Navigating the complexities of homeownership often involves understanding the intricacies of mortgage insurance. Many homeowners are unaware that, under certain circumstances, the premiums paid for this insurance might be deductible from their taxes. This can lead to significant savings, reducing the overall financial burden of homeownership. This guide will explore the eligibility criteria, calculation methods, and necessary documentation for claiming this valuable tax deduction, empowering you to maximize your tax benefits.

Understanding the deductibility of mortgage insurance premiums requires a careful examination of several factors, including your mortgage type, income level, and the specific tax laws applicable in your region. This guide will provide a clear and concise overview of these factors, along with practical examples and illustrative scenarios to help you determine your eligibility and calculate your potential tax savings. We’ll also address common pitfalls and mistakes to avoid when claiming this deduction.

Eligibility for Mortgage Insurance Premium Deduction

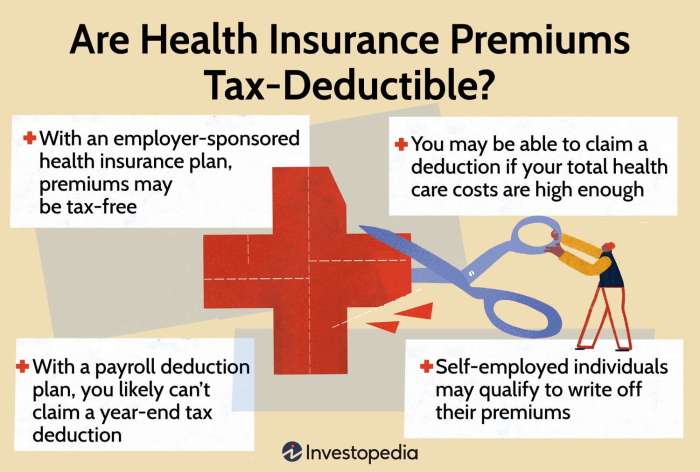

Claiming a deduction for mortgage insurance premiums hinges on several factors, primarily focusing on the type of mortgage, the borrower’s circumstances, and the specific tax laws of their jurisdiction. The eligibility criteria can be complex and vary significantly depending on location. Understanding these nuances is crucial for taxpayers to accurately determine their eligibility and claim the appropriate deduction.

Mortgage Types Eligible for Deduction

The types of mortgages eligible for a mortgage insurance premium deduction are generally those considered high-risk by lenders. This typically includes mortgages with a loan-to-value ratio (LTV) exceeding a certain threshold (often 80%), meaning the loan amount is a larger percentage of the property’s value. Private Mortgage Insurance (PMI) is commonly associated with these types of mortgages in the United States, while other countries may have similar programs with different names. Mortgages with low down payments often require this insurance. Conversely, mortgages with substantial down payments (typically 20% or more) usually do not require mortgage insurance, and therefore the premiums are not deductible.

Situations Where the Deduction May or May Not Apply

Several scenarios illustrate when the deduction might apply or not. For example, a first-time homebuyer in the US securing a mortgage with a 5% down payment would likely pay PMI and, depending on the tax year and other factors, may be able to deduct the premiums. In contrast, a homeowner refinancing their mortgage with a significant equity position (low LTV) would not typically have PMI and thus would not have premiums to deduct. The deduction may also be affected by changes in the tax law; for example, the deductibility of PMI changed in the US over the years, and the current rules need to be checked.

International Variations in Eligibility

Eligibility criteria for mortgage insurance premium deductions vary considerably across different countries and regions. For instance, Canada might have different rules than the United States, focusing on specific government-backed mortgage insurance programs rather than private PMI. In some countries, there may be no tax deduction available for mortgage insurance premiums at all. Taxpayers should always consult their country’s specific tax regulations and seek professional advice to determine their eligibility. The availability of deductions can also be impacted by the type of mortgage insurance provided. For example, government-backed insurance might be treated differently from private insurance in terms of tax deductibility.

Calculating the Deductible Amount

Calculating the deductible portion of your mortgage insurance premiums involves understanding your tax bracket and the total premiums paid during the tax year. The deduction is not for the entire premium, but rather a portion, and the specific amount depends on your individual circumstances. This calculation is straightforward, but understanding the process is key to maximizing your tax benefits.

The calculation itself is generally a simple multiplication. You’ll take your total mortgage insurance premiums paid during the tax year and multiply this by a percentage determined by your adjusted gross income (AGI). The resulting figure represents the amount you can deduct. The IRS provides specific guidelines and tables to determine this percentage based on your AGI. These guidelines are updated annually, so it’s crucial to refer to the most current IRS publications for accurate calculations. There are no alternative calculation methods; the process is standardized.

Mortgage Insurance Premium Deduction Calculation

The following table illustrates how the deduction is calculated for different premium amounts and tax brackets. Remember, these are illustrative examples and the actual percentages may vary depending on the year and your specific AGI. Consult the current IRS guidelines for precise figures.

| Total Mortgage Insurance Premiums Paid | Tax Bracket (Illustrative AGI Range) | Deduction Percentage (Illustrative) | Deductible Amount |

|---|---|---|---|

| $2,000 | $75,000 – $100,000 | 10% | $200 |

| $3,500 | $100,000 – $150,000 | 15% | $525 |

| $5,000 | $150,000 – $200,000 | 20% | $1,000 |

| $1,200 | Below $75,000 | 5% | $60 |

Deductible Amount = Total Mortgage Insurance Premiums Paid * Deduction Percentage (based on AGI)

Common Mistakes and Pitfalls to Avoid

Claiming the mortgage insurance premium deduction can be straightforward, but several common errors can lead to delays or even penalties. Understanding these pitfalls and implementing preventative measures will ensure a smooth tax filing process. This section highlights frequent mistakes and provides guidance on avoiding them.

Incorrect Calculation of Deductible Premiums

A frequent mistake involves miscalculating the amount of premiums eligible for deduction. Taxpayers may incorrectly include premiums paid for purposes other than acquiring a qualified mortgage, or they may fail to account for any limitations or phase-outs based on their adjusted gross income (AGI). For instance, a taxpayer might mistakenly include premiums paid on a refinanced mortgage that doesn’t meet the requirements for the deduction. This could lead to an overstated deduction and potential audit scrutiny. To avoid this, meticulously review your mortgage documents and carefully follow the IRS guidelines on eligible premiums and income limitations. Accurate record-keeping is crucial.

Missing Documentation

Supporting documentation is essential for substantiating the deduction. Without proper documentation, the IRS may disallow the deduction entirely. This documentation includes the mortgage insurance premium payment receipts, the mortgage agreement, and any other relevant documents that demonstrate the eligibility of the premiums. Failure to retain these documents can result in a significant tax liability. A best practice is to maintain a dedicated file for all tax-related mortgage documents. Organize these documents chronologically and clearly label them.

Inaccurate Reporting on Tax Forms

Incorrectly reporting the deduction on the relevant tax forms is another common error. Taxpayers may enter the incorrect amount on Schedule A (Form 1040) or may fail to complete the necessary sections entirely. This can lead to delays in processing the return and potential penalties. To prevent this, carefully review the instructions for Schedule A and ensure that all information is accurately entered and that supporting documentation is attached. Consider using tax preparation software or consulting with a tax professional to minimize the risk of errors.

Claiming the Deduction When Ineligible

Perhaps the most significant mistake is claiming the deduction when the taxpayer doesn’t meet the eligibility requirements. This might involve exceeding the AGI limits, not having a qualified mortgage, or failing to meet other criteria established by the IRS. This could result in a significant tax penalty, including interest and possibly underpayment penalties. Before claiming the deduction, thoroughly review the eligibility requirements to ensure you meet all criteria. If unsure, consult a tax professional.

Illustrative Scenarios

Understanding the impact of the mortgage insurance premium deduction requires examining specific examples. The deduction’s effect varies greatly depending on individual circumstances, primarily income and the cost of the premiums. The following scenarios illustrate this variability.

Scenario 1: Significant Tax Liability Reduction

This scenario depicts a high-income earner with a substantial mortgage and significant mortgage insurance premiums. Let’s assume Sarah, a software engineer, earns $200,000 annually. She recently purchased a $750,000 home with a 10% down payment, requiring mortgage insurance premiums totaling $6,000 annually. Given her high income, Sarah falls within a higher tax bracket. The mortgage insurance premium deduction substantially reduces her overall tax liability. The exact reduction depends on her applicable tax rate, but it could easily save her several hundred dollars, making the deduction a meaningful benefit.

Scenario 2: Minimal Tax Impact

This scenario involves a lower-income individual with a smaller mortgage and lower premiums. Consider David, a teacher, who earns $60,000 annually. He purchased a $300,000 home with a 20% down payment, resulting in annual mortgage insurance premiums of $1,000. Because David is in a lower tax bracket and his premiums are relatively low, the tax deduction provides only a small reduction in his tax liability – perhaps a few tens of dollars. The impact is less significant than in Sarah’s case.

Scenario 3: Deduction Inapplicability

This scenario illustrates a situation where the mortgage insurance premium deduction is not applicable. Maria, a freelance writer, earns $45,000 annually. She purchased a $250,000 home with a 25% down payment, thus avoiding the need for mortgage insurance. Consequently, she has no mortgage insurance premiums to deduct, rendering the deduction irrelevant to her tax situation. This highlights that the deduction’s benefit is contingent on the presence of mortgage insurance.

Last Point

Successfully claiming the deduction for mortgage insurance premiums can provide substantial tax relief for homeowners. By carefully reviewing the eligibility requirements, accurately calculating the deductible amount, and diligently completing the necessary tax forms, you can optimize your tax liability and effectively manage your homeownership costs. Remember to stay informed about any changes in tax laws and regulations to ensure you remain compliant and continue maximizing your tax benefits. Proper planning and understanding of these regulations can significantly improve your financial well-being as a homeowner.

Questions and Answers

Can I deduct mortgage insurance premiums if I have a conventional loan?

Deductibility depends on several factors, including your loan-to-value ratio (LTV) and the year the mortgage was originated. Some countries may have specific rules regarding conventional loans. Consult tax regulations for your area.

What if my mortgage insurance premiums are paid through escrow?

Even if paid through escrow, you can still claim the deduction. You will need documentation from your lender showing the amount paid for mortgage insurance separately.

Is there a limit to the amount of mortgage insurance premiums I can deduct?

The deductibility is typically limited to the amount actually paid for mortgage insurance during the tax year. Specific limits may vary based on your location and tax laws.

What happens if I make a mistake on my tax return related to mortgage insurance premiums?

Errors can lead to amended returns and potential penalties. It’s crucial to accurately record and report all relevant information. Seek professional tax advice if you’re uncertain.