Premium car insurance offers a level of protection and service beyond standard policies, catering to discerning drivers who value comprehensive coverage and added convenience. This exploration delves into the intricacies of premium car insurance, examining its defining characteristics, cost factors, extensive benefits, and the process of selecting the right policy for your needs. We’ll unpack the nuances of coverage, explore supplementary services, and highlight the financial advantages of this elevated insurance approach.

From understanding the target customer profile to navigating the complexities of claim processes, this guide provides a comprehensive overview, empowering you to make informed decisions about your automotive insurance needs. We will also compare premium car insurance to other high-value insurance options, further clarifying its unique position in the market.

Defining “Premium Car Insurance”

Premium car insurance represents a higher tier of coverage compared to standard policies, offering enhanced protection and benefits tailored to drivers with specific needs and valuable vehicles. It’s designed to provide peace of mind for those who want comprehensive coverage and superior service.

Premium car insurance differs from standard policies primarily in the extent of coverage, the level of service provided, and the types of claims handled. While standard policies offer basic protection against liability and damage, premium options go beyond this baseline, encompassing a wider range of risks and offering more generous limits.

Features of Premium Car Insurance Packages

Premium car insurance packages typically include several key features not found in standard policies. These features are designed to address the unique concerns of high-net-worth individuals and those owning luxury or high-value vehicles. The inclusion of these features justifies the higher premiums charged.

- Higher Coverage Limits: Premium policies often provide significantly higher liability and collision coverage limits, offering greater financial protection in the event of an accident.

- Concierge Services: Many premium packages include access to 24/7 concierge services, providing assistance with roadside emergencies, vehicle transportation, and even travel arrangements.

- Guaranteed Replacement Cost: This feature ensures that your vehicle will be replaced with a comparable model, regardless of depreciation, if it’s totaled in an accident.

- New Car Replacement: Some premium policies offer to replace a new car with a new car, even if it’s totaled within a specific timeframe, usually a year or two.

- Loaner Car Coverage: Premium insurance often includes coverage for a loaner car while your vehicle is being repaired after an accident.

- Specialized Claims Handling: Dedicated claims adjusters with expertise in handling high-value vehicles are often assigned to premium policyholders, ensuring efficient and personalized claim processing.

Target Customer Profile for Premium Car Insurance

Premium car insurance is typically targeted toward high-net-worth individuals, those owning luxury or classic cars, and people who value exceptional service and comprehensive protection. This customer profile prioritizes financial security and convenience, willing to pay a higher premium for the enhanced benefits and personalized service offered. The customer often has a significant investment in their vehicle and wants to safeguard that investment.

Comparison with Other High-Value Insurance Products

While premium car insurance shares similarities with other high-value insurance products like homeowners insurance for luxury properties or high-value jewelry insurance, it has a unique focus on automotive risks. Homeowners insurance, for example, protects the structure and contents of a home, while jewelry insurance focuses specifically on valuable jewelry. Premium car insurance, in contrast, centers on the risks associated with owning and operating a high-value vehicle. The coverage and services offered are tailored specifically to the automotive context. However, all these products share the commonality of providing enhanced protection and service to individuals with significant assets.

Cost and Coverage of Premium Car Insurance

Premium car insurance offers extensive protection, but this enhanced security comes at a higher price than standard policies. Understanding the factors influencing cost and the comprehensive coverage provided is crucial for making an informed decision. This section details the cost drivers, coverage levels, typical claims, and the financial advantages of premium insurance.

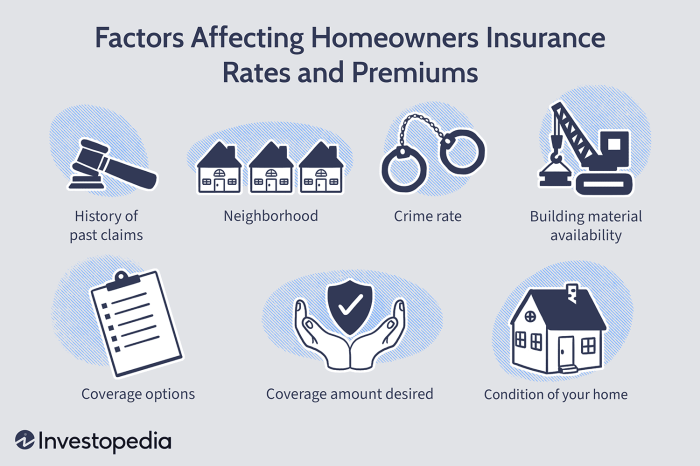

Factors Influencing Premium Car Insurance Cost

Several factors significantly impact the cost of premium car insurance. These factors are often assessed individually and cumulatively to determine the final premium. The insurer’s risk assessment process considers a range of variables to calculate the likelihood of a claim.

| Factor | Impact on Cost | Example |

|---|---|---|

| Vehicle Type and Value | Higher value vehicles, luxury cars, and sports cars generally attract higher premiums due to increased repair costs and potential theft risk. | A high-performance sports car will cost more to insure than a compact sedan. |

| Driver’s Profile | Age, driving history (accidents, violations), and credit score significantly influence premiums. Younger drivers with less experience typically pay more. | A driver with multiple speeding tickets will face higher premiums than a driver with a clean record. |

| Location | Areas with higher rates of theft or accidents usually result in higher insurance premiums. | Urban areas with high crime rates may have higher premiums than rural areas. |

| Coverage Level | Choosing higher coverage limits (e.g., higher liability limits, comprehensive and collision coverage with lower deductibles) leads to higher premiums. | A policy with $500,000 liability coverage will be more expensive than one with $100,000. |

Premium Car Insurance Coverage Tiers

Premium car insurance often offers tiered coverage options, providing varying levels of protection. The table below illustrates a typical comparison of coverage levels across different tiers. Note that specific coverage details can vary between insurance providers.

| Coverage Tier | Liability Coverage | Collision Coverage | Comprehensive Coverage |

|---|---|---|---|

| Basic Premium | $250,000 | $500 deductible | $500 deductible |

| Standard Premium | $500,000 | $250 deductible | $250 deductible |

| High-Limit Premium | $1,000,000 | $0 deductible | $0 deductible |

Claims Covered Under Premium Car Insurance

Premium car insurance typically covers a wide range of claims, exceeding the scope of standard policies. This includes claims related to accidents, theft, vandalism, and natural disasters. Specific coverage can vary depending on the policy and chosen add-ons.

Financial Benefits of Premium Car Insurance

Choosing premium car insurance offers several key financial advantages. The higher premiums provide greater financial protection against significant losses, potentially saving you substantial amounts of money in the event of a major accident or other covered incident. For example, a high-limit liability policy can protect your assets in the event of a lawsuit stemming from an accident you caused. Comprehensive coverage can safeguard your vehicle’s value from unexpected events like theft or hail damage. Lower deductibles can minimize out-of-pocket expenses after a claim. In essence, the higher cost of premium insurance can be offset by the enhanced financial security it offers.

Illustrative Examples

Premium car insurance, while carrying a higher price tag, offers significant advantages in specific situations. The following examples illustrate the value proposition of such comprehensive coverage.

Scenario: High-Value Vehicle Damage in a Multi-Vehicle Accident

Imagine a scenario involving a high-net-worth individual, Ms. Eleanor Vance, driving her classic 1967 Jaguar E-Type. During a heavy rainstorm, a multi-vehicle accident occurs, resulting in substantial damage to Ms. Vance’s Jaguar. Two other vehicles are also involved, with varying degrees of damage. The accident is determined to be the fault of another driver, but the extent of the damage to Ms. Vance’s vehicle is significant, requiring extensive bodywork, specialized parts, and meticulous restoration by a certified Jaguar specialist. The cost of repair exceeds $50,000. With premium car insurance, Ms. Vance’s policy covers the full cost of repairs, including the sourcing of rare parts, without any significant out-of-pocket expense. The claims process is streamlined and efficient, with a dedicated claims adjuster assigned to her case who handles all communications and facilitates the repair process. Contrast this with a standard policy, where she might face significant deductibles, lengthy delays in repair, and potential disputes over the cost of repairs. The premium insurance ensured a swift and hassle-free resolution, allowing Ms. Vance to enjoy her restored vehicle without financial strain or protracted administrative burden.

Premium Car Insurance Advertisement Visuals

A premium car insurance advertisement targeting high-net-worth individuals would feature sophisticated visuals. The imagery would likely showcase sleek, high-performance vehicles in luxurious settings, such as a private estate or a scenic coastal drive. The color palette would be muted and elegant, perhaps employing deep blues, rich greens, and subtle gold accents. The vehicles depicted would be subtly integrated into the background, avoiding overt product placement. Instead, the focus would be on conveying a sense of security, peace of mind, and exclusivity. The messaging would emphasize the personalized service, the comprehensive coverage, and the peace of mind that comes with knowing that their valuable asset is protected. The overall tone would be refined and sophisticated, avoiding flashy or aggressive marketing tactics. The typography would be clean and modern, using a high-quality font that conveys elegance and professionalism.

Customer Testimonial: Exceptional Service and Peace of Mind

“As a successful entrepreneur, my time is incredibly valuable. When I was involved in a minor accident, I was relieved to have the support of [Premium Insurance Provider Name]. Their dedicated claims adjuster handled everything with professionalism and efficiency, ensuring my vehicle was repaired quickly and to the highest standards. The entire process was seamless and stress-free, allowing me to focus on my business without worrying about the inconvenience of a car accident. I highly recommend [Premium Insurance Provider Name] to anyone who values their time and wants the peace of mind that comes with truly exceptional car insurance.” – Mr. Arthur Blackwood, CEO, Blackwood Enterprises.

Epilogue

Ultimately, the decision to opt for premium car insurance hinges on individual needs and risk tolerance. By carefully weighing the enhanced coverage, supplementary services, and potential financial benefits against the associated costs, drivers can determine whether premium car insurance aligns with their priorities. This detailed examination should equip you with the knowledge to confidently choose a policy that provides optimal protection and peace of mind.

FAQ Resource

What types of vehicles typically qualify for premium car insurance?

Premium car insurance often caters to high-value vehicles, including luxury cars, classic cars, and other vehicles with significant market value.

Are there age restrictions for premium car insurance?

While not always explicitly stated, some providers may have age requirements or adjust premiums based on driver experience.

Can I customize my premium car insurance policy?

Many premium car insurance providers offer customizable options to tailor coverage to specific needs and vehicle characteristics.

What happens if I need to make a claim outside of my country of residence?

Premium policies often include international coverage, but the specifics vary depending on the provider and policy details. It’s crucial to review your policy documents.