Securing affordable insurance is a common goal, often leading individuals to explore options for low premium insurance. However, the pursuit of lower premiums shouldn’t overshadow the crucial need for adequate coverage. This exploration delves into the complexities of low-premium insurance, examining the factors that influence cost, the trade-offs between price and protection, and strategies for making informed decisions.

We’ll navigate the intricacies of policy details, highlighting key terms and potential limitations. Furthermore, we’ll discuss how lifestyle choices and risk factors impact premiums, and offer practical advice on balancing cost-effectiveness with comprehensive coverage to ensure long-term financial security.

Finding Low Premium Insurance Options

Securing affordable insurance is a priority for many. This section Artikels strategies for identifying insurance providers offering low premiums and emphasizes the importance of balancing cost with coverage adequacy. Understanding your needs and the potential drawbacks of solely focusing on price is crucial for making an informed decision.

Finding suitable low-premium insurance involves a proactive approach and careful comparison. Several avenues can be explored to identify providers offering competitive rates.

Strategies for Identifying Low-Premium Insurance Providers

Utilizing online comparison tools, contacting multiple insurance providers directly, and exploring options offered through employer-sponsored programs or group affiliations are effective methods for discovering low-premium insurance plans. Online comparison websites aggregate quotes from various insurers, simplifying the process of finding the best deal. Directly contacting insurance companies allows for personalized quotes based on specific needs. Group affiliations often provide access to discounted rates.

Comparison of Low-Premium Insurance Options

The following table compares hypothetical low-premium insurance options. Remember that actual premiums and coverage vary significantly based on individual factors like age, location, health status, and the specifics of the policy. This table is for illustrative purposes only and does not represent actual insurance products.

| Provider | Premium (Monthly) | Coverage Highlights | Policy Details |

|---|---|---|---|

| Insurer A | $150 | Basic hospital coverage, limited doctor visits | High deductible, co-pay structure |

| Insurer B | $200 | Comprehensive hospital coverage, broader doctor network | Moderate deductible, lower co-pays |

| Insurer C | $250 | Extensive coverage, including specialist visits and prescription drugs | Low deductible, minimal out-of-pocket expenses |

Considering Individual Needs When Selecting a Low-Premium Plan

Selecting an insurance plan requires careful consideration of individual needs and circumstances. Factors such as pre-existing conditions, anticipated healthcare utilization, and financial capabilities all play a role in determining the most suitable plan. A plan with a low premium but inadequate coverage might prove more expensive in the long run if significant medical expenses arise.

Potential Drawbacks of Focusing Solely on Price

Prioritizing price above all else can lead to inadequate coverage and unexpectedly high out-of-pocket costs. A low premium might be offset by a high deductible, leading to substantial personal expenses in case of illness or injury. Limited coverage could also restrict access to preferred doctors or necessary treatments. For example, a low-premium plan with a narrow network of doctors might limit choices, potentially impacting the quality of care received. Thorough evaluation of the policy details, including deductibles, co-pays, and coverage limits, is crucial to avoid such situations.

Understanding Policy Details

Securing a low-premium insurance plan is a smart financial move, but understanding the fine print is crucial to avoid unexpected costs. Low premiums often come with trade-offs, so it’s vital to carefully examine the policy details before committing. This section will clarify common exclusions, limitations, and cost-sharing aspects of these plans.

Common Policy Exclusions and Limitations

Low-premium insurance policies often have more exclusions and limitations than higher-premium plans. These exclusions specify situations or conditions not covered by the insurance. For example, pre-existing conditions might have limited or no coverage, and certain treatments or procedures could be excluded entirely. Limitations may restrict the amount or type of care covered, such as limiting specialist visits or the number of days in a hospital stay. It is essential to carefully review the policy’s specific list of exclusions and limitations to understand exactly what is and isn’t covered. For instance, some low-premium plans might exclude coverage for experimental treatments or alternative therapies, while others might have limitations on the types of mental health services covered. Always compare policies across different providers to see the variation in these aspects.

Implications of Deductibles, Co-pays, and Out-of-Pocket Maximums

Low-premium policies often feature higher deductibles, co-pays, and lower out-of-pocket maximums than more expensive plans. Understanding these terms is essential for managing healthcare costs. The deductible is the amount you must pay out-of-pocket before your insurance coverage kicks in. A high deductible means you’ll pay more upfront before the insurance company starts to share the costs. Co-pays are fixed amounts you pay for each doctor’s visit or prescription. A low-premium plan might have higher co-pays than a higher-premium plan. The out-of-pocket maximum represents the most you will pay out-of-pocket in a given policy year. Even with a low premium, a high deductible and high co-pays can lead to significant out-of-pocket expenses before reaching the out-of-pocket maximum. For example, a plan with a $5,000 deductible, $50 co-pays, and a $7,000 out-of-pocket maximum will require you to pay $5,000 before coverage begins, plus additional co-pays, until you reach the $7,000 limit.

Key Policy Terms to Understand

Before purchasing low-premium insurance, it’s crucial to understand several key policy terms. These terms significantly impact your healthcare costs and access to care. A thorough understanding empowers you to make informed decisions.

- Premium: The regular payment you make to maintain your insurance coverage.

- Deductible: The amount you pay out-of-pocket before insurance coverage begins.

- Co-pay: A fixed amount you pay for each doctor’s visit or prescription.

- Co-insurance: The percentage of costs you share with your insurer after meeting your deductible.

- Out-of-pocket maximum: The most you’ll pay out-of-pocket in a policy year.

- Network: The list of doctors, hospitals, and other healthcare providers your insurance covers.

- Exclusions: Specific services, treatments, or conditions not covered by the policy.

- Limitations: Restrictions on the amount or type of care covered.

- Pre-authorization: The requirement to obtain approval from your insurer before receiving certain services.

Claims Processes of Different Low-Premium Insurers

The claims process varies among low-premium insurers. Some insurers may offer online portals for easy submission, while others might require paper forms. Some insurers may have faster processing times than others. It’s advisable to compare the claims procedures of different insurers and choose one with a transparent and user-friendly process. Understanding how to file a claim, what documentation is needed, and the typical processing time is essential for timely reimbursement. For example, one insurer might require you to submit all claims electronically within 30 days of service, while another might allow longer submission periods and offer phone support for claim assistance. Always check the insurer’s website or contact customer service to understand their specific claims process.

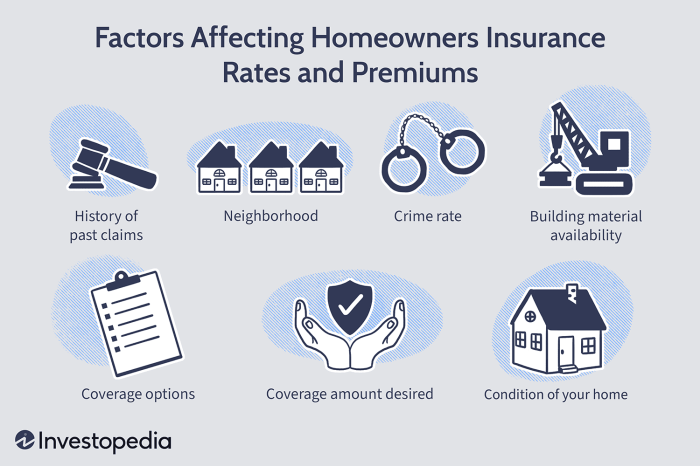

Impact of Lifestyle and Risk Factors

Your lifestyle and inherent risk factors significantly influence the cost of your insurance premiums. Insurance companies assess risk to determine how likely you are to file a claim. Individuals perceived as higher risk will generally pay more. Understanding this relationship empowers you to make informed choices that can lead to lower premiums.

Insurance companies analyze various aspects of your life to calculate your risk profile. This includes factors you can control and others you cannot. By focusing on controllable factors, you can actively work towards securing more affordable insurance.

Lifestyle Choices and Premium Costs

Many lifestyle choices directly impact insurance premiums. For example, smokers often pay significantly higher premiums for health insurance than non-smokers due to the increased risk of health problems associated with smoking. Similarly, individuals who engage in high-risk activities, such as extreme sports, might face higher premiums for accident or life insurance. The rationale is simple: higher risk equates to a higher likelihood of claims, thus increasing the insurer’s financial burden. Conversely, maintaining a healthy lifestyle, including regular exercise and a balanced diet, can positively influence your premium costs.

Reducing Insurance Costs Through Safer Habits

Adopting safer habits can lead to substantial savings on insurance premiums. For health insurance, maintaining a healthy weight, not smoking, and regularly visiting a doctor for preventative care can demonstrate a lower risk profile to insurers, potentially leading to lower premiums or discounts. For auto insurance, consistently practicing safe driving habits, such as avoiding speeding and driving under the influence of alcohol or drugs, significantly reduces the risk of accidents and can result in lower premiums. Many insurance companies offer discounts for drivers with clean driving records and participation in defensive driving courses.

Recommendations for Lowering Risk Profiles

To lower your risk profile and potentially qualify for lower premiums, consider the following:

- Maintain a healthy weight and diet.

- Refrain from smoking and excessive alcohol consumption.

- Regularly exercise and engage in physical activity.

- Practice safe driving habits, including adhering to speed limits and avoiding distracted driving.

- Install security systems in your home to reduce the risk of theft or damage.

- Consider taking a defensive driving course.

Implementing these changes not only benefits your health but also potentially saves you money on insurance.

Credit Scores and Driving Records

Your credit score and driving record are significant factors in determining insurance premiums. A poor credit score can often lead to higher premiums for various types of insurance, including auto and homeowners insurance. Insurers view a poor credit score as an indicator of higher risk. Similarly, a poor driving record, including accidents, speeding tickets, or DUI convictions, will almost certainly result in higher auto insurance premiums. Maintaining a good credit score and a clean driving record are crucial for obtaining lower premiums. Many insurance companies offer discounts for good credit and safe driving.

Closing Notes

Ultimately, the decision regarding low-premium insurance requires careful consideration of individual needs and risk tolerance. While lower premiums offer immediate financial relief, neglecting adequate coverage can lead to significant financial hardship in the event of an unforeseen incident. By understanding the factors influencing premiums, comparing policy options, and regularly reviewing coverage needs, individuals can make informed choices that balance affordability with the vital protection insurance provides.

FAQ

What are the common exclusions in low-premium insurance plans?

Common exclusions can include pre-existing conditions, certain types of treatments, or specific geographical areas. Always carefully review the policy’s exclusions before purchasing.

How do deductibles and co-pays affect low-premium plans?

Low-premium plans often have higher deductibles and co-pays, meaning you’ll pay more out-of-pocket before the insurance coverage kicks in. This should be factored into your budget.

Can I change my low-premium insurance plan later?

Most insurers allow for plan changes during specific enrollment periods. Check your policy for details regarding open enrollment or mid-year adjustments.

How does my credit score affect my insurance premium?

In some jurisdictions, credit scores are considered a factor in determining insurance premiums. A higher credit score generally correlates with lower premiums.