Premium financed life insurance presents a sophisticated approach to securing substantial life insurance coverage, even with limited immediate capital. This strategy leverages loans to pay premiums, allowing individuals to access significantly higher death benefit amounts than might otherwise be attainable. Understanding the nuances of this financial instrument, however, requires careful consideration of various factors, including interest rates, loan terms, and potential tax implications.

This guide delves into the intricacies of premium financed life insurance, exploring its mechanics, financial implications, and legal considerations. We will examine the advantages and disadvantages, offering practical insights and examples to help you make informed decisions. Whether you’re a high-net-worth individual or simply seeking to optimize your life insurance strategy, a thorough understanding of premium financing is crucial.

Defining Premium Financing

Premium financing is a financial strategy that allows individuals to purchase larger life insurance policies than they could afford through traditional payment methods. It essentially involves taking out a loan to pay the insurance premiums, with the life insurance policy itself often serving as collateral. This allows access to higher death benefit amounts and potentially greater financial protection.

Premium financing works by securing a loan from a lender, typically a bank or specialized premium finance company. This loan covers the initial and subsequent premiums of the life insurance policy. The borrower then makes regular payments to the lender to repay the loan, including interest. The interest rate on the loan significantly impacts the overall cost. Importantly, the life insurance policy is not directly impacted by the loan; the loan is a separate financial agreement.

Types of Premium Financing Arrangements

Several types of premium financing arrangements exist, each with its own nuances. The specifics of each arrangement will vary depending on the lender and the individual’s financial situation. Common variations include fixed-rate loans, adjustable-rate loans, and loans with different repayment schedules (e.g., balloon payments). The choice of arrangement depends on factors like risk tolerance, anticipated interest rate movements, and the borrower’s cash flow projections.

Premium Financing Compared to Traditional Payment Methods

Traditional life insurance payment methods involve paying premiums directly to the insurance company, either through monthly, quarterly, or annual installments. Premium financing differs significantly, as it introduces a layer of debt. While traditional payments offer simplicity and predictability, premium financing can provide access to higher coverage amounts but adds the complexity and cost of loan repayment. The choice between these methods depends on individual financial goals and risk tolerance. A person with a significant existing investment portfolio might find premium financing beneficial to leverage assets for greater coverage. In contrast, someone with limited savings might prefer the simplicity and predictability of traditional payments.

| Feature | Traditional Payment | Premium Financing | Comparison |

|---|---|---|---|

| Premium Payment | Directly to insurer | Through a loan from a lender | Traditional is simpler; premium financing requires loan management. |

| Cost | Premiums only | Premiums + loan interest | Premium financing is more expensive due to interest. |

| Coverage Amount | Limited by affordability | Potentially higher | Premium financing allows for greater coverage. |

| Risk | Lower risk, simpler financial management | Higher risk due to loan repayment obligations; potential for default | Traditional payments have lower financial risk; premium financing introduces debt risk. |

Financial Aspects of Premium Financing

Premium financing, while offering a convenient way to access life insurance, involves significant financial considerations that require careful evaluation. Understanding the tax implications, potential risks, and scenarios where it proves beneficial or detrimental is crucial for making informed decisions. This section delves into the key financial aspects to help you navigate this complex financial strategy.

Tax Implications of Premium Financing

Premium financing involves borrowing money to pay life insurance premiums. The interest paid on the loan is generally tax-deductible, while the premiums themselves are not. However, the specific tax treatment can vary depending on the jurisdiction and the type of policy. For instance, in some jurisdictions, the interest may be deductible only if the loan is used for business purposes. Consult with a qualified tax advisor to determine the precise tax implications in your specific situation. It’s crucial to understand how these deductions will affect your overall tax liability. Careful planning is essential to maximize tax advantages while adhering to all relevant tax laws.

Risks Associated with Premium Financing

Premium financing carries inherent risks, primarily stemming from interest rate fluctuations and the potential for loan defaults. Interest rates are a significant factor, as they directly impact the overall cost of financing. Rising interest rates can dramatically increase the cost of the loan, potentially making it difficult to maintain the policy. Furthermore, loan defaults can have severe consequences, including the lapse of the insurance policy and potential financial losses. The borrower’s creditworthiness plays a vital role; a decline in credit score can make it challenging to secure further financing or refinance at favorable rates. Careful monitoring of the loan and the ability to manage interest rate changes are crucial aspects of effective premium financing.

Scenarios Where Premium Financing is Beneficial or Detrimental

Premium financing can be beneficial in situations where individuals require immediate access to a high coverage life insurance policy but lack the immediate capital to pay the premiums. This approach can be particularly advantageous for business owners needing substantial life insurance coverage for succession planning or key-person insurance. Conversely, premium financing can be detrimental if the individual’s financial situation is precarious or if interest rates rise significantly, making loan repayments unsustainable. It is also unsuitable for those who lack a strong understanding of financial markets or risk management. Careful assessment of one’s financial health and long-term outlook is critical before opting for this strategy.

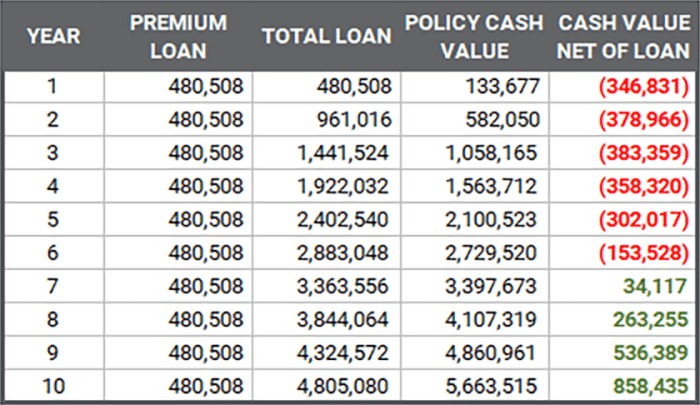

Hypothetical Case Study: 10-Year Premium Financing Impact

Let’s consider a hypothetical case where an individual secures a $1 million life insurance policy with annual premiums of $10,000. They choose premium financing with a 5% fixed interest rate loan over 10 years. The annual loan repayment, including principal and interest, would be approximately $1,295.05. Over the 10-year period, the total interest paid would be roughly $2,950.50. However, if interest rates were to unexpectedly rise to 7% during the loan term, the annual repayment would increase to approximately $1,423.78, and the total interest paid would rise significantly. This scenario illustrates the impact of interest rate fluctuations on the overall cost of premium financing. A detailed amortization schedule would be needed to track these figures accurately over time. This example highlights the importance of considering interest rate risk and having a financial plan that can accommodate potential increases.

Illustrative Examples

Premium financing, while offering significant advantages, requires careful consideration. Understanding its application in different scenarios, including potential pitfalls, is crucial for making informed decisions. The following examples illustrate the complexities and potential outcomes associated with this financial strategy.

Premium Financing for High-Net-Worth Individuals

High-net-worth individuals often utilize premium financing to leverage their assets for substantial life insurance coverage. Consider a successful entrepreneur with a substantial portfolio of investments and significant liquid assets. They might choose premium financing to secure a $10 million life insurance policy, utilizing a portion of their investment portfolio as collateral for the loan. This allows them to maintain liquidity while securing significant death benefit protection for their family and business interests. The interest on the loan is often tax-deductible, further enhancing the strategy’s attractiveness. The premium financing loan itself is typically secured by the cash value growth of the policy itself, mitigating risk for the lender.

Illustrative Growth of a Life Insurance Policy Under Premium Financing

Let’s examine a hypothetical scenario. A 45-year-old individual purchases a $5 million whole life insurance policy with a premium of $50,000 annually. Using premium financing, they secure a loan to cover these premiums. Over the next 10 years, assuming a conservative 4% annual cash value growth and a 6% interest rate on the loan, the following might be observed:

| Year | Annual Premium | Loan Balance | Cash Value | Death Benefit |

|---|---|---|---|---|

| 0 | $50,000 | $50,000 | $0 | $5,000,000 |

| 1 | $50,000 | $102,000 | $2,000 | $5,000,000 |

| 5 | $50,000 | $268,000 | $12,000 | $5,000,000 |

| 10 | $50,000 | $500,000 | $60,000 | $5,000,000 |

Note: These figures are illustrative and simplified. Actual results will vary depending on the specific policy, interest rates, and investment performance.

Impact of Interest Rate Changes on Premium Financing Costs

A rise in interest rates directly increases the cost of the premium financing loan. If, in the above example, interest rates increased to 8%, the loan balance would grow more rapidly, potentially requiring additional contributions or a reduction in the policy’s death benefit to maintain affordability. Conversely, a decrease in interest rates would reduce the overall cost of the loan. This sensitivity highlights the importance of understanding the interest rate environment and incorporating potential fluctuations into financial planning.

Potential Financial Difficulties with Premium Financing

Premium financing can lead to financial difficulties if the underlying investments used as collateral underperform or if interest rates rise significantly. For example, if the market experiences a downturn, the value of the collateral might fall below the loan amount, triggering a margin call, requiring the policyholder to make additional payments to maintain the policy. Failure to meet these margin calls could result in the policy’s lapse, leading to the loss of the insurance coverage and potentially significant financial losses. Furthermore, unexpected increases in premium costs, independent of the loan, could also exacerbate financial strain.

Final Wrap-Up

Premium financed life insurance offers a powerful tool for securing substantial life insurance coverage, but its complexity necessitates a comprehensive understanding of its financial and legal implications. By carefully evaluating your individual circumstances, assessing the potential risks and rewards, and selecting a reputable financing provider, you can harness the potential of premium financing to achieve your financial goals. Remember that thorough due diligence and professional financial advice are paramount in navigating this intricate landscape.

Common Queries

What are the potential downsides of premium financed life insurance?

Potential downsides include the accumulation of debt, the risk of loan defaults if premiums cannot be paid, and potential tax implications depending on your jurisdiction. Interest rate fluctuations can also significantly impact the overall cost.

How does premium financing affect my estate planning?

Premium financing can significantly impact estate planning by allowing for larger death benefits, potentially increasing the value of your estate. However, the loan itself might need to be considered within your estate planning strategy.

Can I use premium financing for term life insurance?

While less common, premium financing can be applied to term life insurance policies, although it’s more frequently used with permanent policies offering cash value growth.

What type of lender typically provides premium financing?

Premium financing is often provided by specialized lenders, banks, or insurance companies themselves. It’s important to compare offerings and terms from multiple lenders.