Premium finance life insurance offers a unique approach to securing substantial life insurance coverage. Instead of paying premiums in smaller installments over many years, this method involves securing a loan to cover the initial, often substantial, premium cost. This strategy allows individuals and businesses to acquire larger policies than might otherwise be feasible, unlocking significant financial benefits and providing comprehensive protection. This guide explores the mechanics, advantages, and potential drawbacks of premium finance life insurance, offering a balanced perspective to inform your decision-making.

We’ll delve into the various types of premium finance arrangements, comparing them to traditional payment methods. We’ll examine the tax implications, explore the potential for leveraging assets, and provide real-world scenarios illustrating the financial impact. Finally, we’ll guide you through the process of choosing a reputable provider and understanding the crucial role of a financial advisor in navigating this complex financial landscape.

Risks and Considerations of Premium Finance Life Insurance

Premium financing, while offering a convenient way to secure substantial life insurance coverage, carries inherent risks that potential users should carefully weigh against the benefits. Understanding these risks is crucial to making an informed decision and avoiding potential financial hardship. This section Artikels the key downsides of premium finance arrangements and compares them to traditional payment methods.

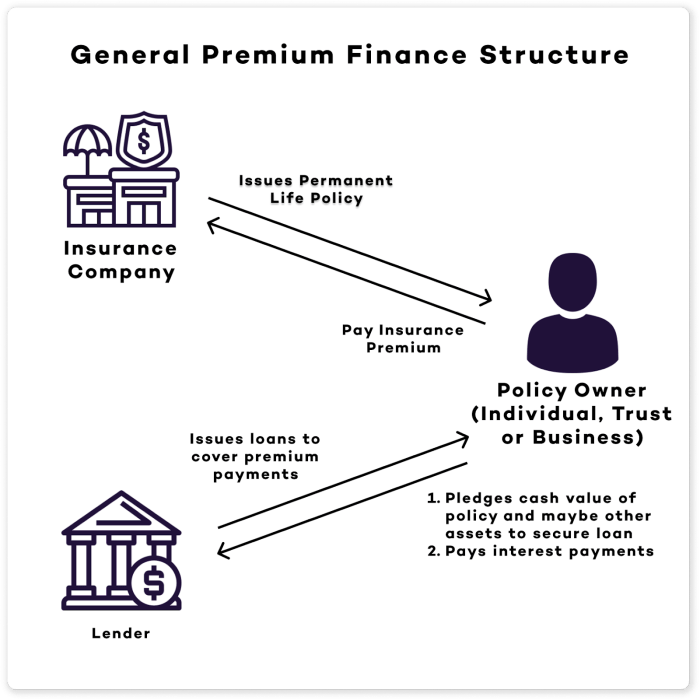

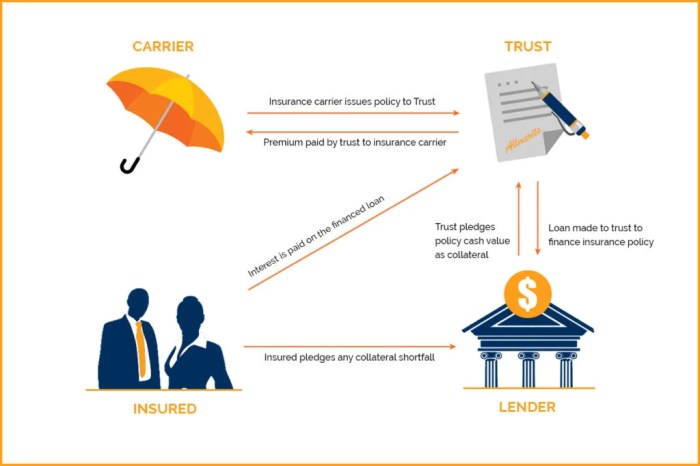

Premium finance arrangements involve borrowing money to pay life insurance premiums. This means you’re essentially taking out a loan, and like any loan, it comes with interest and repayment obligations. Unlike traditional payment plans, where you pay premiums directly, premium finance adds a layer of complexity and financial risk.

Potential Downsides of Premium Finance Arrangements

The primary risk associated with premium finance is the accumulation of debt. Interest charges on the loan can significantly increase the overall cost of your life insurance, potentially exceeding the policy’s death benefit if not managed carefully. Furthermore, if you fail to make loan repayments, the lender may seize the life insurance policy to recover their losses. This leaves you without the insurance coverage and still potentially owing money. Another risk lies in the potential for unexpected changes in interest rates. Variable interest rates can cause your loan repayments to increase substantially, making it difficult to meet your obligations. Finally, the ongoing cost of premium finance needs to be considered in relation to your overall financial circumstances and ability to manage multiple debts.

Comparison of Risks with Traditional Payment Methods

Traditional payment methods, such as monthly premiums paid directly to the insurer, offer greater financial predictability. While you still need to budget for the premiums, there’s no added interest burden or risk of defaulting on a loan. The total cost of the insurance is usually clearer upfront, and you maintain direct control over your policy. Premium finance, on the other hand, introduces the added risk of loan default, interest charges, and the potential loss of the insurance policy itself. The transparency of the total cost is reduced as interest charges are a significant factor that may change over time.

Importance of Understanding the Terms and Conditions of a Premium Finance Agreement

Before entering into a premium finance agreement, it is paramount to thoroughly understand all terms and conditions. This includes the interest rate (fixed or variable), repayment schedule, any penalties for late payments, and the lender’s rights in case of default. A clear understanding of these terms allows you to assess the potential financial implications and make an informed decision about whether premium finance is the right choice for your circumstances. Failure to fully comprehend the agreement could lead to unforeseen financial difficulties and potential loss of the insurance policy.

Factors to Consider Before Using Premium Finance

Before opting for premium finance, consider the following factors:

Your overall financial health: Can you comfortably afford the loan repayments alongside your other financial obligations? A comprehensive assessment of your budget and debt levels is crucial.

The interest rate and repayment terms: Compare interest rates from different lenders to secure the most favorable terms. Carefully review the repayment schedule to ensure you can meet your obligations consistently.

The potential for increased costs: Factor in the added cost of interest and any other fees associated with the loan. Consider the potential impact of interest rate fluctuations if a variable rate is used.

Alternative payment options: Explore other payment options offered by the insurer, such as extended payment plans or reduced premium options, which may offer more favorable terms than premium finance.

The long-term implications: Consider the long-term financial implications of taking on a loan, including the potential impact on your credit score and overall financial stability. Think about how the ongoing cost of the premium finance loan will impact your financial situation in the long term.

The Role of Financial Advisors in Premium Finance

Financial advisors play a crucial role in navigating the complexities of premium finance, ensuring clients understand its benefits and risks before committing. Their expertise helps clients make informed decisions aligned with their broader financial goals, preventing potential pitfalls and maximizing the advantages of this financing strategy.

Premium finance, while offering the ability to secure substantial life insurance coverage without immediate large capital outlays, carries inherent complexities. A financial advisor’s involvement is key to mitigating these complexities and ensuring the strategy aligns with the client’s overall financial picture. Their guidance encompasses a thorough assessment of the client’s financial situation, risk tolerance, and long-term objectives, determining the suitability of premium finance in the context of their unique circumstances.

Advisor’s Role in Recommending Premium Finance

A financial advisor assesses a client’s need for life insurance, financial capacity, and risk tolerance before recommending premium finance. This involves reviewing their existing financial portfolio, understanding their debt levels, and projecting their future income and expenses. The advisor then weighs the advantages of leveraging premium finance against potential downsides, such as interest costs and the risk of defaulting on loan repayments. The recommendation is always tailored to the individual client’s circumstances and financial goals. For example, a high-net-worth individual with a stable income and low debt might find premium finance a suitable strategy to access larger life insurance policies quickly, whereas someone with a fluctuating income and high debt might be better suited to alternative strategies.

Understanding the Implications of Premium Finance

Financial advisors explain the intricacies of premium finance to clients, ensuring they fully comprehend the terms and conditions of the loan agreement, including interest rates, repayment schedules, and potential penalties for late or missed payments. They clarify the impact on cash flow, emphasizing the need for a robust financial plan to accommodate the recurring loan payments. The advisor will also clearly explain the potential risks associated with premium finance, such as the possibility of losing the life insurance policy if loan payments are not met, and the overall cost of the financing over the loan term. This might involve detailed illustrations comparing the total cost of premium finance with alternative methods of funding life insurance premiums. For instance, a comparison could be shown outlining the total premium cost over 10 years using premium finance versus paying premiums outright.

Determining the Appropriateness of Premium Finance

The process of determining the suitability of premium finance begins with a comprehensive financial planning review. The advisor gathers information about the client’s assets, liabilities, income, expenses, and insurance needs. This information is used to create a financial model that simulates different scenarios, including using premium finance. Key factors considered include the client’s debt-to-income ratio, their capacity to meet loan repayments, and their overall financial health. A thorough stress test is conducted to assess the client’s resilience to unexpected financial shocks. For example, the advisor might model the impact of a job loss or unexpected medical expenses on the client’s ability to continue making loan payments. Based on this analysis, the advisor will determine if premium finance aligns with the client’s risk tolerance and financial goals.

Incorporating Premium Finance into a Comprehensive Financial Plan

Premium finance is integrated strategically into a comprehensive financial plan. The advisor considers the interplay between premium finance, other debts, investment strategies, and retirement planning. For instance, a client might use premium finance to secure a substantial life insurance policy, while simultaneously adjusting their investment portfolio to ensure sufficient liquidity for loan repayments. The advisor will also factor in tax implications, ensuring the client is aware of any tax benefits or penalties associated with the financing strategy. An example might be a scenario where a high-income earner uses premium finance to accelerate their estate planning while minimizing the tax impact on their heirs. This would involve careful coordination between the premium finance strategy, estate planning documents, and tax-efficient investment strategies.

Epilogue

Premium finance life insurance presents a powerful tool for securing significant life insurance coverage, but it’s crucial to approach it with careful consideration. Understanding the intricacies of loan agreements, tax implications, and potential risks is paramount. By weighing the benefits against the potential drawbacks and seeking expert financial advice, you can determine whether premium finance is the right strategy to meet your specific financial goals and secure the level of protection you need for yourself, your family, or your business. Remember, thorough research and professional guidance are key to making informed decisions in this area.

FAQ Explained

What happens if I can’t repay the premium finance loan?

Failure to repay the loan could result in the life insurance policy lapsing. This means you lose the coverage, and you may also face further financial penalties depending on the loan agreement.

Are there any age restrictions for premium finance?

While there aren’t strict age restrictions, lenders may assess your overall financial health and risk profile, which can influence their decision to approve a loan. Older applicants may face stricter criteria.

Can I use premium finance for term life insurance?

Yes, premium finance can be used for term life insurance, although it’s more commonly associated with permanent life insurance policies due to their higher premium costs.

How does premium finance affect my estate?

The outstanding loan on the premium finance agreement will typically be deducted from the death benefit payable to your beneficiaries. This is a crucial factor to consider when planning your estate.