Navigating the complexities of healthcare can feel daunting, but understanding your options is key to securing peace of mind. Premium medical insurance offers a higher level of coverage and access to care than standard plans, promising significant advantages in times of illness or injury. This guide delves into the features, costs, and processes associated with premium medical insurance, empowering you to make informed decisions about your healthcare future.

From understanding the nuances of coverage inclusions and provider networks to navigating claims procedures and comparing premium plans against alternatives, we aim to provide a clear and concise overview. We’ll explore how premium insurance can mitigate financial burdens associated with serious medical conditions, comparing its value proposition to other health insurance options available in the market. This comprehensive exploration will equip you with the knowledge needed to choose the best healthcare plan for your individual needs.

Defining Premium Medical Insurance

Premium medical insurance represents a higher tier of health coverage compared to standard plans. It offers broader access to healthcare services, enhanced benefits, and often a more streamlined experience for policyholders. The key differentiators lie in the extent of coverage, the quality of care provided, and the overall convenience offered.

Premium medical insurance plans are designed to provide comprehensive medical care with minimal out-of-pocket expenses for the insured. This typically involves a higher premium payment compared to standard plans, but this cost is often offset by significantly reduced expenses when needing medical attention. The enhanced features aim to provide peace of mind and access to specialized care that may not be available or easily accessible under a standard plan.

Key Features Differentiating Premium Medical Insurance

Premium plans distinguish themselves through several key features. These include broader network access, lower out-of-pocket maximums, access to concierge services, and potentially faster access to specialized care. The higher premium reflects the investment in these enhanced features. This results in a more comprehensive and potentially less stressful healthcare experience for the policyholder.

Typical Coverage Inclusions of a Premium Policy

Premium medical insurance policies typically cover a wide range of medical services. This usually includes hospitalization, surgery, physician visits, diagnostic tests, prescription drugs, and often mental health services. Many premium plans also offer coverage for preventative care, wellness programs, and rehabilitation services. The specific inclusions can vary between providers and policy types, but the overarching aim is to provide extensive medical coverage.

Examples of Specific Benefits in Premium Plans

The following table illustrates some benefits frequently found in premium medical insurance plans, along with their cost implications and examples.

| Benefit | Description | Cost Implications | Example |

|---|---|---|---|

| Concierge Medical Services | Personalized healthcare management with dedicated physician access. | Higher premium cost, but potentially lower overall healthcare expenses due to proactive care. | 24/7 access to a personal physician for advice and appointments, regular health checkups with personalized plans. |

| Global Medical Evacuation | Coverage for emergency medical transportation from anywhere in the world. | Significant increase in premium cost, but crucial for international travelers or expatriates. | Air ambulance transport from a remote location in South America to a specialized hospital in the US. |

| Executive Health Exams | Comprehensive physicals with advanced diagnostic testing, often including genetic testing. | Increased premium, but early detection of health issues can prevent costly treatments later. | Annual comprehensive check-up with detailed blood work, advanced imaging, and consultations with specialists. |

| Dental and Vision Coverage | Extensive coverage for dental and vision care, including preventative and restorative treatments. | Moderately higher premium, but reduces out-of-pocket costs for routine dental and vision needs. | Coverage for routine cleanings, fillings, and eye exams; discounts on corrective lenses and procedures. |

Cost and Value of Premium Medical Insurance

Premium medical insurance offers comprehensive coverage, but the cost can be a significant factor in deciding whether it’s the right choice for you. Understanding the factors that influence the price and weighing the potential long-term financial benefits is crucial for making an informed decision. This section will explore the cost implications of premium medical insurance and the value it provides in return.

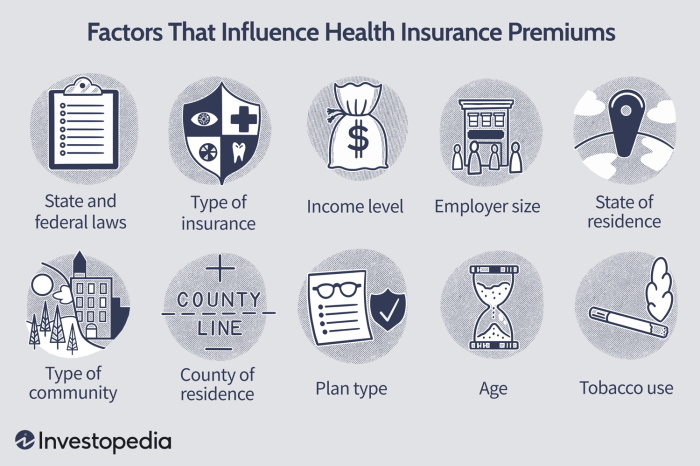

Factors Influencing Premium Costs

Several factors contribute to the overall cost of premium medical insurance. These include the individual’s age, location, chosen plan type (e.g., HMO, PPO), the level of coverage desired (deductible, copay, out-of-pocket maximum), pre-existing conditions, and the insurer’s administrative costs and profit margins. Geographic location plays a significant role, as healthcare costs vary considerably across regions. A plan in a high-cost area like New York City will naturally be more expensive than a comparable plan in a rural area. Pre-existing conditions can also lead to higher premiums, as the insurer anticipates higher healthcare expenses.

Comparison of Premium Costs Across Plans

Premium costs vary considerably depending on the level of coverage. A plan with a low deductible and a low out-of-pocket maximum will typically have a higher monthly premium compared to a plan with a high deductible and a high out-of-pocket maximum. For instance, a “platinum” plan, offering the most comprehensive coverage, might cost significantly more than a “bronze” plan, which has a higher deductible and out-of-pocket maximum. The trade-off is that the platinum plan would likely result in lower out-of-pocket expenses in the event of a serious illness or injury. Choosing the right plan often involves balancing the monthly premium cost with the potential for higher out-of-pocket expenses if a major health event occurs.

Long-Term Financial Benefits of Premium Coverage

While premium plans carry higher monthly costs, they offer substantial long-term financial protection. The peace of mind that comes with comprehensive coverage can be invaluable. In the event of a serious illness or accident, the high costs of hospitalization, surgery, and ongoing treatment can be devastating financially. A premium plan can significantly mitigate these costs, preventing potentially crippling medical debt. For example, a serious illness like cancer can easily lead to hundreds of thousands of dollars in medical expenses. With premium coverage, a large portion of these costs would be covered by the insurance, protecting the individual’s savings and financial stability. Furthermore, preventive care services often included in premium plans can help detect and treat conditions early, potentially reducing the need for expensive treatments later.

Premium Plan Comparison Table

The following table illustrates the differences in premium costs, deductibles, and out-of-pocket maximums for hypothetical premium plans:

| Plan Type | Monthly Premium | Deductible | Out-of-Pocket Maximum |

|---|---|---|---|

| Bronze | $300 | ||

| Silver | $500 | ||

| Gold | $700 | ||

| Platinum | $900 |

Concluding Remarks

Securing premium medical insurance represents a proactive investment in your health and financial well-being. While the cost may be higher than standard plans, the comprehensive coverage, enhanced access to care, and potential for significant cost savings in the long run make it a compelling option for many. By carefully considering your individual needs, comparing different plans, and understanding the enrollment process, you can confidently navigate the path to securing superior healthcare protection. Ultimately, the choice is yours, but armed with this knowledge, you are better equipped to make a decision that prioritizes your health and financial security.

FAQ Explained

What are the common exclusions in premium medical insurance plans?

While premium plans offer extensive coverage, certain services or treatments might be excluded. These can include experimental procedures, cosmetic surgery (unless medically necessary), and pre-existing conditions (depending on the policy). It’s crucial to review the policy document carefully to understand specific exclusions.

How does premium medical insurance handle pre-existing conditions?

Handling of pre-existing conditions varies between insurers and plans. Some premium plans may offer more comprehensive coverage for pre-existing conditions than standard plans, but limitations or waiting periods might still apply. It is vital to check the specific policy details regarding pre-existing conditions coverage.

Can I change my premium medical insurance plan during the year?

Typically, you can only change your premium medical insurance plan during the annual open enrollment period, unless you experience a qualifying life event (e.g., marriage, job loss) that allows for a special enrollment period. Check with your insurer for details on plan changes.

What happens if I need care outside my plan’s network?

Using out-of-network providers will typically result in higher out-of-pocket costs. While some coverage might still apply, it’s generally less comprehensive than in-network care. Always confirm coverage with your insurer before seeking care from an out-of-network provider.