Planning for retirement often involves navigating complex financial landscapes, and healthcare costs are a significant consideration. Understanding the intricacies of New York State retiree health insurance premiums for 2024 is crucial for securing a comfortable and financially sound retirement. This guide provides a detailed overview of the various plan options, premium structures, and enrollment processes, empowering retirees to make informed decisions about their healthcare coverage.

This year brings notable changes to the NY State retiree health insurance program, impacting premium costs and available benefits. We’ll examine the factors influencing premium calculations, compare different plan offerings, and highlight potential cost-saving strategies. Furthermore, we’ll clarify the enrollment procedure, crucial deadlines, and resources available to assist retirees throughout the process. Our aim is to equip you with the knowledge necessary to select the most suitable plan and ensure a smooth transition into retirement.

Overview of NY State Retiree Health Insurance in 2024

Planning for retirement healthcare in New York State requires understanding the available options and associated costs. The New York State Health Insurance Program for retirees undergoes periodic adjustments, and 2024 is no exception. This overview details the changes implemented, the plan choices, eligibility requirements, and a cost comparison to aid in informed decision-making. Note that specific premium amounts and plan details are subject to final confirmation by the relevant authorities and may vary slightly.

NY State Retiree Health Insurance Program Changes for 2024

Several key changes to the NY State retiree health insurance program may have been implemented for 2024. These could include adjustments to premium costs, benefit packages, or eligibility criteria. It’s crucial to consult official sources, such as the New York State Retirement Systems website, for the most up-to-date and accurate information. For example, there might be modifications to prescription drug formularies or changes in the network of participating healthcare providers. These changes often reflect negotiations with insurance providers and adjustments to healthcare costs.

Available Plan Options for Retirees

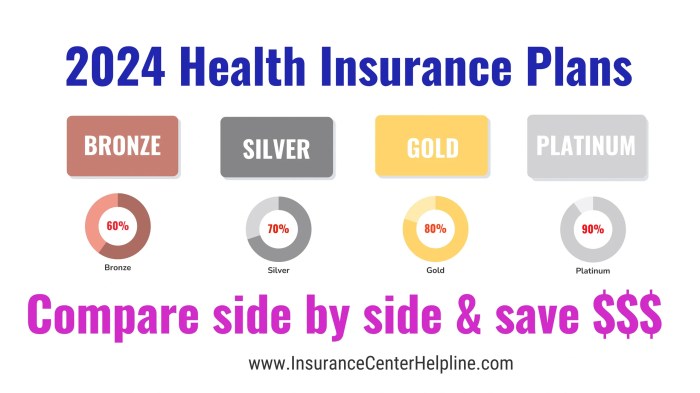

Retirees typically have access to a range of health insurance plans, each offering a different balance of premium costs and benefits. These plans might include options like HMOs (Health Maintenance Organizations), PPOs (Preferred Provider Organizations), and potentially other specialized plans. The specific plans available and their features vary depending on factors such as the retiree’s employment history and years of service.

Eligibility Criteria for Each Plan

Eligibility for each health insurance plan is determined by several factors. These commonly include the retiree’s years of service with the state, their retirement date, and possibly their age. Specific requirements for each plan are Artikeld in the official program documentation. For instance, a retiree might need a minimum number of years of service to qualify for a particular plan or may face different premium contributions based on their retirement age. It’s recommended to carefully review all eligibility requirements to ensure compliance.

Comparison of Plan Options

| Plan Name | Estimated Premium Cost (Monthly) | Key Benefits | Eligibility Requirements (Summary) |

|---|---|---|---|

| Example Plan A (HMO) | $250 | Comprehensive coverage, low out-of-pocket costs, specific network | 10+ years of service, age 62+ |

| Example Plan B (PPO) | $350 | Wider network of providers, higher out-of-pocket costs | 5+ years of service |

| Example Plan C (High Deductible) | $150 | Lower premiums, higher deductible and out-of-pocket maximum | All eligible retirees |

| Example Plan D (Medicare Supplement) | $400 | Supplement to Medicare coverage | Eligible for Medicare |

Premium Costs and Factors Affecting Premiums

Understanding the cost of your NY State retiree health insurance in 2024 is crucial for effective budget planning. Several factors contribute to the final premium amount, and this section will clarify how these premiums are calculated and what influences their variability.

Premium costs for NY State retirees in 2024 are determined through a complex process that considers several key variables. The state’s Office of Employee Relations, in conjunction with the health insurance carriers, establishes the base premium rates for each plan option. These rates reflect the projected cost of providing healthcare services to the retiree population throughout the year. The base rate is then adjusted based on individual factors, resulting in a personalized premium for each retiree.

Factors Influencing Individual Premium Amounts

Several individual factors influence the final premium amount. These factors are used to calculate an individual’s contribution to the overall cost of their health insurance plan. Age, for example, plays a significant role, as older retirees generally have higher healthcare costs. Similarly, the choice of plan (e.g., Empire Plan, etc.) directly impacts the premium, with more comprehensive plans naturally carrying higher premiums. Finally, whether a retiree chooses single or family coverage significantly impacts the premium cost, with family coverage being substantially more expensive. These factors are combined to create a personalized premium that reflects the individual’s expected healthcare needs and plan selection.

Comparison of Premium Costs Across Different Plan Options

The Empire Plan, a prominent option for NY State retirees, offers several tiers with varying levels of coverage and, consequently, premiums. A comparison of these tiers would show a clear correlation between the comprehensiveness of the plan and the associated cost. For instance, a higher-tier plan with lower out-of-pocket expenses would likely have a significantly higher premium than a lower-tier plan with a higher deductible and co-pays. While precise figures are subject to annual adjustments, the general trend of higher coverage correlating with higher premiums consistently holds true. This necessitates a careful assessment of individual healthcare needs and financial capabilities when selecting a plan.

Cost-Saving Measures Available to Retirees

Several strategies can help retirees manage their health insurance costs. For example, choosing a plan with a higher deductible and lower monthly premium can lead to significant savings if the retiree anticipates fewer healthcare needs. Another option is to carefully review the plan’s formulary to ensure prescribed medications are covered at the most favorable cost. Active participation in wellness programs offered by the plan may also lead to discounts or incentives. Finally, understanding and utilizing available resources, such as the plan’s website and customer service, can help retirees make informed decisions and maximize their benefits, leading to better cost management.

Resources and Support for Retirees

Navigating the complexities of health insurance can be challenging, especially during retirement. Fortunately, New York State offers a range of resources and support services designed to assist retirees in understanding their plan options, enrolling in coverage, and managing claims. These resources are crucial for ensuring a smooth transition into retirement and access to the necessary healthcare benefits.

The New York State Department of Civil Service plays a central role in providing information and support to retirees regarding their health insurance. Several other agencies and organizations also offer valuable assistance. Retirees can access a wealth of information through various channels, including dedicated websites, phone lines, and in-person assistance.

Contact Information for Relevant Agencies and Support Services

Several agencies provide crucial support for navigating retiree health insurance. The New York State Department of Civil Service offers comprehensive information on plan options, enrollment procedures, and premium payments. Their website provides detailed plan brochures, FAQs, and contact information for dedicated personnel who can answer specific questions. Additionally, the Office of Employee Relations within the relevant state agency often serves as a point of contact for retirees seeking assistance with their health insurance. Contact details, including phone numbers and email addresses, are readily available on the respective agency websites. Many counties also offer senior services departments that can provide additional support and guidance.

Resources Available to Assist Retirees with Understanding Plan Options

Understanding the nuances of different health insurance plans can be daunting. To aid retirees, the New York State Department of Civil Service provides comprehensive plan descriptions, outlining coverage details, benefits, and cost-sharing responsibilities for each plan. These descriptions are available in various formats, including printable brochures and online versions. Furthermore, they offer informational sessions and workshops, either in-person or online, that walk retirees through the available options. These sessions are often conducted by knowledgeable representatives who can answer questions and provide personalized guidance. Retirees can also access comparison tools on the website to analyze plans side-by-side based on their individual needs and preferences.

Support Services Offered to Help Retirees with Enrollment and Claims Processing

The enrollment process for retiree health insurance can be simplified with the assistance offered by the New York State Department of Civil Service. Dedicated staff are available to guide retirees through the online enrollment portal, providing assistance with completing forms and addressing any technical difficulties. They also offer phone support to answer questions and resolve issues during the enrollment period. For claims processing, retirees can find support through dedicated claim processing departments. These departments provide assistance with submitting claims, tracking their status, and resolving any discrepancies. Detailed instructions on submitting claims, along with frequently asked questions, are readily available on the relevant websites. The support services aim to streamline the claims process, minimizing any potential frustrations for retirees.

Epilogue

Securing appropriate health insurance during retirement is a vital step in financial planning. This comprehensive guide has provided an in-depth look at the intricacies of NYS retiree health insurance premiums for 2024, encompassing plan options, cost factors, enrollment procedures, and future considerations. By understanding the nuances of the program and utilizing the available resources, retirees can confidently choose a plan that aligns with their healthcare needs and budget, ensuring peace of mind during this important life transition. Careful review of the details presented here will be instrumental in making informed decisions that contribute to a secure and healthy retirement.

FAQ

What happens if I miss the enrollment deadline?

Missing the deadline may limit your plan choices or result in a delay in coverage. Contact the relevant agency immediately to explore available options.

Can I change my plan after enrollment?

Typically, plan changes are permitted only during specific open enrollment periods. Check the program guidelines for details.

Where can I find detailed plan comparisons?

The official NYS retirement website should offer detailed plan comparisons and benefit summaries. You may also contact the program administrators directly for clarification.

What if I have pre-existing conditions?

Most plans offer coverage for pre-existing conditions. However, it’s crucial to review the specific policy details of each plan to understand the extent of coverage.