Return of Premium (ROP) term life insurance offers a unique twist on traditional term life coverage. Unlike standard term policies that provide a death benefit but no payout if the insured survives the policy term, ROP policies return all or a significant portion of the premiums paid if the insured remains alive. This innovative approach blends life insurance protection with a potential investment-like element, making it a compelling option for those seeking financial security and a potential return on their premiums. But is it the right choice for everyone? This guide delves into the intricacies of ROP term life insurance, exploring its benefits, drawbacks, and suitability for various financial situations.

We will examine the key features that differentiate ROP from standard term life insurance, analyze the cost factors and premium structures, and compare it with alternative insurance products and investment vehicles. Through illustrative examples and a frequently asked questions section, we aim to provide a clear and comprehensive understanding of this increasingly popular insurance option, empowering you to make an informed decision.

Defining Return of Premium Term Life Insurance

Return of Premium (ROP) term life insurance offers a unique twist on traditional term life insurance, providing a safety net for your loved ones while also offering the potential for a financial return. Unlike standard term life insurance, which only pays out a death benefit if the insured passes away during the policy term, ROP policies guarantee the return of all premiums paid if the insured survives the entire policy term. This makes it an attractive option for those seeking both life insurance coverage and a potential investment.

Return of Premium term life insurance is fundamentally different from standard term life insurance in its core promise. While standard term life insurance provides a death benefit only upon the death of the insured within the policy term, ROP insurance provides this death benefit *plus* a refund of all premiums paid if the insured survives the policy term. This key difference significantly alters the financial implications and makes ROP policies a more complex product to understand.

ROP Insurance Benefits and Suitable Scenarios

ROP insurance is particularly beneficial in scenarios where individuals want both life insurance protection and a guaranteed return on their investment. For example, a young family establishing a home and accumulating assets might find ROP insurance appealing. If the parents survive the policy term, the returned premiums can contribute to their retirement savings or be used for other financial goals. Similarly, individuals nearing retirement who want to ensure a legacy for their heirs but also want to protect their financial resources could benefit from the return of premium feature. The premiums are essentially a form of savings, albeit with a life insurance component. A business owner might also use it to secure the business’s financial future while mitigating personal risk. If the owner survives, the returned premiums can be reinvested into the business or used for other purposes.

Comparison of Return of Premium and Standard Term Life Insurance

| Feature | Return of Premium | Standard Term | Key Differences |

|---|---|---|---|

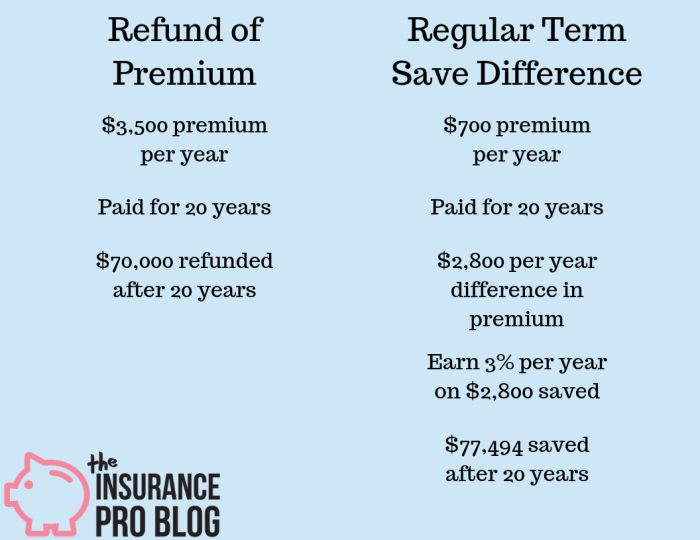

| Premium Payments | Higher premiums than standard term life insurance. | Lower premiums than ROP insurance. | ROP premiums are significantly higher to account for the return of premiums upon policy expiration. |

| Death Benefit | Pays a death benefit if the insured dies during the policy term. | Pays a death benefit if the insured dies during the policy term. | Both policies offer a death benefit, but the premium cost significantly differs. |

| Premium Return | Returns all premiums paid if the insured survives the policy term. | No premium return if the insured survives the policy term. | This is the defining characteristic of ROP insurance. |

| Overall Cost | Potentially more expensive overall, but with a guaranteed return. | Less expensive initially, but no guaranteed return. | The long-term cost-effectiveness depends on the insured’s lifespan relative to the policy term. |

Suitability and Target Audience

Return of premium term life insurance, while offering an attractive benefit, isn’t a one-size-fits-all solution. Understanding the ideal consumer profile is crucial to determining if this type of policy aligns with individual financial goals. This policy’s suitability hinges on a combination of factors, including financial stability, risk tolerance, and long-term planning.

Return of premium term life insurance is particularly appropriate for individuals and families who value financial security and are comfortable with a higher premium in exchange for the potential return of premiums. It’s a strategic choice for those who prioritize both life insurance coverage and the potential for a significant financial return. This contrasts with traditional term life insurance where the premiums are not returned.

Ideal Consumer Profile

The ideal candidate for a return of premium term life insurance policy is typically someone relatively young, with a stable income and a long-term financial outlook. They are financially secure enough to afford the higher premiums compared to a standard term life insurance policy. They also understand and accept the higher cost in exchange for the potential return of premiums at the end of the policy term. This individual or family is generally comfortable with a long-term investment strategy and is looking for a combination of life insurance protection and a potential financial return. They are proactive in their financial planning and are likely to already have other forms of savings and investments in place.

Situations Where This Insurance is Particularly Appropriate

This type of policy is especially suitable for situations where a significant amount of life insurance coverage is needed for a specific period, such as while raising children or paying off a mortgage. The potential return of premiums acts as a financial safety net, offering a significant return at the end of the policy term if the insured survives. This can provide a valuable financial boost for retirement planning or other future goals. For example, a young couple starting a family might find this appealing, providing both protection and a potential nest egg for their children’s education.

Examples of Individuals or Families Who Might Benefit

A high-earning professional aiming to secure their family’s financial future while also planning for their own retirement would find this policy beneficial. The premiums, though higher, are viewed as a long-term investment with a built-in life insurance component. Similarly, a self-employed individual with no employer-sponsored benefits might see this as a way to combine protection and savings. Families with significant debts, such as a large mortgage, may also find this coverage attractive as the return of premiums could help offset future financial burdens.

Determining Alignment with Individual Financial Goals

Determining if a return of premium term life insurance policy aligns with individual financial goals requires a careful assessment of several factors. First, individuals should compare the cost of this policy to standard term life insurance policies with similar coverage amounts. The higher premium should be weighed against the potential return of premiums. Second, individuals should consider their overall financial situation, including existing savings, investments, and debt levels. A thorough financial planning review, perhaps with a financial advisor, can help determine if the higher premiums are justifiable within the context of the individual’s overall financial picture. Finally, individuals should consider their risk tolerance and long-term financial objectives. If the potential return of premiums aligns with their long-term goals, then this policy may be a suitable choice. However, if other investment options offer a higher return with a lower risk, those might be more appropriate.

Final Thoughts

Return of Premium term life insurance presents a compelling alternative to traditional term life policies, offering a potential return on premiums paid if the insured survives the policy term. While it carries higher premiums than standard term insurance, the added benefit of premium repayment can be attractive to certain individuals and families. Ultimately, the suitability of ROP insurance depends on individual financial goals, risk tolerance, and long-term financial planning strategies. Careful consideration of the policy’s features, costs, and potential drawbacks is crucial before making a decision. By understanding the nuances of ROP term life insurance, you can confidently determine if it aligns with your specific needs and financial objectives.

FAQ Guide

What happens if I die during the policy term of a Return of Premium policy?

Your beneficiaries receive the death benefit, as with any term life insurance policy. The return of premium feature is not applicable in this case.

Are there any tax implications for the returned premiums?

The tax treatment of returned premiums can vary depending on your location and specific policy details. It’s crucial to consult a tax advisor for personalized guidance.

Can I cancel my Return of Premium policy before the term ends?

You can usually cancel, but you likely won’t receive the full return of premiums. The insurer may only refund a portion, depending on the policy’s terms and conditions. Check your policy documents for specific details.

How does the return of premium affect the death benefit?

The return of premium feature does not directly affect the death benefit amount. The death benefit remains the same regardless of whether the premiums are returned.