Navigating the world of health insurance can feel like deciphering a complex code. Understanding your monthly premium is crucial for securing adequate coverage without breaking the bank. This guide demystifies the process, providing clear explanations of premium components, influencing factors, and strategies for finding the best plan for your individual needs. We’ll explore various plan types, the impact of lifestyle choices, and resources to help you make informed decisions about your health insurance.

From defining the core elements of a monthly premium to comparing different plan structures like HMOs, PPOs, and EPOs, we will delve into the intricacies of cost determination, including the roles of age, location, health status, and pre-existing conditions. We’ll also offer practical advice on finding affordable options, interpreting plan documents, and managing your health insurance costs effectively.

Defining “Monthly Premium Health Insurance”

Monthly premium health insurance is a type of health insurance plan where you pay a recurring monthly fee (the premium) in exchange for coverage of medical expenses. This coverage protects you from potentially devastating financial burdens associated with illness or injury. Understanding the components and factors influencing your premium is crucial for making informed decisions about your healthcare.

Core Components of a Monthly Health Insurance Premium

Your monthly premium is calculated based on several key factors, combining to create your total cost. These factors often include the cost of the insurer’s administrative expenses, the anticipated claims costs for your specific risk profile, and the profit margin the insurer seeks to maintain. A portion of your premium contributes to the broader pool of funds used to pay for healthcare services for all plan members.

Factors Influencing Premium Costs

Several factors significantly influence the cost of your monthly health insurance premium. These factors are assessed individually and collectively to determine your risk profile and subsequent premium amount.

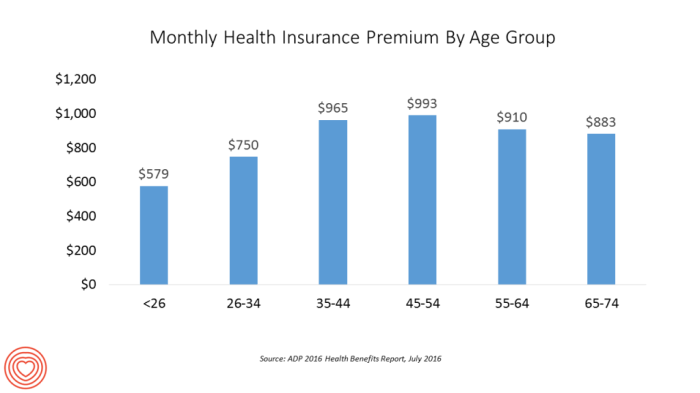

- Age: Generally, older individuals tend to have higher premiums due to a statistically higher likelihood of needing more healthcare services.

- Location: Premiums vary geographically based on the cost of healthcare services in your area. Areas with higher healthcare costs generally have higher premiums.

- Health Status: Individuals with pre-existing conditions or a history of significant health issues often face higher premiums, reflecting the increased risk to the insurer.

- Plan Type: The type of plan you choose (HMO, PPO, EPO, etc.) directly impacts your premium. Plans with more extensive coverage and benefits typically come with higher premiums.

Types of Monthly Health Insurance Plans

Different health insurance plans offer varying levels of coverage and flexibility. Understanding these differences is crucial for choosing a plan that best suits your needs and budget.

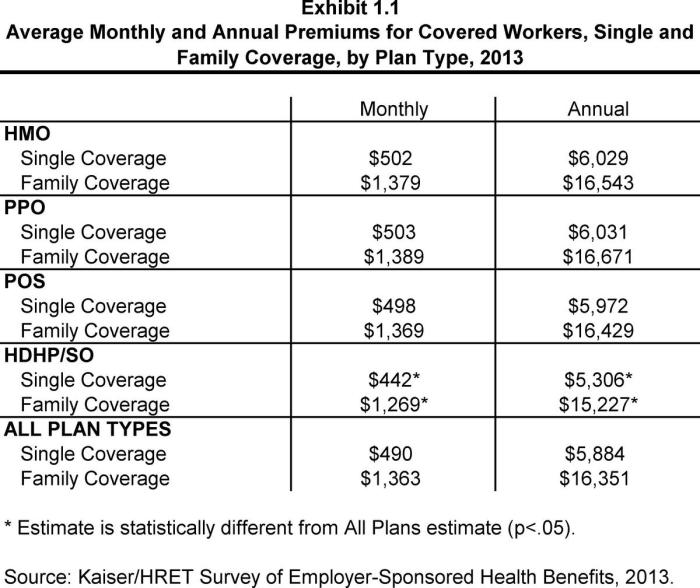

- HMO (Health Maintenance Organization): HMO plans typically require you to choose a primary care physician (PCP) within the network. Referrals from your PCP are usually needed to see specialists. HMO plans generally offer lower premiums but less flexibility in choosing doctors and specialists.

- PPO (Preferred Provider Organization): PPO plans offer more flexibility. You can see any doctor, in-network or out-of-network, but you’ll typically pay less if you stay within the network. Premiums for PPO plans are usually higher than HMO plans.

- EPO (Exclusive Provider Organization): EPO plans are similar to HMOs in that they require you to choose a PCP within the network. However, unlike HMOs, EPO plans usually do not allow you to see out-of-network providers, even in emergencies, unless there is a specific exception noted in the plan documents. Premiums generally fall between HMO and PPO plans.

Comparison of Common Health Insurance Plan Types

The following table summarizes key features of common health insurance plan types:

| Plan Type | Premium Cost | Network Restrictions | Referral Requirements |

|---|---|---|---|

| HMO | Generally Lower | Strict; in-network only (generally) | Usually required for specialists |

| PPO | Generally Higher | More flexible; in-network and out-of-network options | Generally not required |

| EPO | Moderate | Strict; in-network only (generally) | Usually required for specialists |

Factors Affecting Monthly Premium Costs

Several key factors influence the monthly cost of health insurance premiums. Understanding these factors can help individuals make informed decisions when choosing a plan. These factors interact in complex ways, and the final premium is a reflection of the insurer’s assessment of risk.

Deductibles and Co-pays Influence on Premiums

Deductibles and co-pays are significant components of health insurance plans that directly impact monthly premiums. A higher deductible, the amount you pay out-of-pocket before your insurance coverage begins, generally results in a lower monthly premium. Conversely, a lower deductible leads to a higher monthly premium. This is because the insurance company is assuming less initial risk with a higher deductible. Similarly, co-pays, the fixed amount you pay for each doctor’s visit or prescription, can also affect premiums, although the effect is usually less pronounced than that of deductibles. A plan with higher co-pays might offer a slightly lower monthly premium. The relationship is based on risk sharing; you pay more upfront (higher deductible/co-pay) for lower monthly payments, and vice-versa.

Pre-existing Conditions and Premium Determination

In many countries, including the United States under the Affordable Care Act (ACA), insurers cannot deny coverage or charge higher premiums based solely on pre-existing conditions. However, pre-existing conditions can indirectly influence premiums through other factors. For instance, an individual with a history of chronic illness might choose a plan with more comprehensive coverage, resulting in a higher premium. The cost of managing that pre-existing condition is factored into the overall risk assessment by the insurance company. The ACA’s protections prevent discrimination, but the cost of care for pre-existing conditions is still considered in premium calculations.

Individual vs. Family Plan Premium Costs

Family health insurance plans typically cost significantly more than individual plans. This is because family plans cover multiple individuals, increasing the potential for healthcare utilization and associated costs. The insurer accounts for this increased risk by charging a higher premium for family coverage. The exact cost difference varies greatly depending on the number of family members covered, their ages, and the chosen plan’s benefits. For example, a family of four might pay double or even triple the premium of an individual plan, reflecting the increased risk for the insurer.

Hypothetical Scenario: Lifestyle Choices and Premium Costs

Consider two individuals, Sarah and John, both applying for the same health insurance plan. Sarah is a non-smoker, maintains a healthy weight, exercises regularly, and has a balanced diet. John, on the other hand, is a smoker, is overweight, rarely exercises, and follows an unhealthy diet. All other factors being equal (age, pre-existing conditions, etc.), John is likely to pay a higher premium than Sarah. This is because his lifestyle choices increase his risk of developing health problems, thus increasing the likelihood of higher healthcare costs for the insurance company. Many insurers offer wellness programs and discounts for healthy lifestyle choices, reflecting this risk-based pricing model. These programs incentivize healthier choices, potentially leading to lower premiums over time.

Finding and Comparing Monthly Health Insurance Plans

Choosing the right health insurance plan can feel overwhelming, but with a systematic approach, you can find a plan that balances affordability with adequate coverage. This section Artikels resources and steps to effectively compare plans based on your needs and budget.

Finding affordable monthly health insurance options requires utilizing various resources and understanding your eligibility for assistance programs.

Resources for Finding Affordable Health Insurance

Several avenues can help you discover affordable health insurance plans. The HealthCare.gov website is a central resource for finding plans available through the Affordable Care Act (ACA) marketplaces. Navigating this site allows you to input your location, income, and family size to see plans tailored to your circumstances. State insurance marketplaces offer similar services and may have additional programs specific to your state. You can also contact a licensed insurance broker or agent; these professionals can compare plans from various insurers and help you navigate the application process. Many employers offer group health insurance plans, often with lower premiums than individual plans. Finally, consider eligibility for government assistance programs like Medicaid and CHIP (Children’s Health Insurance Program). These programs offer subsidized or free healthcare coverage to eligible individuals and families.

A Step-by-Step Guide to Comparing Health Insurance Plans

Comparing health insurance plans requires a methodical approach.

- Determine your needs: Consider your current health status, anticipated healthcare needs (e.g., doctor visits, prescription drugs), and family circumstances.

- Gather plan information: Obtain detailed information from the insurance company websites or your broker. Pay close attention to the Summary of Benefits and Coverage (SBC).

- Compare monthly premiums: Note the monthly cost for each plan. Consider this in relation to your budget.

- Analyze deductibles and out-of-pocket maximums: Understand the amount you pay before insurance coverage begins and the maximum you’ll pay out-of-pocket in a year.

- Evaluate copayments and coinsurance: Determine the amount you pay for services (doctor visits, hospital stays) under the plan.

- Check the provider network: Ensure your preferred doctors and hospitals are included in the plan’s network. Using out-of-network providers typically leads to higher costs.

- Review prescription drug coverage: If you take prescription medications, check the plan’s formulary (list of covered drugs) and cost-sharing amounts.

- Compare benefits: Consider the types of services covered, such as preventive care, mental health services, and maternity care.

- Make your decision: Weigh the monthly premium against the overall cost-sharing and benefits to find the best fit for your needs and budget.

Interpreting a Sample Health Insurance Plan Document

A sample Summary of Benefits and Coverage (SBC) might show a monthly premium of $300, a $5,000 deductible, a $10,000 out-of-pocket maximum, and a $30 copay for doctor visits. This means you pay $300 monthly. You would then pay all medical expenses up to $5,000 before the insurance starts covering its share. Once you reach $10,000 in out-of-pocket expenses, the insurance covers 100% of your costs for the rest of the year. Each doctor’s visit would cost you $30 until the deductible is met.

Essential Considerations When Choosing a Plan Based on Monthly Premium

Before selecting a health insurance plan, prioritize these factors:

- Affordability: Can you comfortably afford the monthly premium, deductible, and other cost-sharing amounts?

- Coverage needs: Does the plan cover the healthcare services you are likely to need?

- Provider network: Does the plan include your preferred doctors and hospitals?

- Prescription drug coverage: Does the plan cover your necessary medications at an acceptable cost?

- Overall cost: Consider the total cost of the plan over a year, not just the monthly premium.

Understanding the Coverage Provided

Choosing a health insurance plan involves carefully considering the scope of coverage. Understanding what your plan covers and doesn’t cover is crucial for managing healthcare costs and ensuring you receive the necessary care. This section details the typical coverage, differences between provider types, and common limitations.

A standard monthly premium health insurance plan typically includes coverage for a wide range of medical services. This usually encompasses doctor visits, hospital stays, surgeries, diagnostic tests, and prescription drugs. The specifics, however, vary depending on the plan’s design and the insurer. Some plans offer more comprehensive coverage than others, impacting the monthly premium cost.

In-Network versus Out-of-Network Providers

A key distinction in understanding your health insurance coverage lies in the difference between in-network and out-of-network providers. In-network providers are doctors, hospitals, and other healthcare professionals who have contracted with your insurance company to provide services at negotiated rates. Using in-network providers generally results in lower out-of-pocket costs for you, as the insurance company has already pre-arranged discounted fees. Out-of-network providers, on the other hand, haven’t signed contracts with your insurer. Using their services usually means higher costs for you, with the insurance company potentially covering only a portion of the expenses, and you paying a significantly larger share.

Common Exclusions and Limitations

It’s important to be aware that even comprehensive health insurance plans have exclusions and limitations. These are specific services or conditions that the plan does not cover or covers only partially. Common exclusions can include experimental treatments, cosmetic procedures (unless medically necessary), and certain types of long-term care. Limitations may involve annual or lifetime maximums on coverage, requiring you to pay out-of-pocket after reaching those limits. Pre-existing conditions might also be subject to specific waiting periods before full coverage is applied, although this is significantly less common due to the Affordable Care Act.

Typical Benefits and Limitations of a Basic Monthly Premium Plan

Understanding the balance between benefits and limitations is crucial when selecting a basic plan. While these plans generally offer lower monthly premiums, they often come with trade-offs in coverage depth.

- Benefit: Lower monthly premiums compared to more comprehensive plans.

- Benefit: Coverage for essential healthcare services, such as doctor visits and hospitalization.

- Limitation: Higher out-of-pocket costs, including deductibles, co-pays, and coinsurance.

- Limitation: Limited or no coverage for certain specialist visits or procedures.

- Limitation: Potentially higher cost-sharing for prescription drugs.

- Limitation: Smaller network of in-network providers, potentially limiting choice of healthcare professionals.

Managing Monthly Health Insurance Costs

Managing the cost of health insurance is a significant concern for many individuals and families. High premiums can strain household budgets, making it crucial to understand strategies for reducing expenses and maximizing the value of your plan. This section will explore practical methods to control your monthly health insurance costs and resources available to assist you.

Strategies for Reducing Monthly Health Insurance Expenses

Several strategies can help lower your monthly health insurance premiums. Choosing a higher deductible plan, for instance, often results in lower monthly payments. However, it’s essential to weigh this against the potential for higher out-of-pocket costs if you require significant medical care. Another effective approach is to carefully compare plans offered by different insurers. Premiums can vary significantly between providers, even for similar coverage levels. Finally, maintaining a healthy lifestyle can indirectly reduce costs by minimizing the need for frequent medical services. Preventive care, such as annual check-ups and screenings, can also help detect and address potential health issues early, preventing more expensive treatments later.

Programs Assisting with Affordable Health Insurance Premiums

Various government programs and subsidies are designed to help individuals and families afford health insurance. The Affordable Care Act (ACA) marketplace offers subsidies based on income, reducing the cost of premiums for eligible individuals. Medicaid, a joint state and federal program, provides healthcare coverage to low-income individuals and families. In some cases, employers may offer assistance programs to help employees manage their health insurance costs, such as flexible spending accounts (FSAs) or health savings accounts (HSAs). These accounts allow pre-tax contributions to be used for eligible medical expenses, reducing your taxable income and lowering your overall healthcare costs. Eligibility criteria vary depending on the specific program and location.

Maximizing the Value of a Health Insurance Plan

To maximize the value of your health insurance, it is important to understand your plan’s benefits and limitations. Familiarize yourself with your coverage details, including your deductible, copay, and out-of-pocket maximum. Utilize preventive care services covered by your plan, such as annual check-ups and vaccinations. These services can help prevent costly health problems in the future. Actively participate in your healthcare decisions by choosing in-network providers whenever possible, as this typically results in lower costs. Carefully review all medical bills to ensure accuracy and promptly address any discrepancies. Understanding your plan’s benefits and actively managing your healthcare can significantly improve the value you receive.

Consequences of Failing to Pay Monthly Premiums

Non-payment of health insurance premiums can have serious consequences. Your coverage may be canceled, leaving you responsible for the full cost of any medical services you require. This can result in significant financial hardship, particularly in the event of a medical emergency. Furthermore, a history of non-payment can impact your ability to obtain health insurance in the future, as insurers may view you as a higher risk. Depending on the insurer and state regulations, late or missed payments may also lead to penalties or fees. It’s crucial to prioritize paying your health insurance premiums to avoid these potentially severe financial and healthcare repercussions.

Illustrative Examples

Understanding the fluctuations in monthly health insurance premiums requires visualizing how various factors interact over time. The following examples illustrate the complexities of premium calculations and their impact on individuals and families.

Visual Representation of Premium Changes Based on Age and Health Status

Imagine a line graph. The horizontal axis represents age, ranging from 20 to 65 years. The vertical axis represents the monthly premium cost, in dollars. Multiple lines are plotted on this graph, each representing a different health status. A line representing a consistently healthy individual would show a relatively gradual, upward trend. The slope would be gentle, reflecting the typical increase in premiums associated with aging. A second line, representing someone with a pre-existing condition, would start higher and show a steeper upward slope, reflecting higher initial costs and a more pronounced increase with age due to increased risk. A third line, representing someone who develops a serious health condition mid-life, would show a relatively stable cost until the point of diagnosis, followed by a sharp increase in the premium. The graph visually demonstrates how age and health status significantly influence the cost of monthly premiums over time, with age generally increasing costs and pre-existing conditions or new health issues leading to steeper increases.

Monthly Health Insurance Expenses: A Young Professional vs. a Family

This case study compares the monthly health insurance expenses of two individuals: a 28-year-old single professional, Alex, and a family of four – John, 35, his wife Sarah, 32, and their two children, ages 5 and 2.

Alex, a healthy young professional, opts for a high-deductible health plan with a lower monthly premium. His plan might cost approximately $250 per month. This plan offers lower monthly payments but requires him to pay a significant amount out-of-pocket before insurance coverage kicks in. This strategy works for Alex, as he is generally healthy and anticipates minimal healthcare needs.

John’s family, however, requires a more comprehensive plan due to the increased risk associated with having young children. They choose a plan with a lower deductible and broader coverage, which includes pediatric care. Their monthly premium is significantly higher, approximately $1200 per month. This reflects the increased cost associated with covering multiple individuals and the higher likelihood of healthcare utilization within a family. While the monthly premium is substantially more expensive, it offers them greater financial protection in case of unexpected medical expenses for their children or themselves. This comparison highlights how individual circumstances and family size drastically influence the cost of monthly health insurance.

Final Conclusion

Securing affordable and comprehensive health insurance is a significant step towards protecting your well-being. By understanding the factors that influence monthly premiums, comparing plan options effectively, and implementing cost-saving strategies, you can confidently navigate the complexities of health insurance and choose a plan that aligns with your needs and budget. Remember to regularly review your plan and make adjustments as your circumstances change to ensure ongoing financial and healthcare security.

Top FAQs

What is a deductible?

A deductible is the amount you pay out-of-pocket for covered healthcare services before your insurance begins to pay.

What is a copay?

A copay is a fixed amount you pay for a covered healthcare service, such as a doctor’s visit, at the time of service.

Can I change my health insurance plan during the year?

Generally, you can only change your health insurance plan during the annual open enrollment period, unless you qualify for a special enrollment period due to a qualifying life event (e.g., marriage, job loss).

What happens if I don’t pay my monthly premium?

Failure to pay your monthly premium can result in your coverage being cancelled, leaving you responsible for all medical expenses.

Where can I find help affording health insurance?

Several government programs and subsidies can help individuals and families afford health insurance. Check with the Healthcare.gov website or your state’s insurance marketplace for details.