Navigating the complexities of healthcare costs can be daunting, but understanding the Premium Tax Credit (PTC) for health insurance can significantly alleviate financial burdens. This guide delves into the intricacies of the PTC, providing a clear and concise explanation of eligibility, calculation methods, and its overall impact on healthcare access for individuals and families across various income levels. We’ll explore how this vital credit works, its benefits, and the steps involved in claiming it.

From understanding income requirements and household size considerations to navigating the nuances of different health insurance plan types and their associated PTC amounts, this resource aims to empower readers with the knowledge needed to make informed decisions about their healthcare coverage. We’ll also address common misconceptions and provide practical advice for a smoother process, ensuring you can confidently utilize the PTC to secure affordable and quality healthcare.

Calculating the Premium Tax Credit Amount

The Premium Tax Credit (PTC) helps make health insurance more affordable for those who qualify. Understanding how it’s calculated is crucial to maximizing your savings. This section will detail the formula, the role of your chosen plan, and provide a practical example.

The PTC calculation isn’t a simple one-size-fits-all formula. It depends on several factors, primarily your household income and the cost of health insurance plans available in your area. The government uses your modified adjusted gross income (MAGI) to determine your eligibility and the amount of your credit. The MAGI is your gross income with certain deductions added back in. This is then compared to federal poverty guidelines to establish your eligibility percentage.

The Premium Tax Credit Formula

The PTC is calculated based on a complex formula considering your household income, the cost of the benchmark plan in your area, and your eligibility percentage. While the exact formula is intricate and involves several steps performed by the Healthcare.gov system, the core concept is that the credit covers a percentage of the benchmark plan’s cost. The percentage is determined by your income level relative to the federal poverty level. In essence, the lower your income, the higher the percentage of the plan cost covered by the PTC. This percentage is then applied to the cost of the plan you select. It’s important to note that the credit doesn’t cover the entire cost; it helps lower your monthly premiums.

The simplified representation: PTC = (Benchmark Plan Cost * Eligibility Percentage) – (Your Plan Cost * Eligibility Percentage)

Marketplace Plan Cost’s Effect on the Credit Amount

The cost of the health insurance plan you choose directly impacts the amount of your PTC. While the calculation starts with the cost of a benchmark plan (a silver plan with a specific actuarial value), you can choose a different plan. If you choose a more expensive plan (gold, platinum), you will pay more out of pocket even with the PTC. If you choose a less expensive plan (bronze), the PTC may not cover as much of the cost. The PTC is designed to help you afford a plan, but you can choose to pay more for a more comprehensive plan.

Calculating the Credit: A Hypothetical Example

Let’s consider a family of four with a MAGI of $70,000. Their eligibility percentage is determined by the Healthcare.gov system based on their income and location. Let’s assume their eligibility percentage is 75%. The benchmark silver plan in their area costs $1,200 per month. If they choose this benchmark plan, the PTC would be approximately: ($1200 * 0.75) = $900. This means their monthly premium would be $300 ($1200 – $900). However, if they chose a gold plan costing $1,500 per month, their PTC would still be based on the benchmark plan, but their out-of-pocket cost would be higher.

PTC Calculation Comparison for Different Plans

The following table compares the PTC calculation for different plans, assuming the same income and eligibility percentage as the example above (75% eligibility, $1200 benchmark plan cost).

| Plan Type | Monthly Plan Cost | PTC Calculation (75% Eligibility) | Monthly Premium After PTC |

|---|---|---|---|

| Bronze | $800 | ($1200 * 0.75) = $900 | $800 – $900 (0, you pay $800) |

| Silver (Benchmark) | $1200 | ($1200 * 0.75) = $900 | $300 |

| Gold | $1500 | ($1200 * 0.75) = $900 | $600 |

| Platinum | $1800 | ($1200 * 0.75) = $900 | $900 |

The Premium Tax Credit and Marketplace Plans

The Premium Tax Credit (PTC) helps make health insurance more affordable through the Health Insurance Marketplace. However, the amount of the PTC you receive isn’t a fixed number; it depends significantly on the type of plan you choose. Understanding this relationship is crucial to selecting a plan that best balances cost and coverage.

The level of plan coverage directly impacts your PTC amount. This is because the PTC is designed to help lower your monthly premiums, and different plan types have different premium costs. Generally, Bronze plans have the lowest monthly premiums, followed by Silver, Gold, and then Platinum plans. Because of this cost structure, the PTC amount will be lower for Bronze plans and higher for Platinum plans, reflecting the higher premiums associated with the richer benefits.

Plan Coverage and PTC Amounts

The relationship between plan type and PTC amount is not linear. A person eligible for a $500 PTC might receive a smaller subsidy for a Bronze plan than they would for a Platinum plan, because the initial premium cost of a Bronze plan is significantly lower. This means the PTC reduces a smaller portion of the overall cost for a Bronze plan, leaving the consumer with a lower premium, but potentially higher out-of-pocket costs in the event of medical care. Conversely, the same PTC amount would offer a more substantial reduction in the higher premium cost of a Platinum plan, leading to a lower monthly payment. However, the higher premium of a Platinum plan reflects its richer benefits, meaning higher cost-sharing, such as deductibles and co-pays.

Out-of-Pocket Costs and Plan Selection

Choosing a plan with a higher PTC amount doesn’t automatically mean lower overall costs. While the PTC reduces your monthly premium, it’s vital to consider your out-of-pocket costs. For example, a Bronze plan might have a lower monthly premium after the PTC, but it also typically has a higher deductible and higher cost-sharing (copays and coinsurance). This means you might pay less each month but face significantly higher costs if you need medical care. A Platinum plan, while having the highest monthly premiums even after the PTC, generally has a lower deductible and lower cost-sharing, potentially resulting in lower overall healthcare costs if you require significant medical attention.

Let’s illustrate with an example: Imagine two individuals, both eligible for a $400 monthly PTC. One chooses a Bronze plan with a monthly premium of $200 before the PTC, resulting in a $0 monthly premium after the PTC. The other chooses a Platinum plan with a monthly premium of $800 before the PTC, resulting in a $400 monthly premium after the PTC. While the Bronze plan user pays nothing monthly, their deductible might be $7,000, meaning they’d need to pay that amount out-of-pocket before their insurance significantly covers expenses. The Platinum plan user pays $400 monthly, but their deductible might only be $1,000. If both individuals needed significant medical care, the Platinum plan user might ultimately have lower total healthcare costs despite the higher monthly premium after the PTC.

Key Differences in Plan Types and Associated PTC Amounts

Understanding the key differences between plan types is crucial for making informed decisions. The PTC amount received varies depending on the plan selected, but the PTC’s influence on the final premium differs even more dramatically.

- Bronze Plans: Lowest monthly premiums before PTC; highest out-of-pocket maximums; lowest PTC amount (as a percentage of premium); high cost-sharing.

- Silver Plans: Moderate monthly premiums before PTC; moderate out-of-pocket maximums; moderate PTC amount; moderate cost-sharing.

- Gold Plans: Higher monthly premiums before PTC; lower out-of-pocket maximums; higher PTC amount; lower cost-sharing.

- Platinum Plans: Highest monthly premiums before PTC; lowest out-of-pocket maximums; highest PTC amount; lowest cost-sharing.

Final Wrap-Up

Securing affordable healthcare is a fundamental step towards overall well-being, and the Premium Tax Credit plays a crucial role in making this a reality for many. By understanding the eligibility criteria, calculation methods, and the impact on various health insurance plans, individuals can effectively leverage the PTC to access quality healthcare without undue financial strain. This guide serves as a comprehensive resource, equipping readers with the knowledge and tools to navigate the process with confidence and secure the healthcare coverage they deserve.

Key Questions Answered

What happens if my income changes during the year?

Changes in income can affect your PTC. You may need to report the change to the Marketplace. They will adjust your subsidy accordingly, potentially leading to a change in your monthly payment amount.

Can I get the PTC if I’m self-employed?

Yes, self-employed individuals are eligible for the PTC as long as they meet the income and other eligibility requirements.

What if I don’t have a Social Security number?

Eligibility for the PTC generally requires a Social Security number (SSN) or an Individual Taxpayer Identification Number (ITIN). Check the specific requirements on the Healthcare.gov website for exceptions.

Is the PTC available in every state?

The PTC is available nationwide through the Health Insurance Marketplace. However, specific plan options and costs may vary by state.

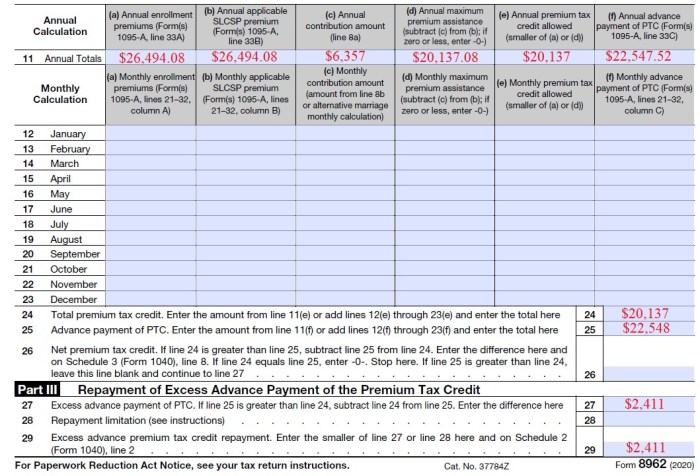

What if I overpay or underpay my estimated taxes for the PTC?

During tax season, you will reconcile the advance payments you received with your actual tax liability. Any overpayment will be refunded, while any underpayment will need to be paid.