Navigating the world of motor insurance can feel like deciphering a complex code. Understanding your motor insurance premium is crucial, not just for budgeting, but for ensuring you have the right coverage at the right price. This guide unravels the factors influencing your premium, from your driving history and vehicle type to your location and chosen policy add-ons. We’ll explore how different insurers assess risk and offer practical strategies to potentially lower your costs.

We’ll delve into the components of your premium, comparing different coverage options and highlighting the impact of seemingly small choices. Through illustrative examples and clear explanations, we aim to empower you with the knowledge to make informed decisions about your motor insurance, ensuring you receive the best value for your money.

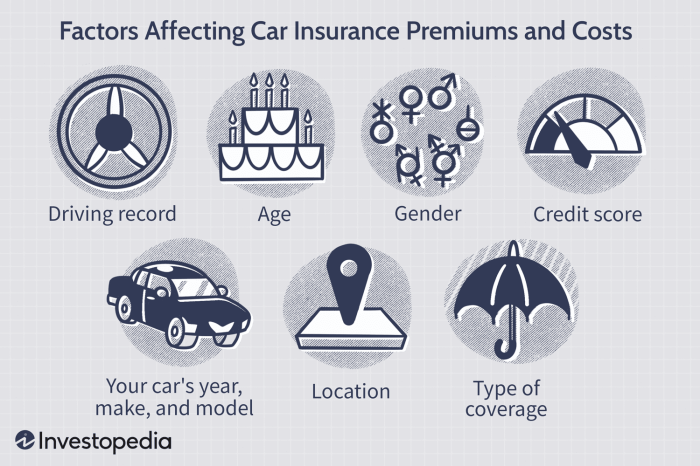

Factors Influencing Motor Insurance Premiums

Understanding the factors that determine your motor insurance premium is crucial for securing the best possible coverage at a competitive price. Several key elements contribute to the final cost, and being aware of these can help you make informed decisions about your policy.

Age and Driving Experience

Your age and driving experience significantly impact your premium. Younger drivers, particularly those with less than three years of driving experience, are statistically more likely to be involved in accidents. Insurance companies reflect this higher risk by charging higher premiums. As you gain more driving experience and reach a certain age (typically around 25), your premium generally decreases, reflecting the reduced risk associated with increased experience and maturity. For example, a 20-year-old driver with a clean driving record might pay significantly more than a 40-year-old driver with a similar record.

Vehicle Type and Value

The type and value of your vehicle are major factors in determining your premium. High-performance cars, luxury vehicles, and those with a high theft or accident rate typically attract higher premiums due to their increased repair costs and higher likelihood of claims. Conversely, smaller, less expensive vehicles generally result in lower premiums. For instance, insuring a sports car will be considerably more expensive than insuring a compact economy car, even if both drivers have similar profiles.

Geographical Location

Insurance premiums vary considerably depending on your location. Areas with higher crime rates, more traffic congestion, and a greater frequency of accidents typically have higher premiums. Urban areas often have higher premiums than rural areas due to the increased risk of accidents and theft. A driver in a densely populated city center might pay more than a driver in a quiet suburban area, even with identical driving records and vehicles.

Claims History

Your claims history is a crucial factor in determining your premium. Making claims, especially multiple claims, significantly increases your premium. Insurance companies view a history of claims as an indicator of higher risk. For example, a driver who has made two claims in the past three years will likely face a much higher premium than a driver with a clean claims history. Conversely, maintaining a clean record often leads to discounts and lower premiums over time.

Policy Add-ons and Coverage Levels

The level of coverage you choose and any add-ons you select will impact your premium. Comprehensive coverage, which protects against a wider range of events, is generally more expensive than third-party liability coverage. Adding optional extras such as roadside assistance or breakdown cover will also increase your premium. Choosing higher coverage limits for liability or other aspects will also result in a higher premium.

Premium Comparison for Different Driver Profiles

| Driver Profile | Age | Driving Experience (Years) | Estimated Annual Premium |

|---|---|---|---|

| Young Driver | 20 | 1 | $1500 |

| Experienced Driver | 45 | 25 | $800 |

| Mid-Career Driver | 35 | 15 | $1000 |

| Senior Driver | 65 | 45 | $900 |

Understanding Policy Components and their Pricing

Understanding the different components of your motor insurance premium is crucial for making informed decisions and securing the best value for your money. A breakdown of these components helps you understand why your premium is what it is and allows you to potentially adjust your coverage to suit your needs and budget.

A typical motor insurance premium is composed of several key elements. These elements are often calculated using complex algorithms that consider a range of factors, as discussed previously. However, understanding the basic components provides a clearer picture of the overall cost.

Third-Party Liability Coverage Costs

Third-party liability coverage protects you against financial losses resulting from accidents you cause that injure or damage another person’s property. The cost of this coverage is primarily determined by the perceived risk associated with the policyholder. Factors such as the driver’s age, driving history (including accidents and convictions), the type of vehicle, and the location where the vehicle is primarily driven all contribute to the risk assessment and subsequent premium. Higher-risk profiles, such as young drivers with a poor driving record, typically result in higher premiums for third-party liability coverage. For example, a young driver with several speeding tickets might pay significantly more than an older driver with a clean driving record for the same level of coverage.

Comprehensive versus Third-Party, Fire, and Theft Coverage Pricing

Comprehensive coverage provides broader protection than third-party, fire, and theft coverage. While third-party, fire, and theft insurance covers damage to other people’s property and your vehicle in the event of fire or theft, comprehensive coverage extends this to cover damage to your own vehicle, regardless of fault. Consequently, comprehensive insurance premiums are generally higher than third-party, fire, and theft premiums. The difference reflects the increased risk the insurer undertakes in covering a wider range of potential losses. A hypothetical example would be comparing the cost of comprehensive insurance on a new luxury car versus the cost of third-party, fire, and theft on an older, less valuable vehicle – the comprehensive policy would be substantially more expensive.

No-Claims Bonus Impact on Premiums

No-claims bonuses (NCBs) reward drivers who have not made a claim on their insurance policy for a specified period. The longer a driver maintains a clean claim history, the larger their NCB becomes, leading to a significant reduction in their premium. Insurers often provide escalating discounts based on the number of claim-free years. For instance, a driver with five consecutive years without a claim might receive a 50% discount, while a driver with ten years might receive a 65% discount. Conversely, making a claim usually results in the loss of all or part of the accumulated NCB, leading to a higher premium in the following year.

Policy Add-ons and their Cost

Policy add-ons provide supplementary coverage beyond the standard policy. These additions can enhance the overall protection and convenience offered by the insurance, but they come at an additional cost.

The following is a list of common add-ons and their typical impact on the premium:

- Roadside Assistance: This covers breakdowns and provides services like towing, tire changes, and jump starts. The cost varies depending on the level of coverage provided. Expect a moderate increase in your premium.

- Legal Protection: This offers legal assistance in case of an accident, including representation and legal fees. This typically adds a moderate to significant cost to the premium.

- Courtesy Car: Provides a replacement vehicle while your car is being repaired after an accident. This add-on can significantly increase the premium.

- Windscreen Repair/Replacement: Covers the cost of repairing or replacing your windscreen. This is usually a relatively inexpensive add-on.

Comparison of Motor Insurance Providers

Choosing the right motor insurance provider can significantly impact your overall cost. Understanding the pricing strategies and risk assessment methods employed by different insurers is crucial for making an informed decision. This section compares the approaches of three major providers, illustrating how their methods affect premiums.

Pricing Strategies of Major Insurers

Major motor insurance providers utilize diverse pricing strategies, often incorporating sophisticated actuarial models and vast datasets. For example, Company A might heavily weigh driving history and claims frequency, resulting in higher premiums for drivers with a history of accidents. Company B, on the other hand, may place greater emphasis on vehicle type and security features, offering lower premiums for vehicles equipped with advanced safety technologies. Company C could adopt a more balanced approach, considering a wider range of factors, including credit score and location, in their pricing algorithms. These differing priorities reflect varying risk appetites and business models.

Risk Assessment and Pricing

Insurers assess risk through a variety of methods. Consider the example of a young driver with a new sports car. Company A, focusing on driving history, might assign a high-risk profile due to the driver’s inexperience, leading to a substantial premium. Company B, emphasizing vehicle type, might also charge a high premium due to the car’s higher repair costs and theft potential. However, Company C, with its more balanced approach, might offer a slightly more competitive rate if the driver has a good credit score and lives in a low-crime area. This illustrates how the same individual can receive significantly different quotes depending on the insurer’s specific risk assessment criteria.

Premium Comparison Table

The following table provides a hypothetical comparison of premiums for a standard policy across three providers (Company A, Company B, and Company C). Note that these figures are illustrative and actual premiums will vary based on individual circumstances.

| Insurer | Annual Premium | Discounts Available | Final Premium (with discounts) |

|---|---|---|---|

| Company A | $1200 | Safe Driver Discount (15%) | $1020 |

| Company B | $1000 | Multi-car Discount (10%) | $900 |

| Company C | $1100 | Online Payment Discount (5%) | $1045 |

Impact of Discounts and Promotions

Discounts and promotions can substantially reduce the final premium. As shown in the table above, a safe driver discount, multi-car discount, or an online payment discount can significantly lower the cost. Insurers often offer these incentives to attract and retain customers, and understanding these options is crucial for securing the best possible rate. For example, bundling home and auto insurance with Company B could potentially unlock additional discounts, further reducing the overall cost. It’s essential to carefully review the terms and conditions of each discount to ensure eligibility.

Epilogue

Securing the right motor insurance at a competitive price requires careful consideration of various factors. By understanding the intricacies of premium calculation, comparing providers, and employing strategic cost-saving measures, you can effectively manage your insurance expenses. Remember, proactive planning and informed decision-making are key to obtaining optimal value and peace of mind.

Query Resolution

What is a no-claims bonus, and how does it affect my premium?

A no-claims bonus (NCB) is a discount offered by insurers for each year you drive without making a claim. The discount increases with each claim-free year, leading to significantly lower premiums over time.

Can my credit score impact my motor insurance premium?

In some regions, insurers may consider your credit score as an indicator of risk. A poor credit score might lead to higher premiums, while a good score could potentially result in lower ones.

How often can I review my motor insurance policy?

You can typically review and potentially adjust your motor insurance policy annually at renewal time. It’s advisable to compare quotes from different insurers each year to ensure you’re getting the best deal.

What happens if I change my car?

Changing your car will necessitate updating your insurance policy. The insurer will reassess your risk based on the new vehicle’s specifications, value, and security features, potentially affecting your premium.