Navigating the complexities of homeownership often involves understanding various tax deductions. One such deduction, often overlooked, is the mortgage insurance premium (MIP) tax deduction. This guide delves into the intricacies of this valuable tax break, exploring its eligibility criteria, potential savings, and implications for different mortgage types. We’ll demystify the process, providing clear explanations and practical examples to empower you to maximize your tax benefits.

Understanding the mortgage insurance premium tax deduction can significantly impact your financial planning, particularly if you’re a first-time homebuyer or have a lower down payment. By carefully examining the eligibility requirements and navigating the filing procedures, homeowners can potentially reduce their tax burden and increase their overall savings. This guide serves as a roadmap to help you confidently claim this often-underutilized deduction.

Tax Benefits and Implications

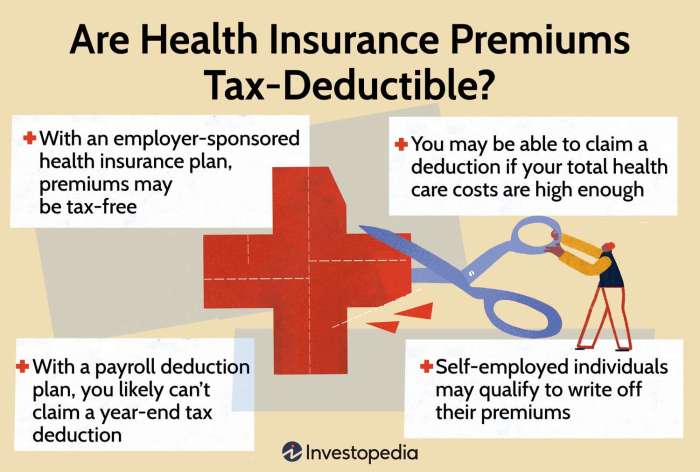

Claiming the mortgage insurance premium tax deduction offers significant financial advantages for homeowners, effectively reducing their overall tax burden. This deduction allows taxpayers to deduct a portion of their mortgage insurance premiums from their taxable income, resulting in a lower tax liability. The exact amount of savings depends on several factors, primarily the taxpayer’s income bracket and the amount of premiums paid.

Financial Benefits of the Mortgage Insurance Premium Tax Deduction

The primary benefit is a direct reduction in taxable income. This translates to a lower tax bill, providing more disposable income for homeowners. The deduction effectively lowers the cost of homeownership, making it more affordable, particularly during the initial years of mortgage repayment when mortgage insurance premiums are typically highest. The amount of the deduction can be substantial, depending on the size of the mortgage and the applicable tax rates. This financial relief can be particularly beneficial for first-time homebuyers, who often face higher upfront costs associated with home purchasing.

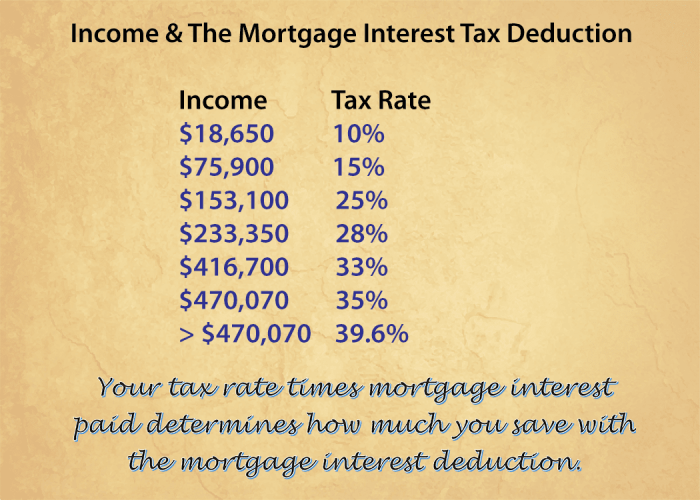

Tax Savings Across Different Income Brackets

The impact of the mortgage insurance premium tax deduction varies significantly across different income brackets. Higher-income taxpayers, facing higher marginal tax rates, will generally realize greater tax savings from the deduction compared to lower-income taxpayers. For example, a taxpayer in the 32% tax bracket will save $32 for every $100 of premiums deducted, while a taxpayer in the 12% tax bracket will save only $12. This disparity arises because the deduction reduces income subject to the higher tax rates for higher-income earners. It’s crucial to remember that the actual tax savings will depend on individual circumstances and the interaction of the deduction with other tax credits or deductions.

Potential Pitfalls and Limitations of the Deduction

While the mortgage insurance premium tax deduction offers substantial benefits, it’s essential to be aware of potential limitations. The deduction is only available for a limited period, typically until the loan-to-value ratio (LTV) falls below a certain threshold (often 80%). Once the LTV drops below this threshold, the mortgage insurance is usually cancelled, and the deduction is no longer applicable. Furthermore, the amount of the deduction is capped, meaning taxpayers cannot deduct an unlimited amount of premiums. The specific rules and limitations regarding the deduction can be complex and vary depending on the jurisdiction and specific mortgage terms. Careful review of the relevant tax regulations is crucial to ensure compliance.

Hypothetical Scenario Illustrating Tax Savings

Let’s consider a hypothetical scenario: Sarah, a single taxpayer in the 22% tax bracket, pays $3,000 in annual mortgage insurance premiums. Assuming she can deduct the full amount, her tax savings would be $3,000 * 0.22 = $660. This means her tax liability is reduced by $660, leaving her with an extra $660 in her pocket. If Sarah were in a higher tax bracket, say 35%, her tax savings would be significantly higher at $1050 ($3000 * 0.35). This illustrates how the tax savings directly correlate with the taxpayer’s marginal tax rate. It’s important to note that this is a simplified example and doesn’t account for other potential tax deductions or credits that might further affect her tax liability.

Impact on Different Types of Mortgages

The mortgage insurance premium (MIP) tax deduction, if available in your jurisdiction, can affect homeowners differently depending on the type of mortgage they have. Understanding these variations is crucial for accurately calculating potential tax savings. The eligibility criteria and claim procedures may vary slightly based on the specific mortgage program.

MIP Deduction and FHA Mortgages

FHA mortgages, insured by the Federal Housing Administration, often require MIP payments. These payments protect the lender against potential losses if the borrower defaults. The deduction, if applicable, would reduce the taxable income by the amount of the MIP paid during the tax year. For example, if a homeowner paid $2,000 in MIP and the deduction is fully allowed, their taxable income would be reduced by $2,000, resulting in a tax savings based on their applicable tax bracket. Claiming the deduction usually involves including the MIP amount on the relevant tax form, providing supporting documentation from the lender.

MIP Deduction and VA Mortgages

VA loans, backed by the Department of Veterans Affairs, generally do not require MIP. However, some VA loans may involve a funding fee, which is a one-time or recurring charge. While the funding fee might not be considered MIP, check your jurisdiction’s tax laws to determine if it’s eligible for any tax benefits. If a similar deduction is available, the process for claiming it would likely follow the same procedures as other mortgage-related deductions. The absence of MIP in most VA loans means the tax benefits related to MIP are not directly applicable in most cases.

MIP Deduction and Conventional Mortgages

Conventional mortgages, not insured by government agencies, may require private mortgage insurance (PMI) if the down payment is less than 20%. While PMI and MIP are similar, they aren’t the same. Check your local tax laws to confirm if PMI is eligible for any tax deductions; many jurisdictions only allow deductions for government-backed mortgage insurance premiums. If a deduction is available for PMI, the process would be similar to claiming the MIP deduction, involving documentation of payments.

Illustrative Examples of MIP Deduction Impact

The following table demonstrates the potential impact of the MIP deduction on different mortgage scenarios, assuming a simplified tax system for illustrative purposes. Actual tax savings will vary based on individual tax brackets and applicable tax laws.

| Mortgage Type | MIP Rate (Annual) | Deductible Amount (Annual) | Net Tax Savings (Estimated, 20% Tax Bracket) |

|---|---|---|---|

| FHA | 0.8% | $1600 | $320 |

| FHA (Higher Loan Amount) | 0.8% | $2400 | $480 |

| VA (Funding Fee) | 2.3% (One-time) | $2300 (One-time) | $460 (One-time) |

| Conventional (PMI) | 0.5% (Assumed Deductible) | $1000 | $200 |

Note: The MIP rates, deductible amounts, and tax savings are illustrative examples only and may not reflect actual values. Consult a tax professional for personalized advice. The deduction of PMI is dependent on local tax laws and is not always permitted. The VA example assumes a one-time funding fee; some VA loans may have annual fees.

Future Outlook and Potential Changes

Predicting the future of the mortgage insurance premium tax deduction is inherently complex, influenced by a confluence of economic, political, and social factors. While its current form offers a tangible benefit to many homeowners, several scenarios could alter its trajectory in the coming years. Analyzing these potential shifts provides valuable insight for both taxpayers and policymakers.

The mortgage insurance premium tax deduction’s future hinges on several key considerations. Changes in the broader housing market, shifts in government fiscal priorities, and evolving public perceptions of homeownership all play a significant role. Furthermore, the deduction’s effectiveness in achieving its intended goals – stimulating homeownership and supporting the housing market – will continue to be evaluated, potentially leading to adjustments in its structure or eligibility criteria.

Potential Changes to the Deduction

Several potential modifications to the mortgage insurance premium tax deduction could occur. These range from minor adjustments to its parameters, such as altering the maximum deductible amount or modifying income thresholds, to more significant changes, such as phasing out the deduction entirely or replacing it with an alternative incentive. For instance, a potential scenario could involve adjusting the deduction to better target first-time homebuyers or those in lower-income brackets, thereby increasing its equity-building impact for those most in need. Conversely, a less favorable scenario might see the deduction reduced or eliminated as part of broader tax reform efforts aimed at reducing the national deficit.

Expert Opinions and Predictions

Experts offer varied perspectives on the long-term viability of the mortgage insurance premium tax deduction. Some economists argue that the deduction disproportionately benefits higher-income homeowners, leading to calls for reforms to enhance its equity. Others highlight the deduction’s role in supporting the housing market and promoting homeownership, advocating for its continued existence, perhaps with targeted adjustments. For example, some policy analysts suggest a gradual phase-out of the deduction over several years, allowing homeowners and the housing market to adapt to the change. This approach aims to mitigate potential negative economic shocks while still achieving the desired fiscal goals. Predicting the precise outcome remains challenging, but a combination of targeted adjustments and gradual changes is considered a likely scenario by many experts.

Factors Influencing the Deduction’s Future

Several key factors will significantly influence the future of the mortgage insurance premium tax deduction. These include fluctuations in interest rates, the overall health of the economy, and the prevailing political climate. For example, a period of high interest rates could lead to increased demand for the deduction, potentially making its modification or elimination less politically palatable. Conversely, a strong economy with robust housing market performance might reduce the perceived need for the deduction, increasing the likelihood of adjustments or elimination. The political landscape also plays a crucial role, with different political parties holding varying views on the deduction’s merits and its role in national fiscal policy. Changes in government priorities and budgetary constraints can directly impact the deduction’s future.

Potential Scenarios for Future Modifications

Several potential scenarios for future modifications to the tax code affecting this deduction exist. One possibility is a complete repeal of the deduction, resulting in a substantial tax increase for homeowners using mortgage insurance. Alternatively, a partial repeal, such as reducing the maximum deductible amount or limiting eligibility, could be implemented. Another scenario involves expanding the deduction’s scope to include a wider range of mortgage products or increasing the deduction for lower-income homeowners. A final scenario could see the deduction replaced entirely with a different incentive program, such as a direct subsidy for first-time homebuyers or a tax credit for mortgage insurance premiums. The ultimate outcome will depend on a complex interplay of economic, political, and social factors.

Outcome Summary

Claiming the mortgage insurance premium tax deduction can provide substantial financial relief for homeowners. By understanding the eligibility criteria, gathering the necessary documentation, and following the proper filing procedures, you can unlock significant tax savings. This guide has provided a comprehensive overview, equipping you with the knowledge to confidently navigate this aspect of homeownership and maximize your tax benefits. Remember to consult with a tax professional for personalized advice tailored to your specific circumstances.

Question Bank

Can I deduct MIP if I have a conventional loan?

The deductibility of MIP on conventional loans depends on the loan terms and whether the premium is considered a part of the loan’s interest. Consult your loan documents and a tax professional for clarification.

What if my mortgage insurance premium is paid in escrow?

Even if your MIP is paid through escrow, you can still claim the deduction. You’ll need documentation from your lender showing the amount paid toward MIP during the tax year.

Is there an income limit to claim the MIP deduction?

There isn’t a specific income limit for claiming the MIP deduction. Eligibility primarily depends on whether you paid MIP on a qualifying mortgage and meet other requirements.

What happens if I overpay or underpay my estimated MIP deduction?

You will adjust the difference when you file your tax return. If you overpaid, you will receive a refund. If you underpaid, you may owe additional taxes.