Securing affordable healthcare is a paramount concern for many Americans. The Premium Tax Credit (PTC) program plays a vital role in making health insurance accessible to individuals and families who might otherwise struggle to afford coverage. This guide delves into the intricacies of the PTC, providing a clear understanding of eligibility, calculation methods, and the overall impact on healthcare affordability. We’ll explore how the program works, the benefits it offers, and what you need to know to successfully navigate the application process.

Understanding the Premium Tax Credit is key to accessing affordable health insurance. This guide will equip you with the knowledge to determine your eligibility, calculate your potential credit, and understand how the marketplace system facilitates access to subsidized coverage. We will examine both the practical application of the PTC and its broader societal implications, providing a comprehensive overview of this crucial program.

Eligibility for Premium Tax Credits

The Premium Tax Credit (PTC) helps many Americans afford health insurance purchased through the Health Insurance Marketplace. Understanding the eligibility requirements is crucial to accessing this financial assistance. This section Artikels the key factors determining PTC eligibility.

Income Requirements for Premium Tax Credits

Eligibility for the PTC is primarily determined by your household income. Your income must be within a specific range, calculated based on the Federal Poverty Level (FPL). For 2023, the FPL for a family of four was $27,750. The exact income limits vary depending on your household size and location. While there’s no upper limit on income for *some* PTC assistance, the amount of the subsidy decreases as your income rises above a certain threshold. Beyond this threshold, you may not be eligible for any PTC assistance at all. It is important to consult the Healthcare.gov website or a qualified tax professional for the most up-to-date income limits.

Household Size Considerations for Eligibility

The size of your household significantly impacts your PTC eligibility. The FPL is adjusted based on the number of people in your household. A larger household generally has a higher FPL threshold, meaning a higher income limit for PTC eligibility. For example, a family of four will have a higher income limit than a single individual. The Healthcare.gov website provides a detailed chart outlining the FPL for various household sizes.

Coverage Levels and Their Impact on Eligibility

The level of health insurance coverage you choose also plays a role in your eligibility and the amount of the PTC you receive. The Marketplace offers various coverage levels, often categorized as Bronze, Silver, Gold, and Platinum. Each level represents a different balance between premiums (what you pay monthly) and out-of-pocket costs (deductibles, co-pays, etc.). While you can generally choose any level, the PTC amount varies depending on the plan’s cost and your income. Choosing a higher-cost plan (like Platinum) may result in a larger PTC, but you’ll also have higher monthly premiums. Conversely, a lower-cost plan (like Bronze) may have a smaller PTC, but lower monthly premiums.

Comparison of Eligibility Criteria Across Different States

While the federal government sets the overall framework for the PTC, some state-specific programs or variations may exist. The following table offers a simplified comparison, noting that this information is for illustrative purposes and may not be completely accurate for all states. Always consult official state and federal resources for precise and current information.

| State | Income Limits (Example – Family of Four) | State-Specific Programs | Additional Notes |

|---|---|---|---|

| California | May have higher limits due to state subsidies | California may offer additional subsidies | Check Covered California for details |

| Texas | Follows federal guidelines | Limited state-level assistance | Consult Healthcare.gov |

| New York | May have higher limits due to state subsidies | New York State of Health offers additional support | Check NY State of Health for details |

| Florida | Follows federal guidelines | Limited state-level assistance | Consult Healthcare.gov |

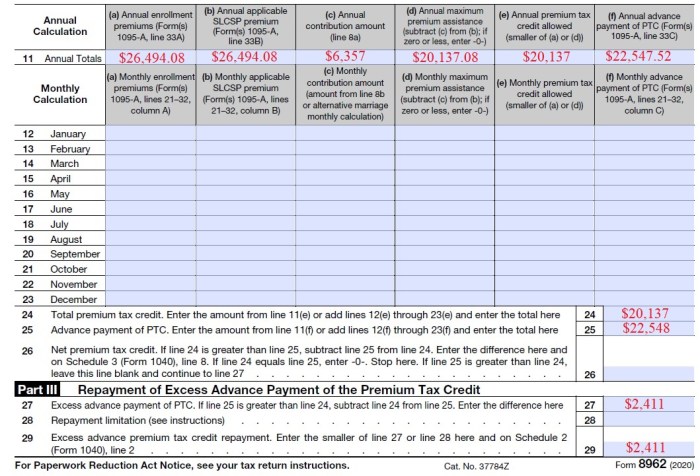

Calculating the Premium Tax Credit

Understanding how the Premium Tax Credit (PTC) is calculated is crucial for accessing affordable health insurance through the Marketplace. This process involves several factors, and the final amount received varies depending on individual circumstances and plan choices. Let’s explore the key elements involved in determining your PTC.

Factors Influencing the Premium Tax Credit Amount

Several key factors determine the final PTC amount. These include your household income, location, age, family size, and the cost of the benchmark plan in your area. Your income is compared to the Federal Poverty Level (FPL), with higher incomes resulting in smaller or no credits. Geographic location impacts the cost of insurance, influencing the credit calculation, as does the age of those covered, with older individuals typically requiring more expensive plans. Finally, the number of people in your household affects the overall cost of coverage and therefore the PTC.

Hypothetical PTC Calculation Example

Let’s consider a hypothetical example: A family of four in California with an annual household income of $60,000. The benchmark plan’s monthly premium is $1,200. After considering their income relative to the FPL and their location, the Marketplace determines their PTC eligibility. Assume the calculation results in a 60% subsidy. This means the government would subsidize 60% of their monthly premium, resulting in a monthly PTC of $720 ($1200 x 0.60). Their monthly cost would be reduced to $480 ($1200 – $720). This is a simplified example, and the actual calculation is more complex.

Marketplace Plan Choice and its Impact on the Credit Amount

The specific plan chosen from the Marketplace directly impacts the PTC amount. While the government subsidizes a percentage of the benchmark plan, choosing a more expensive plan will require a larger out-of-pocket contribution, even with the PTC applied. Conversely, selecting a less expensive plan will result in a lower PTC amount but also lower monthly premiums. The decision involves balancing cost and coverage, with the PTC influencing the affordability of various options.

Step-by-Step Guide to Calculating the Premium Tax Credit

The actual calculation of the PTC is complex and handled by the Healthcare.gov system. However, a simplified, conceptual step-by-step guide is as follows:

1. Determine Household Income: Calculate your total household income for the tax year.

2. Determine FPL Percentage: Divide your household income by the FPL for your household size.

3. Determine Eligibility: Based on your FPL percentage, the system determines your eligibility for the PTC.

4. Determine Benchmark Plan Cost: The system identifies the cost of the benchmark plan in your area.

5. Calculate Subsidy Percentage: Based on your income and FPL percentage, the system calculates your subsidy percentage.

6. Calculate Monthly PTC: Multiply the benchmark plan’s monthly premium by the subsidy percentage. This is your monthly PTC amount.

The formula is simplified as: Monthly PTC = Benchmark Plan Monthly Premium x Subsidy Percentage.

Impact of Premium Tax Credits on Affordability

Premium tax credits (PTCs) significantly impact the cost of health insurance for millions of Americans, making coverage more accessible and affordable. These credits reduce the monthly premiums individuals pay, directly lowering the financial burden of obtaining health insurance. The extent of this impact varies depending on factors such as income, location, and the chosen health plan.

The difference in cost between health insurance with and without PTCs can be substantial. For individuals and families with moderate incomes, the credit can cover a significant portion, or even all, of their monthly premium. Without the credit, many would find health insurance unaffordable, leading to a lack of coverage and potential health risks. This affordability gap is particularly pronounced for those with lower incomes.

Demographic Groups Most Benefiting from Premium Tax Credits

PTCs disproportionately benefit lower- and moderate-income individuals and families. Households earning between 100% and 400% of the federal poverty level are eligible for varying levels of assistance. This translates to substantial savings for many families, particularly those with children or who are facing health challenges. The elderly and those with pre-existing conditions also see significant benefits as PTCs help offset the costs associated with higher premiums often associated with these groups.

Reduction in Out-of-Pocket Expenses Due to Premium Tax Credits

The impact of PTCs extends beyond just reducing monthly premiums. They also contribute to a reduction in overall out-of-pocket costs. Consider the following illustrative examples:

- Example 1: A family of four earning $60,000 annually might see their monthly premium reduced by $300 through a PTC. Over a year, this equates to $3600 in savings. This allows them to allocate those funds to other essential needs or unexpected medical expenses.

- Example 2: An individual with a pre-existing condition might have a high premium without the PTC. The credit might reduce their monthly cost from $500 to $100, making coverage attainable and preventing them from forgoing necessary medical care.

- Example 3: A single mother working part-time might find affordable health insurance inaccessible without the PTC. The credit could lower her monthly premium from an unaffordable $400 to a manageable $50, enabling her to secure essential health coverage for herself and her child.

These examples demonstrate how PTCs can significantly lessen the financial strain of healthcare, promoting better health outcomes by improving access to necessary care. The reduced out-of-pocket costs lead to increased healthcare utilization and improved overall health for individuals and families who otherwise might delay or forgo essential medical services.

The Role of Health Insurance Marketplaces

Health insurance marketplaces, also known as exchanges, play a crucial role in the distribution of Premium Tax Credits (PTCs). They serve as a central hub where individuals and families can compare plans, determine their eligibility for PTCs, and enroll in coverage. This streamlined process ensures fair access to affordable healthcare options.

The marketplaces facilitate the application process for PTCs by integrating eligibility determination directly into the enrollment system. This means applicants can learn about their potential tax credit during the application process, allowing them to choose a plan that fits both their needs and their budget. The information required for PTC eligibility is gathered during the application, simplifying the process and ensuring accuracy.

Marketplace Application Process for Premium Tax Credits

The application process typically begins with creating an account on the marketplace website. Applicants will then be guided through a series of questions to determine their eligibility for PTCs. This involves providing information about household income, family size, and citizenship status. Based on this information, the marketplace will calculate the applicant’s potential PTC amount. After eligibility is confirmed, applicants can browse available plans and select the one that best meets their needs. The entire process is designed to be user-friendly, with online assistance and support readily available.

Types of Health Insurance Plans Available Through Marketplaces

Marketplaces offer a variety of health insurance plans, categorized into metal tiers: Bronze, Silver, Gold, and Platinum. These tiers represent different levels of cost-sharing. Bronze plans have the lowest monthly premiums but higher out-of-pocket costs, while Platinum plans have the highest premiums but the lowest out-of-pocket costs. Silver plans fall in between, offering a balance between premium and out-of-pocket costs. The specific benefits and cost-sharing details vary among plans within each tier. Consumers can compare plans based on their needs and budget. In addition to these metal tiers, Catastrophic plans are available for specific age groups and income levels. These plans have very low monthly premiums but high deductibles.

Navigating the Marketplace Website

Navigating the marketplace website is generally intuitive. Most websites feature a clear and straightforward design, with prominent sections dedicated to key functions such as eligibility determination, plan comparison, and enrollment. Users can typically access information on PTCs through a dedicated section on the website, usually prominently displayed. Interactive tools often allow users to filter plans based on factors such as price, network of doctors, and plan features. Step-by-step guides and FAQs are also available to assist users throughout the process. Customer support is generally available through phone, email, or online chat. Many marketplaces also offer in-person assistance for those who need help navigating the online system.

Ultimate Conclusion

The Premium Tax Credit significantly improves healthcare access for millions of Americans. By understanding the eligibility criteria, calculation methods, and the role of health insurance marketplaces, individuals can effectively leverage this program to secure affordable and comprehensive health coverage. This guide serves as a valuable resource for navigating the complexities of the PTC, empowering readers to make informed decisions about their healthcare needs and financial well-being. Remember to regularly check for updates to the program as regulations and eligibility requirements can change.

Clarifying Questions

What happens if my income changes during the year?

You may need to report the change to the marketplace. This could result in adjustments to your premium tax credit for the remainder of the year.

Can I lose my premium tax credit if I change jobs?

Your eligibility for the PTC may change depending on your new employer’s health insurance offerings and your new income. You should report the change to the marketplace.

What if I don’t qualify for the full premium tax credit?

You will still receive a partial credit, reducing your monthly premiums. The amount will depend on your income and household size.

Are there penalties for not having health insurance?

The individual mandate penalty was eliminated in 2019. However, you may still face higher premiums if you enroll outside of the open enrollment period.

Where can I find more information and assistance?

Visit Healthcare.gov or contact your state’s health insurance marketplace for detailed information and assistance with the application process.