benefit of premium return. A hypothetical scenario: A 35-year-old purchases a 20-year, $500,000 ROP term policy. If they survive the term, they receive their total premiums back. A comparable whole life policy would cost substantially more, offering lifelong coverage but potentially lower overall return if the policyholder lives a long life.

Return of Premium Term Life Insurance Compared to Universal Life Insurance

Universal life insurance offers flexible premiums and adjustable death benefits, accumulating cash value similar to whole life but with more control over premium payments. ROP term life, again, provides coverage for a set term with a premium return feature. Universal life offers more flexibility but typically at a higher cost than ROP term. The choice depends on individual needs; someone needing long-term coverage with flexibility might prefer universal life, while someone needing affordable, temporary coverage with a potential premium refund would opt for ROP term. Consider this: A 40-year-old needs coverage until retirement. A universal life policy might offer the flexibility to adjust premiums based on changing financial circumstances, but the ROP term policy could be a less expensive option if the goal is to secure a specific amount of coverage for a defined period.

Return of Premium Term Life Insurance Compared to Other Investment Options

ROP term life insurance isn’t a direct investment; its primary function is life insurance. Comparing it to investments like stocks, bonds, or mutual funds requires acknowledging this distinction. While ROP term offers a potential return of premiums, it’s not designed to generate high investment returns. Investments carry inherent market risk, while ROP term’s return is guaranteed (provided the insured survives the term). For example, investing $10,000 annually in a stock market index fund could potentially yield significantly higher returns over 20 years, but it also carries the risk of losses. Conversely, a $10,000 annual ROP term life insurance premium guarantees the return of the entire amount if the insured survives the policy term, irrespective of market fluctuations. This highlights the difference in risk tolerance and financial goals.

Last Word

Return of premium term life insurance presents a compelling alternative to traditional term life insurance, offering a blend of protection and potential financial return. While the higher premiums are a significant consideration, the possibility of recouping all paid premiums upon policy expiration makes it an attractive option for certain individuals. Ultimately, the decision of whether or not to purchase a return of premium policy depends on your personal risk tolerance, financial goals, and individual circumstances. Careful consideration of the factors discussed, coupled with consultation with a qualified financial advisor, will ensure you make the best choice for your needs.

Key Questions Answered

What happens if I die during the policy term?

Your beneficiaries will receive the death benefit, regardless of whether premiums have been fully returned.

Are there any health requirements to qualify?

Yes, like traditional life insurance, underwriting is involved. Your health and lifestyle will influence approval and premium rates.

Can I withdraw the accumulated premiums before the policy ends?

Generally, no. The return of premium is typically only paid out at the end of the policy term if the insured is still alive.

How does the return of premium affect my taxes?

The returned premiums may be considered taxable income. Consult a tax professional for personalized advice.

What if I cancel my policy early?

You will likely not receive a full return of your premiums. The specific terms depend on the policy and the insurer.