Navigating the complexities of homeownership often involves understanding mortgage insurance premiums. These premiums, while sometimes overlooked, significantly impact your monthly mortgage payments and overall financial burden. This guide provides a clear and concise explanation of mortgage insurance premiums, equipping you with the knowledge to utilize a mortgage insurance premium calculator effectively and make informed decisions about your home financing.

We will explore the various factors influencing premium calculations, including loan-to-value ratios, credit scores, and loan terms. Through practical examples and a step-by-step guide on using a mortgage insurance premium calculator, you’ll gain confidence in understanding your potential costs and incorporating them into your budget. We’ll also examine alternative financing options that may mitigate the need for mortgage insurance altogether, providing a holistic perspective on managing your home financing journey.

Understanding Mortgage Insurance Premiums

Mortgage insurance protects lenders in the event a borrower defaults on their mortgage loan. It’s a crucial element of the mortgage process, particularly for borrowers with lower down payments. Understanding how premiums are calculated and the various types available is essential for making informed financial decisions.

Mortgage Insurance Purpose

Mortgage insurance primarily safeguards the lender against financial losses if a borrower fails to make their mortgage payments. By insuring the loan, the lender is more willing to approve mortgages with smaller down payments, making homeownership more accessible to a wider range of borrowers. In the event of default, the insurer compensates the lender for the outstanding loan amount, mitigating the lender’s risk.

Factors Influencing Premium Calculations

Several key factors influence the calculation of mortgage insurance premiums. These factors directly impact the risk assessment performed by the insurer. A higher perceived risk translates to a higher premium.

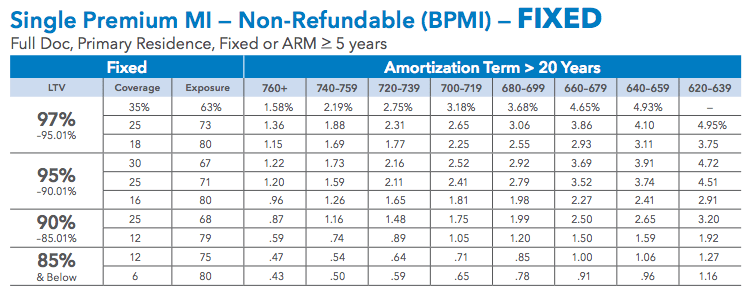

- Loan-to-Value Ratio (LTV): This is the ratio of the loan amount to the appraised value of the property. A higher LTV (e.g., 95% LTV) indicates a higher risk for the lender, resulting in higher premiums. A lower LTV (e.g., 80% LTV) typically results in lower premiums or even eliminates the need for mortgage insurance.

- Credit Score: A borrower’s credit score is a strong indicator of their creditworthiness and repayment ability. A higher credit score generally leads to lower premiums, reflecting a lower risk of default. Conversely, a lower credit score usually translates to higher premiums.

- Type of Mortgage: Different mortgage types carry varying levels of risk. For instance, mortgages with adjustable interest rates might have different premium structures compared to fixed-rate mortgages. The specific terms of the mortgage agreement, such as the length of the loan, also factor into premium calculations.

- Down Payment: As mentioned earlier, a larger down payment reduces the LTV, thereby decreasing the risk and potentially lowering the premium. A smaller down payment usually necessitates mortgage insurance and higher premiums.

Types of Mortgage Insurance and Premiums

There are primarily two main types of mortgage insurance: Private Mortgage Insurance (PMI) and Federal Housing Administration (FHA) insurance. Each has its own premium structure and eligibility requirements.

| Insurance Type | Premium Calculation Method | Typical Premium Range | Eligibility Requirements |

|---|---|---|---|

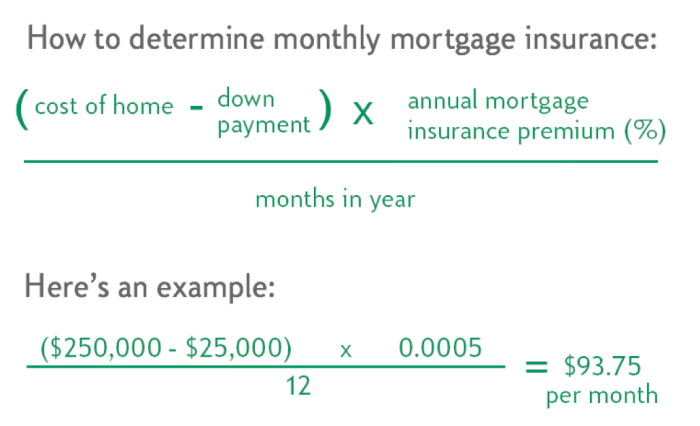

| Private Mortgage Insurance (PMI) | Based on LTV, credit score, and loan terms. Often calculated as a percentage of the loan amount, paid monthly. | 0.5% – 2% of the loan amount annually | Typically required for conventional loans with less than 20% down payment. |

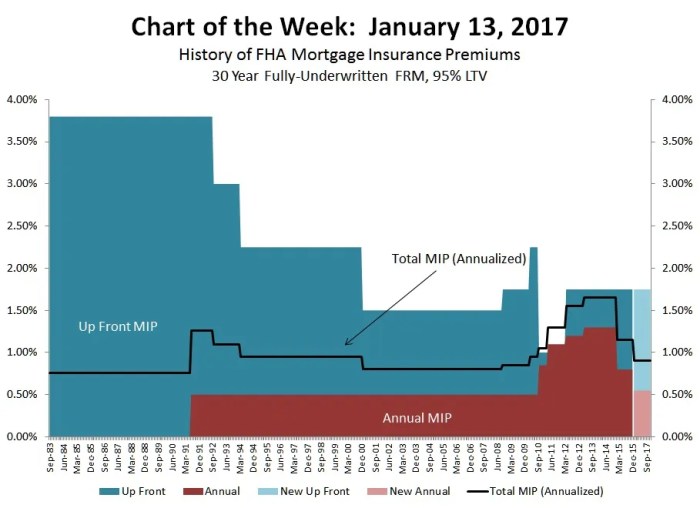

| Federal Housing Administration (FHA) Insurance | Upfront premium paid at closing, plus an annual premium paid monthly. The premiums are determined based on loan amount, loan term, and risk assessment. | Upfront premium: 1.75% of the loan amount; Annual premium: varies based on loan term and risk assessment. | Requires meeting FHA’s credit and income guidelines. Usually allows for lower down payments (as low as 3.5%). |

| VA-backed loans | No upfront premium; funding fee paid at closing or financed into the loan. Funding fee varies depending on the loan amount and veteran’s status. | Funding fee varies (1.4% – 3.6% depending on the down payment and the veteran’s status) | Borrower must be an eligible veteran, service member, or surviving spouse. |

| USDA Loans | Guaranteed loan program; annual guarantee fee paid monthly. | Annual guarantee fee: 0.5% to 1% of the loan amount annually. | Borrower must meet USDA eligibility requirements, typically residing in a rural area. |

Using a Mortgage Insurance Premium Calculator

Understanding how mortgage insurance premiums are calculated can seem daunting, but using a calculator simplifies the process considerably. These online tools automate the complex calculations, providing you with a quick estimate of your monthly premiums. This section will guide you through using a mortgage insurance premium calculator effectively.

Typical Inputs for a Mortgage Insurance Premium Calculator

Most mortgage insurance premium calculators require a specific set of inputs to generate an accurate estimate. These inputs directly influence the calculated premium, so providing accurate information is crucial. Inaccurate data will lead to an inaccurate premium estimate.

- Loan Amount: The total amount of money you’re borrowing to purchase the home.

- Down Payment: The percentage or dollar amount of your own funds you’re contributing towards the purchase price.

- Credit Score: Your credit score significantly impacts the premium rate. A higher credit score generally leads to lower premiums.

- Loan Type: The type of mortgage you’re obtaining (e.g., conventional, FHA, VA). Different loan types have different insurance requirements.

- Loan Term: The length of your mortgage loan (e.g., 15 years, 30 years).

- Home Price (sometimes required): Some calculators may ask for the home’s purchase price to calculate the loan-to-value ratio (LTV).

- Location (sometimes required): In some cases, the location might influence the premium, reflecting regional variations in risk assessment.

Step-by-Step Guide to Using a Mortgage Insurance Premium Calculator

Using a mortgage insurance premium calculator is typically straightforward. The specific steps might vary slightly depending on the calculator’s interface, but the general process remains consistent.

- Find a reputable online calculator: Many financial websites and mortgage lenders offer free calculators. Choose one from a trusted source.

- Enter your loan details: Carefully input the required information, ensuring accuracy. Double-check each entry before proceeding.

- Review the results: The calculator will display your estimated monthly mortgage insurance premium and possibly the total premium over the loan’s lifespan.

- Understand the limitations: Remember that the result is an estimate. The actual premium may vary slightly depending on the lender’s specific underwriting guidelines.

Benefits of Using an Online Calculator Versus Manual Calculation

Manual calculation of mortgage insurance premiums is extremely complex and involves intricate formulas and risk assessments. Using an online calculator offers several advantages:

- Convenience and Speed: Online calculators provide instant results, eliminating the time-consuming manual calculations.

- Accuracy: Reputable online calculators are programmed with accurate formulas, reducing the risk of errors associated with manual calculations.

- Accessibility: Online calculators are readily available 24/7, providing access to information whenever needed.

- Ease of Use: User-friendly interfaces make online calculators accessible even for those without a strong financial background.

Flowchart Illustrating the Process of Using a Mortgage Insurance Premium Calculator

Imagine a flowchart with rectangular boxes representing steps and diamond shapes representing decisions.

The flowchart would start with a box labeled “Begin”. This would lead to a diamond asking “Have you found a reputable online calculator?”. A “Yes” branch would lead to a rectangle “Enter Loan Details”. A “No” branch would loop back to a rectangle “Find a reputable online calculator”. After “Enter Loan Details”, there would be a rectangle “Review Results”. Finally, there’s a rectangle “End”. The flowchart visually represents the iterative and straightforward nature of using such calculators.

Interpreting Calculator Results

Understanding the output of a mortgage insurance premium calculator is crucial for accurate budgeting and financial planning. The calculator provides a clear picture of your potential monthly and annual costs, allowing you to incorporate this expense into your overall financial strategy. This section will guide you through interpreting the results and integrating them into your mortgage budget.

Understanding Premium Components

The calculator’s output typically breaks down the total premium into several components. These may include the upfront premium (a single payment at closing), the annual premium (paid monthly or annually), and any applicable fees or taxes. It’s important to understand each component to get a complete picture of your costs. For example, a calculator might show a $5,000 upfront premium, a $100 monthly premium, and a $50 annual administrative fee. This allows you to see the total cost spread out over the life of the loan. You should also note that premium amounts are influenced by factors like your down payment, credit score, and the type of mortgage.

Incorporating Premiums into a Mortgage Budget

Once you have the premium breakdown, you can easily incorporate it into your overall mortgage budget. This ensures you’re prepared for all associated costs. Remember to account for both the upfront and recurring premiums. For instance, if your upfront premium is $5,000, you may need to adjust your savings or secure a loan to cover this amount. The recurring monthly premium should be factored into your monthly expenses, just like your mortgage payment, property taxes, and homeowner’s insurance.

Sample Mortgage Budget Table

A comprehensive mortgage budget table helps visualize your monthly and annual expenses. This table provides a clear overview of your financial commitments, allowing for informed decision-making.

| Expense Type | Monthly Amount | Annual Amount | Percentage of Total |

|---|---|---|---|

| Mortgage Principal & Interest | $1,500 | $18,000 | 45% |

| Property Taxes | $200 | $2,400 | 6% |

| Homeowner’s Insurance | $100 | $1,200 | 3% |

| Mortgage Insurance Premium (Monthly) | $75 | $900 | 2.25% |

| Utilities (Water, Gas, Electric) | $250 | $3,000 | 7.5% |

| Other Expenses (Maintenance, etc.) | $100 | $1,200 | 3% |

| Total Monthly Expenses | $2,225 | $26,700 | 100% |

Note: This is a sample budget, and your actual expenses will vary depending on your location, property, and lifestyle. The percentages are calculated based on the total annual expenses. Remember to adjust the figures to reflect your specific circumstances. Also, consider including the upfront mortgage insurance premium as a separate line item in your initial closing costs budget.

Ultimate Conclusion

Understanding mortgage insurance premiums is crucial for responsible homeownership. By leveraging the power of a mortgage insurance premium calculator and understanding the various factors that influence your premiums, you can effectively manage your monthly expenses and make informed financial decisions. Remember to explore alternative financing options and compare them carefully to find the best fit for your unique circumstances. Armed with this knowledge, you can confidently navigate the path to homeownership with greater financial clarity and peace of mind.

Frequently Asked Questions

What happens if I pay off my mortgage early and still have mortgage insurance?

Many mortgage insurance policies allow for cancellation or a refund of the remaining premium upon early payoff. Contact your lender or insurance provider to determine the specifics of your policy.

Can I shop around for mortgage insurance?

While your lender may offer mortgage insurance, you may be able to find more competitive rates by comparing quotes from different providers. It’s advisable to compare options before making a decision.

Does mortgage insurance affect my credit score?

Paying your mortgage insurance premiums on time will generally have a positive impact on your credit score, similar to other debt payments. Late or missed payments can negatively affect your credit.

How often are mortgage insurance premiums reviewed?

The frequency of premium reviews varies depending on the type of mortgage insurance and the lender’s policies. Some policies have fixed premiums, while others may be adjusted periodically based on factors like your loan-to-value ratio.