Securing your family’s future is paramount, and understanding the cost of life insurance is a crucial step. A term life insurance premium calculator offers a powerful tool to navigate this process, providing personalized estimates based on your unique circumstances. This guide will demystify the workings of these calculators, empowering you to make informed decisions about your financial protection.

We’ll explore the key factors influencing premium calculations, including age, health, coverage amount, and lifestyle choices. By understanding these variables, you can gain a clearer picture of your insurance needs and budget accordingly. We’ll also delve into the process of comparing quotes from different insurers, ensuring you find the best value for your investment.

Understanding “Premium for Term Life Insurance Calculator”

A term life insurance premium calculator is a valuable tool that helps individuals quickly estimate the cost of term life insurance based on their specific circumstances. It simplifies the process of understanding how various factors influence the premium, allowing for informed decision-making before contacting an insurance agent. These calculators provide a preliminary cost estimate, and the final premium may vary slightly depending on the insurance provider and specific policy details.

Core Functionality of a Term Life Insurance Premium Calculator

The core functionality of a term life insurance premium calculator involves taking several key pieces of information as input and using actuarial data to calculate an estimated monthly or annual premium. The calculator employs algorithms that consider various risk factors to determine the likelihood of a claim and, consequently, the premium required to cover potential payouts. The output is a projected premium amount, offering a quick understanding of the potential cost.

Input Variables Used in Premium Calculations

Several key input variables determine the calculated premium. These include:

| Variable | Description | Impact on Premium |

|---|---|---|

| Age | The applicant’s age is a crucial factor, as older individuals generally have a higher risk of mortality. | Higher age leads to higher premiums. |

| Gender | Statistically, there are differences in life expectancy between genders, influencing premium calculations. | Premiums may differ slightly between genders. |

| Health Status | Pre-existing health conditions and lifestyle factors (smoking, etc.) significantly impact risk assessment. | Poor health leads to higher premiums. |

| Coverage Amount | The desired death benefit amount directly impacts the premium; higher coverage means higher premiums. | Higher coverage leads to higher premiums. |

| Policy Term Length | The length of the policy (e.g., 10, 20, 30 years) influences the premium; longer terms may have higher premiums overall but lower annual costs. | Longer term may result in higher overall premiums, but lower annual cost. |

Impact of Input Variables on Premiums: Examples

Let’s illustrate how different input variables affect the calculated premium. Consider two individuals:

* Individual A: 30-year-old, non-smoker, excellent health, seeking $250,000 coverage for a 20-year term.

* Individual B: 45-year-old, smoker, pre-existing condition (high blood pressure), seeking $500,000 coverage for a 20-year term.

Individual B will likely receive a significantly higher premium than Individual A due to age, smoking status, pre-existing condition, and higher coverage amount. The difference could be substantial, highlighting the importance of these factors.

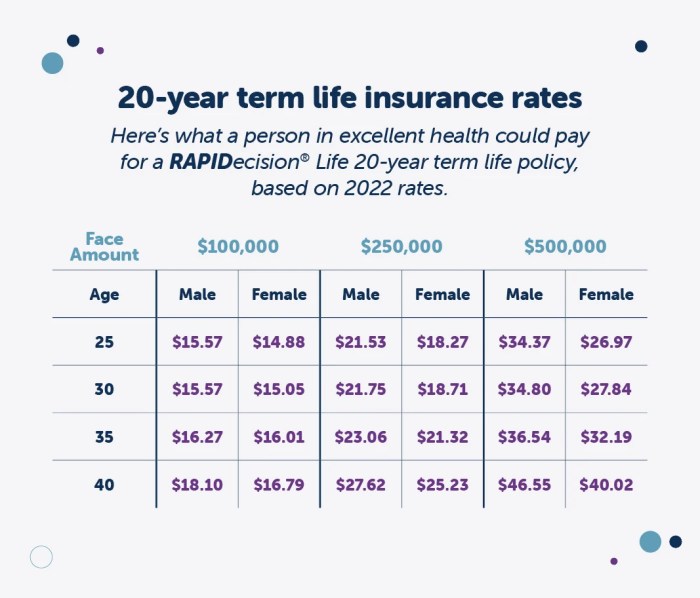

Premium Differences Based on Age and Coverage Amount

The following table demonstrates how age and coverage amount influence premiums. These are illustrative examples and actual premiums will vary based on the other factors mentioned above.

| Age | $250,000 Coverage (Annual Premium) | $500,000 Coverage (Annual Premium) | Premium Difference |

|---|---|---|---|

| 30 | $500 | $900 | $400 |

| 40 | $750 | $1350 | $600 |

| 50 | $1200 | $2100 | $900 |

Factors Influencing Term Life Insurance Premiums

Several key factors determine the cost of your term life insurance premiums. Understanding these factors allows you to make informed decisions and potentially secure more affordable coverage. This section will explore the most significant influences on your premium calculations.

Health Status and Premium Costs

Your health plays a crucial role in determining your life insurance premium. Insurers assess your health risk through a medical questionnaire and sometimes a medical exam. Pre-existing conditions, such as heart disease, diabetes, or cancer, will generally lead to higher premiums because they increase the likelihood of a claim. Conversely, individuals in excellent health with no significant medical history often qualify for lower premiums. The insurer’s underwriting process carefully evaluates this information to assign a risk category, directly impacting the premium offered. A thorough and accurate health declaration is therefore essential.

Smoking Habits and Premium Costs

Smoking significantly increases your risk of various health problems, including heart disease, lung cancer, and stroke. Because of this elevated risk, insurers typically charge significantly higher premiums to smokers compared to non-smokers. The extent of the increase varies depending on the insurer and the amount and duration of smoking. Quitting smoking can lead to lower premiums in the future, as some insurers offer discounts or adjusted rates after a period of abstinence, usually verified through a follow-up health assessment.

Term Length and Premium Costs

The length of your term life insurance policy also affects the premium. Shorter-term policies (e.g., 10-year terms) generally have lower premiums than longer-term policies (e.g., 20-year or 30-year terms). This is because the insurer’s risk is lower over a shorter period. However, it’s important to consider your long-term needs when choosing a term length. A longer term provides coverage for a more extended period, but at a higher premium cost. For example, a 30-year term policy for a 30-year-old might cost more per year than a 10-year term policy for the same individual, but it offers protection until age 60.

Lifestyle Choices and Premium Calculations

Lifestyle choices significantly impact your overall health and, consequently, your life insurance premiums. Factors like diet, exercise, and alcohol consumption are all considered. Individuals who maintain a healthy lifestyle, including regular exercise and a balanced diet, may qualify for lower premiums. Conversely, those with unhealthy habits might face higher premiums. For example, someone who regularly engages in extreme sports might see a higher premium compared to someone with a more sedentary but healthy lifestyle.

Health Factors and Premium Costs

The following list illustrates various health factors and their potential influence on premium costs:

- Body Mass Index (BMI): A higher BMI often correlates with increased health risks and higher premiums.

- Blood Pressure: Consistently high blood pressure increases the risk of heart disease and stroke, leading to higher premiums.

- Cholesterol Levels: High cholesterol levels contribute to heart disease, potentially resulting in higher premiums.

- Family History of Disease: A family history of certain diseases, such as cancer or heart disease, can increase your perceived risk and premiums.

- Pre-existing Conditions: Conditions like diabetes, asthma, or previous heart surgery can significantly impact premium costs.

Comparing Quotes from Different Insurers

Obtaining the lowest premium isn’t the sole objective when securing term life insurance. A thorough comparison of quotes from multiple insurers is crucial to ensure you’re receiving the best value and coverage for your needs. This involves more than just looking at the price tag; it necessitates a comprehensive understanding of policy details and the reputation of the insurance provider.

Identifying Reputable Insurance Companies

Choosing a financially stable and reputable insurance company is paramount. A company’s financial strength directly impacts its ability to pay out claims when needed. Several resources can help you assess an insurer’s reliability. Independent rating agencies, such as A.M. Best, Moody’s, and Standard & Poor’s, provide financial strength ratings for insurance companies. These ratings reflect the insurer’s ability to meet its obligations. Checking the Better Business Bureau (BBB) for complaints and reviews can also provide valuable insights into a company’s customer service and handling of claims. Additionally, researching the company’s history and market presence can offer further assurance of its stability and trustworthiness.

Policy Details Beyond the Premium

Focusing solely on the premium amount is a mistake. Policy details such as the coverage amount, the length of the term, the riders offered (e.g., accidental death benefit, terminal illness benefit), and the specific exclusions and limitations are equally important. Understanding these details will ensure the policy aligns with your specific needs and circumstances. For example, a lower premium might come with a shorter term or less comprehensive coverage, ultimately proving less valuable in the long run. Carefully review the policy documents to understand what is and isn’t covered.

Factors to Consider When Comparing Policies

Several factors should guide your comparison of insurance policies beyond the price. These include the financial strength rating of the insurer, the policy’s coverage amount and term length, the availability and cost of riders, the claims process, the customer service reputation, and any exclusions or limitations within the policy. A lower premium might be offset by a more complicated claims process or restrictive policy terms. Consider the long-term implications of each policy and select the one that best balances cost and coverage.

Hypothetical Insurance Quote Comparison

The following table compares hypothetical quotes from three different insurance companies, highlighting key differences that go beyond the premium amount. Remember, these are hypothetical examples and actual quotes will vary based on individual circumstances.

| Insurance Company | Annual Premium | Coverage Amount | Policy Term (Years) |

|---|---|---|---|

| Insurer A | $500 | $500,000 | 20 |

| Insurer B | $450 | $400,000 | 20 |

| Insurer C | $550 | $500,000 | 30 |

Final Summary

Ultimately, utilizing a term life insurance premium calculator is a proactive step towards securing your family’s financial well-being. By understanding the factors influencing premium costs and comparing quotes from multiple providers, you can confidently choose a policy that aligns with your budget and long-term goals. Remember, informed decisions lead to greater peace of mind. Take control of your financial future today.

Essential Questionnaire

What is the difference between term and whole life insurance?

Term life insurance provides coverage for a specific period (term), while whole life insurance offers lifelong coverage with a cash value component.

Can I use a calculator to estimate premiums for critical illness or disability cover?

Most online calculators focus on term life insurance. For critical illness or disability cover, you’ll likely need to contact insurers directly for quotes.

How accurate are online premium calculators?

Online calculators provide estimates. Actual premiums may vary depending on the insurer’s underwriting process and individual health assessment.

What if I have pre-existing health conditions?

Pre-existing conditions can affect your premiums. It’s crucial to disclose all relevant health information to the insurer for an accurate quote.