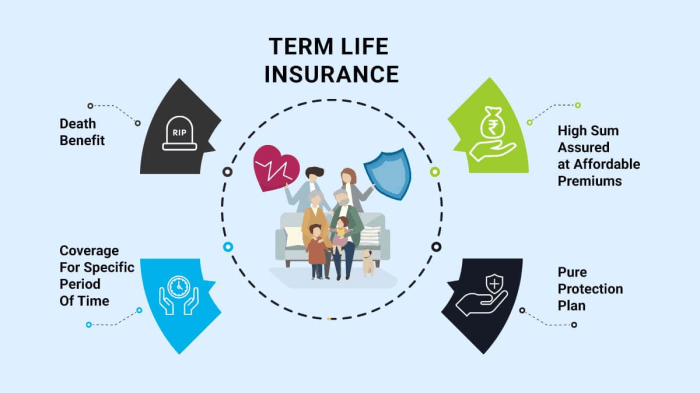

Premium term life insurance offers a crucial financial safety net for families and individuals, providing a cost-effective way to protect loved ones against the unforeseen. Unlike permanent life insurance options, term life insurance offers coverage for a specified period (the term), providing peace of mind during a critical life stage, such as raising a family or paying off a mortgage. This guide will delve into the intricacies of premium term life insurance, exploring its benefits, costs, and the process of securing the right policy.

We will examine the key factors that influence premium costs, including age, health, and lifestyle choices. We’ll also explore the various riders available to enhance your coverage, such as accidental death benefits or terminal illness benefits. By understanding the application and underwriting process, you can confidently navigate the selection of a policy that aligns with your specific needs and budget.

Policy Benefits and Riders

Premium term life insurance offers a robust foundation of financial protection for your loved ones, but its value can be significantly enhanced through understanding the core benefits and the optional riders available. This section will detail the standard benefits included in most policies, along with explanations of common riders and how they can tailor your coverage to your specific needs.

Standard Benefits of Premium Term Life Insurance

The primary benefit of any term life insurance policy, including premium term policies, is the death benefit. This is a lump sum payment made to your designated beneficiaries upon your death during the policy’s term. The amount of this benefit is determined at the policy’s inception and remains fixed for the duration of the term. Beyond the death benefit, some policies may also include features like a grace period for late payments, allowing a short timeframe to make a missed payment without lapsing the policy. Additionally, policies often contain a policy loan provision, enabling you to borrow against your policy’s cash value (if applicable), though this will reduce the eventual death benefit.

Accidental Death Benefit Rider

This rider provides an additional death benefit payment if the insured’s death is a direct result of an accident. The payout amount is typically a multiple of the base death benefit (e.g., double or triple the face value). For example, a $500,000 policy with a double indemnity accidental death benefit rider would pay out $1,000,000 to beneficiaries if the insured dies in an accident. This offers critical supplemental financial security for unforeseen circumstances.

Terminal Illness Benefit Rider

This rider allows for a portion or all of the death benefit to be paid out while the insured is still alive if they are diagnosed with a terminal illness with a life expectancy of a specified period (e.g., 12 months or less). This provides financial assistance to cover medical expenses, end-of-life care, and other needs during a difficult time. A family facing the financial strain of extensive medical care for a terminally ill family member could greatly benefit from accessing these funds early.

Other Available Benefits and Riders

Below is a list of additional benefits and riders commonly offered with premium term life insurance policies. The availability of specific riders may vary depending on the insurer and the individual’s circumstances.

- Waiver of Premium Rider: If the insured becomes totally disabled, this rider waives future premium payments while maintaining the policy’s coverage.

- Guaranteed Insurability Rider: Allows the insured to purchase additional coverage at predetermined times (e.g., marriage, birth of a child) without undergoing a new medical examination.

- Children’s Term Rider: Provides term life insurance coverage for the insured’s children.

- Return of Premium Rider: Returns a portion or all of the premiums paid if the insured outlives the policy term.

Application and Underwriting Process

Securing premium term life insurance involves a straightforward yet crucial application and underwriting process. Understanding these steps will help you navigate the process efficiently and ensure a smooth experience. This section details the procedures involved, from initial application to final policy issuance.

The application process for premium term life insurance typically begins with completing an application form. This form gathers essential personal and health information necessary for the insurer to assess your risk profile. The information provided is then reviewed by underwriters who determine your eligibility and the appropriate premium rate.

Application Form Completion

The application form requires detailed personal information, including your age, occupation, medical history, and lifestyle habits. Accurate and complete information is crucial for a timely and successful application. Providing false or misleading information can lead to policy denial or even cancellation. Common information requested includes full name, date of birth, address, contact details, employment history, and details of any existing health conditions. You may also be asked about family medical history, as this can be a significant factor in assessing risk.

Underwriting Process Overview

Following application submission, the underwriting process commences. This involves a thorough review of your application, including verification of the information provided. This may involve contacting your physician for medical records, obtaining credit reports, and potentially requiring a medical examination. The underwriters use this information to assess your risk profile and determine the appropriate premium rate for your policy. The goal is to accurately assess your likelihood of needing to make a claim.

Information Required During Underwriting

Underwriters require comprehensive information to evaluate the risk associated with insuring your life. This includes detailed medical history, family medical history (including causes of death of close relatives), lifestyle factors such as smoking and alcohol consumption, and your occupation. They may also request details about any hazardous hobbies or activities. Financial information may also be considered, although this is less common for term life insurance.

Step-by-Step Application and Underwriting Guide

- Application Submission: Complete and submit the application form online or via mail, providing all requested information accurately and completely.

- Initial Review: The insurer reviews your application for completeness and any immediately apparent issues.

- Information Verification: The insurer verifies the information provided, contacting your physician or other sources as needed.

- Medical Examination (if required): A paramedical exam might be required, involving blood and urine tests and a physical examination. This is more common for larger policy amounts.

- Risk Assessment: Underwriters assess your risk profile based on all gathered information.

- Premium Determination: The insurer determines your premium based on the assessed risk.

- Policy Issuance: If approved, the policy is issued, and you receive your policy documents.

Examples of Application Questions

Applicants may be asked questions about their medical history, such as whether they have ever been diagnosed with cancer, heart disease, or diabetes. They might also be questioned about their lifestyle, including smoking habits, alcohol consumption, and participation in high-risk activities. Questions about family history of certain diseases are also standard. For example, an applicant might be asked about the age and cause of death of their parents and siblings. The specific questions will vary depending on the insurer and the applicant’s profile.

Choosing the Right Policy

Selecting the right premium term life insurance policy is crucial, as it provides financial security for your loved ones in the event of your untimely death. The ideal policy will depend on your individual circumstances, financial goals, and risk tolerance. Carefully considering various options and understanding the implications of each choice will ensure you make an informed decision.

Comparing Premium Term Life Insurance Options

Different providers offer various premium term life insurance options, each with unique features and pricing structures. These variations often include differing policy lengths (terms), coverage amounts, and rider availability. For instance, one provider might offer a 10-year term with a lower premium but less overall coverage compared to another provider’s 20-year term with a higher premium and greater coverage. Understanding these nuances is essential for effective comparison. Consider factors like the provider’s financial stability, customer service reputation, and claim settlement process when evaluating different options.

Factors to Consider When Selecting a Policy

A comprehensive checklist should guide your policy selection. This involves assessing your current financial situation, future financial needs, and the individuals who would benefit from your life insurance coverage.

Key factors include:

- Your age and health: These significantly impact premium rates.

- Desired coverage amount: Determine the amount needed to cover outstanding debts, future expenses, and provide for your dependents.

- Policy term length: Choose a term that aligns with your financial goals and life stage. A longer term offers longer coverage but typically comes with higher premiums.

- Premium affordability: Select a policy with premiums you can comfortably afford throughout the policy term.

- Rider options: Consider additional riders, such as accidental death benefit or critical illness coverage, to enhance your policy’s protection.

- Provider reputation and financial stability: Research the provider’s financial strength and customer reviews before committing.

Assessing Policy Value and Suitability

Assessing a policy’s value requires considering its cost relative to the benefits provided. A suitable policy effectively balances affordability with adequate coverage to meet your specific needs. For example, a policy with a lower premium but insufficient coverage might not provide adequate protection for your family’s financial future. Conversely, a high-premium policy with extensive coverage might strain your budget unnecessarily. The ideal balance is crucial.

Comparison of Hypothetical Premium Term Life Insurance Policies

The following table compares three hypothetical premium term life insurance policies from different providers. Note that these are examples and actual policies and premiums will vary.

| Policy | Provider | Term Length (Years) | Annual Premium (Example: $50,000 coverage) |

|---|---|---|---|

| Policy A | Provider X | 10 | $500 |

| Policy B | Provider Y | 20 | $800 |

| Policy C | Provider Z | 15 | $650 |

Illustrative Examples

Understanding the benefits of premium term life insurance is best achieved through real-world scenarios. The following examples illustrate how this type of insurance can provide crucial financial protection and peace of mind for various individuals and families.

Young Family Benefitting from Premium Term Life Insurance

Imagine a young couple, Sarah and John, both in their late 20s, with a one-year-old child. Sarah is a teacher, and John works as a software engineer. They have a mortgage, student loans, and are saving diligently for their child’s future education. A premium term life insurance policy provides them with a substantial death benefit, ensuring that if either Sarah or John were to pass away unexpectedly, the surviving spouse would have the financial resources to cover their mortgage, debts, and childcare expenses, without facing undue financial hardship. The policy’s affordability during their younger, healthier years makes it a financially responsible choice. The death benefit could also fund a college fund for their child, ensuring their future is secure.

Protection Against Financial Burdens in Case of Death

Consider David, a 45-year-old single father of two teenagers. He is the sole provider for his family, and his job provides a comfortable income, but also carries a significant risk of job loss in the current economic climate. A premium term life insurance policy offers David a safety net. In the event of his unexpected death, the policy’s death benefit would provide his children with the financial resources to complete their education, pay off their mortgage, and maintain their standard of living until they become self-sufficient. This significantly mitigates the potential financial devastation his family would face without life insurance. The policy acts as a crucial financial buffer, reducing the stress and anxiety associated with the uncertainty of the future.

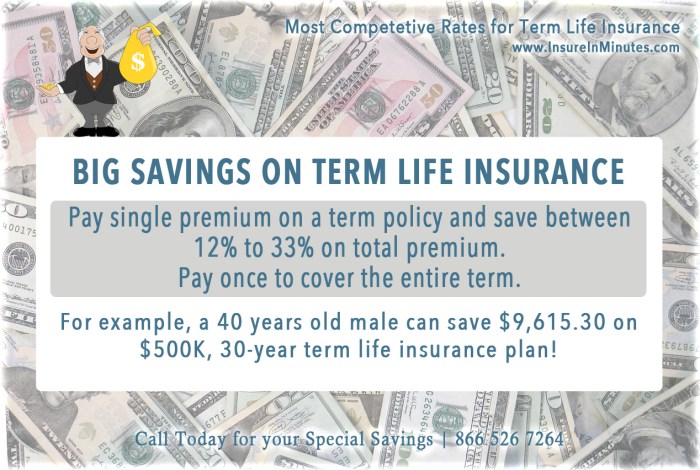

Cost-Effectiveness of Premium Term Life Insurance

Let’s examine the case of Maria, a 30-year-old single professional with a stable income and no dependents. She is focused on building her career and saving for a down payment on a house. She opts for a premium term life insurance policy with a relatively short term, perhaps 10 or 20 years, focusing on covering her outstanding debts and providing a financial cushion during her high-earning years. The premiums are relatively low due to her age and health, making it a cost-effective way to protect her financial assets and future plans. The cost of the policy is significantly less than the potential financial losses she would face if an unexpected event were to occur. This approach allows her to balance financial protection with her current financial goals.

Hypothetical Individual’s Life Insurance Needs and Premium Term Policy

Consider Alex, a 50-year-old married individual with two children in college. He is a high-earning executive with a substantial mortgage and other financial obligations. Alex’s life insurance needs are significant, requiring a substantial death benefit to cover his family’s expenses, including college tuition, mortgage payments, and living expenses. A premium term life insurance policy, possibly with a longer term to cover his children’s education, provides him with the high death benefit he needs at a manageable premium cost, tailored to his specific financial circumstances. This policy effectively addresses his need for significant coverage without the high cost associated with permanent life insurance, aligning with his financial priorities and risk tolerance. The policy allows him to provide for his family’s future financial security even after his passing.

Closure

Choosing the right premium term life insurance policy is a significant decision that requires careful consideration of your individual circumstances and financial goals. By understanding the factors influencing cost, the available benefits and riders, and the application process, you can make an informed choice that provides adequate protection for your family and safeguards their financial future. Remember to compare policies from different providers and seek professional advice if needed to ensure you select a policy that best meets your needs and budget.

Common Queries

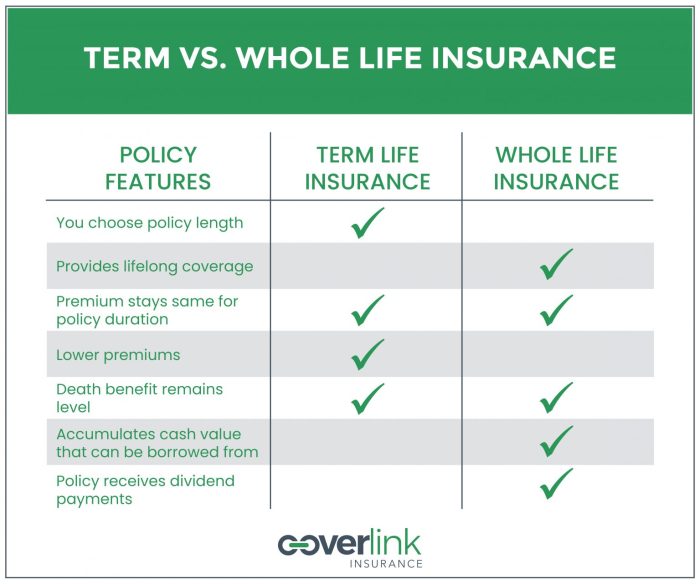

What is the difference between level term and decreasing term life insurance?

Level term life insurance provides a fixed death benefit throughout the policy term, while decreasing term life insurance offers a death benefit that gradually reduces over time. Decreasing term is often used to cover a mortgage that decreases over time.

How long does the underwriting process take?

The underwriting process can vary depending on the insurer and the applicant’s health and risk profile. It typically takes anywhere from a few days to several weeks.

Can I increase my coverage amount later?

Some policies allow for an increase in coverage during a specified period, but this often requires a new underwriting process and may result in higher premiums.

What happens if I miss a premium payment?

Missing a premium payment can lead to a lapse in coverage. Most policies offer a grace period, typically 30 days, before the policy lapses. Contact your insurer immediately if you anticipate difficulties making a payment.