Navigating the complexities of auto insurance in Michigan can feel like traversing a maze, especially when it comes to understanding the medical portion of your premiums. Michigan’s unique no-fault system significantly impacts these costs, creating a landscape of varying coverage options, influencing factors, and potential savings. This exploration delves into the intricacies of Michigan’s auto insurance medical coverage, providing clarity on what factors affect your premiums and how you can make informed decisions.

From understanding the different coverage levels and their associated costs to exploring the impact of driving history, age, and pre-existing conditions, we’ll equip you with the knowledge to navigate this crucial aspect of your auto insurance policy. We’ll also examine how recent legislative changes have shaped the market and offer practical tips for minimizing your premium expenses.

Michigan’s No-Fault Auto Insurance System

Michigan operates under a no-fault auto insurance system, meaning that regardless of who caused an accident, your own insurance company covers your medical expenses and lost wages. This system significantly impacts the cost of auto insurance premiums, as the potential for high medical bills is directly reflected in the price you pay. Understanding the intricacies of Michigan’s no-fault system is crucial for choosing the right coverage.

Structure of Michigan’s No-Fault System and its Impact on Medical Coverage in Auto Insurance Premiums

Michigan’s no-fault system mandates that all drivers carry personal injury protection (PIP) coverage. This coverage pays for your medical bills, lost wages, and other expenses resulting from a car accident, regardless of fault. The amount of PIP coverage you choose directly affects your premium; higher coverage limits lead to higher premiums. The system also includes property damage liability coverage, which covers damages to other people’s vehicles or property in an accident you cause. The higher the potential payout for medical expenses under PIP, the higher the premium cost for the insurer to manage the risk. This is because the insurer is responsible for paying out claims regardless of who caused the accident.

Available Coverage Options Under Michigan’s No-Fault Law

Michigan offers several levels of PIP coverage, allowing drivers to choose the amount of medical expense coverage they want. The most common options include $1,000, $2,000, $5,000, $10,000, $20,000, $50,000, and unlimited coverage. Choosing a higher coverage limit provides greater financial protection in the event of a serious accident, but also increases your premium. It’s important to weigh the potential costs of medical treatment against the cost of the higher premium. Beyond PIP, drivers also need to consider property damage liability coverage, uninsured/underinsured motorist coverage, and collision and comprehensive coverage, all of which can impact the overall premium.

Comparison of Medical Coverage Limits Offered by Various Insurance Providers in Michigan

Different insurance providers in Michigan offer varying rates for the same level of PIP coverage. These differences can stem from a variety of factors, including the insurer’s risk assessment, operating costs, and competitive pricing strategies. It is advisable to obtain quotes from multiple insurers to compare pricing and coverage options before making a decision. While specific rates fluctuate constantly, a general trend shows that insurers offering lower premiums might have stricter claim processing procedures or higher deductibles.

Cost Comparison of Various Medical Coverage Options

The following table provides a hypothetical comparison of monthly premiums and deductibles for different levels of PIP coverage. Remember that these are estimates, and actual costs will vary depending on the insurer, your driving record, and other factors.

| Coverage Level | Estimated Monthly Premium | Deductible | Notes |

|---|---|---|---|

| $1,000 | $50 | $250 | Lower premium, but limited coverage. |

| $5,000 | $75 | $500 | More comprehensive coverage, higher premium. |

| $20,000 | $125 | $1000 | Significant coverage for serious injuries. |

| Unlimited | $200 | $2500 | Maximum protection, highest premium. |

Factors Influencing Medical Portion Premiums

Understanding the factors that determine the cost of your medical portion of auto insurance in Michigan is crucial for making informed decisions. Several key elements contribute to the final premium, and it’s important to understand how these elements interact to influence your overall cost. This section will explore these factors in detail.

Driving History

Your driving record significantly impacts your medical premium. Insurers view a history of accidents and traffic violations as indicators of higher risk. Multiple accidents, particularly those resulting in injuries, will likely lead to higher premiums, reflecting the increased likelihood of future medical claims. Similarly, numerous speeding tickets or other moving violations suggest a less cautious driving style, potentially increasing the risk of accidents and associated medical costs. Conversely, a clean driving record with no accidents or violations will generally result in lower premiums. For example, a driver with three at-fault accidents in the past five years might face substantially higher premiums than a driver with a spotless record.

Age and Gender

Age and gender are statistically correlated with accident rates and healthcare utilization, and therefore influence premium calculations. Younger drivers, particularly those in their late teens and early twenties, generally pay higher premiums due to their statistically higher accident rates. This reflects the higher risk associated with inexperience and potentially less cautious driving habits. While gender-based differences in accident rates are less pronounced, some studies suggest variations that insurers may consider. It’s important to note that these are statistical trends; individual risk profiles may vary significantly. For instance, a 20-year-old with a clean driving record might pay less than a 50-year-old with a history of accidents, despite the age difference.

Pre-existing Medical Conditions

Pre-existing medical conditions are generally not a direct factor in determining the cost of your *auto* insurance medical coverage in Michigan’s no-fault system. Michigan’s no-fault law mandates that your insurer cover your medical expenses regardless of fault, up to the limits of your policy. However, the severity and potential cost of treating a pre-existing condition could indirectly affect the premium calculation in a different manner. If an insurer believes a pre-existing condition might exacerbate injuries from an accident, leading to significantly higher medical bills, they might use that information to assess risk in other ways, potentially leading to higher premiums for other aspects of your coverage. This is less about the pre-existing condition itself and more about the overall assessment of potential claim costs.

Understanding Medical Payments Coverage

Michigan’s no-fault auto insurance system includes medical payments coverage, a valuable benefit that helps pay for medical expenses resulting from a car accident, regardless of fault. This coverage is distinct from Personal Injury Protection (PIP), which covers a broader range of expenses including lost wages. Understanding its specifics is crucial for navigating the claims process and ensuring you receive the appropriate compensation.

Types of Covered Medical Expenses

Medical payments coverage in Michigan typically covers reasonable and necessary medical expenses incurred as a direct result of an auto accident. This includes expenses such as doctor visits, hospital stays, surgery, prescription medications, physical therapy, and ambulance services. The policy will usually specify a coverage limit, representing the maximum amount the insurer will pay for these expenses. It’s important to note that the definition of “reasonable and necessary” can be subject to interpretation and may be challenged by the insurance company. Documentation, such as bills and medical reports, is essential for supporting claims.

Filing a Medical Payments Claim

Filing a claim for medical expenses under your Michigan auto insurance policy generally involves contacting your insurance company as soon as possible after the accident. You’ll need to provide information about the accident, including the date, time, location, and individuals involved. Crucially, you will also need to submit detailed documentation of your medical expenses, such as bills, receipts, and medical reports from your healthcare providers. Your insurer will review your claim and, if approved, will process payment directly to the healthcare providers or reimburse you for expenses you’ve already paid. The timeframe for processing claims varies depending on the insurer and the complexity of the claim. Delayed or denied claims may require further communication with your insurer or legal counsel.

Limitations and Exclusions

While medical payments coverage offers valuable protection, it does have limitations and exclusions. For instance, policies typically have a stated coverage limit, meaning the insurer will only pay up to a specified amount, regardless of the total medical expenses incurred. Pre-existing conditions are usually excluded, meaning expenses related to injuries or illnesses that existed before the accident are unlikely to be covered. Similarly, expenses deemed unnecessary or unreasonable by the insurer might be denied. Finally, coverage might be limited to expenses incurred within a specific timeframe after the accident. It’s crucial to carefully review your policy to understand the specific limitations and exclusions that apply to your coverage.

Common Scenarios for Medical Payments Coverage Application

The following scenarios illustrate situations where medical payments coverage might apply:

- You are injured in a car accident, requiring emergency room treatment and follow-up care.

- A passenger in your car is injured and requires medical attention.

- You are involved in a hit-and-run accident and sustain injuries.

- You are injured while driving someone else’s car and that car’s insurance doesn’t cover your medical expenses.

- You sustain injuries while driving your own car and need to seek medical treatment, even if you are at fault for the accident.

Comparison of Insurance Providers

Choosing the right auto insurance provider in Michigan can significantly impact your medical coverage costs and claim experience. This section compares the medical coverage options and pricing of three major providers, along with their customer service and claim processing performance. Note that rates and services can vary based on individual factors like driving history, location, and the specific policy chosen. It’s crucial to obtain personalized quotes from each provider for an accurate comparison.

Medical Coverage Options and Pricing

Several factors influence the cost of medical coverage in Michigan no-fault insurance. These include the amount of Personal Injury Protection (PIP) coverage selected, deductibles, and any additional riders or endorsements. Let’s examine the offerings of three hypothetical major providers—Company A, Company B, and Company C—for a standard policy with $500,000 in PIP coverage. These are illustrative examples and do not represent actual current pricing from specific companies.

Company A might offer a base policy with a $1,000 deductible for $150 per month. Company B might offer similar coverage with a $500 deductible for $175 per month. Company C, focusing on lower deductibles, could offer a $250 deductible option for $200 per month. These prices can fluctuate based on the aforementioned individual factors. It’s important to note that higher deductibles generally result in lower premiums, but increase your out-of-pocket expenses in the event of a claim.

Customer Service Ratings and Claim Processing Times

Customer satisfaction and efficient claim processing are crucial aspects to consider when selecting an auto insurance provider. The following table presents hypothetical ratings and processing times for our three example providers. These are illustrative and should not be taken as definitive representations of actual provider performance. Independent rating agencies and customer review sites offer more comprehensive and up-to-date data.

| Provider | Customer Service Rating (out of 5) | Average Claim Processing Time (days) | Claim Dispute Resolution Method |

|---|---|---|---|

| Company A | 4.0 | 21 | Internal review, then arbitration if needed |

| Company B | 3.5 | 28 | Mediation, followed by litigation if necessary |

| Company C | 4.2 | 18 | Internal review, then potentially independent medical examination (IME) |

Dispute Resolution Processes

Disputes regarding medical payments can arise due to disagreements over the necessity or reasonableness of medical treatment, the amount billed, or the extent of injuries. Each provider typically has its own internal dispute resolution process. Company A, for example, might offer an internal review process where a claims adjuster re-examines the claim. If the dispute remains unresolved, they may resort to binding arbitration. Company B might utilize mediation as a first step, attempting to reach a settlement between the insured and the provider. If mediation fails, litigation may become necessary. Company C may utilize an independent medical examination (IME) to assess the validity of the medical treatment claimed. The results of the IME would then be considered in the resolution of the dispute. It is essential to review each provider’s specific policies and procedures regarding dispute resolution before purchasing a policy.

Impact of Legislation and Reforms

Michigan’s auto insurance landscape has undergone significant transformation due to recent legislative reforms. These changes, primarily focused on the state’s no-fault system, have had a profound impact on the cost of medical coverage within auto insurance premiums. Understanding these reforms is crucial for both consumers and insurers alike.

The most significant change was the 2019 reform package, which altered several key aspects of the no-fault system. Prior to the reforms, Michigan had unlimited medical coverage under no-fault, leading to high premiums. The reforms introduced a system of capped medical benefits, allowing drivers to choose different coverage levels. This shift aimed to lower premiums by limiting potential payouts for medical expenses.

Effects of Capped Medical Benefits on Premiums

The introduction of capped medical benefits has demonstrably affected auto insurance premiums. While the goal was to reduce costs, the impact has been varied. Consumers choosing lower coverage limits generally experience lower premiums. Conversely, those who maintain higher coverage levels may see a smaller reduction, or even an increase in some cases, depending on their individual risk profile and the insurer’s pricing structure. The actual premium reduction varies widely depending on the chosen coverage level and the individual’s driving record and other risk factors. For example, a driver choosing the minimum $50,000 medical coverage limit might see a substantial decrease compared to someone who opts for unlimited coverage.

Consumer Choices and Access to Affordable Coverage

The reforms have undeniably impacted consumer choices. Drivers now face a decision regarding the appropriate level of medical coverage, balancing cost savings against potential financial risk in the event of a serious accident. This requires careful consideration of individual circumstances and risk tolerance. The availability of lower-cost options has increased access to auto insurance for some, but others may find themselves with less comprehensive coverage due to budget constraints. For instance, individuals with pre-existing conditions might opt for higher coverage despite the higher premium, fearing the financial burden of a severe injury.

Impact on the Medical Provider Network

The reforms have also altered the dynamics within the medical provider network. With capped benefits, medical providers are now dealing with limitations on reimbursements, potentially affecting their willingness to treat patients with auto insurance. Negotiations between insurers and healthcare providers have become more complex, with insurers seeking to manage costs and providers seeking to maintain profitability. This could lead to longer wait times for care or a reduction in the number of providers accepting auto insurance. The long-term consequences of these changes on the accessibility and quality of medical care for accident victims remain to be seen.

Tips for Reducing Medical Premium Costs

Lowering your Michigan auto insurance medical premiums requires a proactive approach. Several strategies can significantly impact your overall cost, allowing you to maintain adequate coverage without breaking the bank. By understanding these options and taking advantage of available discounts, you can effectively manage your insurance expenses.

Several factors influence the cost of your medical coverage, and understanding these factors empowers you to make informed decisions. Careful consideration of your driving history, insurance choices, and the potential for discounts can lead to considerable savings.

Good Driving Record Discounts

Maintaining a clean driving record is one of the most effective ways to reduce your insurance premiums. Insurance companies reward safe drivers with discounts, reflecting the lower risk they pose. For example, many insurers offer significant reductions for drivers who have remained accident-free for several years, often starting with a 5% discount for three years and increasing progressively. Similarly, avoiding traffic violations also leads to lower premiums. The specific discounts vary between insurance providers, so it’s advisable to compare quotes from multiple companies.

Bundling Insurance Policies

Bundling your auto insurance with other types of insurance, such as homeowners or renters insurance, often results in substantial savings. Insurance companies frequently offer discounts for customers who bundle their policies. This practice is beneficial because it simplifies administration and reduces the risk for the insurance company. For example, bundling your auto and home insurance with the same provider could lead to a discount of 10% or more on your auto insurance premiums. Always inquire about bundled policy discounts when obtaining quotes.

Exploring Payment Options

Paying your premiums annually, rather than monthly or quarterly, can often lead to lower overall costs. Many insurance companies offer a discount for paying in full upfront, as this simplifies their accounting and reduces administrative overhead. The amount of the discount varies between providers, but it’s a worthwhile option to consider if you can manage the upfront payment. For example, a 5% discount for annual payment is common. Carefully weigh the convenience of monthly payments against the potential savings of paying annually.

Summary

Ultimately, understanding the medical portion of your Michigan auto insurance premium requires a nuanced approach, considering the interplay of state regulations, individual risk profiles, and the offerings of various insurance providers. By carefully evaluating your coverage needs, comparing provider options, and implementing cost-saving strategies, you can secure the appropriate level of protection while managing your expenses effectively. Remember, informed choices lead to better financial outcomes and peace of mind.

FAQ Explained

What happens if I’m injured in an accident and don’t have enough medical coverage?

If your medical expenses exceed your policy’s coverage limit, you may be personally responsible for the remaining costs. Consider purchasing higher coverage limits to mitigate this risk.

Can I choose my own doctor after an accident?

Generally, yes, but it’s advisable to inform your insurer promptly. Your insurer may have preferred providers or a process for approving out-of-network care.

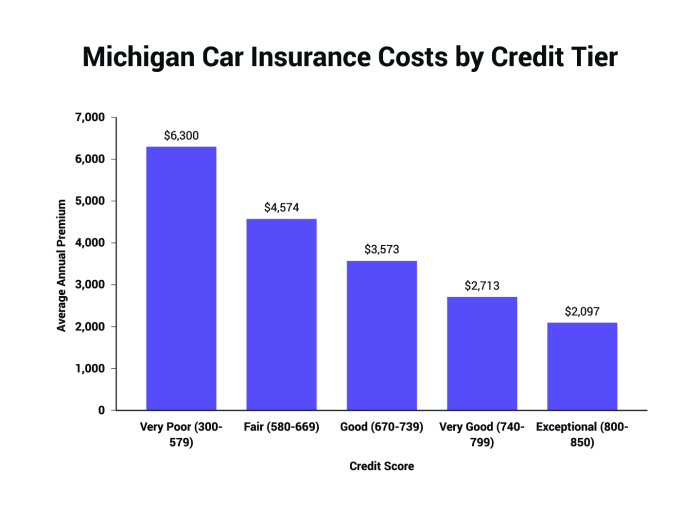

How does my credit score affect my auto insurance premiums?

In Michigan, credit-based insurance scores are often used to assess risk, and a lower score can lead to higher premiums. Maintaining a good credit score can positively influence your rates.

What if I disagree with my insurer’s assessment of my medical claim?

You have the right to appeal the decision. Your policy documents will Artikel the appeals process. You may also wish to consult with an attorney.