Securing your family’s financial well-being is a paramount concern, and understanding the costs associated with whole life insurance is a crucial step in that process. This comprehensive guide delves into the intricacies of the New York Life Whole Life Insurance Premium Calculator, empowering you to navigate the complexities of life insurance planning with confidence and clarity. We’ll explore the factors influencing premium calculations, guide you through using the online calculator, and compare whole life insurance with alternative options.

From understanding the impact of age and health on premiums to navigating policy riders and deciphering policy documents, we aim to provide a clear and accessible resource for anyone considering New York Life whole life insurance. This guide equips you with the knowledge necessary to make informed decisions about protecting your loved ones’ financial future.

Understanding Whole Life Insurance Premiums

Choosing a whole life insurance policy from New York Life involves understanding the factors that determine your premiums. These premiums, unlike term life insurance, remain level throughout your life, offering lifelong coverage. However, the initial premium amount varies based on several key factors.

Factors Influencing New York Life Whole Life Insurance Premium Calculations

Several key factors influence the calculation of your New York Life whole life insurance premium. These factors are carefully considered to ensure the premium accurately reflects the risk associated with providing lifelong coverage. Age is a primary determinant, with younger applicants typically receiving lower premiums due to their longer life expectancy. Health status, including pre-existing conditions and lifestyle choices, plays a significant role, as healthier individuals present a lower risk to the insurer. The amount of coverage desired also directly impacts premiums; larger death benefits necessitate higher premiums. Finally, the policy’s specific features, such as riders or additional benefits, can influence the overall cost.

Guaranteed and Non-Guaranteed Premiums

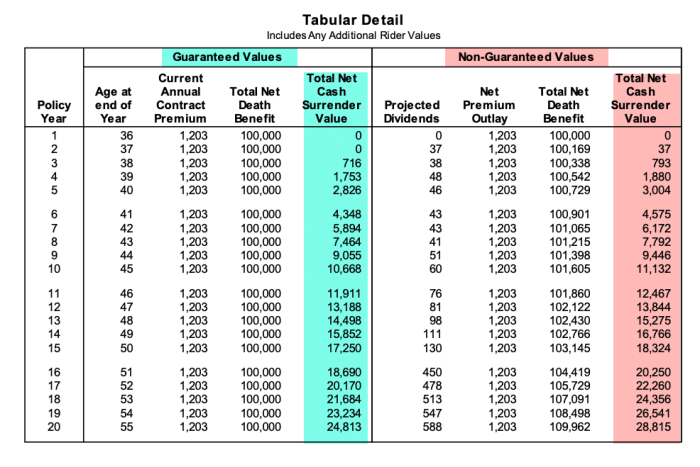

New York Life whole life insurance policies typically feature a guaranteed premium structure for a portion of the premium. This guaranteed portion ensures your premium will not increase over time, providing financial predictability. However, some policy components may include non-guaranteed elements, such as dividends. These non-guaranteed components are not part of the fixed premium and are dependent on the company’s investment performance and other factors. It’s important to understand that while the guaranteed premium remains constant, the total out-of-pocket cost may vary depending on dividend payouts. These dividends are not guaranteed and can fluctuate annually.

Components of a Whole Life Insurance Premium

A whole life insurance premium comprises several key components. A significant portion covers the cost of death benefit protection, reflecting the insurer’s risk assessment. Administrative costs, including policy maintenance and management, also contribute to the premium. Furthermore, a portion of the premium goes towards building the policy’s cash value component, which grows tax-deferred over time. This cash value accumulation is a distinguishing feature of whole life insurance and contributes to the overall premium. The specific allocation among these components may vary based on the policy type and the insured’s circumstances.

Comparison of New York Life Whole Life Insurance Premium Structures

The following table illustrates a simplified comparison of premium structures for different New York Life whole life insurance policies. Note that these are illustrative examples and actual premiums will vary depending on individual circumstances.

| Policy Type | Age at Issue | Face Amount | Approximate Annual Premium |

|---|---|---|---|

| Guaranteed Universal Life | 35 | $500,000 | $3,000 – $4,000 |

| Traditional Whole Life | 35 | $500,000 | $4,500 – $6,000 |

| Variable Universal Life | 35 | $500,000 | $3,500 – $5,000 |

| Adjustable Whole Life | 35 | $500,000 | $4,000 – $5,500 |

Using the New York Life Whole Life Insurance Premium Calculator

The New York Life online premium calculator provides a convenient way to estimate the cost of a whole life insurance policy. This tool simplifies the process of understanding potential premiums, allowing individuals to explore different coverage options and plan accordingly. Navigating the calculator effectively requires understanding the necessary input and interpreting the output.

The calculator streamlines the process of obtaining a preliminary premium estimate. It’s important to remember that this is an estimate, and the final premium will be determined during the formal application process after a thorough underwriting review.

Information Required for Premium Estimation

To obtain a premium estimate using the New York Life whole life insurance premium calculator, you will need to provide several key pieces of information. This data allows the calculator to generate a personalized estimate based on your individual circumstances. Accurate input is crucial for receiving a reliable estimate.

The calculator typically requests information such as age, gender, desired death benefit amount, and the desired policy type (e.g., level term, variable universal life, etc.). Additional information may include your health status (this may be simplified to a general health assessment rather than detailed medical records at this stage), smoking status, and potentially occupation. The more detailed the information provided, the more accurate the premium estimate will be.

Step-by-Step Guide to Using the Calculator

The online calculator usually follows a straightforward process. First, you will navigate to the New York Life website and locate the premium calculator tool. This is often found within the insurance products section. Then, you will be presented with a series of fields to fill out.

The steps typically involve: (1) Entering your personal details (age, gender, etc.), (2) Specifying the desired death benefit, (3) Selecting the type of whole life policy, (4) Providing information about your health and lifestyle, and (5) Submitting your information to receive a premium estimate. After submitting your information, the calculator will process the data and provide an estimated premium. It is advisable to review the estimate carefully and consult with a New York Life agent for personalized advice.

Potential Challenges in Using the Calculator

While generally user-friendly, some challenges might arise when using the New York Life whole life insurance premium calculator. Understanding these potential difficulties can help users navigate the process more smoothly.

Users might encounter difficulties understanding the terminology used, especially if they lack prior experience with insurance. Inaccurate or incomplete data entry can lead to inaccurate premium estimates. The calculator may not accommodate all specific circumstances, particularly those involving complex health conditions or unusual occupational hazards. Finally, relying solely on the calculator’s estimate without consulting a financial advisor can lead to uninformed decisions.

Flowchart Illustrating the Premium Quote Process

Imagine a flowchart with rectangular boxes representing steps and diamond shapes for decision points.

The flowchart would start with a box labeled “Access New York Life’s Whole Life Insurance Premium Calculator.” This leads to a diamond: “Have you gathered all necessary information (age, gender, desired death benefit, etc.)?”. A “yes” branch leads to a box: “Enter information into the calculator.” A “no” branch leads back to a box: “Gather required information.” The “Enter information into the calculator” box leads to a box: “Submit information.” This leads to a diamond: “Is the estimate satisfactory?”. A “yes” branch leads to a box: “Review and record estimate.” A “no” branch could lead to a box: “Adjust input parameters and resubmit.” Finally, both “Review and record estimate” and “Adjust input parameters and resubmit” lead to a final box: “Consult with a New York Life agent for personalized advice.”

Policy Riders and Their Impact on Premiums

Adding riders to your New York Life whole life insurance policy can enhance its coverage, but it’s crucial to understand how these additions affect your premiums. Riders provide supplemental benefits beyond the core death benefit, offering protection against specific risks or adding financial flexibility. However, this added protection comes at a cost, increasing your overall premium payments.

Rider Cost Increases

The cost of a rider depends on several factors, including your age, health, the type of rider, and the benefit amount you select. Generally, the higher the benefit amount and the greater the risk covered, the more significant the premium increase. For example, adding a long-term care rider, which helps cover expenses related to long-term care services, will typically increase premiums more substantially than adding an accidental death benefit rider, which simply doubles the death benefit in the event of an accident. These increases are calculated individually for each rider and added to your base whole life insurance premium.

Examples of Riders and Associated Costs

Let’s consider a few common riders and their potential impact. Suppose a 40-year-old individual purchases a $500,000 whole life policy. Adding a long-term care rider with a daily benefit of $150 might increase their annual premium by $500 to $1000, depending on the specific terms. Conversely, adding an accidental death benefit rider that doubles the death benefit to $1,000,000 might only increase the annual premium by $100 to $200. These are illustrative examples; actual costs vary based on the factors mentioned earlier. A waiver of premium rider, which covers premiums if you become disabled, would also increase premiums, but the amount varies significantly based on your health and underwriting.

Selecting Riders and Understanding Cost Impact

The process of selecting riders involves carefully considering your individual needs and financial situation. Your New York Life agent can help you assess your risk tolerance and explain the various riders available. They will provide you with a detailed illustration showing how each rider impacts your premiums and overall policy cost. It’s crucial to understand the trade-off between the added protection and the increased premium payments before making a decision. Remember to carefully review the policy documents and ask questions until you fully understand the implications of adding any rider.

Available Riders, Features, and Premium Increase

| Rider Type | Features | Expected Premium Increase (Illustrative Example) | Notes |

|---|---|---|---|

| Long-Term Care Rider | Provides funds for long-term care services | $500 – $1500 annually (depending on benefit amount and age) | Significant premium increase due to high risk |

| Accidental Death Benefit Rider | Doubles the death benefit in case of accidental death | $100 – $300 annually (depending on policy face value) | Relatively small premium increase compared to other riders |

| Waiver of Premium Rider | Waives future premiums if you become totally disabled | Variable, depending on health and underwriting | Premium increase depends on individual risk assessment |

| Guaranteed Insurability Rider | Allows you to increase your coverage amount at certain intervals without a medical exam | Small annual increase, but cumulative effect over time | A small premium increase now can prevent larger increases later. |

Conclusion

Planning for the future requires careful consideration of various factors, and life insurance plays a vital role in securing financial stability for your family. By understanding the mechanics of the New York Life Whole Life Insurance Premium Calculator and the elements that influence premium costs, you can confidently assess your insurance needs and choose a policy that aligns with your financial goals. Remember, proactive planning is key to securing a brighter future for yourself and your loved ones.

Helpful Answers

What types of whole life insurance policies does New York Life offer?

New York Life offers various whole life insurance policies with differing features and premium structures. It’s best to consult their website or an agent for specific details.

Can I get a premium quote without providing personal information?

While some online calculators offer basic estimates, a precise quote from New York Life usually requires providing personal information like age, health status, and desired death benefit.

What happens if my health changes after I purchase a policy?

Your premiums are generally locked in once the policy is issued. However, significant health changes may impact future rider additions or policy changes. Consult your policy documents or a New York Life representative.

How often are whole life insurance premiums paid?

Premiums are typically paid annually, but other payment options like semi-annually, quarterly, or monthly might be available. The specific options will depend on the policy and your preference.