Return of Premium (ROP) life insurance offers a unique blend of life insurance coverage and potential financial returns. Unlike traditional term life insurance, ROP policies promise to refund all or a portion of your premiums if you outlive the policy term. This intriguing feature has made ROP insurance a subject of increasing interest, but understanding its complexities requires careful consideration. This guide delves into the mechanics of ROP insurance, exploring its benefits, drawbacks, and the crucial role of a return of premium life insurance calculator in navigating this financial landscape.

This guide will equip you with the knowledge to understand how these calculators work, the factors influencing premium calculations, and how to effectively use them to compare different policies. We’ll examine various scenarios to illustrate the potential financial implications of ROP insurance, providing you with a clear understanding of whether it aligns with your personal financial goals. By the end, you’ll be better positioned to make informed decisions about this increasingly popular insurance option.

Understanding Return of Premium Life Insurance

Return of Premium (ROP) life insurance is a type of term life insurance policy that offers a unique benefit: if you outlive the policy term, you receive back all or a significant portion of the premiums you paid. This contrasts with traditional term life insurance, where premiums are paid, and if the insured survives the term, there’s no monetary return. Understanding the nuances of ROP policies is crucial for determining if they align with your financial goals.

Core Concept of Return of Premium Life Insurance

ROP life insurance operates on the principle of providing life insurance coverage for a specified term, while simultaneously acting as a form of savings vehicle. Premiums paid are invested, and if the policyholder survives the term, the accumulated premiums (and sometimes interest earned) are returned. The amount returned is typically the total premiums paid, though specific policy details will dictate the exact return. This return is tax-free in many jurisdictions, enhancing its appeal.

Benefits and Drawbacks of Return of Premium Life Insurance

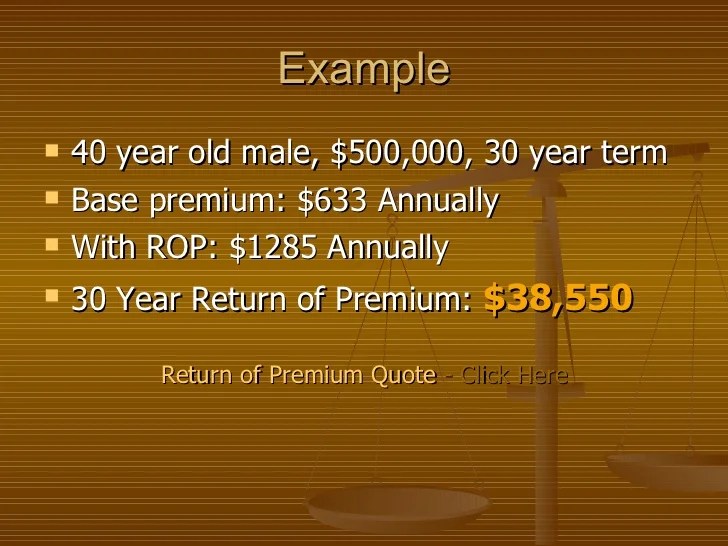

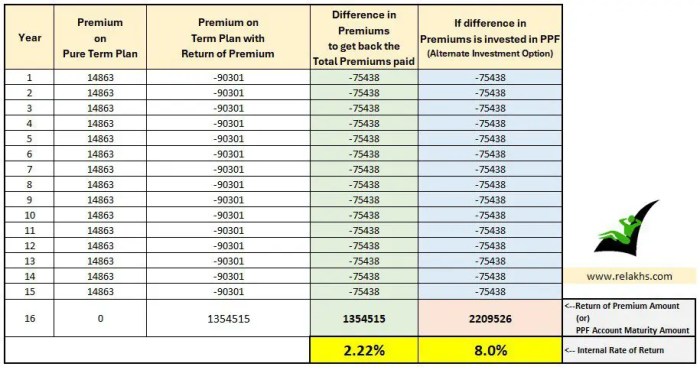

ROP policies offer several advantages. The primary benefit is the return of premiums, offering a form of financial security even if no death benefit is paid. This can be particularly appealing to individuals who prioritize financial planning and want a safety net. However, there are drawbacks. ROP policies typically have higher premiums than traditional term life insurance policies offering the same death benefit. This is because a portion of the premium is allocated to the return-of-premium feature. Furthermore, the rate of return on the invested premiums might not always exceed what could be achieved through other investment vehicles.

Comparison with Traditional Term Life Insurance

Traditional term life insurance provides a death benefit for a specified period. If the insured survives the term, no money is returned. Premiums are generally lower than for ROP policies. ROP policies, on the other hand, offer the death benefit and the potential for a return of premiums if the insured survives the policy term. The higher premiums reflect this added benefit. The choice between the two hinges on individual risk tolerance and financial goals. Someone prioritizing a lower cost and only needing a death benefit might opt for traditional term life insurance. Someone wanting the security of a premium return might prefer ROP.

Scenarios Where a Return of Premium Policy Might Be Advantageous

A ROP policy might be advantageous for individuals who: want a guaranteed return on their investment; value financial security and risk mitigation; have a longer-term financial plan that benefits from a potential premium refund; or are seeking a combination of life insurance coverage and a savings element. For example, a young professional saving for retirement could find the combination of life insurance and potential premium return appealing. Another example is a parent securing their child’s future, knowing that the premiums paid could be returned later.

Key Features Comparison: Return of Premium vs. Traditional Term Life Insurance

| Feature | Return of Premium (ROP) | Traditional Term Life Insurance |

|---|---|---|

| Premium Cost | Higher | Lower |

| Premium Return | Yes, if surviving the term | No |

| Death Benefit | Yes | Yes |

| Investment Component | Yes | No |

How Return of Premium Life Insurance Calculators Work

Return of premium life insurance calculators are sophisticated tools that estimate the cost and potential return of this specific type of policy. They use complex algorithms to analyze various factors and provide a personalized projection of premiums and potential payouts. Understanding how these calculators function is crucial for making informed decisions about life insurance.

Understanding the factors that influence premium calculations is key to interpreting the results of a return of premium life insurance calculator. These calculators are not simple addition or subtraction tools; they incorporate several variables to generate a personalized estimate.

Factors Influencing Premium Calculations

Several key factors are considered when calculating premiums for return of premium life insurance. These factors significantly impact the final cost. The more risk an insurance company perceives, the higher the premium.

- Age: Older applicants generally pay higher premiums due to increased mortality risk.

- Health: Pre-existing health conditions or lifestyle factors (smoking, etc.) increase risk and therefore premiums.

- Coverage Amount: A larger death benefit necessitates a higher premium to cover the increased potential payout.

- Policy Term: Longer policy terms generally mean higher premiums, as the insurance company is covering a longer period of risk.

- Gender: Historically, actuarial tables have shown differences in life expectancy between genders, which can influence premiums (though this is becoming less of a factor in many jurisdictions).

- Occupation: High-risk occupations may result in higher premiums due to increased mortality risk.

Mathematical Models Used in Return of Premium Calculators

The mathematical models employed in these calculators are complex and proprietary. However, they generally rely on actuarial tables and sophisticated statistical analysis. These models incorporate mortality rates, interest rates, and expense loading to project the cost of the policy over time. A simplified representation might involve discounting future cash flows (the return of premium) back to the present value, accounting for the probability of death at different ages. The specific formulas are often trade secrets held by insurance companies.

A simplified representation might involve: Present Value = Σ (Return of Premium at time t) / (1 + interest rate)^t, where ‘t’ represents the time period.

This formula is vastly simplified, as it doesn’t account for mortality risk or other factors. Real-world calculators utilize far more complex models, often incorporating stochastic (random) elements to account for the unpredictable nature of mortality.

Key Data Inputs Required by a Return of Premium Calculator

To generate an accurate estimate, return of premium life insurance calculators require several key data inputs from the user. The accuracy of the output is directly dependent on the accuracy of these inputs.

- Age: Precise age is crucial for determining mortality risk.

- Gender: Used in conjunction with age to determine mortality risk.

- Health Status: Information on pre-existing conditions and lifestyle habits.

- Desired Coverage Amount: The amount of death benefit the applicant wishes to secure.

- Policy Term: The length of time the policy will remain in effect.

- Smoking Status: A significant factor in mortality risk assessment.

Limitations and Inaccuracies of Online Calculators

While online calculators offer a convenient way to estimate premiums, it’s essential to understand their limitations. They provide estimates, not guaranteed values. The results may not reflect the specific underwriting criteria of a particular insurance company.

- Simplified Models: Online calculators often use simplified models that may not capture the full complexity of actuarial calculations.

- Lack of Individualized Assessment: They cannot account for all individual health factors or nuances that may influence premium calculations.

- Changes in Interest Rates and Mortality Rates: Underlying assumptions about interest rates and mortality rates can change over time, impacting the accuracy of projections.

- Exclusion of Fees and Charges: Some calculators may not include all fees and charges associated with the policy.

Flowchart Illustrating Return of Premium Calculation Steps

The following describes a simplified flowchart of the calculation process:

1. Input Data: Gather user data (age, health, coverage amount, etc.).

2. Risk Assessment: Assess risk based on input data using actuarial tables and models.

3. Premium Calculation: Calculate the base premium based on risk assessment and policy terms.

4. Return of Premium Calculation: Project the return of premium based on policy terms and mortality rates.

5. Total Cost Calculation: Calculate the total cost of the policy, including premiums and any fees.

6. Present Value Calculation: Discount future cash flows (return of premium) to present value.

7. Output: Display the estimated premiums, return of premium, and total cost.

Factors Affecting Return of Premium Calculations

Several key factors influence the cost of return of premium life insurance and, consequently, the calculations used to determine the potential return. Understanding these factors is crucial for making an informed decision about this type of policy. This section will explore the major variables that impact your premium.

Age

Age is a significant factor in determining return of premium life insurance premiums. Generally, younger individuals receive lower premiums than older individuals. This is because statistically, younger people have a lower risk of mortality. Insurance companies assess risk based on actuarial tables that reflect the probability of death within a specific age group and timeframe. A 30-year-old will typically pay considerably less than a 50-year-old for the same coverage amount and policy term. The increase in premium with age reflects the higher risk the insurance company assumes.

Health Status

An applicant’s health status plays a crucial role in premium calculations. Individuals with pre-existing conditions or a family history of certain diseases are considered higher risk and will typically pay higher premiums. Insurance companies conduct thorough medical underwriting to assess the risk profile of each applicant. This might involve reviewing medical records, requiring medical examinations, and asking detailed health questions. Applicants with excellent health and a clean medical history are likely to receive more favorable rates. For example, someone with a history of heart disease would likely face significantly higher premiums compared to someone with a clean bill of health.

Coverage Amount

The amount of coverage desired directly impacts the premium. A larger death benefit requires a higher premium. This is a straightforward relationship: the greater the financial protection sought, the greater the cost. For instance, a $500,000 policy will have a higher premium than a $250,000 policy, all other factors being equal. This is because the insurance company assumes a greater financial obligation with higher coverage amounts.

Policy Term Length

The length of the policy term also influences premiums. Longer term policies generally have higher premiums than shorter-term policies. This is because the insurance company is committing to providing coverage over a more extended period, increasing the risk of a claim. A 20-year term life insurance policy will typically have a higher premium than a 10-year term policy with the same coverage amount, reflecting the increased duration of the risk for the insurer.

Relative Importance of Factors in Premium Calculation

| Factor | Relative Importance | Impact on Premium | Example |

|---|---|---|---|

| Age | High | Directly proportional; increases with age | A 30-year-old pays less than a 50-year-old. |

| Health Status | High | Directly proportional; poorer health equals higher premiums | Pre-existing conditions lead to higher premiums. |

| Coverage Amount | High | Directly proportional; higher coverage equals higher premiums | $500,000 policy costs more than a $250,000 policy. |

| Policy Term Length | Medium | Directly proportional; longer term equals higher premiums | A 20-year term costs more than a 10-year term. |

Last Point

Ultimately, the decision of whether to invest in return of premium life insurance hinges on a careful assessment of individual needs and financial circumstances. While the potential for premium refunds offers an attractive element, it’s crucial to weigh this against the potentially higher premiums compared to traditional term life insurance. Utilizing a return of premium life insurance calculator, coupled with a thorough understanding of the factors influencing premium calculations, empowers you to make a well-informed choice. Remember to compare quotes from multiple insurers and consult with a financial advisor to ensure the policy aligns with your long-term financial strategy.

Question Bank

What is the difference between a return of premium and a traditional term life insurance policy?

Traditional term life insurance provides coverage for a specified period, with no refund of premiums if you survive the term. ROP policies offer the same coverage but also return premiums paid if you survive the term.

Are there any tax implications associated with return of premium life insurance?

Yes, the returned premiums may be subject to taxation depending on your jurisdiction and the specific policy structure. Consult a tax professional for personalized advice.

Can I use a return of premium calculator for policies with riders or add-ons?

Most online calculators focus on basic ROP policies. Adding riders or add-ons might significantly alter the premium, so it’s best to contact the insurer directly for an accurate quote.

How accurate are online return of premium life insurance calculators?

Online calculators provide estimates based on the information you input. They are helpful for comparison but should not be considered definitive. Always obtain a formal quote from an insurer.