Navigating the world of health insurance can feel like deciphering a complex code. Understanding your monthly medical insurance premium is crucial for securing adequate healthcare coverage without breaking the bank. This guide unravels the mysteries behind premium calculations, exploring the factors that influence costs and offering strategies to manage expenses effectively. We’ll delve into the nuances of different plan types, coverage levels, and government assistance programs, empowering you to make informed decisions about your health insurance.

From the impact of age and pre-existing conditions to the influence of geographic location and deductible choices, we’ll examine the key variables that shape your monthly premium. We’ll also provide practical advice on finding affordable plans, utilizing preventative care, and leveraging available financial assistance to ensure you receive the healthcare you need without undue financial burden.

Defining “Monthly Medical Insurance Premium”

A monthly medical insurance premium is the recurring payment you make to an insurance company in exchange for coverage under a health insurance plan. This payment secures your access to a range of healthcare services, helping to mitigate the financial burden of unexpected medical expenses. Understanding the components and factors influencing your premium is crucial for making informed decisions about your health insurance.

Components of a Monthly Medical Insurance Premium

Several factors contribute to the final cost of your monthly premium. These components often include administrative costs incurred by the insurance company, the cost of claims paid out to policyholders, and the insurer’s profit margin. Additionally, the actuarial assessment of risk plays a significant role, with higher-risk individuals typically paying more. The specific breakdown of these components isn’t always publicly available, but the overall cost is a reflection of the expected expenses the insurer anticipates covering.

Factors Influencing Premium Costs

Numerous factors influence how much you pay monthly for your medical insurance. Age is a significant factor, with older individuals generally paying higher premiums due to increased healthcare utilization. Your health status, including pre-existing conditions, also impacts your premium. Individuals with pre-existing conditions often face higher premiums as they represent a higher risk to the insurer. Geographic location plays a role, with premiums varying based on the cost of healthcare services in your area. The type of plan you choose—for example, a high-deductible plan versus a low-deductible plan—significantly affects your monthly payment. Finally, the level of coverage you select influences the premium; more comprehensive coverage typically comes with a higher premium.

Types of Medical Insurance Plans and Premium Variations

Different types of medical insurance plans offer varying levels of coverage and, consequently, different premium costs. For instance, Health Maintenance Organizations (HMOs) typically have lower premiums but require you to use in-network providers. Preferred Provider Organizations (PPOs) offer more flexibility in choosing providers but usually come with higher premiums. Point-of-Service (POS) plans blend aspects of both HMOs and PPOs, offering a middle ground in terms of cost and flexibility. High-deductible health plans (HDHPs) feature lower premiums but require you to pay a significant amount out-of-pocket before insurance coverage kicks in. Catastrophic plans are designed for young adults who are healthy and are only meant to cover catastrophic illnesses or injuries.

Premium Variations Across Age Groups and Health Conditions

The following table illustrates how premiums can vary based on age and health status. Note that these are illustrative examples and actual premiums will vary based on numerous factors, including location, insurer, and specific plan details.

| Age Group | Health Condition | Estimated Monthly Premium (Illustrative Example) | Plan Type |

|---|---|---|---|

| 25-34 | Healthy | $300 | HMO |

| 25-34 | Pre-existing condition (diabetes) | $450 | HMO |

| 55-64 | Healthy | $600 | HMO |

| 55-64 | Pre-existing condition (heart disease) | $900 | HMO |

Factors Affecting Premium Costs

Several key factors influence the cost of your monthly medical insurance premium. Understanding these factors can help you make informed decisions when choosing a plan. These factors interact in complex ways, and the relative importance of each can vary depending on the specific insurance company and the details of the plan.

Age and Premium Costs

Age is a significant factor determining premium costs. Generally, older individuals pay higher premiums than younger individuals. This is because the risk of needing more extensive medical care increases with age. Insurance companies base their premiums on actuarial data, which reflects the statistically higher healthcare utilization among older populations. For example, a 60-year-old might pay significantly more than a 30-year-old for the same coverage due to the increased likelihood of chronic conditions and higher healthcare expenses.

Pre-existing Conditions and Premium Costs

Pre-existing conditions, or health issues you had before enrolling in a health insurance plan, can significantly impact your premium. In many countries, while pre-existing conditions are no longer grounds for denial of coverage, they can still lead to higher premiums. Insurance companies consider the potential cost of treating these conditions when setting premiums. Someone with a history of heart disease, for instance, might face higher premiums than someone with no such history, reflecting the increased likelihood of needing related care.

Individual vs. Family Plans

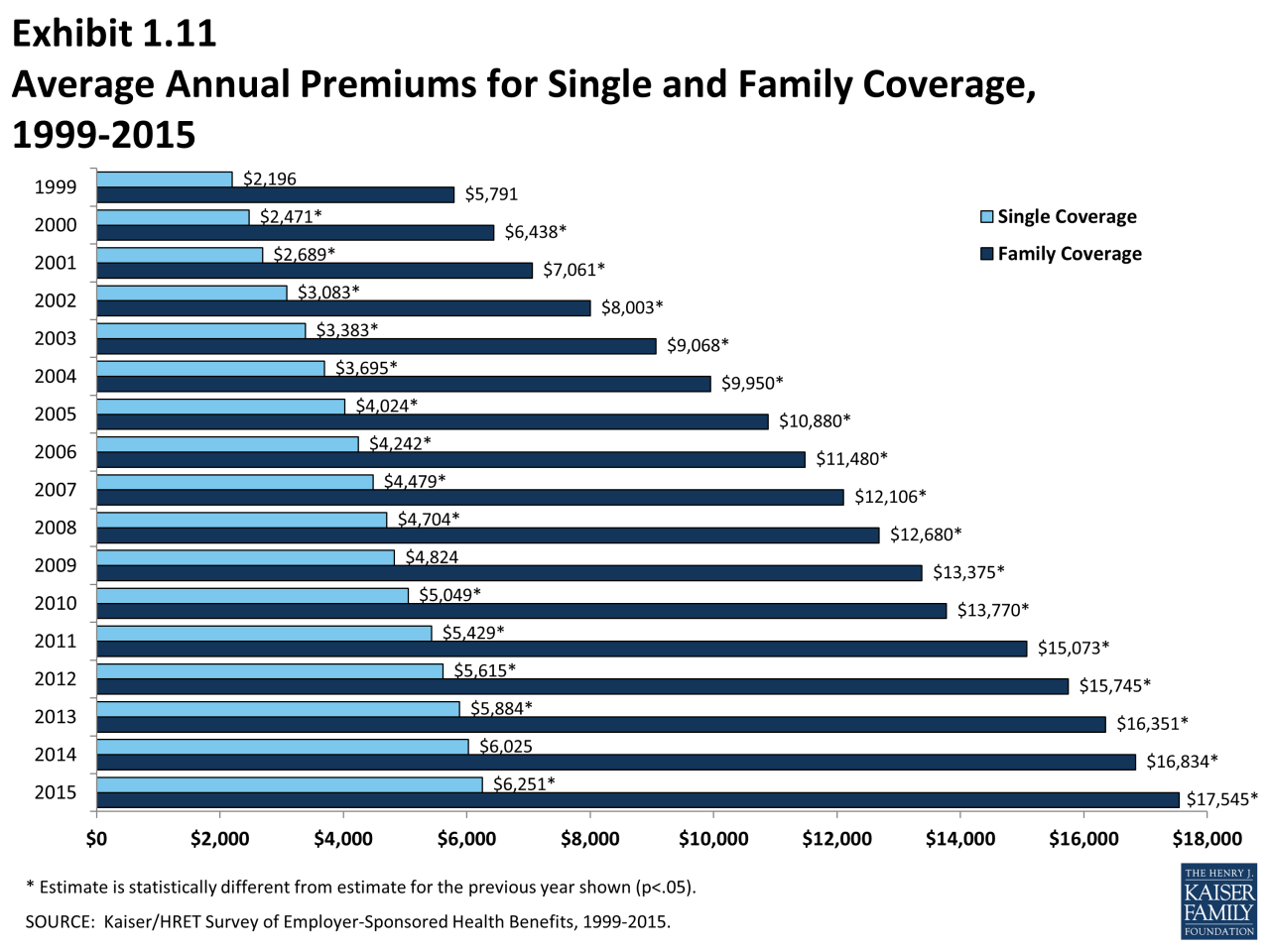

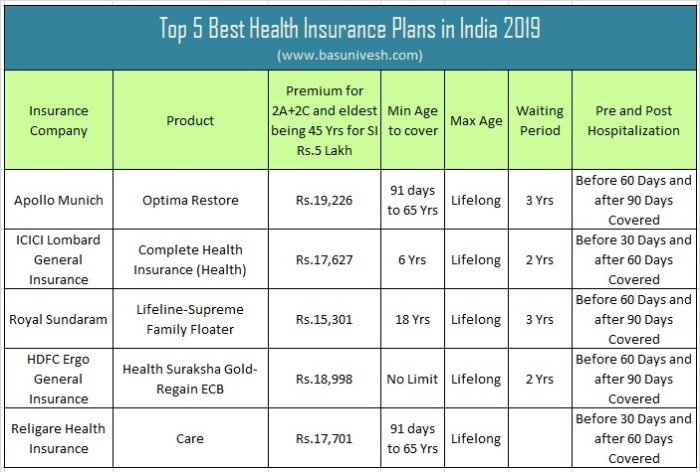

Family plans typically cost more than individual plans, but often offer better value per person. While the exact cost difference varies greatly based on the number of family members and the plan’s specifics, the overall cost for a family plan reflects the coverage provided for multiple individuals. A family plan covers several people under a single policy, resulting in a higher premium than an individual plan, but potentially offering a more cost-effective solution compared to purchasing individual plans for each family member.

Geographic Location and Premium Rates

Geographic location plays a substantial role in determining premium costs. Areas with higher healthcare costs, such as those with a higher concentration of specialists or expensive medical facilities, typically have higher premiums. Furthermore, the cost of living and the prevalence of certain health conditions in a region also contribute to premium variations. For example, someone living in a major metropolitan area might pay more than someone in a rural area due to the higher cost of healthcare services in densely populated regions.

Deductible Choices and Premium Costs

The deductible, the amount you pay out-of-pocket before your insurance coverage kicks in, significantly affects your monthly premium. A higher deductible generally results in a lower monthly premium, and vice versa. This is because a higher deductible means the insurance company bears less risk in the short term. For example, a plan with a $5,000 deductible might have a monthly premium of $200, while a plan with a $1,000 deductible might cost $300 per month. The choice depends on individual risk tolerance and financial capacity.

Strategies for Managing Premium Costs

Managing your monthly medical insurance premium requires a proactive approach. Understanding the factors influencing costs and employing effective strategies can significantly impact your overall healthcare expenses. This section Artikels practical steps to reduce your premium burden and maintain adequate coverage.

Finding Affordable Medical Insurance Plans

Locating affordable medical insurance involves careful research and consideration of various plan options. Several strategies can help you find a plan that fits your budget and healthcare needs. For example, exploring plans offered through your employer’s group insurance program often provides more affordable rates due to economies of scale. Alternatively, researching plans available through the Health Insurance Marketplace (in the US) or similar government-sponsored programs in other countries allows for comparison shopping based on your income and family size, potentially qualifying you for subsidies that lower your monthly costs. Consider factors like deductible, copay, and out-of-pocket maximums when comparing plans, as lower premiums might mean higher costs when you need care. Finally, understanding the differences between HMOs (Health Maintenance Organizations), PPOs (Preferred Provider Organizations), and other plan types is crucial to choosing the best fit for your healthcare usage patterns.

Lifestyle Choices and Premium Costs

Lifestyle choices significantly influence your health and, consequently, your insurance premiums. Maintaining a healthy weight, engaging in regular physical activity, and adopting a balanced diet can reduce your risk of developing chronic conditions such as heart disease, diabetes, and obesity. These conditions often require expensive treatments and medications, driving up insurance costs. Conversely, insurers may offer discounts or lower premiums for individuals demonstrating a commitment to healthy habits, through wellness programs or self-reported data. Smoking, excessive alcohol consumption, and substance abuse increase the likelihood of health complications and, therefore, lead to higher premiums. Insurers assess risk based on lifestyle factors, so making healthy choices can translate into long-term cost savings.

Preventative Care and Long-Term Premium Savings

Preventative care plays a crucial role in managing long-term healthcare costs and, indirectly, insurance premiums. Regular checkups, screenings, and vaccinations help detect and address potential health issues early, preventing them from escalating into more serious and expensive conditions. For instance, regular blood pressure and cholesterol checks can help identify and manage hypertension and high cholesterol, reducing the risk of heart disease. Similarly, routine cancer screenings can detect early-stage cancers, improving treatment outcomes and potentially reducing long-term healthcare expenses. While preventative care might involve immediate costs, the long-term savings in medical bills and lower insurance premiums due to reduced risk often outweigh the initial investment. Many insurance plans cover preventative services at little to no cost to the insured.

Step-by-Step Guide to Comparing Insurance Plans

Comparing insurance plans requires a systematic approach. First, gather information from various sources, such as your employer, the Health Insurance Marketplace (if applicable), or directly from insurance providers. Next, focus on key factors: premium costs, deductible, copay, out-of-pocket maximum, and covered services. Create a comparison table to organize this information. Then, consider your healthcare needs and usage patterns. If you anticipate frequent doctor visits or specialized care, a plan with a lower copay and deductible might be preferable, even if the premium is slightly higher. Finally, carefully review the plan’s formulary (list of covered medications) if you take prescription drugs regularly. Choosing a plan that covers your necessary medications is crucial to avoid unexpected expenses. This detailed comparison ensures you select a plan that best balances cost and coverage for your specific requirements.

Last Recap

Ultimately, understanding your monthly medical insurance premium is key to securing comprehensive healthcare coverage that aligns with your budget and health needs. By carefully considering the factors influencing premium costs, exploring different plan options, and utilizing available resources, you can confidently navigate the complexities of health insurance and make informed decisions that protect your financial well-being and your health.

Commonly Asked Questions

What happens if I miss a monthly premium payment?

Missing a payment can lead to a lapse in coverage, potentially resulting in denial of claims and penalties. Contact your insurance provider immediately if you anticipate difficulty making a payment; they may offer payment plans or other solutions.

Can I change my health insurance plan during the year?

Generally, you can only change plans during the annual open enrollment period, unless you qualify for a special enrollment period due to a qualifying life event (e.g., marriage, job loss, birth of a child).

How do I appeal a denied claim?

Your insurance policy will Artikel the appeals process. This typically involves submitting a written appeal with supporting documentation within a specified timeframe.

What is a copay versus a coinsurance?

A copay is a fixed amount you pay for a doctor’s visit or other service. Coinsurance is a percentage of the cost you pay after you’ve met your deductible.