Securing your family’s financial future often involves navigating the complexities of life insurance. A key element of this process is understanding your annual life insurance premium. This comprehensive guide delves into the various factors influencing premium costs, explores different payment options, and provides practical advice to help you make informed decisions about your life insurance coverage.

We’ll examine the different types of life insurance policies – term life, whole life, and universal life – highlighting their respective premium structures and suitability for various life stages and financial goals. We’ll also explore how factors like age, health, smoking habits, and coverage amount significantly impact your premium calculations, empowering you to find the most cost-effective and appropriate coverage.

Understanding “Annual Life Insurance Premium”

An annual life insurance premium is the yearly cost you pay to maintain your life insurance coverage. Understanding its components and the factors influencing its price is crucial for making informed decisions about your financial protection. This cost is not a fixed amount; it varies significantly based on several key elements.

Components of an Annual Life Insurance Premium

The annual premium comprises several key elements. These include the insurer’s operating costs (administrative expenses, commissions paid to agents, etc.), the cost of claims paid out to beneficiaries, and the insurer’s profit margin. A significant portion of the premium goes towards building a reserve to cover future death benefit payouts. The specific breakdown can vary depending on the type of policy and the insurer.

Factors Influencing Premium Costs

Several factors significantly influence the cost of your annual life insurance premium. These include your age (premiums increase with age), your health status (individuals with pre-existing conditions or unhealthy lifestyles generally pay more), your gender (historically, women have paid less, although this is changing in many jurisdictions), your smoking habits (smokers pay considerably more), your occupation (high-risk occupations lead to higher premiums), and the amount of coverage you choose (more coverage equals higher premiums). Furthermore, the type of policy selected plays a crucial role in determining the premium.

Types of Life Insurance Policies and Premium Structures

Different life insurance policies have varying premium structures. Term life insurance offers coverage for a specific period (e.g., 10, 20, or 30 years), with premiums remaining level during the term. Whole life insurance provides lifelong coverage with premiums typically remaining level throughout your life. Universal life insurance offers flexibility, allowing you to adjust premiums and death benefits within certain limits, resulting in premiums that can fluctuate.

Comparison of Life Insurance Premiums

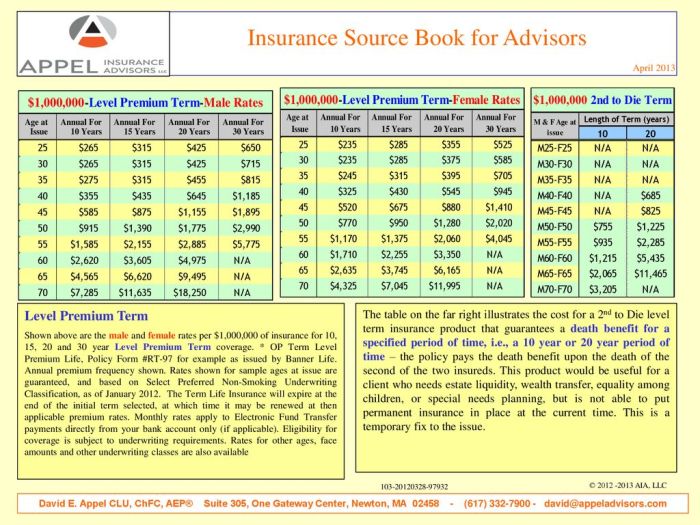

The following table compares the premium structures for three common types of life insurance: term life, whole life, and universal life. Note that these are illustrative examples and actual premiums will vary depending on the insurer, individual circumstances, and policy specifics.

| Factor | Term Life | Whole Life | Universal Life |

|---|---|---|---|

| Age (Example: 35) | $200 – $400 per year | $500 – $1000 per year | $400 – $800 per year (adjustable) |

| Age (Example: 55) | $500 – $1200 per year | $1000 – $2000+ per year | $800 – $1600+ per year (adjustable) |

| Health (Excellent) | Lower premiums | Lower premiums | Lower premiums |

| Health (Poor) | Higher premiums or denial of coverage | Higher premiums or denial of coverage | Higher premiums or denial of coverage |

| Coverage Amount ($500,000) | Premiums will be higher than for $250,000 | Premiums will be higher than for $250,000 | Premiums will be higher than for $250,000 |

Premium Payment Options and Methods

Choosing the right method for paying your annual life insurance premium is crucial for maintaining your policy’s active status and avoiding potential penalties. Several options exist, each with its own advantages and disadvantages, impacting both convenience and financial management. Understanding these options allows for informed decision-making, ensuring seamless premium payments.

Premium payment methods offer varying levels of convenience and control over your financial commitments. The selection should align with your personal preferences and financial habits. Factors such as budgeting, technological comfort, and risk tolerance all play a role in choosing the optimal method.

Electronic Funds Transfer (EFT)

EFT, also known as electronic bank transfer, provides a secure and automated way to pay premiums directly from your bank account. This method eliminates the need for writing checks or remembering due dates. Advantages include convenience, reduced risk of late payments due to automated deductions, and often a slight discount offered by some insurance companies as an incentive. However, a disadvantage is the reliance on sufficient funds in your account on the payment date; insufficient funds can lead to payment failure and potential policy lapse.

Check Payments

Traditional check payments offer a straightforward method for paying premiums. Checks provide a paper trail of transactions, and many find this method familiar and reassuring. However, mailing checks carries a risk of lost or delayed mail, leading to late payments and potential penalties. Additionally, this method requires more manual effort compared to automated options.

Automatic Payments

Automatic payments, often linked to a bank account or credit card, offer the convenience of EFT without the need for manual initiation each payment cycle. The insurance company automatically deducts the premium amount on the due date. This method minimizes the risk of missed payments and provides a consistent payment schedule. However, a potential drawback is the lack of immediate control; you must proactively monitor your account balance to ensure sufficient funds are available.

Credit Card Payments

Paying premiums via credit card provides flexibility and can offer rewards points or cashback depending on your credit card. This can offset the premium cost slightly. However, it’s crucial to manage credit card debt carefully, as interest charges can outweigh any benefits if the balance isn’t paid in full each month. Additionally, some insurers may charge a small processing fee for credit card payments.

Consequences of Missed or Late Premium Payments

Missed or late premium payments can have significant consequences. Depending on the insurance company and policy terms, late payments can lead to penalties, interest charges, or even policy lapse. A lapsed policy means your coverage is terminated, leaving you without life insurance protection. Reinstating a lapsed policy might be possible, but it often involves additional fees and proof of insurability, which can be challenging to obtain.

Example Premium Payment Process Flowchart (Fictional Insurance Company: “SecureLife”)

The flowchart would depict a simple process:

1. Policyholder initiates payment: The policyholder chooses their payment method (EFT, check, automatic payment, credit card) via SecureLife’s online portal or by phone.

2. SecureLife receives payment information: The system records the payment method and amount.

3. Payment processing: For EFT/automatic payments, funds are directly debited. For checks, the check is processed. Credit card payments are processed via the payment gateway.

4. Payment confirmation: The policyholder receives confirmation via email or text message.

5. Premium applied to policy: Once processed, the payment is applied to the policy, updating the payment status.

6. Payment failure (if applicable): If payment fails (insufficient funds, declined card, etc.), SecureLife sends a notification to the policyholder.

Factors Affecting Premium Costs

Several key factors influence the cost of your annual life insurance premium. Understanding these factors allows you to make informed decisions about the type and amount of coverage you need, and how much you can expect to pay. These factors interact in complex ways, so it’s beneficial to consider them holistically.

Key Factors Influencing Premium Costs

The cost of your life insurance premium is determined by a variety of factors, each contributing to the overall price. These factors are assessed by insurance companies to determine your risk profile, which directly impacts the premium you pay. A higher-risk profile generally results in higher premiums.

| Factor | Description | Impact on Premium | Example |

|---|---|---|---|

| Age | Older applicants generally face higher premiums due to increased mortality risk. | Increases with age | A 30-year-old will typically pay less than a 50-year-old for the same coverage. |

| Health Status | Pre-existing conditions or health issues can significantly increase premiums, reflecting the higher risk to the insurer. | Increases with poorer health | Someone with a history of heart disease will likely pay more than someone with a clean bill of health. |

| Smoking Status | Smokers are considered higher risk and pay substantially more than non-smokers. | Significantly increases premiums for smokers | A smoker may pay double or even triple the premium of a non-smoker with the same coverage. |

| Coverage Amount | Higher death benefit amounts result in higher premiums, as the insurer assumes a greater financial obligation. | Increases with coverage amount | A $500,000 policy will cost more than a $100,000 policy. |

| Policy Type | Different policy types (term life, whole life, universal life) carry varying costs, reflecting differences in coverage features and investment components. | Varies depending on policy type | Term life insurance is generally cheaper than whole life insurance, but offers coverage for a limited time. |

Relative Importance of Factors

While the relative importance of these factors can vary depending on the individual and the insurer, age and health status typically have the most significant impact on premium costs. Smoking status is a major factor, while the coverage amount and policy type also play important roles. It’s crucial to remember that these factors are interconnected; for example, a smoker with a pre-existing condition will face significantly higher premiums than a non-smoker in good health.

Premium Adjustments and Changes

Life insurance premiums, while initially set based on your application information, aren’t necessarily fixed for life. Several factors can lead to adjustments, both upward and downward, throughout the policy’s duration. Understanding these potential changes is crucial for responsible financial planning.

Premiums can fluctuate due to a variety of circumstances. The most common reasons involve changes in the policyholder’s health, alterations to the policy’s coverage, or shifts in the insurer’s risk assessment. These adjustments are typically Artikeld in the policy’s terms and conditions, which should be carefully reviewed.

Premium Increases Due to Health Changes

A significant reason for premium increases is a deterioration in the policyholder’s health. If a policyholder develops a serious medical condition after the policy is issued, the insurer may reassess the risk. This reassessment could lead to a higher premium, reflecting the increased likelihood of a claim. For example, a policyholder diagnosed with a serious illness like cancer might see a substantial premium increase, as the insurer now faces a greater financial risk. The increase would be proportionate to the added risk. It’s important to note that insurers generally cannot increase premiums due to age alone for permanent life insurance policies. However, some policies may have specific clauses regarding health changes.

Premium Adjustments Following Policy Modifications

Changes to the policy itself can also impact premiums. Adding coverage, such as increasing the death benefit or adding riders (like long-term care or disability benefits), will generally result in higher premiums. Conversely, reducing coverage, such as lowering the death benefit or removing optional riders, usually leads to lower premiums. For example, if a policyholder decides to increase their death benefit from $500,000 to $1,000,000, they should expect a corresponding increase in their premium. Similarly, removing a rider, such as a waiver of premium rider, will usually decrease the premium.

Scenario: Premium Adjustment Impact on Budget

Consider Sarah, a 35-year-old who purchased a $500,000 term life insurance policy five years ago. Her annual premium was $1,200. Recently, Sarah was diagnosed with type 2 diabetes. As a result, her insurer reassessed her risk profile and increased her annual premium by 25%, to $1,500. This $300 increase represents a significant change to Sarah’s budget. She needs to re-evaluate her financial plan to accommodate this additional expense. She might consider reducing other expenses, increasing her income, or exploring alternative insurance options, although finding comparable coverage at a lower rate may be difficult given her changed health status.

Comparing Insurance Providers and Premiums

Choosing the right life insurance policy involves careful consideration of various factors, and a key element is comparing premiums across different providers. Understanding the nuances of premium structures and policy features is crucial for making an informed decision that best suits your needs and budget. This section will guide you through the process of comparing life insurance premiums and interpreting policy documents to find the most suitable option.

Interpreting Policy Documents to Understand Premium Details

Policy documents can appear complex, but understanding key sections is vital for accurate premium comparisons. Look for the premium schedule, which clearly Artikels the annual, semi-annual, or quarterly payment amounts. Pay close attention to any stated conditions, such as introductory rates that might expire after a specific period. Note any clauses regarding premium increases based on factors like age or health changes. Finally, thoroughly review the benefits and exclusions Artikeld in the policy to ensure it aligns with your protection goals.

Best Practices for Finding Affordable Life Insurance Premiums

Several strategies can help you find affordable life insurance. First, compare quotes from multiple providers; online comparison tools can simplify this process. Second, consider your health status; maintaining a healthy lifestyle can positively influence premium costs. Third, evaluate different policy types; term life insurance generally offers lower premiums than whole life insurance. Fourth, increase your coverage gradually as your financial needs change rather than seeking maximum coverage immediately. Finally, explore options like bundled insurance packages, if offered, to potentially benefit from cost savings.

Premium Comparison Table

The following table compares premiums from three hypothetical insurance providers (Provider A, Provider B, and Provider C) for a $250,000, 20-year term life insurance policy for a 35-year-old male non-smoker in good health. Remember that these are illustrative examples and actual premiums will vary based on individual circumstances and provider specifics.

| Provider | Annual Premium | Policy Features | Benefits |

|---|---|---|---|

| Provider A | $500 | Guaranteed level premiums for 20 years, death benefit of $250,000 | Accidental death benefit rider available |

| Provider B | $450 | Guaranteed level premiums for 20 years, death benefit of $250,000 | Waiver of premium rider included |

| Provider C | $550 | Guaranteed level premiums for 20 years, death benefit of $250,000 | Cash value accumulation feature |

Illustrative Examples of Premium Calculations

Understanding how life insurance premiums are calculated can seem complex, but breaking down the process reveals a logical structure based on several key factors. These factors are weighed differently depending on the policy type and the individual’s risk profile. The following examples illustrate this process for two different scenarios.

Example 1: Term Life Insurance Premium Calculation for a Healthy 35-Year-Old Male

Let’s consider a healthy 35-year-old male, John, applying for a $500,000 20-year term life insurance policy. Several factors will influence his premium. His age, health status (including medical history and lifestyle choices like smoking), the policy’s face value ($500,000), and the policy term (20 years) are all key components. The insurer’s assessment of his risk, through a process called underwriting, plays a crucial role.

The insurer’s actuarial department uses complex models that consider mortality tables (statistical data on life expectancy), expenses, and profit margins. These models predict the likelihood of John needing to make a claim within the 20-year policy term. Assuming John is deemed a low-risk individual due to his health and lifestyle, the insurer might use a mortality rate suggesting a low probability of death within the 20-year period. This lower risk translates to a lower premium.

Let’s assume, for illustrative purposes, the following simplified calculation: The insurer estimates an annual cost of $1,000 to cover John’s risk based on their actuarial model. They add an administrative expense of $50 per year, and a profit margin of $100 per year. Therefore, John’s annual premium would be $1,150 ($1,000 + $50 + $100). This is a simplified example; real-world calculations are far more intricate.

Example 2: Whole Life Insurance Premium Calculation for a 50-Year-Old Female

Now, let’s consider a different scenario. Sarah, a 50-year-old female, is applying for a $250,000 whole life insurance policy. Whole life insurance differs from term life because it provides lifelong coverage, and it typically includes a cash value component that grows over time.

Because whole life insurance offers lifelong coverage and a cash value element, the premiums are generally higher than those for term life insurance. Sarah’s age is a significant factor, as older individuals have a statistically higher risk of mortality. Her health status, lifestyle, and any pre-existing conditions will also be considered during the underwriting process.

Let’s suppose that, after underwriting, Sarah is assessed as a moderate risk. The insurer’s actuarial model, considering her age, policy type, and risk profile, might estimate an annual cost of $2,500 to cover her risk. Adding administrative expenses (let’s say $100) and a profit margin ($200), her annual premium might be $2,800 ($2,500 + $100 + $200). Again, this is a simplification; real calculations are significantly more complex and involve sophisticated actuarial models.

Underwriting’s Impact on Premium Calculations

Underwriting is the critical process where the insurance company assesses the risk associated with insuring an individual. It involves a thorough review of the applicant’s medical history, lifestyle, occupation, and other relevant factors. A comprehensive application, often including medical examinations and questionnaires, is part of this process.

The underwriting process directly impacts the premium calculation. Individuals deemed higher risk (due to pre-existing health conditions, hazardous occupations, or unhealthy lifestyle choices) will generally receive higher premiums. Conversely, individuals with excellent health and low-risk profiles will receive lower premiums. The more detailed and accurate the information provided during underwriting, the more precisely the insurer can assess the risk and set an appropriate premium. This ensures fairness for all policyholders while allowing the insurer to manage its financial risk effectively.

Closing Summary

Understanding your annual life insurance premium is crucial for securing your family’s financial well-being. By carefully considering the factors influencing premium costs, exploring various payment options, and comparing different insurance providers, you can make informed decisions that align with your individual circumstances and financial objectives. Remember to regularly review your policy and make adjustments as needed to ensure your coverage remains adequate and affordable throughout your life.

FAQ Summary

What happens if I miss a premium payment?

Missing a premium payment can result in your policy lapsing, meaning your coverage ends. Most insurers offer grace periods, but it’s crucial to contact your provider immediately if you anticipate difficulties making a payment to explore options like payment plans.

Can I change my premium payment method?

Yes, most insurance companies allow you to change your payment method. Contact your provider to update your information and select your preferred payment option (e.g., automatic bank transfer, check, credit card).

How often are premiums reviewed and adjusted?

The frequency of premium reviews varies depending on the type of policy. Term life insurance premiums generally remain fixed for the policy term, while whole life and universal life insurance premiums can be adjusted based on factors like the policy’s cash value and the insurer’s investment performance.

Are there tax benefits associated with life insurance premiums?

Tax benefits related to life insurance premiums can vary depending on your location and the type of policy. Consult a tax professional for specific guidance on tax implications.