Homeownership is a significant investment, and protecting that investment is paramount. While standard house insurance provides basic coverage, premium house insurance offers a significantly enhanced level of protection, tailored to the needs of homeowners seeking comprehensive security and peace of mind. This exploration delves into the key differences between standard and premium policies, highlighting the benefits and value proposition of opting for a more robust insurance plan.

We will examine the expanded coverage options, higher liability limits, and superior claims handling often associated with premium house insurance. By understanding the nuances of these policies, homeowners can make informed decisions to safeguard their most valuable asset – their home.

Defining Premium House Insurance

Premium house insurance offers a higher level of protection and coverage compared to standard policies. It’s designed for homeowners with valuable possessions, unique property features, or a higher risk tolerance who require more comprehensive safeguards. This type of insurance goes beyond basic coverage, providing enhanced benefits and peace of mind.

Premium house insurance distinguishes itself through several key features. These features often cater to a more affluent clientele or those with properties requiring specialized protection.

Key Features of Premium House Insurance

Premium house insurance typically includes higher coverage limits for building and contents, often exceeding the amounts available in standard policies. It frequently incorporates broader coverage for specific perils, such as flooding, earthquakes, or acts of terrorism, which might be excluded or have limited coverage in standard plans. Additionally, premium policies often include enhanced services such as 24/7 emergency assistance, higher coverage for valuable items (jewelry, artwork), and expedited claims processing. Another significant difference is the inclusion of alternative accommodation coverage, offering more extensive temporary living expenses in the event of a covered loss.

Target Audience for Premium House Insurance

The target audience for premium house insurance is diverse but generally consists of individuals and families owning high-value properties, including those with unique architectural features or significant landscaping. Homeowners with substantial collections of valuable artwork, antiques, jewelry, or other high-value possessions also benefit from the increased coverage limits and specialized protection offered by premium policies. Furthermore, those living in high-risk areas prone to natural disasters might find the broader coverage options more appealing. Finally, individuals seeking a more personalized and attentive insurance experience, with access to dedicated claims adjusters and 24/7 support, often opt for premium plans.

Premium vs. Standard House Insurance Coverage

The table below illustrates the key differences between premium and standard house insurance policies.

| Feature | Premium Coverage | Standard Coverage | Key Differences |

|---|---|---|---|

| Building Coverage | Higher coverage limits; may include specific upgrades and features | Lower coverage limits; may exclude certain upgrades | Significant difference in coverage amounts and inclusion of specific features |

| Contents Coverage | Higher limits; may include specialized coverage for valuable items (e.g., jewelry, art) | Lower limits; limited or no coverage for high-value items | Greater protection for valuable possessions and higher coverage limits |

| Peril Coverage | Broader coverage, including potentially flooding, earthquakes, and terrorism | Limited or no coverage for certain perils | Inclusion of more catastrophic events and broader protection against risks |

| Additional Services | 24/7 emergency assistance, expedited claims processing, dedicated claims adjuster | Basic claims processing; limited or no emergency assistance | Enhanced customer service and faster response times during claims |

| Liability Coverage | Higher liability limits | Lower liability limits | Increased protection against legal liabilities |

Coverage Aspects of Premium House Insurance

Premium house insurance offers a significantly enhanced level of protection compared to standard policies. This heightened security stems from broader coverage, higher liability limits, and inclusion of perils typically excluded in basic plans. Understanding these differences is crucial for homeowners seeking comprehensive protection for their most valuable asset.

Extended Coverage Options

Premium house insurance often includes several extended coverage options not found in standard policies. These additions provide peace of mind against a wider range of potential losses. For example, many premium plans incorporate coverage for things like water backup from sewers and drains, which is frequently excluded from standard policies. They may also offer increased coverage for valuable items like jewelry or artwork, often with higher limits than standard plans. Furthermore, some premium policies include coverage for specific situations such as identity theft or legal expenses related to property disputes. These additional layers of protection can prove invaluable in the event of unforeseen circumstances.

Perils Covered Under Premium Policies

Premium house insurance policies typically cover a broader spectrum of perils than standard plans. While standard policies usually cover basic events like fire and theft, premium policies often extend coverage to encompass events like earthquakes, floods, and even acts of terrorism, depending on the specific policy and location. These are typically considered high-risk events and are excluded from most standard home insurance policies due to their unpredictable nature and potential for widespread damage. For instance, a homeowner in an earthquake-prone region would find significant value in a premium policy that includes earthquake coverage. Similarly, coastal homeowners would benefit from flood coverage, which is rarely included in standard plans.

Liability Limits Comparison

A key differentiator between premium and standard house insurance lies in the liability limits. Standard policies usually offer lower liability limits, meaning the insurer’s maximum payout for third-party claims is capped at a lower amount. Premium policies, however, typically offer substantially higher liability limits. This is particularly crucial if a homeowner is found liable for significant property damage or personal injury to a third party. For example, a standard policy might cap liability at $300,000, while a premium policy could offer $1,000,000 or even more. This increased coverage can prevent catastrophic financial consequences for the homeowner.

Scenarios Illustrating Superior Protection

Consider a scenario where a homeowner’s property is severely damaged by a major storm event including flooding and wind damage. A standard policy might only cover the damage from the wind, excluding the flood damage, potentially leaving the homeowner with substantial uninsured costs for repairs. A premium policy, however, would likely cover both the wind and flood damage, providing significantly more comprehensive protection. Similarly, imagine a situation where a homeowner’s dog bites a visitor, causing serious injuries. The medical expenses and potential legal costs could quickly exceed the liability limit of a standard policy. A premium policy with higher liability coverage would offer much greater financial security in such a scenario, protecting the homeowner from potentially devastating financial losses.

Cost and Value Proposition

Understanding the cost of premium house insurance and its associated value is crucial for homeowners making informed decisions about their protection. Several factors influence the price, while the benefits extend beyond simple financial compensation.

Premium house insurance offers a comprehensive level of protection, exceeding the scope of standard policies. This enhanced coverage translates to greater peace of mind and potentially significant financial savings in the event of a major incident. However, this increased protection comes at a higher premium.

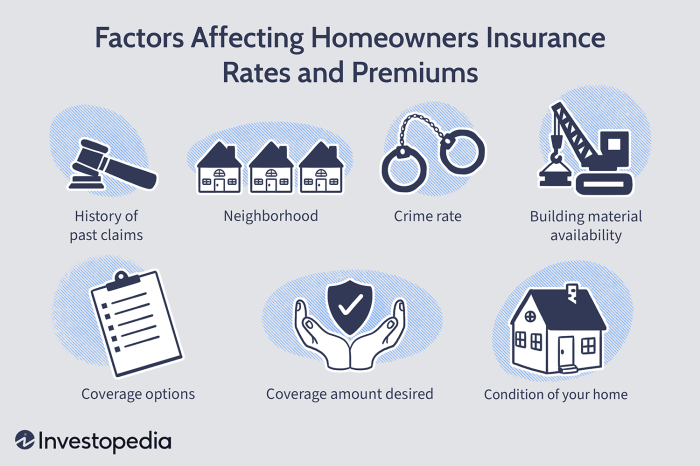

Factors Influencing the Cost of Premium House Insurance

The cost of premium house insurance is determined by a variety of factors, each contributing to the overall premium. These factors are assessed individually and cumulatively to create a personalized quote. Key considerations include the location of the property, its age and construction, the level of coverage desired, the homeowner’s claims history, and the presence of security features. Higher-risk properties, those located in areas prone to natural disasters or with a higher incidence of crime, will generally command higher premiums. Similarly, older homes requiring more extensive repairs may also result in increased costs. The extent of coverage selected directly impacts the premium; more comprehensive coverage will invariably cost more. A homeowner’s claims history is a significant factor; a history of claims can lead to increased premiums. Conversely, security features such as alarm systems and fire sprinklers can lead to reduced premiums.

Value Proposition of Premium House Insurance for Homeowners

Premium house insurance provides significant value by offering superior protection against a wider range of risks compared to standard policies. This superior protection translates to peace of mind, knowing that a broader spectrum of potential damages and losses are covered. In addition to comprehensive coverage, many premium policies offer additional benefits such as emergency services, temporary accommodation, and legal assistance in the event of a claim. The value proposition is further enhanced by the potential for faster and smoother claim processing compared to standard policies. This expedited process can minimize disruption and stress during already challenging circumstances.

Cost-Benefit Analysis: Premium vs. Standard House Insurance

The following table illustrates a comparative cost-benefit analysis of premium versus standard house insurance. Note that these figures are illustrative examples and actual costs will vary depending on individual circumstances.

| Feature | Premium Cost (Annual) | Standard Cost (Annual) | Value Difference |

|---|---|---|---|

| Coverage Amount | $2,000 | $1,000 | $1,000 (Higher coverage) |

| Coverage Breadth (Types of perils covered) | Broader, including specialized risks | Basic perils only | Enhanced protection against a wider range of events |

| Claim Processing Speed | Faster, more efficient | Slower, potentially more complex | Reduced stress and quicker recovery |

| Additional Benefits (e.g., emergency services) | Included | Not included | Added value and support during emergencies |

| Deductible | Potentially higher | Potentially lower | Consider the balance between deductible and coverage |

Long-Term Value of Premium House Insurance

While the initial cost of premium house insurance is higher, the long-term value can significantly outweigh this initial investment. Consider a scenario where a homeowner experiences a major event like a fire. A standard policy might only partially cover the damages, leaving the homeowner with substantial out-of-pocket expenses. A premium policy, however, would likely provide significantly more comprehensive coverage, minimizing or eliminating these additional costs. This potential savings over the long term can far exceed the difference in annual premiums, particularly for high-value properties or those located in high-risk areas. The peace of mind and financial security provided by premium coverage are invaluable assets that justify the higher initial investment.

Closing Notes

Ultimately, the decision of whether to opt for premium house insurance hinges on individual needs and risk tolerance. While the initial cost may be higher than standard policies, the enhanced coverage, superior customer service, and potential for significant payouts in the event of a major incident often make it a worthwhile investment for homeowners seeking comprehensive protection. By carefully weighing the costs and benefits and understanding the specific features of a premium policy, homeowners can confidently secure their home’s future.

Helpful Answers

What are the common exclusions in standard house insurance that are often covered by premium policies?

Standard policies often exclude or limit coverage for events like flooding, earthquakes, and specific types of damage from severe weather. Premium policies frequently offer broader coverage for these perils.

How does the claims process differ between premium and standard house insurance?

Premium insurers often provide dedicated claims adjusters, faster processing times, and more proactive communication throughout the claims process, leading to a smoother and less stressful experience.

Can I get premium house insurance if I have a pre-existing condition on my property?

It depends on the specific condition and the insurer. Some insurers may offer coverage with adjustments to the premium or specific exclusions, while others may decline coverage altogether. It’s crucial to disclose all relevant information to the insurer.

What factors determine the cost of premium house insurance?

Factors include the location of the property, its value, the level of coverage chosen, the age and condition of the home, and the homeowner’s claims history.