Navigating the complex world of health insurance can feel overwhelming, especially when considering the significant differences between standard and premium plans. Premium health insurance offers a higher level of coverage and benefits, but comes at a higher cost. This guide delves into the intricacies of premium health insurance, exploring its features, costs, and suitability for various demographics. We’ll examine the value proposition, helping you understand if a premium plan aligns with your individual healthcare needs and budget.

From comprehensive coverage details and cost comparisons to insightful examples and practical advice on plan selection, this guide aims to equip you with the knowledge necessary to make an informed decision. We’ll explore how premium plans address specific healthcare concerns and compare them to standard options, illuminating the key differences and highlighting the potential long-term advantages of investing in superior healthcare protection.

Premium Health Insurance and Specific Demographics

Premium health insurance plans, while often more expensive upfront, offer comprehensive coverage and numerous benefits that can be particularly advantageous for specific demographic groups. Understanding these benefits within the context of individual needs is crucial for making informed healthcare decisions. This section will explore how premium plans cater to the unique healthcare requirements of families with children, senior citizens, and individuals with pre-existing conditions.

Premium Health Insurance for Families with Children

Families with children often face significant healthcare expenses, from routine checkups and vaccinations to unexpected illnesses and injuries. Premium health insurance plans typically offer extensive pediatric coverage, including well-child visits, immunizations, and specialist care. Many plans also provide coverage for dental and vision care, further reducing the financial burden associated with a growing family’s healthcare needs. The comprehensive nature of these plans ensures that children receive the necessary medical attention without the worry of substantial out-of-pocket costs. For example, a family with a child diagnosed with asthma could benefit greatly from the extensive coverage of a premium plan, which would cover medications, specialist visits, and hospitalizations related to managing the condition.

Premium Health Insurance Benefits for Senior Citizens

Senior citizens often require more frequent and extensive healthcare services due to age-related health issues. Premium health insurance plans can provide substantial benefits in this context. These plans frequently offer comprehensive coverage for chronic conditions like diabetes, heart disease, and arthritis, including prescription medications, specialized treatments, and rehabilitation services. Moreover, many premium plans include coverage for preventive care, such as annual checkups and screenings, which are vital for early detection and management of age-related health problems. Consider a senior citizen with a history of heart disease; a premium plan might cover regular cardiac checkups, prescription medications to manage cholesterol and blood pressure, and potentially even cardiac rehabilitation programs. This comprehensive coverage can significantly improve the quality of life and reduce the financial strain associated with managing chronic conditions.

Premium Health Insurance for Individuals with Pre-existing Conditions

Individuals with pre-existing conditions often face challenges in obtaining affordable and comprehensive health insurance. Premium health insurance plans can be particularly beneficial in this situation. While the specific coverage can vary depending on the plan and the pre-existing condition, many premium plans provide robust coverage for managing these conditions, including medications, treatments, and specialist care. The Affordable Care Act (ACA) in the United States, for instance, prohibits health insurers from denying coverage or charging higher premiums based solely on pre-existing conditions. This protection is crucial for individuals with conditions like diabetes, cancer, or heart disease, ensuring access to necessary healthcare without facing discriminatory pricing or denial of coverage. For example, an individual with type 1 diabetes would benefit from a premium plan’s comprehensive coverage for insulin, regular checkups, and potential complications related to the condition. The peace of mind knowing that essential treatments are covered can be invaluable.

Illustrative Examples

Let’s explore scenarios illustrating the benefits of premium health insurance compared to standard plans. These examples highlight the financial protection and comprehensive care premium plans offer, particularly in situations where standard plans might fall short.

Premium Health Insurance Benefits: A Hypothetical Scenario

Imagine Sarah, a 45-year-old entrepreneur, who opts for a premium health insurance plan. During the year, she experiences a serious car accident resulting in multiple fractures and requiring extensive surgery and rehabilitation. The total medical bill, including hospitalization, surgical fees, physical therapy, and medication, amounts to $150,000. Her premium plan covers 90% of these costs, leaving her with a manageable out-of-pocket expense of $15,000. This is significantly less than the potential financial burden she would face with a standard plan, which might only cover 70% and leave her with a much higher out-of-pocket expense of $45,000. Furthermore, her premium plan includes access to a concierge medical service, providing her with expedited appointments with specialists and personalized care coordination, accelerating her recovery.

Insufficient Standard Health Insurance: A Comparative Scenario

Consider John, a 60-year-old retiree with a pre-existing condition – heart disease. He chooses a standard health insurance plan due to its lower premium. He experiences a heart attack requiring immediate hospitalization, angioplasty, and a prolonged stay in a cardiac rehabilitation facility. His medical bills reach $80,000. His standard plan, with its higher co-pays, deductibles, and limited coverage for pre-existing conditions, leaves him with a substantial out-of-pocket expense of $30,000, a significant strain on his retirement savings. A premium plan, however, would likely have covered a much larger portion of his expenses, mitigating the financial burden and ensuring access to specialized cardiac care, potentially leading to a faster and more complete recovery. The premium plan might also include coverage for preventative care, such as regular check-ups and screenings, that could have helped detect potential problems earlier.

Ultimate Conclusion

Ultimately, the decision of whether to opt for premium health insurance is a personal one, heavily influenced by individual health needs, financial considerations, and risk tolerance. By understanding the comprehensive benefits, cost implications, and specific features of premium plans, you can make a well-informed choice that best safeguards your health and financial well-being. This guide provides a foundation for that decision, empowering you to navigate the complexities of healthcare coverage with confidence.

Top FAQs

What are the common exclusions in premium health insurance plans?

While premium plans offer extensive coverage, some services might still have limitations or exclusions. These can vary by provider and plan, so reviewing the specific policy details is crucial. Common exclusions may include experimental treatments, cosmetic procedures, and certain pre-existing conditions (though coverage for pre-existing conditions is often better than in standard plans).

Can I switch from a standard to a premium health insurance plan mid-year?

The ability to switch plans mid-year depends on your country’s regulations and your insurance provider’s specific policies. Some insurers allow changes during open enrollment periods or in response to qualifying life events, such as marriage or the birth of a child. Contact your insurance provider directly to inquire about your options.

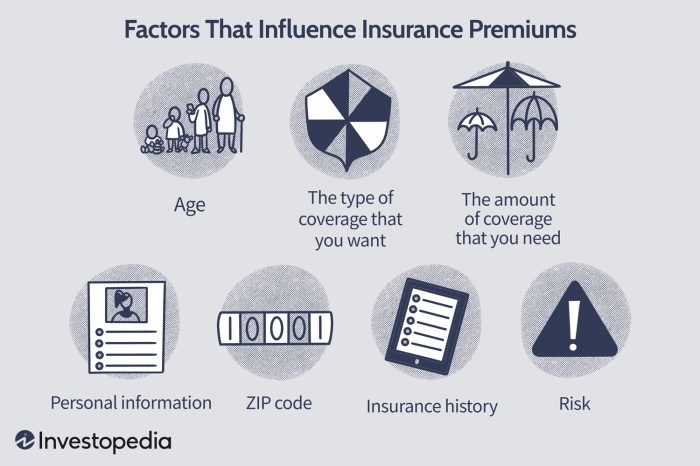

How does my health history affect the premium cost?

Your health history significantly impacts premium costs. Individuals with pre-existing conditions or a history of significant healthcare utilization typically face higher premiums. Insurers assess risk based on this information to determine appropriate pricing.

What is the role of a health insurance broker in choosing a premium plan?

A health insurance broker can be invaluable in navigating the complexities of choosing a premium plan. Brokers provide unbiased advice, compare plans from multiple providers, and assist with the enrollment process. Their expertise can save you time and ensure you select a plan that best fits your needs.