Navigating the complexities of healthcare costs is a universal challenge. Understanding how medical insurance premium deductions work can significantly impact your financial well-being and access to quality care. This guide delves into the intricacies of these deductions, exploring various types, eligibility criteria, and the potential tax advantages they offer. We’ll unpack the often-confusing details, empowering you to make informed decisions about your healthcare finances.

From defining the different types of deductions available to comparing schemes across various regions, we aim to provide a comprehensive resource. We’ll explore the impact of these deductions on individual budgets, analyze the influence of factors like age and health status, and even offer a glimpse into future trends in this crucial aspect of healthcare planning. Whether you’re an individual, a family, or a business owner, understanding medical insurance premium deductions is key to effective financial management in the healthcare landscape.

Definition and Types of Medical Insurance Premium Deductions

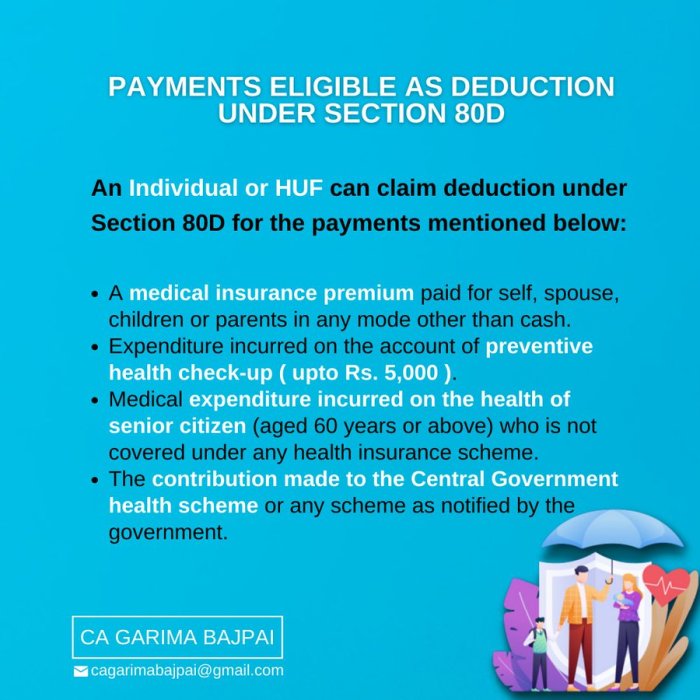

Medical insurance premium deductions offer a way to reduce your taxable income by deducting the cost of your health insurance premiums. This can significantly lower your overall tax liability, making health insurance more affordable. Understanding the different types of deductions and their eligibility criteria is crucial for maximizing your tax savings.

Types of Medical Insurance Premium Deductions

Several types of medical insurance premium deductions exist, depending on your employment status and the type of health insurance plan you have. These deductions can be either pre-tax or post-tax, impacting how much you save.

Tax-Deductible Medical Expenses Influencing Premium Calculations

Certain medical expenses can directly influence the calculation of your medical insurance premiums. These expenses, often considered tax-deductible, are factored into your overall health risk profile by insurance providers, potentially affecting the premium you pay. Examples include pre-existing conditions requiring ongoing treatment, past medical history indicating higher risk, and the level of coverage you choose (e.g., higher deductibles may lead to lower premiums). The specifics vary by insurance provider and policy.

Pre-tax versus Post-tax Deductions

The primary difference lies in *when* the deduction is applied. Pre-tax deductions reduce your income *before* taxes are calculated, resulting in greater savings. Post-tax deductions, on the other hand, reduce your income *after* taxes are calculated, offering less of a tax benefit. For instance, if you deduct $5,000 pre-tax at a 25% tax bracket, you save $1,250 in taxes. The same $5,000 post-tax deduction only saves you $5,000 directly, which is less impactful.

Comparison of Deduction Methods

| Deduction Method | Eligibility Criteria | Limitations | Tax Benefit |

|---|---|---|---|

| Pre-tax deduction through employer-sponsored plan | Employment with a company offering this benefit | Contribution limits may apply, determined by the employer and IRS regulations | Significant tax savings due to deduction before tax calculation |

| Post-tax deduction (Self-employed or individual plans) | Self-employed individuals or those with individual health insurance plans, meeting specific IRS criteria | Limited to the amount of premiums paid and subject to IRS adjusted gross income (AGI) limitations. | Lower tax savings compared to pre-tax deductions |

| Health Savings Account (HSA) Deduction | Eligibility requires enrollment in a high-deductible health plan (HDHP). | Contribution limits apply annually, set by the IRS. | Triple tax advantage: contributions are pre-tax, earnings grow tax-free, and withdrawals for qualified medical expenses are tax-free. |

| Flexible Spending Account (FSA) Deduction | Employment with a company offering this benefit. | Contribution limits apply annually, set by the IRS. Use-it-or-lose-it rule often applies. | Pre-tax deduction reducing taxable income. |

Impact of Medical Insurance Premium Deductions on Individuals and Families

Medical insurance premium deductions offer significant financial relief to individuals and families, directly impacting household budgets and the overall cost of healthcare. Understanding these impacts is crucial for making informed decisions about health insurance coverage. This section explores the financial benefits and demonstrates how deductions can lead to substantial savings.

The financial impact of premium deductions on household budgets is substantial. For many families, health insurance premiums represent a significant portion of their monthly expenses. Deductions, whether through employer-sponsored plans or government programs, directly reduce this burden, freeing up funds for other essential needs such as food, housing, and education. This increased financial flexibility can significantly improve a family’s overall financial stability and reduce stress associated with managing healthcare costs.

Affordability of Health Insurance with and without Deductions

The affordability of health insurance is dramatically improved with premium deductions. Consider a family with a $1,000 monthly premium. With a 50% employer-sponsored deduction, their monthly cost drops to $500, a significant difference. This reduction makes health insurance accessible to families who might otherwise struggle to afford it. Without the deduction, the family would face a considerably higher financial strain, potentially forcing them to forgo necessary coverage or choose a less comprehensive plan.

Effect of Deductions on Overall Healthcare Costs

While premium deductions directly reduce monthly costs, their impact extends to the overall cost of healthcare. Reduced premiums often translate to a lower out-of-pocket expense for the insured. Although deductibles and co-pays still exist, the lower monthly premium helps manage the overall financial risk associated with unexpected medical expenses. A lower monthly premium allows for better budgeting and potentially less reliance on high-interest loans or credit cards to cover medical bills.

Hypothetical Scenario Illustrating Savings from Premium Deductions

Let’s consider the Smith family, with two working parents and two children. Without any premium deductions, their monthly health insurance premium is $1,200. However, through their employer’s plan, they receive a 75% deduction. This reduces their monthly premium to $300. Over a year, this translates to a savings of $10,800 ($900 x 12 months). This substantial saving allows the Smiths to allocate those funds towards other essential expenses or savings goals, enhancing their overall financial well-being and reducing the financial stress associated with healthcare costs.

Factors Affecting the Amount of Medical Insurance Premium Deductions

The amount you pay for medical insurance premiums, and consequently, the amount you can deduct, is influenced by a variety of interconnected factors. Understanding these factors allows for better planning and budgeting for healthcare expenses. This section will detail the key elements affecting the size of your potential premium deduction.

Age and Health Status

Age significantly impacts premium costs. Older individuals generally face higher premiums due to a statistically increased likelihood of requiring more extensive medical care. Pre-existing conditions and current health status also play a crucial role. Individuals with pre-existing conditions or those requiring ongoing medical treatment often pay more for insurance, as the insurer anticipates higher claims. For example, a 60-year-old with diabetes will likely pay a higher premium than a 30-year-old in excellent health. This higher premium, in turn, translates to a larger potential deduction.

Geographic Location

The cost of healthcare varies widely depending on geographic location. Areas with a higher cost of living and greater demand for medical services tend to have higher insurance premiums. For instance, premiums in major metropolitan areas are typically higher than those in rural areas. This difference reflects the varying costs associated with healthcare providers, facilities, and the overall healthcare market in different regions.

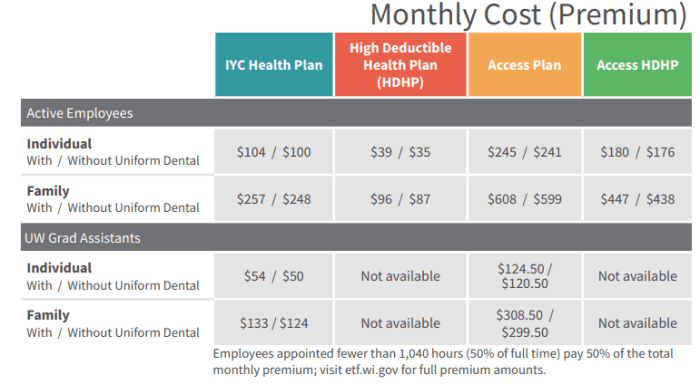

Type of Health Insurance Plan

The type of health insurance plan chosen directly affects both the premium amount and the deductible. High-deductible health plans (HDHPs) typically have lower premiums but require the policyholder to pay a significantly higher out-of-pocket deductible before the insurance coverage kicks in. Conversely, plans with lower deductibles usually have higher premiums. A family choosing an HDHP might see lower premiums and therefore a smaller deduction, while a family opting for a plan with comprehensive coverage will pay higher premiums and thus have a larger potential deduction.

Family Size and Composition

The number of people covered under a health insurance plan also affects the premium. Adding dependents, such as a spouse or children, increases the overall premium. The age and health status of these dependents further contribute to the premium calculation. A family with several children, particularly those with pre-existing conditions, will likely pay a higher premium than a single individual.

| Factor | Impact on Premium | Impact on Deduction | Example |

|---|---|---|---|

| Age | Increases with age | Increases with age (higher premium = higher potential deduction) | A 65-year-old will generally pay more than a 35-year-old. |

| Health Status | Higher for those with pre-existing conditions | Higher for those with pre-existing conditions | Someone with diabetes will pay more than someone without. |

| Location | Higher in high-cost areas | Higher in high-cost areas | Premiums in New York City are likely higher than in rural Iowa. |

| Plan Type | Lower for HDHPs, higher for comprehensive plans | Lower for HDHPs, higher for comprehensive plans | An HDHP will have lower premiums, a lower potential deduction, but a higher out-of-pocket maximum. |

Comparison of Medical Insurance Premium Deduction Schemes Across Different Countries (or States/Provinces)

Medical insurance premium deduction schemes vary significantly across the globe, reflecting differing healthcare systems, economic priorities, and social safety nets. A comparison of these schemes highlights the complexities involved in balancing individual financial burdens with the need for accessible and affordable healthcare. This section will analyze the systems in the United States and Canada, showcasing key differences and their impact on healthcare access.

United States Medical Insurance Premium Deduction Schemes

The United States employs a largely employer-sponsored health insurance system, supplemented by government programs like Medicare and Medicaid. Premium deductions are often offered as a pre-tax benefit by employers, reducing the employee’s taxable income and thus their overall tax burden. The amount of the deduction varies widely depending on the employer’s generosity, the employee’s contribution level, and the type of plan chosen. Self-employed individuals and those without employer-sponsored insurance can purchase plans through the Affordable Care Act (ACA) marketplaces, where premium subsidies are available based on income. However, even with subsidies, premiums can be substantial, particularly for those with pre-existing conditions or requiring extensive care. The deduction mechanisms are primarily tax-based, with the reduction in taxable income being the main benefit.

Canadian Medical Insurance Premium Deduction Schemes

Canada’s publicly funded healthcare system differs markedly from the U.S. model. Provinces and territories administer their own healthcare insurance plans, providing universal coverage for medically necessary services. While there are no premium deductions in the same sense as the U.S., provincial taxes fund the system, and these taxes are deducted from individual incomes. Canadians generally do not face large out-of-pocket expenses for doctor visits or hospital stays, although additional premiums for optional private insurance may exist to cover services not included in the public plan. The impact of these taxes on individuals varies across provinces, reflecting differing tax rates and healthcare spending priorities.

Comparison of Eligibility Criteria and Deduction Amounts

A key difference lies in eligibility. In the U.S., employer-sponsored plans have eligibility criteria set by the employer, while ACA marketplace plans have income-based eligibility for subsidies. Canada’s publicly funded system offers universal eligibility, irrespective of income, although certain services may have limitations. Regarding deduction amounts, U.S. deductions are variable, dependent on employer contributions and individual plan choices. In contrast, Canadian tax contributions for healthcare are determined by provincial tax rates, which are not directly tied to individual healthcare needs or consumption. The U.S. system offers greater potential for larger deductions but relies heavily on employer-sponsored plans, leaving those without employment at a disadvantage. Canada’s system, while offering universal coverage, relies on general taxation and may not always reflect the precise healthcare costs incurred by each individual.

Impact of Variations on Access to Healthcare

The differing schemes significantly influence healthcare access. The U.S. system, with its reliance on employer-sponsored insurance, can create barriers for those without employment or with limited access to such plans. High premiums and deductibles can deter individuals from seeking necessary care, leading to delayed or forgone treatment. Canada’s universal system aims to eliminate such financial barriers, ensuring access to essential healthcare services regardless of income. However, waiting times for certain procedures can be longer in Canada due to system capacity constraints. The variations in these schemes reflect a trade-off between individual financial responsibility and universal access, with each system presenting both advantages and disadvantages in terms of affordability and accessibility.

Closing Summary

Ultimately, maximizing the benefits of medical insurance premium deductions requires a proactive approach. By understanding your eligibility, carefully reviewing your options, and keeping abreast of relevant regulations, you can significantly reduce your healthcare expenses and improve your financial security. This guide serves as a starting point for this journey, encouraging you to explore the specifics relevant to your situation and seek professional advice when necessary. Remember, informed decisions lead to better outcomes, particularly when managing the complexities of healthcare costs.

Frequently Asked Questions

What happens if I overestimate my medical expenses when claiming a deduction?

Overestimating can lead to an audit and potential penalties. It’s crucial to maintain accurate records and claim only eligible expenses.

Can I deduct premiums for my dependents’ insurance?

The deductibility of dependents’ premiums depends on your country/region’s specific regulations. Check local tax laws for details.

Are there income limits for claiming medical insurance premium deductions?

Yes, many jurisdictions have income limits that determine eligibility. These limits vary and should be verified through official sources.

What if I lose my job and my employer-sponsored insurance? Can I still deduct premiums?

This depends on your country/region’s laws and whether you obtain individual insurance. Check with your tax authority or insurance provider.