Renters insurance is a crucial safety net, but what if your standard policy falls short? Premium renters insurance offers a higher level of protection, tailored to the needs of renters with valuable possessions or a desire for enhanced coverage. This comprehensive guide explores the key features, benefits, and considerations surrounding premium renters insurance, empowering you to make informed decisions about your financial security.

We’ll delve into the specifics of coverage amounts, liability limits, and additional options not typically found in standard plans. We’ll also analyze the cost-benefit analysis, comparing premium policies to standard ones, and guiding you through the process of choosing a provider and filing a claim. By the end, you’ll have a clear understanding of whether premium renters insurance is the right choice for you.

Defining Premium Renters Insurance

Renters insurance protects your belongings in case of damage or theft, but premium renters insurance offers enhanced coverage and higher limits compared to standard policies. It provides a more comprehensive safety net for your personal assets and liability. This added protection comes at a higher cost, but for those with valuable possessions or a higher risk tolerance, it can be a worthwhile investment.

Premium renters insurance distinguishes itself from standard policies through several key features. These features provide greater peace of mind and more robust financial protection in the event of unforeseen circumstances.

Key Features of Premium Renters Insurance

Premium renters insurance typically includes higher coverage limits for personal property, increased liability protection, and potentially additional coverage options not found in standard policies. For instance, it might offer coverage for higher-value items like jewelry or electronics, or include specific endorsements for things like water backup or identity theft. These additions significantly enhance the policy’s overall value and protection.

Coverage Amounts and Limits

Standard renters insurance policies often cap personal property coverage at $10,000 to $30,000, while liability coverage might be limited to $100,000. Premium policies, however, frequently offer significantly higher limits, potentially reaching $50,000 or more for personal property and $300,000 or more for liability. The exact amounts will vary depending on the insurer and the specific policy chosen. For example, a policyholder with extensive collections or high-value electronics would benefit from the elevated coverage limits offered by a premium plan.

Situations Benefiting from Premium Coverage

Premium renters insurance becomes particularly valuable in situations involving significant losses or high liability risks. For example, if a fire damages a renter’s apartment, a premium policy with higher personal property coverage could significantly reduce financial strain. Similarly, if a renter is held liable for a substantial injury to a guest, increased liability coverage could prevent devastating financial consequences. Consider a scenario where a renter hosts a party and a guest is injured due to negligence. A standard policy’s liability limit might be insufficient to cover legal fees and medical expenses, while a premium policy would offer greater protection.

Comparison with Other Insurance Types

Unlike homeowners insurance, which covers the structure of the dwelling itself, renters insurance focuses solely on the renter’s personal belongings and liability. Premium renters insurance, however, offers a level of protection comparable to some higher-tier homeowners insurance policies in terms of coverage amounts. Both types of insurance offer liability coverage, but homeowners insurance typically includes coverage for the building’s structure, while renters insurance does not. The choice between renters and homeowners insurance depends entirely on the individual’s housing situation and ownership status.

Cost and Value of Premium Renters Insurance

Understanding the cost and value of premium renters insurance is crucial for making an informed decision that protects your belongings and provides financial security. While a standard policy offers basic coverage, premium options provide enhanced protection and potentially significant long-term savings. This section will delve into the factors influencing premium costs, illustrate how premium features save money, and highlight the value proposition for various renter profiles.

Factors Influencing the Cost of Premium Renters Insurance

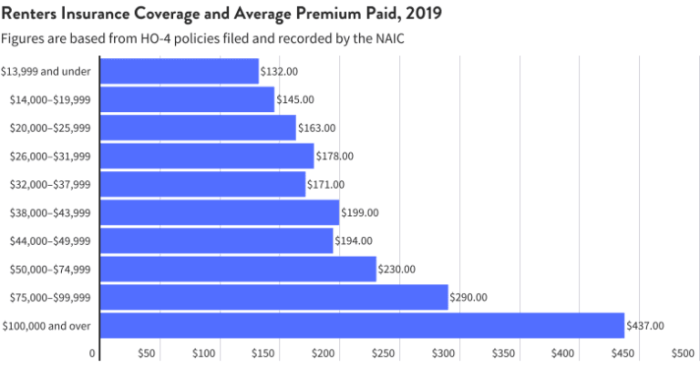

Several factors contribute to the overall cost of a premium renters insurance policy. These include the coverage amount selected (the higher the coverage, the higher the premium), the location of the rental property (areas with higher crime rates or a greater risk of natural disasters typically command higher premiums), the value of your personal belongings, and the specific features and add-ons chosen. For example, adding coverage for valuable items like jewelry or electronics will increase the premium, while choosing a higher deductible can lower it. Your credit history may also play a role in determining your premium.

Examples of Premium Features Saving Money in the Long Run

Premium renters insurance often includes features that can lead to substantial cost savings over time. For instance, higher liability coverage can protect you from significant financial losses in the event you are held responsible for someone else’s injuries or property damage. Without sufficient liability coverage, you could face crippling debt. Similarly, coverage for replacement cost value (RCV) rather than actual cash value (ACV) ensures you receive the full cost of replacing damaged or stolen items, rather than their depreciated value. This is particularly beneficial for newer possessions. Consider also the inclusion of identity theft protection; recovering from identity theft can be incredibly expensive, and this coverage can mitigate those costs.

Value Proposition of Premium Renters Insurance for Different Renter Profiles

The value of premium renters insurance varies depending on individual circumstances. For renters with high-value possessions, such as electronics, jewelry, or collectibles, a premium policy offering higher coverage limits and replacement cost value is essential. Young professionals starting their careers might benefit from the added liability protection, safeguarding against potential lawsuits. Renters in high-risk areas, prone to natural disasters or theft, will find the enhanced coverage offered by premium plans particularly valuable. Families with children may appreciate the added peace of mind from increased liability coverage and potentially included add-ons such as water backup coverage.

Comparison of Standard and Premium Renters Insurance Plans

The following table compares standard and premium renters insurance plans, highlighting the cost differences and benefits:

| Feature | Standard Plan | Premium Plan | Cost Difference (Example) |

|---|---|---|---|

| Liability Coverage | $100,000 | $300,000 | +$10/month |

| Personal Property Coverage | Actual Cash Value | Replacement Cost Value | +$5/month |

| Deductible | $500 | $1000 | -$5/month |

| Additional Coverage (e.g., Water Backup) | No | Yes | +$15/month |

Filing a Claim with Premium Renters Insurance

Filing a claim with your premium renters insurance is a straightforward process designed to help you recover from covered losses. Understanding the steps involved and the necessary documentation will ensure a smoother experience. Remember to always refer to your specific policy documents for detailed information relevant to your coverage.

Claim Filing Process

The process generally begins with reporting the incident to your insurance provider as soon as reasonably possible after it occurs. This allows them to start the investigation and assessment promptly. Following the initial report, you will be guided through the next steps, which may involve providing detailed information about the incident, the extent of the damage, and the value of any lost or damaged property. Throughout the process, clear communication with your insurer is key to a successful claim resolution.

Required Documentation for Claim Support

Supporting your claim with comprehensive documentation is crucial for a timely and efficient resolution. This typically includes a detailed description of the incident, including date, time, and location. Photographs and videos of the damage are invaluable, as are any police reports if applicable (especially in cases of theft or vandalism). Receipts or proof of purchase for damaged or stolen items are also essential for verifying value and ownership. Finally, a completed claim form, provided by your insurance company, is usually a necessary component of the process.

Claim Resolution Steps and Timelines

Once you’ve submitted your claim and supporting documentation, your insurance company will begin its investigation. This may involve reviewing your policy, assessing the damage, and potentially contacting witnesses or other relevant parties. The timeline for claim resolution can vary significantly depending on the complexity of the claim and the availability of information. Simple claims may be resolved within a few weeks, while more complex claims involving significant damage or disputes may take several months. Regular communication with your adjuster will keep you updated on the progress of your claim.

Step-by-Step Claim Filing Guide

- Report the incident to your insurance company immediately. Note down the claim number assigned.

- Gather all necessary documentation: photos/videos of damage, police reports (if applicable), receipts for damaged items, and a completed claim form.

- Submit your claim and supporting documentation to your insurer via their preferred method (online portal, mail, or fax).

- Cooperate fully with your insurance adjuster’s investigation. This may include providing additional information or allowing access to your property.

- Review the adjuster’s assessment and negotiate a settlement if necessary. Be prepared to provide further documentation if requested.

- Once the claim is approved, you will receive payment according to your policy terms. This might be a direct deposit or check, depending on your insurer’s procedures.

Closure

Securing adequate renters insurance is a fundamental aspect of responsible renting. While standard policies provide basic protection, premium renters insurance offers a significant upgrade for those with higher-value belongings or a greater need for liability coverage. By carefully weighing the cost and benefits, understanding the nuances of coverage options, and selecting a reputable provider, you can confidently safeguard your assets and peace of mind. Remember, the investment in premium protection can be invaluable in mitigating the financial repercussions of unforeseen events.

FAQ

What is the difference between actual cash value and replacement cost coverage?

Actual cash value (ACV) covers the replacement cost minus depreciation. Replacement cost covers the full cost of replacing the item, regardless of its age.

Can I add coverage for specific high-value items, like jewelry or electronics?

Yes, many premium renters insurance policies allow you to schedule specific high-value items for additional coverage beyond the standard limits.

What happens if I have a dispute with my insurance company regarding a claim?

Most policies Artikel a process for resolving disputes, often involving internal review or mediation. You may also have the option to pursue legal action.

Does premium renters insurance cover damage caused by my negligence?

Liability coverage in premium plans helps protect you against financial responsibility for accidents or injuries you cause to others, even if unintentional. However, intentional acts are typically excluded.