Securing your financial legacy is a paramount concern for many seniors. Return of premium senior life insurance offers a unique approach, promising both death benefit protection and a potential return of premiums paid over the policy’s term. This guide delves into the intricacies of this specialized insurance product, exploring its benefits, drawbacks, and suitability within various financial planning scenarios.

We will examine the core features of return of premium policies, comparing them to traditional senior life insurance options. We’ll also cover eligibility criteria, application processes, tax implications, and crucial factors to consider before making a purchase decision. Real-world scenarios and case studies will illuminate the practical applications and potential outcomes of choosing this type of coverage.

Defining Return of Premium Senior Life Insurance

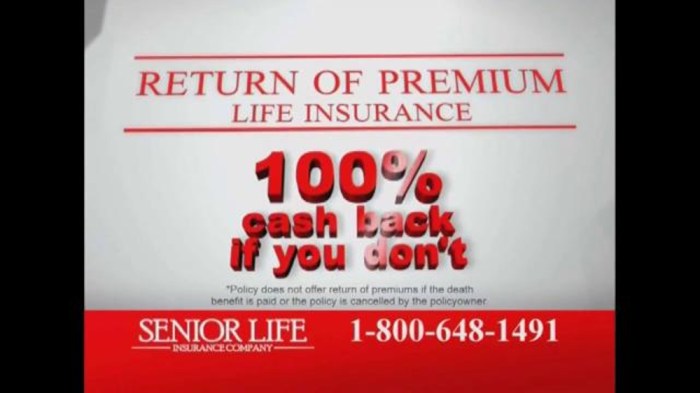

Return of Premium (ROP) senior life insurance offers a unique blend of life insurance coverage and a savings component. Unlike traditional life insurance policies, which primarily provide a death benefit, ROP policies guarantee the return of all or a significant portion of the premiums paid, provided certain conditions are met. This makes them an attractive option for those seeking both financial protection for their loved ones and a potential return on their investment.

ROP policies function by accumulating the premiums paid over the policy term. If the insured survives the policy term, the accumulated premiums, plus any accumulated interest, are returned to the policyholder, tax-free in most cases. If the insured dies during the policy term, the death benefit is paid to the beneficiary, typically exceeding the total premiums paid. This dual benefit – life insurance coverage and premium return – makes ROP policies a distinct category within the senior life insurance market.

Types of Return of Premium Policies

Several variations exist within the ROP policy structure. The key differences often lie in the percentage of premiums returned, the length of the policy term, and the specific conditions that must be met for the premium return to be triggered. Some policies might return 100% of premiums paid, while others might offer a percentage, such as 90% or even less. The policy term can range from 10 to 30 years, and specific conditions, such as the insured remaining tobacco-free, could impact the return.

Scenarios Where a Return of Premium Policy is Beneficial

A ROP policy can be particularly advantageous in several situations. For example, consider a healthy 65-year-old individual who wants to secure a death benefit for their family while also building a nest egg for retirement. If they survive the policy term, they receive their premiums back, supplementing their retirement savings. Conversely, if they pass away during the policy term, their family receives the death benefit. Another example is an individual concerned about the rising cost of long-term care. While the policy won’t directly cover long-term care expenses, the return of premiums could help offset these costs if the individual survives the policy term. A third scenario involves individuals who wish to leave a legacy for their heirs but also want a financial safety net for themselves. The return of premium offers a potential financial buffer should they outlive the policy term.

Comparing Return of Premium with Traditional Senior Life Insurance

Choosing the right senior life insurance policy requires careful consideration of various factors, including cost, benefits, and long-term financial implications. Understanding the differences between Return of Premium (ROP) and traditional policies is crucial for making an informed decision. This comparison highlights the key distinctions to aid in your selection process.

Cost Structure Comparison

ROP and traditional senior life insurance policies differ significantly in their cost structures. Traditional policies generally have lower premiums than comparable ROP policies. This is because ROP policies incorporate the premium return feature, which necessitates higher premiums to fund the eventual return of premiums paid. The higher premium reflects the added benefit of getting your premiums back. Conversely, traditional policies offer a lower premium but do not guarantee a return of premiums. The cost difference can be substantial over the policy’s lifetime. For example, a 70-year-old purchasing a $100,000 policy might pay significantly more annually for an ROP policy compared to a traditional policy. The specific cost difference varies depending on factors such as age, health, policy term, and the insurer.

Benefits and Payout Structures

The core difference lies in the payout structure. Traditional policies pay a death benefit to the beneficiaries upon the insured’s death. The amount paid is typically the face value of the policy. ROP policies, on the other hand, offer a death benefit and, if the insured outlives the policy term, a return of all premiums paid. This return is often paid out in a lump sum. This dual benefit—death benefit and premium return—makes ROP policies more attractive to those who want a guarantee of recovering their investment. However, this guarantee comes at the cost of higher premiums.

Long-Term Financial Implications

The long-term financial implications depend heavily on the insured’s lifespan. If the insured dies early, the beneficiaries receive the death benefit under both policy types. However, with a traditional policy, the premiums paid are essentially lost. With an ROP policy, the beneficiaries still receive the death benefit, but the premiums are not returned. If the insured lives beyond the policy term, the ROP policy provides a significant financial advantage, returning all premiums paid. A traditional policy, in this scenario, offers no such return. Consider this example: A 65-year-old purchases a $250,000 policy. If he passes away within five years, his beneficiary receives $250,000 regardless of policy type. However, if he lives to 90, a ROP policy will return all the premiums he paid, adding a substantial sum to his estate. A traditional policy would provide only the death benefit upon his passing at 90.

Key Feature Comparison

| Policy Type | Premium Cost | Death Benefit | Premium Return | Illustrative Example |

|---|---|---|---|---|

| Traditional | Lower | Face value of policy | None | $100,000 death benefit; premiums not returned upon death or policy expiration. |

| Return of Premium | Higher | Face value of policy | All premiums paid if insured outlives policy term | $100,000 death benefit; all premiums paid returned if insured lives past the policy term. |

Eligibility and Application Process

Securing a return of premium senior life insurance policy involves navigating specific eligibility requirements and a comprehensive application process. Understanding these aspects is crucial for a smooth and successful application. This section details the typical criteria and steps involved.

Eligibility Criteria for Return of Premium Senior Life Insurance typically centers around age and health. Insurers assess applicants based on a range of factors to determine their risk profile and suitability for the policy.

Applicant Age and Health

Insurers generally set minimum and maximum age limits for return of premium policies. The minimum age is usually higher than for traditional policies, often starting around 50 or 60, reflecting the longer coverage period. Maximum age limits vary, but applicants should expect limitations as they approach the age where the risk of mortality increases significantly. Beyond age, health plays a pivotal role. Applicants undergo a medical underwriting process, involving medical history review, potentially including a medical exam, to assess pre-existing conditions and overall health status. Policies may not be offered to individuals with certain severe health conditions. The stricter underwriting standards reflect the insurer’s commitment to managing risk associated with the return of premium feature. For example, an applicant with a history of heart disease might face higher premiums or be ineligible altogether.

Application and Underwriting Process

The application process for return of premium senior life insurance involves several key steps. Initially, potential applicants will complete an application form providing detailed personal and health information. This information is meticulously reviewed by the insurer’s underwriters. Subsequently, depending on the insurer and the applicant’s profile, medical examinations or additional health information requests may be necessary. The underwriting process thoroughly assesses the risk associated with insuring the applicant. Once the underwriting is complete, the insurer will make a decision regarding coverage and premium amounts. This decision reflects the assessed risk and the chosen policy features. If approved, the applicant receives a policy document outlining the terms and conditions.

Flowchart Illustrating the Application Process

The application process can be visualized as follows:

[Imagine a flowchart here. The flowchart would begin with “Application Submission,” branching to “Review of Application and Medical History.” This would then branch to either “Medical Exam Required” (leading to “Medical Exam Completion” and then back to “Underwriting Review”) or “No Medical Exam Required” (directly leading to “Underwriting Review”). The “Underwriting Review” box would branch to either “Policy Approved” (leading to “Policy Issuance”) or “Policy Denied.” Finally, a “Policy Denied” box would have a branch indicating reasons for denial.]

The flowchart visually depicts the sequential steps, highlighting the decision points based on applicant information and the insurer’s risk assessment. This process ensures a comprehensive evaluation before policy issuance.

Tax Implications and Financial Planning

Return of premium (ROP) life insurance policies, while offering the attractive feature of premium repayment, have tax implications that require careful consideration as part of a comprehensive financial plan. Understanding these implications is crucial for seniors seeking to maximize the benefits of such policies and ensure they align with their overall financial goals. This section will explore the tax aspects and demonstrate how ROP policies can fit into a well-structured financial strategy for retirement.

The primary tax implication of ROP life insurance lies in the treatment of the death benefit. The death benefit paid to beneficiaries is generally income tax-free, similar to traditional life insurance policies. However, the returned premiums during the policyholder’s lifetime are considered taxable income in the year they are received. This is because the returned premiums represent a return of investment, rather than a tax-free benefit. The tax liability will depend on the individual’s tax bracket and the amount received. It’s essential to consult with a tax advisor to determine the specific tax consequences based on your individual circumstances.

Taxation of Returned Premiums

The Internal Revenue Service (IRS) classifies the returned premiums as ordinary income, meaning they are taxed at the individual’s marginal income tax rate. This means a higher-income individual will pay a higher tax rate on the returned premiums compared to someone in a lower tax bracket. For example, if a senior receives $50,000 in returned premiums and is in the 22% tax bracket, they would owe approximately $11,000 in taxes on that amount. Accurate tax calculations require consideration of other income sources and applicable deductions. It is highly recommended that seniors work with a financial advisor and tax professional to determine the overall impact on their tax liability.

Integrating ROP into a Financial Plan

ROP policies can play a valuable role in a senior’s financial plan, offering a combination of life insurance coverage and a potential return of premiums. They can be particularly beneficial for individuals who want a guaranteed return of their investment while also securing a death benefit for their beneficiaries. This dual function makes them a flexible tool for various financial objectives.

ROP for Specific Financial Goals

ROP policies can help seniors achieve various financial goals. For example, they can serve as a supplemental retirement income source, providing a stream of tax-deferred income while the policy is in force. The return of premiums can help offset potential healthcare expenses or provide a financial cushion during retirement. Additionally, the death benefit can provide a legacy for heirs, ensuring financial security for family members after the senior’s passing. Consider a scenario where a senior uses the returned premiums to fund a long-term care facility stay should the need arise, minimizing the impact on their retirement savings.

Ending Remarks

Return of premium senior life insurance presents a compelling alternative to traditional life insurance, offering a potential return of premiums alongside death benefit coverage. However, careful consideration of individual financial goals, health status, and long-term planning is crucial. Understanding the policy details, seeking professional financial advice, and comparing various options are essential steps in making an informed decision that aligns with your specific needs and circumstances. Ultimately, the choice between return of premium and traditional policies hinges on a thorough evaluation of your personal risk tolerance and financial objectives.

Top FAQs

What is the typical age range for purchasing return of premium senior life insurance?

While specific age limits vary by insurer, these policies are generally targeted towards individuals aged 50 and above, although some companies may offer coverage to younger seniors.

Are there health requirements for obtaining a return of premium policy?

Yes, underwriting is involved. Applicants will undergo a medical evaluation, and approval depends on their health status. Pre-existing conditions may impact eligibility or premium rates.

What happens if I die before the premium return period ends?

Your beneficiaries will receive the death benefit, regardless of whether the premium return period has concluded. The death benefit is typically the face value of the policy.

Can I surrender my return of premium policy before the end of the term?

Usually, surrendering before the term ends will result in a cash value payout, which may be less than the premiums paid. The exact amount will depend on the policy’s terms and the insurer’s surrender charges.

How do I compare different return of premium policies?

Compare premium costs, death benefit amounts, the length of the premium return period, and any associated fees or charges. Consider the insurer’s financial stability and reputation.