Navigating the world of health insurance can feel like deciphering a complex code, especially when it comes to understanding premiums. This seemingly simple term holds significant weight, directly impacting your access to healthcare and your financial well-being. Understanding what constitutes a health insurance premium, the factors influencing its cost, and the various payment options available is crucial for making informed decisions about your coverage.

This guide provides a clear and concise explanation of health insurance premiums, breaking down their components, exploring the various factors that determine their cost, and outlining different payment methods. We’ll also delve into the different types of premiums available, how they vary across plans, and what you can expect regarding potential increases. By the end, you’ll possess a comprehensive understanding of this critical aspect of health insurance.

Defining “Premium” in Health Insurance

A health insurance premium is the recurring payment you make to your insurance provider in exchange for coverage under your chosen health plan. Think of it as the price you pay for the peace of mind knowing you have financial protection against unexpected medical expenses. Understanding your premium is crucial for managing your healthcare budget effectively.

Premium Components

Several factors contribute to the overall cost of your health insurance premium. These components work together to determine the final price you pay. A typical premium includes administrative costs incurred by the insurance company, the cost of claims paid out to policyholders, and the company’s profit margin. The proportion of each component varies depending on the insurance company and the specific plan. For example, a plan with a high level of coverage will naturally have a higher premium due to the increased likelihood of larger claims.

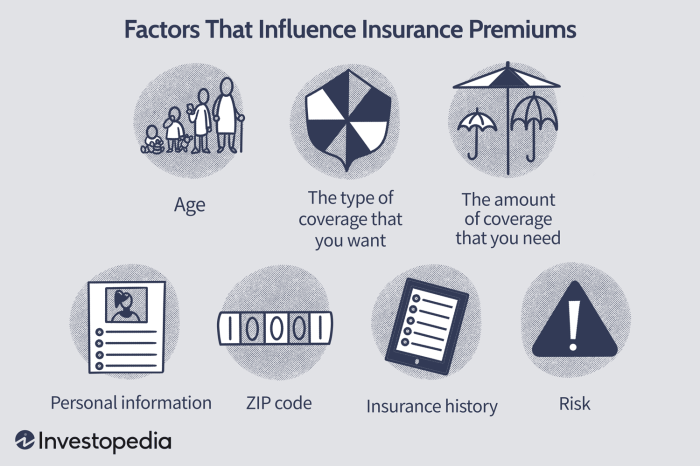

Factors Influencing Premium Costs

Numerous variables influence the calculation of your health insurance premium. Your age, location, chosen plan type (e.g., HMO, PPO), the level of coverage selected (deductibles, co-pays, out-of-pocket maximums), and your health status all play a significant role. For instance, someone living in an area with high healthcare costs will typically pay a higher premium than someone in an area with lower costs. Similarly, individuals with pre-existing conditions might face higher premiums. The insurance company assesses the risk associated with insuring you, and this risk directly impacts your premium.

Premium Calculation

The calculation of health insurance premiums is a complex process involving actuarial science. Insurance companies use sophisticated statistical models to predict the likelihood and cost of claims for a given population. They consider various factors, including the demographic characteristics of the insured population, the prevalence of certain diseases in the area, and historical claim data. The calculation aims to balance the expected cost of claims with the premiums collected, ensuring the insurer’s financial stability while providing affordable coverage to policyholders. This is a continuous process, with adjustments made periodically to reflect changes in healthcare costs and risk profiles.

Comparison of Premium Structures Across Different Health Insurance Plans

The following table provides a simplified comparison of premium structures for different health insurance plans. Note that these are average costs and can vary significantly depending on location, age, and other factors.

| Plan Type | Coverage Level | Average Premium Cost (Monthly) | Deductible |

|---|---|---|---|

| HMO | High | $500 | $1000 |

| PPO | High | $650 | $5000 |

| HMO | Low | $300 | $5000 |

| EPO | Medium | $400 | $2500 |

Types of Health Insurance Premiums

Health insurance premiums, the recurring payments made to maintain coverage, vary significantly depending on several factors. Understanding these variations is crucial for making informed decisions about your health insurance plan. This section explores the different types of premiums and the factors influencing their cost.

Individual vs. Family Health Insurance Premiums

Individual health insurance premiums cover only the policyholder, while family plans extend coverage to a spouse and dependent children. Family plans typically cost more than individual plans, reflecting the increased risk and potential healthcare expenses for a larger group. The exact cost difference depends on the number of dependents and the insurer’s pricing structure. For instance, a family plan covering two adults and two children will generally be substantially more expensive than a single individual plan.

Group Health Insurance Premiums

Group health insurance premiums are offered through employers or other organizations to their members. These premiums are often lower than individual plans due to economies of scale and risk pooling. The employer usually contributes a portion of the premium, further reducing the cost to the employee. The premium structure for group plans is typically determined by the employer’s negotiation with the insurance provider and may include various options and contribution levels for employees.

Premium Variations Based on Age, Location, and Health Status

Premium costs are significantly influenced by factors like age, location, and health status. Older individuals generally pay higher premiums due to a statistically higher likelihood of needing medical care. Geographic location also plays a role, with premiums tending to be higher in areas with a higher cost of living or a greater concentration of specialized medical facilities. Pre-existing health conditions can also lead to higher premiums, as insurers assess the increased risk of future claims. For example, someone with a history of heart disease might pay a higher premium than a healthy individual of the same age and location.

Impact of Deductibles, Co-pays, and Out-of-Pocket Maximums on Premiums

The relationship between premiums and cost-sharing mechanisms like deductibles, co-pays, and out-of-pocket maximums is inverse. Plans with higher deductibles and co-pays usually have lower premiums. This is because the insured assumes a greater portion of the healthcare costs upfront. Conversely, plans with lower deductibles and co-pays, offering greater coverage, generally come with higher premiums. The out-of-pocket maximum acts as a cap on the total amount the insured will pay annually, regardless of the number of claims. While a higher out-of-pocket maximum may lead to a lower premium, it also increases the potential financial risk for the insured.

Key Differences Between Individual and Family Health Insurance Premiums

The following points highlight the key differences:

- Coverage: Individual plans cover only one person; family plans cover the policyholder and their dependents.

- Cost: Family plans are significantly more expensive than individual plans due to increased risk and coverage.

- Eligibility for Dependents: Family plans require meeting specific criteria for dependents, such as age and relationship to the policyholder.

- Premium Payment: Premium payments are made by the individual for individual plans and can be shared or subsidized by employers for family plans.

Understanding Premium Increases

Health insurance premiums, the monthly payments you make for coverage, are not static. Several factors contribute to their fluctuations, often resulting in increases over time. Understanding these factors is crucial for consumers to make informed decisions about their healthcare choices.

Healthcare costs are the primary driver of premium increases. The rising costs of medical services, prescription drugs, and hospital stays directly impact the amount insurance companies must pay out in claims. When claims costs increase, insurers must adjust premiums to maintain their financial solvency and ability to provide coverage.

Healthcare Cost Inflation’s Impact on Premiums

The increasing cost of healthcare services, including doctor visits, hospital stays, and prescription drugs, significantly impacts premium adjustments. For example, a 5% increase in the average cost of a hospital stay could necessitate a corresponding increase in premiums to cover the added expense for the insurance company. This effect is compounded by the aging population and advancements in medical technology, which often lead to more expensive treatments. A specific example could be the rising costs of cancer treatments; the development of new, highly effective but expensive therapies necessitates higher premiums to ensure that insurance plans can cover these treatments for their members.

The Role of Government Regulations in Premium Adjustments

Government regulations, such as the Affordable Care Act (ACA) in the United States, play a significant role in shaping health insurance premiums. These regulations often mandate coverage for specific services, such as preventative care or pre-existing conditions, which can increase the overall cost of providing insurance. Furthermore, regulations aimed at controlling costs, such as those that limit price increases for certain drugs, can have both positive and negative impacts on premiums, depending on their effectiveness and implementation. For instance, regulations requiring transparency in drug pricing could potentially lead to negotiations that lower costs and therefore, premiums. Conversely, regulations that restrict insurers’ ability to manage costs might lead to higher premiums.

The Process of Determining Premium Adjustments

Insurance companies employ sophisticated actuarial models to determine premium adjustments. These models consider various factors, including claims history, projected healthcare costs, the demographics of the insured population, and government regulations. Actuaries analyze historical claims data to predict future costs and then use this data, along with other factors, to calculate the necessary premium increase to ensure the plan remains financially viable. This process is complex and involves statistical analysis, forecasting, and risk assessment. It is important to note that these models are not perfect and can be affected by unforeseen circumstances, such as unexpected pandemics or natural disasters that significantly increase claims costs.

The Impact of Inflation on Health Insurance Premiums

General inflation, the overall increase in the price of goods and services in an economy, also contributes to premium increases. As the cost of everything from hospital supplies to administrative staff salaries rises due to inflation, the overall cost of providing healthcare increases, leading to higher premiums. For example, if the overall inflation rate is 3%, this could translate to a similar percentage increase in administrative and operational costs for insurance companies, necessitating a premium adjustment to offset these increased expenses. The effect of inflation is often seen in conjunction with other factors, such as increased healthcare utilization and the introduction of new, expensive technologies.

Outcome Summary

In conclusion, understanding your health insurance premium is paramount to effective healthcare planning. From the initial calculation considering factors like age, location, and health status, to the various payment options and potential for increases, a clear grasp of premiums empowers you to choose the plan that best suits your needs and budget. By carefully considering all the elements discussed – plan type, coverage level, payment methods, and potential influences – you can confidently navigate the complexities of health insurance and secure the coverage you deserve.

User Queries

What happens if I miss a premium payment?

Missing a premium payment can lead to a lapse in coverage, meaning you’ll be responsible for all medical expenses until your payment is made and coverage is reinstated. Late payment fees may also apply.

Can I change my payment frequency?

Most insurers allow you to adjust your payment frequency (monthly, quarterly, annually). Contact your insurance provider to explore available options and any potential associated fees.

How often do premiums typically increase?

Premium increases are usually annual, but the specific timing and amount vary depending on the insurer and several market factors.

What is the difference between a deductible and a premium?

A premium is the regular payment you make to maintain your health insurance coverage. A deductible is the amount you pay out-of-pocket for covered healthcare services before your insurance begins to pay.

Are there tax benefits associated with health insurance premiums?

Depending on your country and specific circumstances (e.g., employer-sponsored plans), you may be eligible for tax deductions or credits related to your health insurance premiums. Consult a tax professional for personalized advice.