Navigating the complexities of healthcare costs is a challenge many face. Understanding the potential tax benefits associated with medical insurance premiums can significantly impact your financial well-being. This guide delves into the intricacies of medical insurance premiums tax deductibility, providing clarity on eligibility, claiming procedures, and potential pitfalls. We’ll explore how tax deductions can lessen the burden of healthcare expenses and offer practical strategies for maximizing your savings.

From defining medical insurance premiums and their components to outlining the specific tax laws and regulations governing deductions, we aim to equip you with the knowledge to confidently manage your healthcare finances. We’ll also examine the differences in tax deductibility across various employment situations and explore potential future trends that could affect your ability to claim these deductions.

Tax Deductibility of Medical Insurance Premiums

Medical insurance premiums are a significant expense for many individuals and families. Understanding the tax implications of these premiums can lead to substantial savings. The deductibility of these premiums varies considerably depending on factors such as employment status, the country of residence, and specific regulations in place. This section will explore the eligibility criteria, relevant laws, and international/interstate comparisons regarding tax deductions for medical insurance premiums.

Eligibility Criteria for Deducting Medical Insurance Premiums

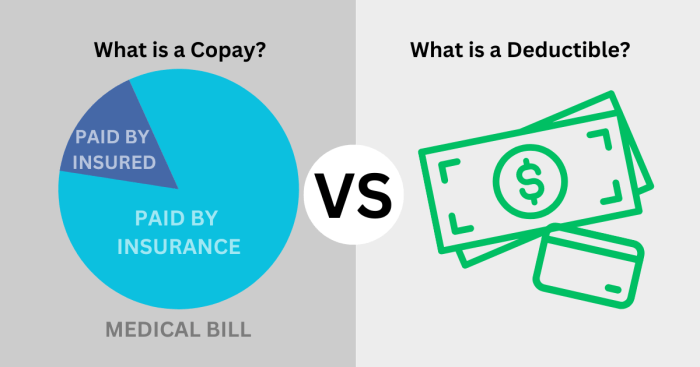

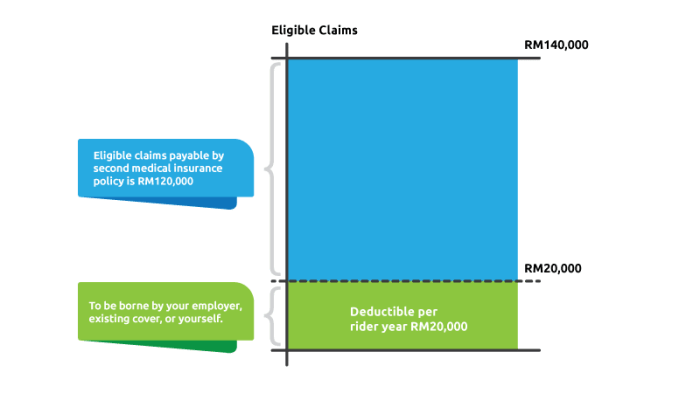

Eligibility for deducting medical insurance premiums typically hinges on factors like the type of insurance plan (e.g., self-employed vs. employer-sponsored), the nature of the expenses (e.g., premiums, co-pays, deductibles), and the individual’s tax filing status. Generally, individuals who pay for their own health insurance, such as the self-employed or those whose employers do not offer comprehensive coverage, are more likely to be eligible for deductions. However, even within these categories, specific requirements and limitations apply, often varying by jurisdiction. For instance, some countries may only allow deductions for specific types of medical expenses or impose limits on the amount that can be deducted.

Relevant Tax Laws and Regulations Pertaining to Premium Deductions

Tax laws concerning medical insurance premium deductions are complex and vary significantly between countries and even within states of a single country. For example, in the United States, the Affordable Care Act (ACA) influences deductibility, particularly for individuals purchasing insurance through the marketplaces. Self-employed individuals may be able to deduct premiums as a business expense under certain circumstances, while employees may have limited options for deduction, depending on their employer’s contributions and the specific plan. In other countries, such as Canada, the rules might focus on medical expense tax credits rather than direct deductions from income. It’s crucial to consult the specific tax regulations of your relevant jurisdiction for accurate and up-to-date information. Failure to comply with these regulations can result in penalties.

Comparison of Tax Deductibility Rules Across Different Countries or States

The deductibility of medical insurance premiums shows considerable variation globally. In some countries, comprehensive deductions are allowed, potentially offering substantial tax relief. Other countries may have stricter limitations, allowing only partial deductions or offering tax credits instead. For instance, some European countries offer generous tax benefits for health insurance, while others may have more limited provisions. Similarly, within the United States, state-level tax codes can further modify the federal rules, leading to variations in the final tax liability. This underscores the importance of researching the specific rules of your location.

Tax Deductions: Self-Employed vs. Employed Individuals

| Eligibility | Deduction Limits | Documentation Requirements | Tax Benefits |

|---|---|---|---|

| Self-employed individuals generally can deduct premiums as a business expense if the insurance is for themselves or their family. Specific criteria may apply depending on the country/state. | Varies widely depending on country/state and tax laws. Often capped at a certain percentage of income or a fixed amount. | Proof of premium payments (receipts, invoices, bank statements), tax identification number, and possibly other documentation showing eligibility. | Reduced taxable income, leading to lower tax liability. The exact amount saved depends on the individual’s tax bracket and the deduction amount. |

| Employed individuals typically cannot deduct premiums if their employer provides health insurance as part of their compensation package. Exceptions might exist for situations where the employer’s plan is insufficient or if additional private insurance is necessary. | Generally, no deduction is allowed if the employer provides coverage. If additional private insurance is purchased, deduction rules mirror those for the self-employed, depending on country/state. | Similar to self-employed individuals, proof of premium payments, and potentially documentation proving inadequacy of employer-provided insurance. | Reduced taxable income (only if additional private insurance is deductible), leading to lower tax liability. |

Different Types of Tax Deductions

Beyond the premiums you pay for medical insurance, several other medical expenses may be tax-deductible, depending on your country’s tax laws and specific circumstances. Understanding these deductions can significantly reduce your overall tax burden. This section will explore these additional deductions and how they interact with premium deductions.

The rules surrounding tax deductions for medical expenses often vary based on factors like your country of residence, your tax filing status, and the specific expenses incurred. It’s crucial to consult with a tax professional or refer to official government resources for the most accurate and up-to-date information.

Deduction Limits for Premiums and Other Medical Expenses

Deduction limits for medical insurance premiums and other medical expenses are often distinct. While premiums usually have specific limitations or thresholds (e.g., a percentage of adjusted gross income), other medical expenses may also be subject to limitations, often expressed as a percentage of your adjusted gross income (AGI) exceeding a certain amount. For instance, in some jurisdictions, only medical expenses exceeding a certain percentage of AGI are deductible, while others might have a flat dollar limit. The precise details vary considerably by location and tax year. For example, a country might allow a deduction for medical insurance premiums up to 7.5% of AGI, while other qualifying medical expenses might only be deductible if they exceed 10% of AGI.

Examples of Combining Premiums and Other Medical Expenses for Tax Benefits

Combining deductions for medical insurance premiums and other eligible medical expenses can maximize tax savings. Consider the following scenarios:

Let’s imagine a taxpayer, John, with an AGI of $70,000. His medical insurance premiums totaled $4,000, and he incurred additional medical expenses of $6,000 during the year. If the applicable tax law allows a deduction for premiums up to 7.5% of AGI ($5,250) and allows a deduction for other medical expenses exceeding 10% of AGI ($7,000), John could deduct his full $4,000 in premiums. However, because his additional medical expenses ($6,000) are below the 10% threshold, he cannot deduct them. However, if his other medical expenses were $8,000, he could deduct the amount exceeding $7,000, which is $1,000, in addition to his premium deduction.

Types of Deductible Medical Expenses Beyond Premiums

Many medical expenses beyond insurance premiums can be deductible. These typically include, but are not limited to: doctor and specialist visits, hospital stays, prescription medications, dental and vision care (sometimes with limitations), medical equipment (like wheelchairs or hearing aids), and certain types of therapy. The specific expenses that qualify vary by jurisdiction and may be subject to specific documentation requirements. Always maintain detailed records of all medical expenses for tax purposes.

Future Trends and Considerations

Predicting the future of tax laws is inherently uncertain, but analyzing current trends and government priorities offers valuable insights into potential changes affecting the tax deductibility of medical insurance premiums. Several factors, including budgetary pressures, healthcare reform initiatives, and evolving societal needs, could significantly impact this aspect of tax policy.

The deductibility of medical insurance premiums has been a subject of ongoing debate. Governments often face trade-offs between providing tax incentives for health insurance and managing overall budgetary constraints. Increased healthcare costs and aging populations place considerable strain on public finances, potentially leading to reevaluations of existing tax benefits. Furthermore, broader healthcare reforms, aiming to increase access and affordability, might influence how medical insurance premiums are treated for tax purposes. For example, a shift towards universal healthcare coverage could diminish the need for individual tax deductions related to private insurance.

Potential Changes in Tax Laws

Several scenarios are plausible. One possibility is a gradual reduction in the amount of medical insurance premiums that are deductible. This could involve increasing the income thresholds above which the deduction is phased out or reducing the percentage of premiums eligible for deduction. Another potential change involves stricter requirements for qualifying medical insurance plans, limiting the deductibility to plans meeting specific criteria regarding coverage and affordability. Alternatively, the government might maintain the current system but increase scrutiny of claims, potentially leading to more stringent audits and penalties for fraudulent deductions. For instance, a government might introduce a more rigorous verification process for premium payments, requiring more detailed documentation from taxpayers. This could involve linking tax returns to insurance company records. Finally, the government could completely eliminate the tax deduction for medical insurance premiums, shifting its focus to other mechanisms for promoting health insurance coverage.

Implications for Individuals and Families

Changes in the tax deductibility of medical insurance premiums would have significant implications for individuals and families. A reduction in the deduction or stricter eligibility criteria would lead to higher after-tax costs for health insurance. This would disproportionately affect individuals and families with higher medical expenses or those relying on private insurance. For example, a family currently deducting $10,000 in premiums annually could face a substantial increase in their tax liability if the deduction is reduced or eliminated. This would require them to either adjust their budget, consider less comprehensive insurance plans, or seek other ways to offset the increased cost. The elimination of the deduction could force individuals to re-evaluate their health insurance choices, potentially opting for less expensive, but possibly less comprehensive, plans to minimize out-of-pocket costs.

Adapting to Potential Changes

Individuals and families can take several steps to prepare for potential changes. Careful financial planning is crucial, including budgeting for higher health insurance costs. Exploring different health insurance options, including comparing plans and coverage levels, is essential. Seeking professional advice from a tax advisor or financial planner can help individuals understand the potential implications of tax law changes and develop strategies to mitigate their impact. Staying informed about updates to tax laws and regulations is vital to make timely adjustments to financial plans. This includes monitoring government announcements and consulting reputable financial news sources. Furthermore, maximizing contributions to health savings accounts (HSAs) or flexible spending accounts (FSAs), where applicable, can help offset some of the increased healthcare costs.

Epilogue

Successfully navigating the landscape of medical insurance premiums and tax deductions requires careful planning and understanding of applicable regulations. By leveraging the information presented in this guide, you can effectively manage your healthcare expenses and optimize your tax liability. Remember to consult with a tax professional for personalized advice tailored to your specific circumstances. Proactive financial planning, combined with a thorough understanding of tax laws, empowers you to make informed decisions and secure your financial future.

FAQ

Can I deduct premiums for my spouse’s insurance?

Deductibility often depends on your filing status and whether your spouse is also covered under your plan or has a separate policy. Specific rules vary by jurisdiction. Consult relevant tax regulations.

What if I have multiple medical insurance plans?

The rules regarding deducting premiums for multiple plans are complex and vary by location. Generally, you may be able to deduct premiums for only one plan, but it’s advisable to seek professional tax advice.

What documentation do I need to claim the deduction?

You’ll typically need proof of payment (e.g., receipts, bank statements) and your insurance policy information. Specific requirements depend on your tax jurisdiction.

Are there any income limits for claiming the deduction?

Income limits for deducting medical expenses, including premiums, vary by country and sometimes state. Some jurisdictions may not have income limitations while others might impose thresholds.