Beyond the standard policy, premium car insurance offers a world of enhanced protection and personalized service. This isn’t just about covering accidents; it’s about peace of mind and a significantly elevated driving experience. We delve into the key differentiators, exploring the comprehensive coverage, superior benefits, and overall value proposition that sets premium car insurance apart.

This exploration will cover the nuanced details of premium car insurance, from understanding its unique features and benefits to navigating the claims process and choosing the right policy for your specific needs. We’ll also address common concerns regarding cost and affordability, ensuring you have a clear understanding before making a decision.

Defining “Premium Car Insurance”

Premium car insurance offers a higher level of coverage and benefits compared to standard policies. It’s designed for drivers who want enhanced protection and a more personalized insurance experience, often reflecting the value and features of their vehicles. This enhanced protection extends beyond the basic requirements mandated by law.

Premium car insurance is distinguished from standard policies primarily by the breadth and depth of its coverage. While standard policies fulfill minimum legal requirements, premium options provide significantly more comprehensive protection against various risks. This includes higher coverage limits, broader definitions of covered events, and additional benefits not typically found in standard plans.

Key Features and Benefits of Premium Car Insurance

Premium car insurance typically includes a range of features and benefits tailored to meet the needs of high-value vehicle owners and those seeking enhanced peace of mind. These features go beyond the basic collision and liability coverage found in standard policies.

These benefits often include: higher liability limits, offering greater protection in case of an accident causing significant damage or injury; lower deductibles, reducing out-of-pocket expenses in the event of a claim; coverage for additional drivers, ensuring protection even when others are driving your vehicle; replacement cost coverage for a new vehicle, as opposed to diminished value coverage; concierge services, offering personalized assistance with roadside emergencies, vehicle maintenance, and other needs; and 24/7 claims assistance, ensuring prompt and efficient handling of any claims. Furthermore, some premium policies may offer coverage for specific types of damage or loss not typically included in standard plans.

Target Demographic for Premium Car Insurance

The target demographic for premium car insurance is relatively specific. It primarily caters to individuals who own high-value vehicles, such as luxury cars, sports cars, or classic cars. These vehicles often require specialized repair services and parts, resulting in higher repair costs. The policy’s higher coverage limits and benefits directly address these concerns. Beyond vehicle value, the target demographic also includes individuals who place a high value on personalized service, comprehensive coverage, and peace of mind, even if they do not own the most expensive vehicles. High-net-worth individuals, those with a history of careful driving, and those who prioritize convenience and seamless claims processing are also prime candidates.

Comparison of Premium and Standard Car Insurance

The following table provides a clear comparison between premium and standard car insurance policies across key aspects:

| Coverage | Cost | Benefits | Target Customer |

|---|---|---|---|

| Basic liability and collision, potentially limited coverage options. | Lower premiums. | Meets minimum legal requirements; limited additional benefits. | Drivers with older vehicles, budget-conscious drivers. |

| Comprehensive coverage, high liability limits, specialized coverage options (e.g., for classic cars). | Higher premiums. | Extensive protection, higher liability limits, lower deductibles, additional benefits (concierge services, etc.). | Owners of high-value vehicles, drivers prioritizing comprehensive coverage and personalized service. |

Coverage and Benefits of Premium Car Insurance

Premium car insurance offers a significantly enhanced level of protection and peace of mind compared to standard policies. It goes beyond the basic requirements, providing broader coverage and higher limits to safeguard you against a wider range of potential risks and financial burdens associated with car accidents or vehicle damage. This comprehensive approach ensures greater financial security and a more seamless claims process.

Premium car insurance distinguishes itself through a variety of unique coverage options and substantial benefits. These features are designed to cater to the specific needs of high-value vehicles, affluent individuals, and those seeking superior protection and service.

Unique Coverage Options

Premium car insurance packages often include coverage options not typically found in standard policies. For example, “Gap insurance” bridges the difference between the actual cash value of your vehicle and the outstanding loan amount in case of a total loss. Another valuable addition might be “New Car Replacement,” which replaces a totaled new car with a brand-new vehicle of the same make and model, regardless of depreciation. Furthermore, many premium plans incorporate coverage for roadside assistance, including towing, lockout service, and fuel delivery, offering immediate support in unexpected situations. Finally, some premium plans even offer coverage for rental car expenses while your vehicle is being repaired after an accident.

Advantages of Higher Coverage Limits and Broader Protection

Higher coverage limits in premium car insurance significantly reduce your out-of-pocket expenses in the event of an accident. For instance, a standard liability policy might only offer $25,000 per person and $50,000 per accident, leaving you vulnerable to substantial financial loss if you cause a serious accident resulting in high medical bills or property damage. Premium plans typically offer significantly higher limits, such as $100,000 or even $500,000 per person and $300,000 or more per accident. This enhanced protection offers considerable peace of mind, knowing that you are adequately covered even in the most severe scenarios. Similarly, broader protection extends to cover a wider array of events, including damage caused by natural disasters or vandalism, which are often excluded or have lower limits in standard plans.

Financial Benefits of Premium Car Insurance

Choosing premium car insurance can yield substantial financial benefits in the long run. The comprehensive coverage and higher limits translate directly into reduced financial risk and potential savings.

- Reduced Out-of-Pocket Expenses: Higher coverage limits mean you pay less after an accident.

- Lower Legal Costs: Robust liability coverage protects you against costly lawsuits.

- Faster Claims Processing: Premium insurers often provide expedited claims handling.

- Avoidance of Financial Ruin: Comprehensive coverage safeguards against catastrophic financial losses from major accidents.

- Potential for Discounts: Safe driving records and bundled insurance options can lead to premium discounts.

Non-Monetary Benefits of Premium Car Insurance

Beyond the financial advantages, premium car insurance often provides non-monetary benefits that enhance the overall experience.

- Enhanced Customer Service: Premium insurers typically offer dedicated customer service representatives who provide personalized support and assistance.

- Personalized Support: Expect more proactive communication and tailored advice from your insurer.

- Access to Specialized Services: Premium plans often include access to concierge services, such as 24/7 roadside assistance and specialized claims handling.

- Peace of Mind: Knowing you have comprehensive coverage and exceptional support reduces stress and anxiety associated with driving.

Cost and Affordability of Premium Car Insurance

Premium car insurance, while offering superior protection, naturally comes with a higher price tag than standard policies. Understanding the factors that influence this cost, and exploring strategies to manage expenses, is crucial for prospective buyers. This section will delve into the pricing dynamics of premium car insurance, comparing it to standard options and highlighting ways to make this valuable coverage more accessible.

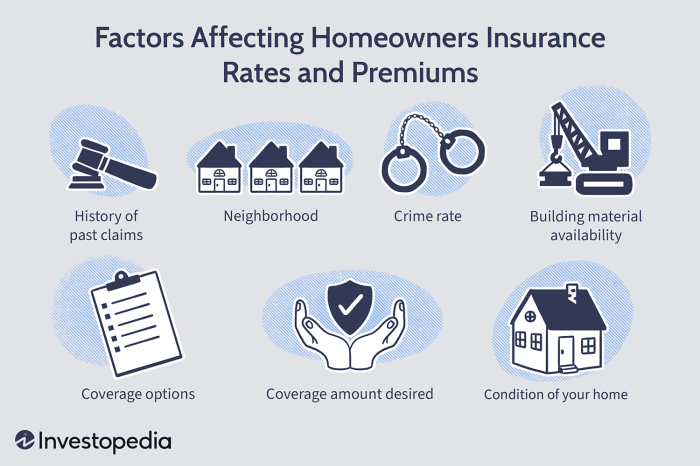

Factors Influencing the Cost of Premium Car Insurance

Several key factors determine the cost of a premium car insurance policy. These factors are often interconnected and influence the final premium calculation in complex ways. Understanding these factors empowers consumers to make informed decisions and potentially reduce their insurance costs.

These factors include, but are not limited to, the insured’s driving history (accidents, violations), age and experience, the type and value of the vehicle being insured, the coverage level selected (higher limits generally cost more), the location of the insured (urban areas often have higher rates due to increased risk), and the insurer’s risk assessment methodology. Specific add-ons like roadside assistance or rental car reimbursement also affect the final premium.

Comparison of Premium and Standard Car Insurance Pricing

Premium car insurance policies typically cost significantly more than standard policies. This is because they offer broader coverage, higher limits, and often include additional benefits not found in standard plans. For example, a standard policy might offer liability coverage with a relatively low limit, while a premium policy might provide significantly higher liability limits, along with comprehensive and collision coverage with higher deductibles. The difference in cost can vary considerably depending on the specific insurer, coverage levels, and the individual’s risk profile. A general estimate, based on industry averages, could show a premium policy costing anywhere from 30% to 70% more than a comparable standard policy. This is a broad range, and actual costs will vary greatly.

Cost-Saving Strategies for Premium Car Insurance

Despite the higher initial cost, several strategies can help individuals manage the expense of premium car insurance. These strategies often involve a balance between coverage and cost, focusing on obtaining the necessary protection while minimizing unnecessary expenditures.

These strategies include, but are not limited to, shopping around and comparing quotes from multiple insurers, maintaining a clean driving record to avoid surcharges, opting for higher deductibles (though this increases out-of-pocket costs in case of an accident), bundling insurance policies (home and auto), taking advantage of discounts offered by insurers (e.g., for good students, safe drivers, or those who install anti-theft devices), and considering the type and value of the vehicle carefully – choosing a less expensive car can significantly reduce premiums. It’s also important to review your policy annually to ensure you have the appropriate coverage and are not paying for unnecessary features.

Potential Cost Variations Based on Driver Profiles and Vehicle Types

The following table illustrates potential cost variations based on different driver profiles and vehicle types. These figures are illustrative examples and should not be considered definitive quotes. Actual costs will vary based on numerous factors and specific insurer pricing models.

| Driver Profile | Vehicle Type | Estimated Annual Premium (Premium Policy) |

|---|---|---|

| Young Driver (20 years old), Clean Record | Luxury Sedan (e.g., BMW 5 Series) | $2,500 – $3,500 |

| Experienced Driver (45 years old), Multiple Accidents | Luxury SUV (e.g., Range Rover) | $4,000 – $6,000 |

| Senior Driver (65 years old), Clean Record | Mid-size Sedan (e.g., Toyota Camry) | $1,800 – $2,800 |

| Young Driver (22 years old), Clean Record | Sports Car (e.g., Porsche 911) | $3,500 – $5,000 |

Claims Process and Customer Service

Premium car insurance distinguishes itself not only through comprehensive coverage but also via a streamlined claims process and superior customer service. The aim is to minimize stress and inconvenience during what can be a difficult time. This contrasts sharply with standard plans, which often involve longer wait times and less personalized support.

Premium insurers prioritize speed and efficiency in handling claims. This begins with readily available, multiple contact channels – phone, online portal, and even dedicated mobile apps – ensuring easy reporting.

Claims Process Efficiency

The claims process typically begins with a prompt initial assessment of the damage. Premium insurers often utilize advanced technology, such as AI-powered damage assessment tools, to expedite this stage. Following the initial assessment, a dedicated claims adjuster is assigned to the case, providing a single point of contact throughout the process. This contrasts with standard plans, where customers may interact with multiple representatives, leading to delays and confusion. From there, the insurer works swiftly to arrange repairs or replacement vehicles, often with preferred partnerships with reputable repair shops to further reduce wait times. Settlement is then processed promptly, with clear communication maintained at every step. For example, a high-value claim involving a luxury vehicle might see a dedicated team working around the clock to ensure a swift and efficient resolution. The insurer might also leverage specialized repair facilities to ensure the vehicle is restored to its pre-accident condition using original parts.

Customer Service Comparison

Premium car insurance offers a significantly enhanced customer service experience compared to standard plans. This typically involves dedicated claims representatives who are readily available to answer questions, provide updates, and advocate for the policyholder. Premium plans often include 24/7 customer support, allowing for immediate assistance regardless of the time of day or day of the week. This is in stark contrast to standard plans, which may have limited operating hours or longer wait times for customer service assistance. Premium insurers frequently provide proactive communication, keeping customers informed of the progress of their claim without the need for constant follow-up. This level of personalized attention and proactive communication significantly reduces customer stress and anxiety.

Support and Resources Offered

Premium car insurance customers typically have access to a wider range of support and resources than those with standard plans. This might include:

- 24/7 roadside assistance, including towing, lockout service, and fuel delivery.

- Rental car coverage during repairs, often with upgraded vehicle options.

- Access to a dedicated claims portal for online tracking of claim status and communication.

- Personalized concierge services to assist with various aspects of the claim process, such as arranging transportation or finding temporary accommodations.

These resources aim to alleviate the burden on the customer, minimizing disruption to their daily life.

Handling Complex or High-Value Claims

Premium insurers are equipped to handle complex or high-value claims with greater expertise and resources. They often have specialized teams of adjusters and investigators with extensive experience in dealing with high-value vehicles or complex accident scenarios. For instance, a claim involving a classic car might require the expertise of a specialist appraiser to accurately assess the vehicle’s value. In such cases, premium insurers may employ advanced investigation techniques to ensure a fair and accurate settlement. They also often have established relationships with specialized repair facilities and parts suppliers, ensuring that repairs are completed to the highest standards and in a timely manner. A case involving a multi-vehicle accident might involve dedicated legal counsel to manage any subsequent litigation. The commitment to resolving such complex scenarios efficiently demonstrates the value proposition of premium car insurance.

Epilogue

Ultimately, the decision to opt for premium car insurance hinges on individual needs and risk tolerance. While the cost may be higher than standard policies, the enhanced coverage, superior customer service, and potential for significant financial protection make it a compelling option for many drivers. By carefully weighing the benefits against the cost and understanding your personal circumstances, you can confidently choose the car insurance that best safeguards your investment and provides the peace of mind you deserve.

Top FAQs

What are the typical exclusions in premium car insurance policies?

While premium policies offer extensive coverage, exclusions may still apply, such as intentional acts, damage from wear and tear, or certain types of racing activities. Specific exclusions vary by insurer and policy; review your policy documents carefully.

Can I add additional drivers to my premium car insurance policy?

Yes, but adding drivers may influence your premium. Insurers typically assess the driving history and risk profile of all listed drivers when determining the overall cost of the policy.

How does the claims process differ for high-value vehicles under premium insurance?

Premium insurers often have dedicated claims teams for high-value vehicles, providing expedited service and potentially utilizing specialized repair facilities to ensure the vehicle is restored to its pre-accident condition.

What types of vehicles are typically insured under premium car insurance plans?

Premium car insurance is often sought for high-value vehicles, luxury cars, classic cars, and other vehicles with a significant monetary worth. However, some insurers may offer premium plans for a wider range of vehicles.