Navigating the world of health insurance can feel like deciphering a complex code. While marketplace plans offer a centralized platform for comparing options, many individuals find themselves considering non-marketplace health insurance. This guide delves into the intricacies of non-marketplace health insurance premiums, exploring the factors that influence their cost and providing practical strategies for making informed decisions. We’ll examine the differences between marketplace and non-marketplace plans, highlighting key considerations for consumers seeking comprehensive coverage.

From understanding the various types of non-marketplace plans available – including individual and employer-sponsored options – to deciphering the often-confusing terminology found in policy documents, we aim to equip you with the knowledge needed to confidently assess your options and choose a plan that best suits your needs and budget. This exploration will include a detailed look at how factors such as age, location, health status, and plan features impact premium costs, offering a clearer picture of what influences the final price you pay.

Defining Non-Marketplace Health Insurance Premiums

Understanding non-marketplace health insurance premiums requires clarifying their distinction from plans offered through the Health Insurance Marketplace (often referred to as the exchange). While both provide health coverage, they differ significantly in how they’re purchased, regulated, and the types of coverage offered.

Non-marketplace health insurance plans are health insurance policies purchased outside of the government-facilitated Health Insurance Marketplaces established under the Affordable Care Act (ACA). These plans are not subject to the same regulations and subsidies as marketplace plans, leading to variations in coverage, cost, and eligibility requirements.

Types of Non-Marketplace Health Insurance

Non-marketplace plans encompass a range of options, primarily categorized by how they are obtained. The most common types include individual plans and employer-sponsored plans.

Individual Plans: These are purchased directly from an insurance company by individuals or families. They offer more flexibility in plan selection but often come with higher premiums than marketplace plans, particularly for those who don’t qualify for subsidies. For example, a self-employed individual might opt for an individual plan to secure health coverage independent of an employer.

Employer-Sponsored Plans: These plans are offered by employers as a benefit to their employees. The employer typically contributes a portion of the premium, and employees may choose from a range of plans offered by the employer. These plans often provide more comprehensive coverage than individual plans and are usually less expensive due to group purchasing power. A large corporation, for instance, might offer several different employer-sponsored health insurance options to its workers, ranging from HMOs to PPOs.

Coverage Differences Between Marketplace and Non-Marketplace Plans

A key distinction lies in the subsidies and regulations. Marketplace plans, for eligible individuals, often receive government subsidies to lower the cost of premiums. Non-marketplace plans do not typically offer such subsidies. Furthermore, marketplace plans must adhere to specific requirements set by the ACA, guaranteeing minimum essential health benefits (like maternity care, mental health services, and prescription drug coverage). Non-marketplace plans may offer different levels of coverage and may not include all essential health benefits. For example, a marketplace plan is mandated to cover preventative care with no cost-sharing, while a non-marketplace plan might require a copay or deductible for the same services. Additionally, marketplace plans typically have stricter regulations regarding pre-existing conditions, guaranteeing coverage regardless of health status, whereas non-marketplace plans may have more restrictive policies.

Factors Influencing Non-Marketplace Premiums

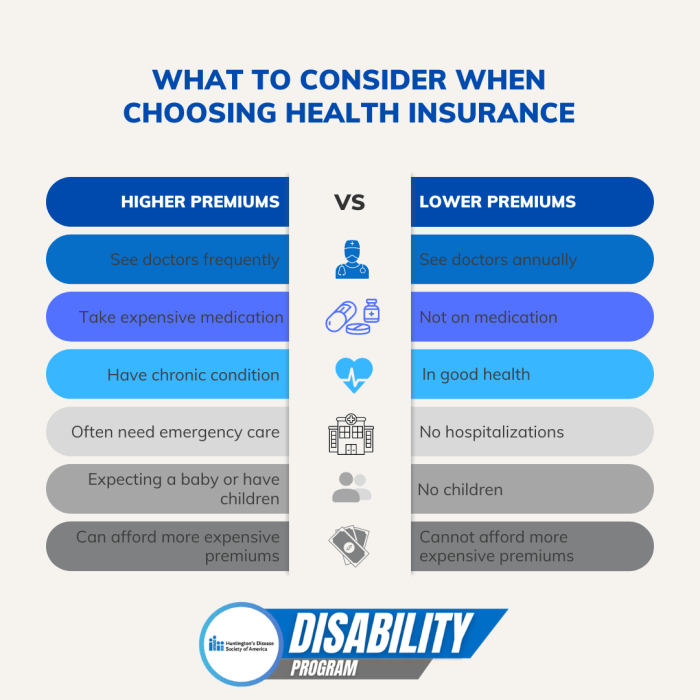

Non-marketplace health insurance premiums are determined by a complex interplay of factors, making it crucial to understand these influences to make informed choices. Several key elements contribute to the final cost, ranging from individual characteristics to the specifics of the insurance plan itself and the insurer’s operational expenses.

Demographic Factors Impacting Premiums

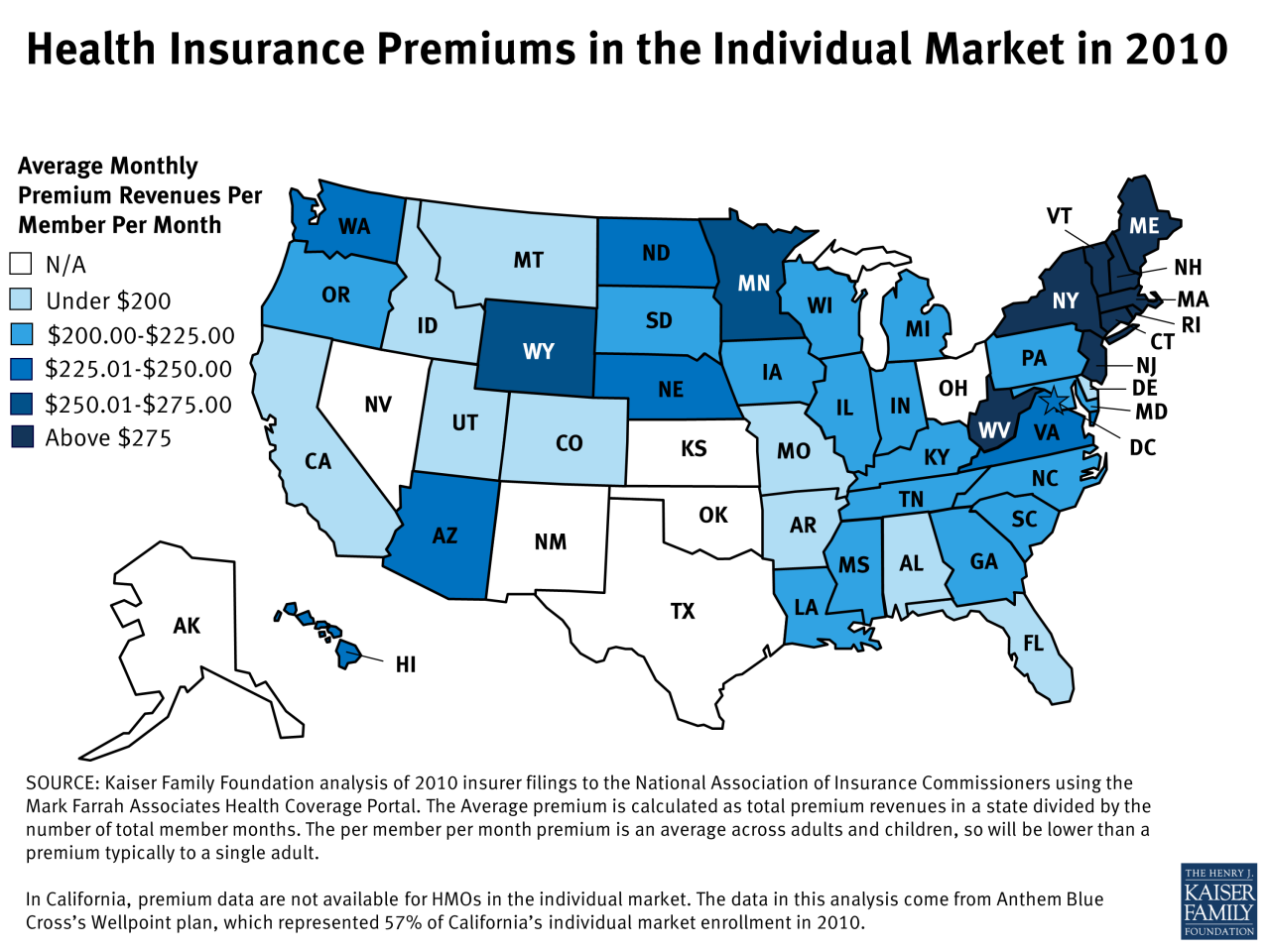

Age, geographic location, and individual health status significantly affect non-marketplace health insurance premiums. Older individuals generally pay more due to a higher likelihood of needing medical care. Location influences premiums due to variations in healthcare costs; areas with high healthcare provider salaries and a high concentration of specialists tend to have higher premiums. Pre-existing conditions and overall health status also play a critical role; individuals with pre-existing conditions or a history of significant medical expenses will likely face higher premiums. Insurers assess risk based on these factors, adjusting premiums accordingly.

The Role of Plan Features in Premium Determination

The features of a non-marketplace health insurance plan directly influence the premium cost. Higher deductibles, which represent the amount an individual must pay out-of-pocket before insurance coverage begins, generally result in lower premiums. Conversely, lower deductibles lead to higher premiums. Similarly, co-pays (the fixed amount paid for each medical visit) and out-of-pocket maximums (the most an individual will pay in a year) impact premiums. Plans with lower co-pays and out-of-pocket maximums typically have higher premiums, reflecting the greater financial protection they offer.

Insurer Profitability and Administrative Costs

Insurer profitability and administrative costs are factored into premium calculations. Insurers need to cover their operational expenses, including claims processing, administrative staff salaries, and marketing costs. Furthermore, they must generate a profit to remain financially viable. These costs are ultimately reflected in the premiums charged to policyholders. A highly profitable insurer might have slightly lower premiums compared to one with lower profit margins, assuming all other factors are equal. Similarly, insurers with highly efficient administrative processes may offer slightly lower premiums than those with less efficient operations.

Comparison of Premium Factors Across Non-Marketplace Plan Types

| Plan Type | Age Bracket | Location | Average Premium (Example) |

|---|---|---|---|

| Individual PPO | 30-39 | Rural Area | $400/month |

| Individual HMO | 30-39 | Urban Area | $550/month |

| Family PPO | 40-49 with 2 children | Suburban Area | $1500/month |

| Family HMO | 40-49 with 2 children | Urban Area | $1800/month |

Accessing and Understanding Non-Marketplace Premium Information

Securing affordable and suitable health insurance can be a complex process, particularly when navigating the options outside of the government-facilitated marketplaces. Understanding how to obtain and interpret information about non-marketplace premiums is crucial for making informed decisions about your healthcare coverage. This section Artikels methods for obtaining premium quotes and deciphering the often-complex language of non-marketplace insurance plan documents.

Obtaining premium quotes from non-marketplace insurers involves several avenues. Directly contacting insurance companies is a common approach. Many insurers have user-friendly websites with online quote tools allowing individuals to input relevant information (age, location, desired coverage level) to receive personalized premium estimates. Insurance brokers can also be invaluable resources. They act as intermediaries, comparing plans from multiple insurers to find the best fit for individual needs and budgets. Finally, some employers offer non-marketplace group health insurance plans, providing employees with access to specific plans and premium information through their human resources department.

Methods for Obtaining Non-Marketplace Premium Quotes

Individuals can obtain premium quotes through several channels. Directly contacting insurance companies via their websites or phone lines provides access to online quote tools or personalized assistance from representatives. Utilizing the services of an independent insurance broker offers a broader comparison of plans from various insurers. Employers sometimes offer group health insurance plans outside the marketplace, providing employees with access to specific plan details and premium information.

Navigating Non-Marketplace Insurance Plan Documents

Understanding the information presented in a non-marketplace health insurance plan document requires a systematic approach. A step-by-step guide can simplify this process. First, review the Summary of Benefits and Coverage (SBC). This document provides a concise overview of the plan’s key features, including covered benefits, cost-sharing details (deductibles, copayments, coinsurance), and out-of-pocket maximums. Next, carefully examine the plan’s Certificate of Insurance (COI). This document contains the specific terms and conditions of the policy, including details about eligibility, coverage limitations, and renewal provisions. Finally, refer to the provider directory to identify in-network healthcare providers. This ensures you understand which doctors and hospitals are covered under the plan and the associated cost-sharing responsibilities.

Interpreting Key Terms and Conditions in Non-Marketplace Plan Documents

Several key terms are frequently encountered in non-marketplace health insurance plan documents. Understanding these terms is crucial for making informed decisions. The deductible represents the amount an individual must pay out-of-pocket before the insurance coverage begins. Copayments are fixed amounts paid for each medical service, while coinsurance is a percentage of the cost shared between the individual and the insurer after the deductible has been met. The out-of-pocket maximum is the highest amount an individual will pay for covered services in a given plan year. Understanding these terms allows individuals to accurately estimate their potential healthcare expenses under a given plan. For example, a plan with a $1,000 deductible, $20 copay for doctor visits, and a 20% coinsurance rate after the deductible means that an individual would pay $1,000 initially, then $20 per visit, and 20% of the remaining cost for covered services after the deductible is met. The out-of-pocket maximum sets a limit on the total amount the individual will pay.

Comparison of Non-Marketplace Premiums Across Insurers

Choosing a health insurance plan outside the Health Insurance Marketplace can offer various options, but comparing premiums across different insurers requires careful consideration. Understanding the factors that influence these costs is crucial for making an informed decision.

Premium costs for similar plans can vary significantly between insurers, even within the same geographic area. This variation stems from a number of interconnected factors.

Factors Contributing to Premium Cost Variations

Several key factors contribute to the differences in non-marketplace health insurance premiums offered by various insurers. These factors influence the overall cost of providing coverage and, consequently, the premiums charged to consumers.

- Insurer Profit Margins: Insurers have different business models and profit targets. Some may prioritize higher profits, leading to higher premiums, while others may opt for lower profit margins to attract more customers.

- Administrative Costs: The expenses involved in managing the insurance plan, including claims processing, customer service, and marketing, vary among insurers. Higher administrative costs often translate into higher premiums.

- Risk Assessment and Underwriting: Insurers assess the risk associated with insuring a particular population. Factors such as the health status of the insured group and the prevalence of specific conditions in a geographic area can influence premium calculations.

- Network Size and Provider Relationships: Insurers negotiate rates with healthcare providers (doctors, hospitals). A larger, more comprehensive network generally leads to higher premiums, as the insurer pays more to include a wider range of providers. Conversely, a smaller, more limited network may offer lower premiums, but potentially less choice for consumers.

- Plan Benefits and Coverage: The specific benefits and coverage offered by a plan directly impact the premium. Plans with more comprehensive benefits and lower out-of-pocket costs will typically have higher premiums than plans with more limited coverage.

Examples of Insurer Network Impact on Healthcare Costs

The insurer’s network of healthcare providers significantly impacts an individual’s overall healthcare costs.

- Scenario 1: Limited Network Plan. Imagine a plan with a smaller network, offering lower premiums. If your preferred doctor or specialist is not in that network, you’ll pay significantly more out-of-pocket for their services, potentially negating the initial premium savings.

- Scenario 2: Extensive Network Plan. A plan with a broader network might have higher premiums, but offers greater flexibility in choosing providers. This can lead to lower out-of-pocket expenses if you can easily access in-network specialists and facilities.

Premium Comparison Example: A Hypothetical Scenario

Let’s consider a hypothetical example in the Denver, Colorado area for a 40-year-old non-smoker seeking a Bronze level plan.

| Insurer | Monthly Premium | Network Size (Approximate) | Notes |

|---|---|---|---|

| Insurer A | $350 | Small | Limited provider choices, potentially higher out-of-pocket costs. |

| Insurer B | $420 | Medium | Good balance between provider choice and premium cost. |

| Insurer C | $480 | Large | Extensive provider network, potentially lower out-of-pocket costs. |

Note: These figures are purely hypothetical and for illustrative purposes only. Actual premiums will vary based on individual circumstances and plan specifics.

Closing Summary

Ultimately, understanding non-marketplace health insurance premiums requires a multifaceted approach. By carefully considering the factors influencing costs, diligently comparing plans from different insurers, and actively engaging with the information provided in policy documents, individuals can make well-informed choices. This guide serves as a starting point for this process, empowering you to navigate the complexities of health insurance and secure the coverage that best protects your health and financial well-being. Remember to consult with a qualified insurance professional for personalized guidance.

Query Resolution

What is the difference between a deductible and a copay?

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A copay is a fixed fee you pay for a doctor’s visit or other service.

Can I change my non-marketplace health insurance plan during the year?

Generally, you can only change your non-marketplace plan during the annual open enrollment period, unless you experience a qualifying life event (e.g., marriage, job loss).

What does “out-of-pocket maximum” mean?

The out-of-pocket maximum is the most you’ll pay for covered healthcare services in a plan year. Once you reach this limit, your insurance company covers 100% of your costs for covered services.

Where can I find information about my insurer’s network of doctors and hospitals?

Your insurance policy documents or your insurer’s website should provide a directory of in-network providers.