Navigating the complexities of homeownership often involves understanding the nuances of mortgage insurance premium (MIP). This seemingly small detail can significantly impact your overall home financing costs, potentially adding thousands of dollars to your total mortgage burden. This guide unravels the intricacies of MIP, offering a clear understanding of its purpose, calculation, and impact on your financial journey.

From defining MIP and its various forms to exploring its role in the home buying process and refinancing, we’ll examine the factors that influence its cost and explore strategies to mitigate its impact. We will also provide practical examples and visual aids to illustrate how MIP affects your budget, empowering you to make informed decisions about your mortgage.

Calculation and Factors Affecting MIP

Mortgage insurance premiums (MIP) are a crucial aspect of securing a mortgage, particularly for those with lower down payments. Understanding how MIP is calculated and the factors influencing it is essential for borrowers to accurately budget for their homeownership costs. This section details the key components involved in MIP calculation and illustrates how different scenarios impact the final cost.

Several factors influence the calculation of MIP. The most significant is the loan-to-value ratio (LTV), which represents the loan amount as a percentage of the home’s value. A higher LTV generally translates to a higher MIP. Other factors include the type of mortgage (FHA, VA, conventional), the loan term, and the borrower’s credit score. While a borrower’s credit score doesn’t directly impact the MIP percentage, a lower score might lead to a higher interest rate, indirectly increasing the overall cost of the loan, including MIP.

Loan-to-Value Ratio (LTV) and MIP

The LTV is a primary determinant of the MIP percentage. As the LTV increases (meaning a smaller down payment), the MIP percentage also increases to reflect the higher risk to the lender. The following table illustrates this relationship using hypothetical examples.

| LTV | MIP Percentage (Example) | Loan Amount Example | Total MIP Cost Example (Annual Premium) |

|---|---|---|---|

| 80% | 0.5% | $200,000 | $1,000 |

| 90% | 1.0% | $200,000 | $2,000 |

| 95% | 1.5% | $200,000 | $3,000 |

| 97% | 2.25% | $200,000 | $4,500 |

Note: These MIP percentages are hypothetical examples and may vary based on the lender and specific loan program. Actual MIP rates are subject to change.

MIP Calculations for Different Loan Types

MIP calculations differ slightly depending on the type of mortgage. FHA loans, for instance, typically have an upfront MIP paid at closing and an annual MIP paid throughout the loan term. The upfront MIP is usually a percentage of the loan amount, while the annual MIP is a percentage of the outstanding loan balance. VA loans, on the other hand, do not require MIP, as they are backed by the Department of Veterans Affairs. Conventional loans may or may not require private mortgage insurance (PMI), which functions similarly to MIP but is provided by private insurers, not the government. The requirements for PMI depend on the LTV and the borrower’s credit score.

Key Variables in MIP Calculations

The key variables used in MIP calculations include the loan amount, the home’s appraised value, the LTV, the loan term, the type of mortgage, and, indirectly, the borrower’s credit score (influencing interest rates and potentially eligibility for certain loan programs). The specific formulas and percentages used can vary by lender and program, so it’s crucial to review the details of your specific mortgage offer.

MIP Alternatives and Strategies

Mortgage insurance premiums (MIP) can be a significant expense for homebuyers, particularly those with smaller down payments. Understanding alternatives and strategies to minimize or avoid MIP is crucial for making informed financial decisions. This section explores various options and approaches to help navigate the complexities of mortgage insurance.

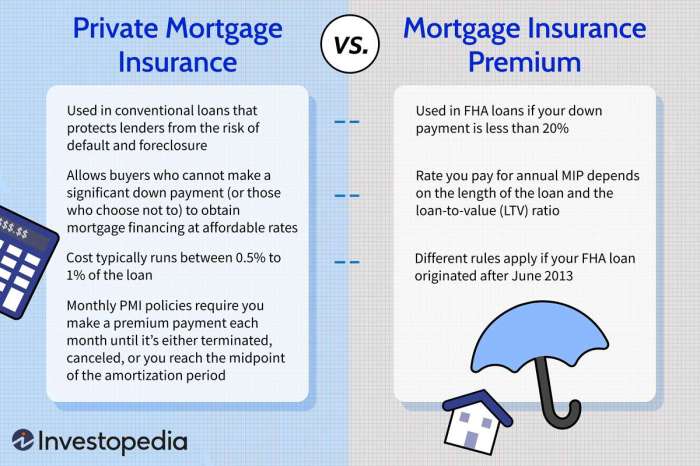

Comparison of MIP with Other Mortgage Insurance Options

While MIP is common for FHA loans, other mortgage insurance options exist, each with its own set of terms and conditions. Private Mortgage Insurance (PMI) is frequently used for conventional loans with down payments below 20%. Comparing these options involves analyzing factors like premium amounts, eligibility requirements, and cancellation provisions. Generally, PMI premiums are often higher than MIP, especially in the early years of the loan. However, PMI can be cancelled once the homeowner achieves 20% equity in the home, a milestone not always guaranteed with MIP. Conversely, MIP cancellation criteria depend on the specific FHA loan program and may be more complex to navigate.

Situations Where Alternative Financing Options Are More Suitable Than MIP

Several scenarios might make alternative financing more appealing than loans requiring MIP. For instance, individuals with a substantial down payment (20% or more) might find conventional loans without PMI more cost-effective in the long run. Similarly, individuals with excellent credit scores and stable income might qualify for loans with lower interest rates that offset the potential savings from avoiding MIP. Furthermore, certain government-backed loans, like those offered by the VA, do not require mortgage insurance, making them an attractive option for eligible veterans. Finally, if the buyer anticipates significant appreciation in their home’s value in a short period, they might prefer a loan with higher initial costs but lower overall insurance expenses. For example, someone buying in a rapidly appreciating market might find the higher upfront cost of a larger down payment preferable to years of paying PMI or MIP.

Decision-Making Flowchart for Choosing Between MIP and Alternative Options

A flowchart illustrating the decision-making process would start with assessing the down payment amount. If the down payment is 20% or more, the path leads to exploring conventional loans without PMI. If the down payment is less than 20%, the path branches to consider FHA loans with MIP and conventional loans with PMI. A subsequent decision point would involve comparing the total cost of each option, factoring in interest rates, loan terms, and insurance premiums. This would require careful analysis of the individual’s financial situation, risk tolerance, and long-term financial goals. The final decision would be based on the option with the lowest total cost and the greatest alignment with the borrower’s financial circumstances. A simplified representation:

Down Payment ≥ 20%? Yes -> Conventional Loan (No PMI) No -> Compare FHA Loan (MIP) and Conventional Loan (PMI) -> Choose option with lowest total cost.

Strategies to Minimize or Avoid MIP

Several strategies can help minimize or avoid MIP. Increasing the down payment to 20% or more is the most direct approach to eliminate PMI on conventional loans. Alternatively, improving credit scores can lead to better loan terms and potentially lower interest rates, making the total cost of the loan more competitive, even with MIP. Exploring alternative loan programs, such as VA loans, which don’t require mortgage insurance, can also be beneficial for eligible borrowers. Finally, carefully comparing loan offers from different lenders and negotiating loan terms can help minimize the overall cost of borrowing and reduce the burden of mortgage insurance premiums. For example, a buyer could shop around for the best interest rates, potentially reducing the overall cost of the loan and making the insurance premiums a smaller percentage of the total cost.

Visual Representation of MIP’s Impact

Understanding the financial implications of Mortgage Insurance Premium (MIP) requires a clear visual representation of its impact on overall mortgage costs. This section will illustrate how MIP affects yearly mortgage payments and the total cost over the life of the loan.

Visualizing MIP’s impact helps homeowners understand the added expense and make informed decisions about their mortgage options. By comparing mortgages with and without MIP, borrowers can assess the long-term financial implications of their choices.

Yearly Mortgage Cost Breakdown with MIP

This illustration depicts a sample yearly mortgage cost breakdown, including MIP. Imagine a bar graph with several colored segments representing different components of the yearly payment. The largest segment, in blue, represents the principal payment – the portion of the payment that reduces the loan’s balance. A smaller, orange segment represents the interest payment. A smaller, distinct purple segment represents the annual MIP payment. A smaller green segment represents property taxes, and a final smaller yellow segment represents homeowner’s insurance. The total length of the bar represents the total yearly mortgage payment. The specific proportions of each segment would vary based on the loan amount, interest rate, and MIP rate. For example, a $300,000 mortgage with a 30-year term at 7% interest and a 0.5% annual MIP might show the principal payment as the largest portion, followed by interest, with MIP, property taxes and homeowner’s insurance making up the remaining smaller portions. The exact figures for each segment can be calculated and displayed numerically alongside the bar graph.

Comparison of Total Mortgage Cost with and without MIP

This visual representation would ideally be a line graph charting the cumulative cost of a mortgage over 30 years, with two distinct lines. One line, in solid blue, represents the total cost of a mortgage *with* MIP included. The other line, in dashed red, represents the total cost of a comparable mortgage *without* MIP (e.g., a mortgage with a 20% down payment). The y-axis would represent the total cumulative cost (in dollars), and the x-axis would represent the time elapsed (in years). The difference between the two lines clearly illustrates the total additional cost incurred due to MIP over the 30-year period. For instance, if the mortgage with MIP costs a total of $500,000 over 30 years, and the mortgage without MIP costs $450,000, the graph would show a clear $50,000 difference, highlighting the significant financial impact of MIP. A table alongside the graph could quantify this difference, providing a clear summary of the total cost savings achieved by avoiding MIP through a larger down payment or other strategies.

Epilogue

Securing a mortgage is a significant financial undertaking, and understanding mortgage insurance premium is crucial for responsible homeownership. By carefully considering the factors influencing MIP, exploring alternative financing options, and utilizing strategies to minimize its effect, you can navigate the complexities of home financing with confidence and achieve your homeownership goals effectively. Remember, informed decisions lead to successful financial outcomes.

Common Queries

What happens to my MIP if I refinance my mortgage?

Whether your MIP is removed during refinancing depends on factors like your new loan-to-value ratio (LTV) and the type of loan. If your LTV falls below the threshold requiring MIP, it might be eliminated. Otherwise, you may need to continue paying it or secure a new type of insurance.

Can I pay off my MIP early?

Typically, you cannot pay off MIP early. It’s usually paid monthly as part of your mortgage payment and continues until a specific condition is met (e.g., reaching a certain equity level).

Is MIP tax deductible?

The deductibility of MIP depends on your specific circumstances and tax laws. Consult a tax professional for personalized advice.

What is the difference between MIP and PMI?

While both protect lenders, MIP is specifically for FHA-insured loans, while PMI is for conventional loans. They have similar purposes but differ in the specifics of their calculation and requirements.