Premium whole life insurance stands as a cornerstone of long-term financial planning, offering a unique blend of life insurance coverage and cash value accumulation. Unlike term life insurance, which provides coverage for a specified period, premium whole life insurance offers lifelong protection, building cash value that grows tax-deferred over time. This comprehensive guide delves into the intricacies of premium whole life insurance, exploring its features, benefits, costs, and suitability within diverse financial strategies.

We will examine the various types of premium whole life policies available, analyzing their cost structures and long-term financial implications. We’ll also compare premium whole life insurance to alternative investment vehicles, providing a nuanced understanding of its place within a well-rounded financial portfolio. The guide will equip you with the knowledge to make informed decisions regarding this significant financial commitment.

Defining Premium Whole Life Insurance

Premium whole life insurance is a type of permanent life insurance policy that provides lifelong coverage as long as premiums are paid. Unlike term life insurance, which covers a specific period, whole life insurance offers a death benefit payable upon the policyholder’s death, regardless of when that occurs. It also builds a cash value component that grows tax-deferred over time. This cash value can be borrowed against or withdrawn, offering financial flexibility.

Premium whole life insurance differs significantly from term life insurance in several key aspects. The most obvious difference lies in the duration of coverage. Term life insurance provides coverage for a specific term (e.g., 10, 20, or 30 years), after which the coverage expires unless renewed. Premium whole life insurance, on the other hand, offers lifelong coverage, provided premiums are consistently paid. Furthermore, term life insurance typically has lower premiums than whole life insurance, but it does not build cash value. Whole life insurance, with its higher premiums, offers the advantage of a growing cash value component that can be accessed for various financial needs.

Types of Premium Whole Life Insurance

Several types of premium whole life insurance policies cater to different needs and financial situations. These variations primarily relate to how premiums are structured and the flexibility offered.

Comparing Premium Whole Life Insurance Products

The following table compares three common types of premium whole life insurance, highlighting key features and cost considerations. Note that actual premiums and cash value growth will vary based on factors such as age, health, and the specific insurer.

| Policy Type | Premium Structure | Cash Value Growth | Typical Cost |

|---|---|---|---|

| Straight Whole Life | Level premiums throughout life | Guaranteed minimum rate of return | High, but predictable |

| Limited-Pay Whole Life | Premiums paid for a specified period (e.g., 20 years), then coverage continues for life | Guaranteed minimum rate of return | Higher initial premiums than straight whole life, but premiums cease after a set period |

| Adjustable Whole Life | Premiums and death benefit can be adjusted within certain limits | Guaranteed minimum rate of return, but may fluctuate based on adjustments | More flexible premiums, but may be higher or lower than straight whole life depending on adjustments |

Cost and Benefits Analysis

Premium whole life insurance represents a significant long-term financial commitment. Understanding the associated costs and potential benefits is crucial before making a purchase decision. This analysis explores the long-term financial implications, focusing on cash value accumulation and comparing growth projections under different premium payment structures. We will also illustrate potential benefits across various life stages through a hypothetical scenario.

The cost of premium whole life insurance is determined by several factors, including the policy’s face value, the insured’s age and health, and the specific features included. Premiums are typically fixed and remain constant throughout the policy’s duration, providing predictable budgeting. However, these premiums can be substantial compared to term life insurance, demanding careful consideration of one’s financial capacity. The long-term financial implications extend beyond the premium payments themselves, encompassing the potential for cash value growth and the tax advantages associated with policy withdrawals and death benefits.

Cash Value Accumulation in Premium Whole Life Insurance

Premium whole life insurance policies build cash value over time. This cash value grows tax-deferred, meaning you don’t pay taxes on the earnings until you withdraw them. The growth rate is typically linked to the insurer’s investment performance, though it’s often less volatile than market-based investments. A portion of each premium payment contributes to the cash value, and the policy earns interest on this accumulating amount. This cash value can be accessed through policy loans or withdrawals, offering financial flexibility in various life circumstances. However, it is important to note that borrowing against the cash value increases the policy’s overall cost.

Projected Cash Value Growth Under Different Premium Payment Options

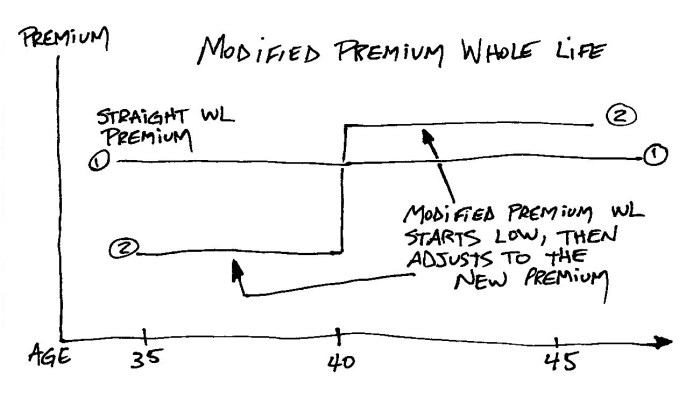

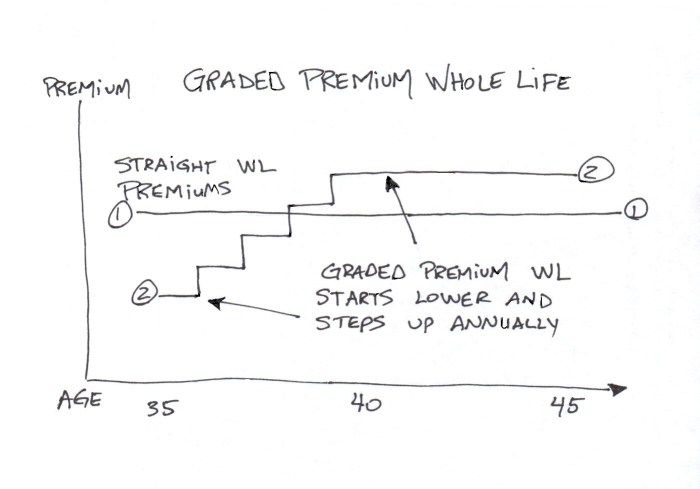

The rate of cash value accumulation varies depending on the chosen premium payment option. For instance, a single-premium whole life policy requires a large upfront payment, resulting in rapid cash value growth. Conversely, a level-premium policy spreads payments over many years, leading to a slower but steadier accumulation. Let’s consider a hypothetical scenario: A 35-year-old purchases a $500,000 whole life policy. With a single premium of $200,000, the cash value might reach $300,000 in 20 years (assuming a conservative average annual growth rate of 4%). A level premium policy with annual payments of $10,000 might accumulate a cash value of $150,000 over the same period. These are illustrative examples and actual growth rates vary based on several factors.

Hypothetical Scenario Demonstrating Potential Benefits Across Life Stages

Consider Sarah, a 30-year-old professional. She purchases a premium whole life insurance policy. In her 30s, the policy provides peace of mind, knowing her family is financially protected. In her 40s, she uses a policy loan to finance her child’s education. By her 50s, she leverages the accumulated cash value for retirement planning, supplementing her other retirement savings. In her 60s, the policy continues to provide a death benefit for her family, while the cash value remains available for unforeseen expenses or estate planning. This illustrates how a premium whole life insurance policy can adapt to changing financial needs throughout different life stages. It is important to remember that this is a hypothetical scenario and the actual benefits experienced will depend on individual circumstances and market conditions.

Policy Riders and Add-ons

Premium whole life insurance policies offer flexibility through a range of riders and add-ons, allowing you to tailor your coverage to your specific needs and circumstances. These optional additions enhance the core policy benefits, providing extra protection against unforeseen events or adding valuable features that might otherwise be unavailable. Understanding these riders is crucial to making an informed decision about your life insurance coverage.

Adding riders can significantly impact both the cost and the overall value of your policy. While they provide increased protection, they naturally increase your premiums. Careful consideration of your individual financial situation and risk tolerance is essential before selecting any add-ons.

Common Policy Riders and Add-ons

Several common riders are available to augment a premium whole life insurance policy. These riders provide additional coverage or benefits beyond the basic death benefit. Choosing the right riders depends heavily on individual circumstances and financial goals. A thorough understanding of each rider’s functionality and associated costs is vital before making a decision.

- Waiver of Premium Rider: This rider waives future premium payments if you become totally and permanently disabled. This ensures your policy remains in force even if you are unable to work and pay premiums.

- Accidental Death Benefit Rider (ADB): Provides an additional death benefit if the insured dies as a result of an accident. This can double or even triple the policy’s death benefit, offering significant financial support to beneficiaries in the event of an accidental death.

- Long-Term Care Rider: This rider provides funds for long-term care expenses, such as nursing home care or in-home assistance, should you require it later in life. This can be invaluable in protecting your assets and ensuring you receive the necessary care without depleting your savings.

- Disability Income Rider: Pays a monthly income benefit if you become totally and permanently disabled, providing financial support during a period of lost earnings. This can help maintain your lifestyle and cover living expenses while you recover.

- Guaranteed Insurability Rider (GIR): Allows you to increase your death benefit at specific times (e.g., marriage, birth of a child) without undergoing a new medical examination. This is particularly useful for ensuring coverage keeps pace with life changes and growing financial responsibilities.

Potential Benefits and Drawbacks of Adding Riders

Adding riders offers significant benefits, but it’s important to weigh these against potential drawbacks. For example, a long-term care rider can provide peace of mind knowing that future care costs are covered, but it will increase your premiums. Similarly, a disability income rider offers financial protection during disability, but the added cost should be considered against your overall financial plan.

- Long-Term Care Rider Benefits: Covers potentially significant long-term care costs, preventing depletion of personal assets. Drawbacks: Increased premiums, may not cover all long-term care needs depending on the policy details.

- Disability Income Rider Benefits: Provides a steady income stream during disability, alleviating financial strain. Drawbacks: Increased premiums, specific definition of disability may limit payouts.

Examples of Customized Policies Using Riders

A young couple starting a family might add a Guaranteed Insurability Rider to increase their coverage as their family grows and their financial responsibilities increase. An older individual nearing retirement might prioritize a Long-Term Care Rider to protect their assets against the high cost of long-term care. A self-employed individual might find a Disability Income Rider essential to replace lost income if they become unable to work. These are just examples; the optimal combination of riders depends on individual circumstances.

Rider Costs and Availability

The cost of riders varies significantly depending on the insurance company, the type of rider, the amount of coverage, and the insured’s age and health. It’s crucial to obtain quotes from multiple insurers to compare costs and benefits. Specific cost information is best obtained directly from an insurance provider.

Note: Rider costs are not standardized and will vary. Always request a detailed breakdown of costs from your insurance provider before making a decision.

Understanding Policy Documents and Clauses

Your premium whole life insurance policy is a legally binding contract. Understanding its terms and conditions is crucial to ensure you’re getting the coverage you expect and to avoid any unexpected surprises down the line. This section will help you navigate the key elements of your policy document.

Common Clauses in Premium Whole Life Insurance Policies

Premium whole life insurance policies contain several standard clauses that define the agreement between the policyholder and the insurance company. These clauses Artikel the rights and responsibilities of both parties, covering aspects such as premium payments, death benefits, and policy surrender. Familiarizing yourself with these clauses is vital for informed decision-making. A thorough understanding of these clauses will empower you to make informed choices regarding your policy.

Importance of Understanding Policy Terms and Conditions

Failure to understand your policy’s terms and conditions can lead to unforeseen financial consequences. For example, not understanding the surrender charges could result in significant losses if you decide to cancel your policy early. Similarly, being unaware of the policy’s grace period for premium payments could lead to unintentional lapse of coverage. Understanding the policy’s provisions ensures you are fully protected and aware of your rights and obligations.

Interpreting Key Information in a Sample Policy Document

Let’s consider a hypothetical example. Imagine a sample policy document that states: “The death benefit payable upon the insured’s death is $500,000, less any outstanding loans.” This clause clearly indicates that the beneficiary will receive $500,000, but this amount might be reduced if the policyholder had taken out any loans against the policy’s cash value. Another clause might state: “Premiums are due annually on the policy anniversary date.” This specifies the frequency and timing of premium payments. Understanding such specific details is crucial for managing your policy effectively.

Policy Surrender Charges and Fees

Surrender charges are fees levied by the insurance company if you decide to cancel your policy before its maturity date. These charges are typically highest in the early years of the policy and gradually decrease over time. For instance, a policy might have a surrender charge of 10% of the cash value in the first year, decreasing by 1% annually until it reaches zero. This means that surrendering the policy early will result in a substantial loss of the accumulated cash value. In addition to surrender charges, other fees, such as administrative fees or policy loan interest, may apply. These fees are usually Artikeld in the policy document’s fee schedule. Understanding these charges is critical for evaluating the overall cost of the policy and making informed decisions about its continuation.

Comparison with Alternative Investment Strategies

Premium whole life insurance presents a unique investment approach, differing significantly from traditional investment vehicles like mutual funds or index funds. Understanding these differences is crucial for making informed financial decisions. This section will compare and contrast premium whole life insurance with these alternatives, examining their respective risks, returns, and suitability for various financial goals.

Premium whole life insurance offers a guaranteed cash value that grows tax-deferred, providing a level of security not always found in market-based investments. Conversely, mutual funds and index funds offer the potential for higher returns but carry the risk of market fluctuations, meaning the value of your investment can go up or down. The choice between these options depends heavily on your risk tolerance, investment timeline, and financial objectives.

Risk and Return Comparison

The risk profile of premium whole life insurance is considerably lower than that of mutual funds or index funds. While the returns on whole life insurance are generally more modest and predictable, they are also less susceptible to market downturns. Mutual funds and index funds, on the other hand, offer the potential for significantly higher returns but are subject to market volatility. A poorly performing market can lead to substantial losses, especially in the short term. For instance, the 2008 financial crisis saw significant drops in the value of many mutual funds and index funds, whereas the cash value of whole life insurance policies remained relatively stable.

Situations Where Premium Whole Life Insurance is Suitable

Premium whole life insurance can be a suitable investment for individuals prioritizing guaranteed growth and long-term financial security, particularly those seeking: a guaranteed death benefit for their loved ones; a stable, tax-deferred savings vehicle; a source of funds for future needs, such as retirement or college expenses; or a hedge against market volatility.

Examples include individuals seeking a guaranteed inheritance for their children or those needing a reliable source of funds for long-term care expenses. The predictable nature of whole life insurance makes it attractive for individuals with a low risk tolerance.

Situations Where Premium Whole Life Insurance May Not Be Suitable

Premium whole life insurance may not be the optimal investment for individuals seeking high returns or those with a higher risk tolerance. If maximizing investment growth is the primary goal, mutual funds or index funds may offer more potential, although with greater risk. For instance, an individual with a long investment horizon and a high risk tolerance might find mutual funds or index funds a more suitable choice for building wealth, even considering the associated market risks.

This is especially true for younger investors who have a longer time horizon to recover from potential market downturns.

Tax Implications Comparison

The tax implications of premium whole life insurance differ significantly from those of mutual funds and index funds. This table summarizes the key differences:

| Investment Vehicle | Growth | Withdrawals | Death Benefit |

|---|---|---|---|

| Premium Whole Life Insurance | Tax-deferred | Potentially taxable, depending on method | Generally tax-free to beneficiaries |

| Mutual Funds | Taxable annually (if capital gains are realized) | Taxable upon withdrawal (capital gains and dividends) | Taxable to beneficiaries |

| Index Funds | Taxable annually (if capital gains are realized) | Taxable upon withdrawal (capital gains and dividends) | Taxable to beneficiaries |

Illustrative Examples of Policy Use Cases

Premium whole life insurance, while often perceived as a complex financial instrument, offers versatile applications tailored to diverse life goals. The following scenarios highlight its adaptability in achieving specific financial objectives.

Estate Planning for a Growing Family

This scenario centers on a young couple, Sarah and Mark, expecting their first child. They recognize the importance of securing their family’s financial future, particularly concerning potential future education costs and maintaining their lifestyle in case of unforeseen circumstances. A premium whole life insurance policy offers a solution by providing a substantial death benefit that could cover outstanding mortgage payments, educational expenses for their child, and maintain their family’s living standard. The cash value component of the policy could also be accessed, tax-advantaged, for emergencies or significant life events. The policy’s death benefit acts as a legacy, ensuring their child’s financial security even if they are no longer around.

Visual Representation: A bar graph illustrating the potential death benefit payout covering mortgage, education costs, and a living expenses fund. Another bar could represent the growth of the cash value over time, showcasing its potential for future access.

Retirement Income Supplement for a Self-Employed Individual

Consider David, a self-employed consultant who lacks access to a traditional employer-sponsored retirement plan. He understands the need for a secure retirement income stream but is concerned about market volatility affecting his investments. A premium whole life insurance policy, with its guaranteed cash value growth, offers a stable, predictable source of funds for retirement. The cash value accumulation can be withdrawn systematically throughout retirement, supplementing other income sources and providing a level of financial security. The death benefit remains in place, offering additional protection for his family.

Visual Representation: A line graph depicting the steady growth of the policy’s cash value over time, alongside a separate line showing a more volatile, market-dependent investment. A final section could show a steady stream of withdrawals during retirement years.

Business Succession Planning for a Small Business Owner

Imagine Maria, the owner of a successful bakery. She wants to ensure a smooth transition of her business to her children upon her retirement or passing. A premium whole life insurance policy can serve as a crucial element of her business succession plan. The death benefit could provide the necessary capital for her children to purchase the business or cover any outstanding business debts, ensuring a seamless transition and preserving the family legacy. The policy’s cash value could also be used to fund business expansions or improvements during Maria’s ownership.

Visual Representation: A flowchart depicting the business succession process. The policy’s death benefit is represented as a key element enabling the smooth transfer of ownership to the next generation. A separate box shows the use of the cash value for business growth and improvements.

Final Review

Premium whole life insurance presents a powerful tool for securing your family’s future and building lasting wealth. By carefully considering your individual financial goals, risk tolerance, and long-term objectives, you can determine if premium whole life insurance aligns with your overall financial strategy. This guide has provided a framework for understanding the complexities of this insurance type, empowering you to engage in informed discussions with financial advisors and make choices that best serve your needs. Remember to thoroughly review policy documents and seek professional financial advice before making any decisions.

Quick FAQs

What are the tax implications of withdrawing cash value from a premium whole life insurance policy?

Withdrawals of cash value are generally tax-free up to the amount of premiums paid. Withdrawals exceeding the premiums paid are subject to income tax and a 10% penalty if taken before age 59 1/2.

Can I borrow against the cash value of my premium whole life insurance policy?

Yes, most premium whole life insurance policies allow you to borrow against the accumulated cash value. Interest is typically charged on these loans, and failure to repay could impact your death benefit.

How does the death benefit of a premium whole life insurance policy work?

The death benefit is the amount paid to your beneficiaries upon your death. This amount is typically the face value of the policy, less any outstanding loans.

What happens if I stop paying premiums on my premium whole life insurance policy?

If premiums are not paid, the policy may lapse, meaning the coverage ends and the cash value may be forfeited, depending on the policy’s terms.