Insurance premiums—the cost of securing your financial future—are often shrouded in complexity. This guide unravels the mysteries surrounding premiums insurance, exploring the factors that influence their cost, the structure of insurance policies, and strategies for managing and potentially reducing your premiums. We’ll delve into various insurance types, compare providers, and provide practical advice to empower you to make informed decisions about your financial protection.

From understanding the impact of risk assessment and lifestyle choices on your premium rates to learning how to compare different insurance providers and coverage options, this guide aims to equip you with the knowledge necessary to navigate the world of insurance premiums confidently. We’ll also examine the intricacies of insurance policy structures, claim procedures, and explore effective strategies for minimizing your costs.

Defining “Premiums Insurance”

Insurance premiums are the regular payments you make to an insurance company in exchange for financial protection against unforeseen events. Essentially, you’re paying for a safety net, transferring the risk of potential losses to the insurer. This allows you to manage financial uncertainty and avoid potentially devastating costs should an accident, illness, or other covered event occur.

Premium costs are determined by a complex interplay of factors. The insurer assesses the level of risk associated with insuring you, considering various aspects of your profile and the coverage you select.

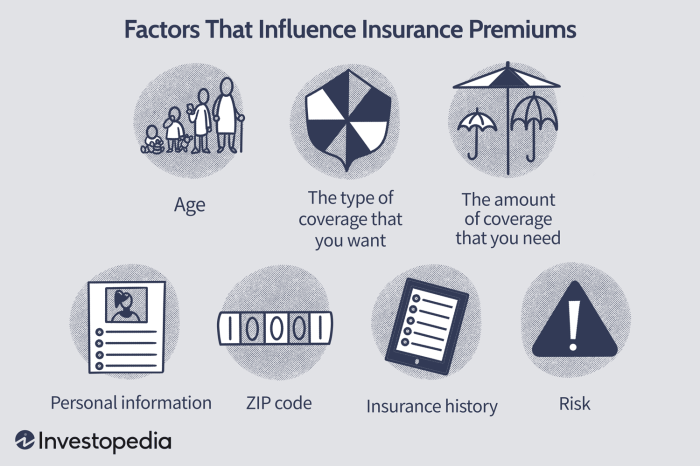

Factors Influencing Premium Costs

Several key factors influence the cost of your insurance premiums. These factors help insurers determine the likelihood of you needing to make a claim and the potential cost of that claim. A higher perceived risk translates to higher premiums. These factors include age, location, health status (for health insurance), driving history (for auto insurance), credit score (in some jurisdictions), and the type and amount of coverage you choose. For instance, a person with a history of reckless driving will likely pay higher auto insurance premiums than someone with a clean driving record. Similarly, a person living in a high-crime area might pay more for home insurance than someone in a safer neighborhood.

Types of Insurance Premiums

Insurance premiums are not a one-size-fits-all cost. They vary significantly depending on the type of insurance. Below are some common examples:

- Health Insurance Premiums: These cover medical expenses, such as doctor visits, hospital stays, and prescription drugs. Premiums vary widely based on the plan’s coverage, your age, and your health status. A comprehensive plan with low deductibles and co-pays will typically have higher premiums than a high-deductible plan with a Health Savings Account (HSA).

- Auto Insurance Premiums: These protect you against financial losses resulting from car accidents. Factors influencing auto insurance premiums include your driving record, the type of vehicle you drive, your location, and the level of coverage you select (liability, collision, comprehensive).

- Home Insurance Premiums: These cover damage or loss to your home and its contents due to events like fire, theft, or natural disasters. Premiums are affected by the value of your home, its location, the level of coverage, and the presence of security features.

- Life Insurance Premiums: These provide a death benefit to your beneficiaries upon your passing. Premiums depend on factors such as your age, health, the amount of coverage, and the type of policy (term life, whole life).

Premium Cost Comparison by Age Group (Auto Insurance)

The following table illustrates how auto insurance premiums can vary based on age. These are illustrative examples and actual premiums will vary depending on many other factors.

| Age Group | Average Annual Premium (Example) |

|---|---|

| 16-25 | $2,000 |

| 26-35 | $1,500 |

| 36-45 | $1,200 |

| 46-55 | $1,000 |

Factors Affecting Premium Costs

Several key factors influence the cost of insurance premiums. Understanding these factors allows individuals to make informed decisions about their coverage and budget accordingly. These factors are interconnected and often work in combination to determine the final premium amount.

Risk Assessment and Premium Pricing

Insurance companies employ sophisticated risk assessment models to determine the likelihood of a claim. This assessment considers various data points, including age, health history (pre-existing conditions, lifestyle choices), location (crime rates, natural disaster risk), and the specific coverage requested. Higher-risk individuals are statistically more likely to file a claim, leading to higher premiums to offset the increased potential cost for the insurance provider. For example, a person with a history of heart conditions will likely pay more for health insurance than someone with a clean bill of health. Similarly, someone living in an area prone to hurricanes will pay more for home insurance than someone in a low-risk area. The underlying principle is that the price reflects the anticipated cost of potential payouts.

Lifestyle Choices and Premium Rates

An individual’s lifestyle significantly impacts premium costs. For example, in health insurance, smokers typically pay higher premiums than non-smokers due to a statistically higher risk of health issues. Similarly, drivers with a history of accidents or traffic violations will often face higher car insurance premiums. Maintaining a healthy lifestyle, including regular exercise, a balanced diet, and avoiding risky behaviors, can positively influence premium costs across various insurance types. Conversely, engaging in activities deemed high-risk by insurers will generally lead to higher premiums.

Premium Costs for Different Coverage Levels

The level of coverage directly impacts premium costs. Higher coverage limits generally mean higher premiums. For instance, a comprehensive car insurance policy with high liability limits will cost more than a basic policy with lower limits. Similarly, in health insurance, a plan with a low deductible and low out-of-pocket maximum will typically be more expensive than a high-deductible plan. The trade-off is between the level of financial protection and the cost of that protection. Choosing a higher coverage level offers greater financial security in the event of a claim but comes with a higher premium. Conversely, lower coverage levels offer lower premiums but leave the policyholder more financially exposed in the event of a significant claim.

Premium Calculation Process

The following flowchart illustrates a simplified version of the premium calculation process:

[Diagram Description: The flowchart begins with a box labeled “Applicant Information (Age, Health, Location, etc.)”. An arrow points to a box labeled “Risk Assessment”. Another arrow points from “Risk Assessment” to a box labeled “Coverage Selection (Type and Limits)”. An arrow then leads to a box labeled “Base Premium Calculation (based on risk and coverage)”. From there, an arrow goes to a box labeled “Adjustments (for discounts, surcharges, etc.)”. Finally, an arrow points from “Adjustments” to a final box labeled “Final Premium Amount”.]

The final premium is a complex calculation, incorporating numerous factors and often utilizing sophisticated actuarial models.

Understanding Insurance Policy Structure

Navigating an insurance policy can feel daunting, but understanding its structure is key to maximizing your coverage. A well-structured policy clearly Artikels your rights, responsibilities, and the extent of the insurer’s commitment. This section will break down the essential components of a typical insurance policy and guide you through the process of understanding your benefits.

Key Components of an Insurance Policy

A standard insurance policy typically includes several crucial sections. The declarations page summarizes the key details of your coverage, including your name, policy number, coverage amounts, effective dates, and premium payments. The definitions section clarifies the meaning of specific terms used throughout the policy, ensuring a common understanding between you and the insurer. The insuring agreement Artikels the insurer’s promise to pay for covered losses, specifying the events that trigger coverage and the extent of that coverage. Exclusions detail the specific circumstances or events not covered by the policy. Conditions Artikel your responsibilities as the policyholder, such as timely premium payments and cooperation in the event of a claim.

Significance of Policy Terms and Conditions

The terms and conditions within an insurance policy are legally binding agreements. Understanding these terms is crucial to avoid misunderstandings and disputes later. For example, a policy might specify a time limit for filing a claim or require you to provide specific documentation to support your claim. Ignoring these terms could jeopardize your ability to receive benefits. Carefully reviewing and understanding all terms and conditions before signing the policy is vital. This includes paying close attention to any exclusions or limitations on coverage. Failing to understand these aspects could result in a denied claim even when you believe you’re covered.

Filing a Claim Procedure

The claim process varies depending on the type of insurance and the insurer, but generally involves several steps. First, you’ll need to notify your insurer as soon as possible after an incident occurs. Next, you’ll need to gather all necessary documentation, such as police reports, medical records, or repair estimates, depending on the nature of the claim. Then, you’ll need to complete and submit a claim form, often available online or through your insurer’s representative. The insurer will then investigate your claim and determine the extent of your coverage. Finally, you’ll receive a settlement or denial of your claim, with an explanation of the decision.

Understanding Your Policy Benefits

Understanding your policy benefits requires a systematic approach. Here’s a step-by-step guide:

- Read the entire policy carefully: Don’t just skim it; take the time to understand each section.

- Pay attention to definitions: Familiarize yourself with the specific meanings of terms used in the policy.

- Identify your coverage amounts: Note the maximum amounts your policy will pay for various covered losses.

- Review exclusions and limitations: Understand what is not covered by your policy.

- Understand the claim process: Know the steps involved in filing a claim and the required documentation.

- Contact your insurer if you have questions: Don’t hesitate to reach out for clarification.

Comparing Insurance Providers

Choosing the right insurance provider can significantly impact your financial well-being. Understanding the differences in premium offerings, coverage, and provider models is crucial for making an informed decision. This section compares three major insurance providers to illustrate these key differences.

Premium Offerings and Coverage Comparison

Several factors influence insurance premiums, including age, location, driving history (for auto insurance), and the type and level of coverage selected. Three major insurance providers – let’s call them Provider A, Provider B, and Provider C – often exhibit variations in their pricing and coverage. Provider A generally offers competitive premiums for basic coverage but might charge more for comprehensive options. Provider B tends to have a higher average premium but frequently includes more extensive benefits in their standard packages. Provider C often positions itself as a budget-friendly option, though this may come with trade-offs in coverage breadth. It’s important to note that these are generalizations; actual premiums will vary based on individual circumstances.

Key Differences in Coverage and Benefits

Provider A might offer robust roadside assistance as a standard feature, while Provider B may excel in offering extensive liability coverage. Provider C, focused on affordability, might offer fewer add-on options. For example, Provider A may include rental car reimbursement after an accident as standard, while Provider B might offer it as an add-on for an additional cost. Provider C may not offer this benefit at all. Understanding these nuances is vital in determining which provider best aligns with your specific needs and risk tolerance.

Advantages and Disadvantages of Different Provider Models

Different insurance providers utilize varying business models, impacting their pricing strategies and customer service. Provider A, for instance, may operate a large, centralized model with standardized processes, potentially leading to efficient claims handling but potentially less personalized customer service. Provider B, using a more decentralized, regional model, might offer more personalized attention but potentially slower processing times. Provider C, a smaller, more agile company, might offer competitive rates but potentially lack the resources of larger providers for extensive claims support.

Summary Table of Insurance Provider Features

| Feature | Provider A | Provider B | Provider C |

|---|---|---|---|

| Average Premium (Example: Annual Auto Insurance) | $1200 | $1500 | $900 |

| Liability Coverage (Example: Limits) | $100,000/$300,000 | $250,000/$500,000 | $50,000/$100,000 |

| Comprehensive Coverage (Example: Included Features) | Collision, Uninsured Motorist | Collision, Uninsured Motorist, Rental Car Reimbursement | Collision (Optional Add-on), Uninsured Motorist |

| Roadside Assistance | Standard | Optional Add-on | Not Offered |

Illustrative Examples of Premium Scenarios

Understanding how various factors influence your insurance premiums is crucial for making informed decisions. The following scenarios illustrate the impact of different choices and circumstances on your premium costs.

Impact of a Major Claim on Future Premiums

A driver with a clean driving record and low premiums is involved in a significant car accident, resulting in $20,000 in damages. The insurance company pays out the claim, but the driver’s premium increases significantly in the following year. This increase reflects the increased risk associated with the accident. The premium might rise by 20-30%, or even more, depending on the insurer’s risk assessment and the specific details of the accident. The higher premium acts as a deterrent against future risky behavior and helps the insurance company recoup its losses. The increased premium will likely remain elevated for several years, gradually decreasing as the accident fades further into the past. This scenario highlights the importance of safe driving practices and the long-term financial implications of accidents.

Benefits of Choosing a Higher Deductible

A homeowner opts for a higher deductible on their home insurance policy. Instead of a $500 deductible, they choose a $2,000 deductible. This significantly reduces their monthly premium. While they’ll pay more out-of-pocket in the event of a claim, the lower premium offers substantial savings over the long term, especially if no claims are filed. For instance, if the annual premium with a $500 deductible is $1200 and the premium with a $2000 deductible is $900, the homeowner saves $300 annually. This saving is substantial if no claims are filed. However, if a claim exceeding $2000 is filed, the homeowner will face a larger out-of-pocket expense than with a lower deductible. This scenario underscores the importance of carefully weighing the trade-off between premium cost and out-of-pocket expenses in case of a claim.

Preventative Measures Leading to Lower Premiums

A homeowner invests in a new, state-of-the-art security system and upgrades their smoke detectors. They also ensure their home is properly insured. Their insurance company recognizes these preventative measures and offers a discount on their home insurance premium. This discount reflects the reduced risk of theft or fire damage associated with the improvements. This might result in a 5-10% reduction in their annual premium. This scenario demonstrates the financial benefits of proactive risk mitigation strategies. The insurer is incentivized to reward responsible behavior, leading to a win-win situation for both parties.

Relationship Between Risk Factors and Premium Costs

Imagine a graph with “Premium Cost” on the vertical axis and “Risk Factors” on the horizontal axis. The graph depicts a positive correlation. The horizontal axis could be segmented into factors like age, driving history (accidents, tickets), credit score, location (crime rates, natural disaster frequency), and health history (for health insurance). The higher the number of negative risk factors (e.g., multiple speeding tickets, poor credit score, living in a high-risk area), the higher the point plotted on the graph representing increased premium cost. Conversely, a low number of negative risk factors results in a lower point on the graph, indicating lower premiums. The line connecting these points would show an upward trend, illustrating the direct relationship between accumulated risk factors and the resulting premium cost. The graph visually reinforces the concept that individual choices and circumstances directly influence insurance premiums.

Final Wrap-Up

Securing adequate insurance coverage is a crucial aspect of financial planning, and understanding the mechanics of premiums insurance is key to making informed choices. By carefully considering the factors influencing premium costs, comparing providers, and implementing effective management strategies, you can optimize your insurance protection while maintaining financial stability. This guide has provided a foundation for navigating the complexities of insurance premiums, empowering you to make confident and cost-effective decisions for your future.

Key Questions Answered

What happens if I miss a premium payment?

Missing a premium payment can lead to policy lapse, meaning your coverage is terminated. Contact your insurer immediately to explore options for reinstatement, which may involve late fees or penalties.

Can I change my insurance policy after it’s been issued?

Generally, yes. You may be able to adjust coverage levels, add or remove drivers (for auto insurance), or make other modifications, but there might be fees or changes to your premium. Consult your insurer for details.

How does my credit score affect my insurance premiums?

In many jurisdictions, your credit score is a factor in determining your insurance premium. A higher credit score often translates to lower premiums, as it’s viewed as an indicator of responsible financial behavior.

What is a deductible, and how does it affect my premiums?

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Choosing a higher deductible typically results in lower premiums, as you’re assuming more of the risk.