Owning a home is a significant investment, representing years of hard work and accumulated wealth. Standard home insurance often falls short when protecting truly valuable assets and unique circumstances. This is where premium home insurance steps in, offering a comprehensive shield against unforeseen events. This guide delves into the intricacies of premium home insurance, exploring its distinctive features, cost factors, coverage options, and the process of selecting the right provider to safeguard your most valuable possession – your home.

We’ll examine how premium home insurance differs from standard policies, highlighting the expanded coverage and specialized options available to high-net-worth homeowners. We’ll also explore the crucial role of factors like location, home features, and the insurer’s financial stability in determining premium costs and the overall value of your policy. Through illustrative scenarios, we aim to clarify the real-world benefits of this enhanced protection.

Cost Factors of Premium Home Insurance

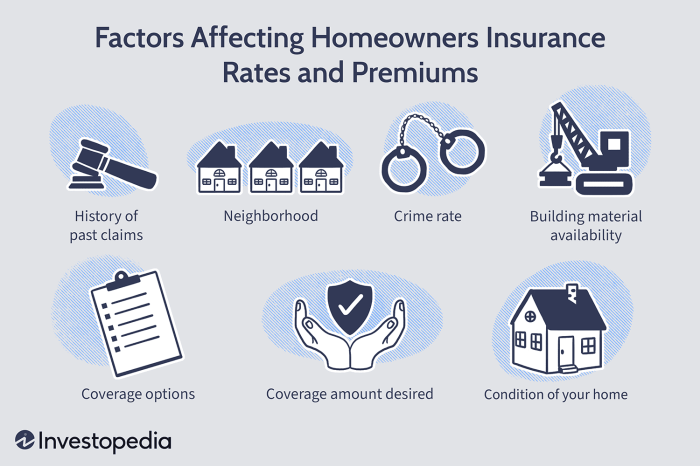

Securing premium home insurance involves understanding the various factors that contribute to the final cost. Several key elements influence the price you pay, and this section will explore those factors in detail, helping you to better understand your premium. This knowledge will allow you to make informed decisions and potentially find ways to reduce your insurance costs.

Location’s Impact on Premium Home Insurance Pricing

Your home’s location significantly impacts your insurance premium. Insurers assess risk based on factors such as crime rates, proximity to fire hydrants, the likelihood of natural disasters (earthquakes, floods, hurricanes, wildfires), and the overall stability of the area. Homes in high-risk areas, like those prone to flooding or wildfires, will generally command higher premiums due to the increased likelihood of claims. Conversely, homes situated in low-risk areas with low crime rates and readily available fire services may enjoy lower premiums. For example, a home in a coastal region susceptible to hurricanes will likely have a higher premium than a similar home located inland.

The Role of Home Features in Determining Premiums

The characteristics of your home itself play a crucial role in determining your insurance premium. Features that enhance security and reduce the risk of damage or loss will generally lead to lower premiums. These features include security systems (alarms, surveillance cameras), fire suppression systems (sprinklers), and the type of construction materials used. Homes constructed with fire-resistant materials like brick or concrete will typically attract lower premiums than those built with wood. Similarly, homes equipped with modern security systems are considered lower risk and often receive discounts. For instance, a home with a monitored security system might qualify for a 5-10% discount, while a fire sprinkler system could offer even greater savings.

Comparison of Cost Factors Across Different Insurance Providers

The cost of home insurance can vary significantly between different providers, even for similar properties. This variation stems from differences in their risk assessment models, underwriting practices, and the services they offer. The table below illustrates how different factors might influence premium costs across hypothetical insurance providers. Note that these are illustrative examples and actual premiums will vary depending on specific circumstances.

| Factor | Provider A | Provider B | Provider C |

|---|---|---|---|

| Location (High Risk) | $2000 | $1800 | $2200 |

| Location (Low Risk) | $1200 | $1000 | $1300 |

| Security System (Present) | -10% Discount | -5% Discount | -8% Discount |

| Fire Sprinkler System (Present) | -15% Discount | -10% Discount | -12% Discount |

| Construction (Fire Resistant) | -5% Discount | -3% Discount | -7% Discount |

Illustrative Scenarios

Premium home insurance offers comprehensive protection, but understanding its value often requires visualizing real-world applications. The following scenarios illustrate the diverse ways a premium policy can safeguard your assets and financial well-being.

Significant Property Damage Claim

Imagine a severe storm causing significant damage to your home. High winds rip off sections of your roof, causing extensive water damage throughout the interior. Trees fall, smashing windows and damaging your siding. A standard homeowner’s policy might cover a portion of the repairs, but a premium policy would likely offer higher coverage limits, ensuring you receive sufficient funds to fully restore your home to its pre-loss condition, including covering the cost of temporary accommodation while repairs are underway. This includes not only the structural repairs but also the replacement of damaged personal belongings, exceeding the limitations of a basic policy. The claim process, while still involving paperwork and assessments, would likely be smoother and more efficient due to the dedicated claims handling services typically associated with premium policies.

High-Value Item Coverage Benefits

Let’s say you own a valuable collection of antique clocks, each appraised at several thousand dollars. A standard policy may only provide limited coverage for such items, leaving you significantly underinsured in case of theft or damage. A premium policy, however, would allow you to schedule these high-value items, providing specific coverage amounts for each clock, ensuring full replacement or repair value in the event of a loss. This customized coverage offers peace of mind knowing your treasured possessions are adequately protected against unforeseen circumstances, such as fire, burglary, or accidental damage. The appraisal process, often included as part of the premium policy, ensures accurate valuation and avoids disputes during claims.

Liability Coverage Proving Essential

Consider a scenario where a guest at your home slips on an icy patch on your walkway and suffers a serious injury. Medical bills and potential legal fees could easily reach hundreds of thousands of dollars. Your premium home insurance policy’s robust liability coverage would step in, protecting you from financial ruin. The policy would cover the guest’s medical expenses, legal defense costs, and any potential settlements or judgments awarded against you. This comprehensive protection is crucial, as even a seemingly minor accident can lead to significant financial repercussions without adequate liability insurance. The policy would also cover legal representation, ensuring you have expert assistance throughout the process.

Specialized Coverage for Unique Circumstances

Suppose you own a large collection of original artwork housed in a dedicated gallery within your home. Standard policies might not offer sufficient coverage for such a specialized collection. A premium policy, however, allows you to add specialized endorsements for valuable art, providing comprehensive protection against loss, damage, or theft, including coverage for specific restoration or conservation needs. Similarly, if your home is located in a flood-prone area, a standard policy may not cover flood damage. A premium policy, however, would allow you to add flood insurance, offering critical protection against this specific risk. This tailored approach ensures your unique assets and circumstances are adequately protected, offering peace of mind beyond the scope of standard policies.

Ending Remarks

Ultimately, securing premium home insurance is about more than just financial protection; it’s about peace of mind. By carefully considering the factors Artikeld in this guide – from understanding the nuances of coverage to selecting a reputable provider – homeowners can confidently navigate the complexities of premium home insurance and create a robust safety net for their most cherished asset. Investing in the right premium home insurance policy is an investment in the future security and tranquility of your home and family.

Helpful Answers

What are the typical exclusions in premium home insurance policies?

Common exclusions can include damage caused by wear and tear, intentional acts by the policyholder, and certain types of natural disasters (depending on specific riders).

How often should I review my premium home insurance policy?

It’s recommended to review your policy annually, or whenever significant changes occur in your home’s value, contents, or risk profile.

What is the difference between replacement cost and actual cash value coverage?

Replacement cost coverage pays to replace damaged items with new ones of similar kind and quality, while actual cash value considers depreciation.

Can I get premium home insurance if I have a history of claims?

Insurers consider claims history, but it doesn’t automatically disqualify you. It may affect your premium rate.

How do I file a claim under my premium home insurance policy?

The claims process varies by provider but generally involves contacting your insurer immediately after an incident and following their Artikeld procedures.