Securing your financial future through long-term insurance is a crucial decision, but understanding the complexities of long-term insurance premiums can feel daunting. This guide navigates the intricacies of premium calculations, offering insights into the factors influencing cost, strategies for management, and predictions for future trends. We aim to demystify this often-opaque process, empowering you to make informed choices about your financial well-being.

From the impact of age and health history to the role of lifestyle choices and policy types, we explore the multifaceted nature of long-term insurance premiums. We’ll delve into the components of your premium, strategies for cost reduction, and the influence of economic factors like inflation. By the end, you’ll possess a clearer understanding of how premiums are determined and how to effectively manage them over time.

Factors Influencing Long-Term Insurance Premiums

Understanding the factors that determine your long-term insurance premiums is crucial for making informed decisions about your coverage. Several key elements contribute to the final cost, and knowing how they interact allows you to better understand your policy and potentially find ways to optimize your premiums.

Age

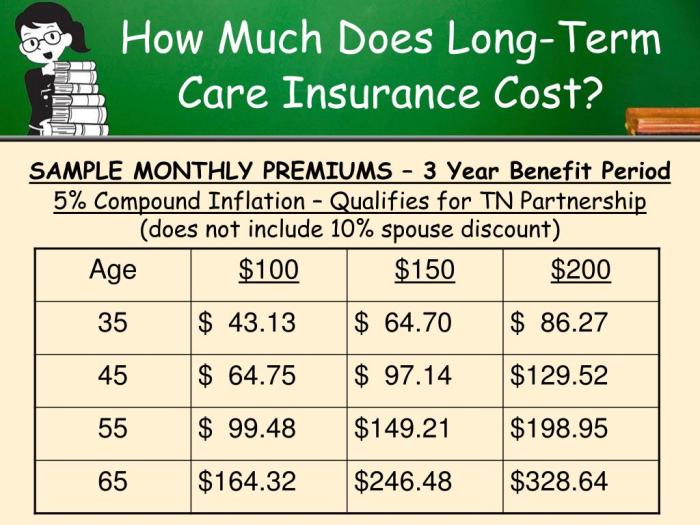

Age is a significant factor in premium calculations. Statistically, the older a person is, the higher the risk of mortality. Insurance companies use actuarial tables, which reflect historical mortality data, to assess this risk. Younger individuals generally receive lower premiums because they have a statistically lower chance of claiming on their policy within the policy term. As age increases, premiums rise to reflect the increased likelihood of a claim. For example, a 30-year-old applying for a 20-year term life insurance policy will typically receive a lower premium than a 50-year-old applying for the same coverage.

Health History

An individual’s health history plays a critical role in determining premiums. Pre-existing conditions, such as heart disease, diabetes, or cancer, significantly increase the risk of a claim. Insurance companies will review medical records and may require medical examinations to assess the applicant’s overall health. Those with a history of serious illnesses or chronic conditions can expect higher premiums compared to individuals with clean health records. Applicants with a family history of certain diseases may also see their premiums affected.

Policy Type

Different policy types carry varying levels of risk and, consequently, different premium structures. Term life insurance policies provide coverage for a specific period (e.g., 10, 20, or 30 years), offering lower premiums than whole life insurance. Whole life insurance, on the other hand, provides lifelong coverage and typically involves higher premiums due to its longer duration and the inclusion of a cash value component. Universal life and variable life insurance policies also have different premium structures depending on their features and investment options.

Lifestyle Choices

Lifestyle choices significantly impact premium costs. Factors such as smoking, excessive alcohol consumption, and a lack of physical activity increase the risk of health problems and, consequently, higher premiums. Insurance companies often consider these factors during the underwriting process. For instance, smokers typically pay significantly more than non-smokers due to the increased risk of lung cancer and other smoking-related illnesses. Maintaining a healthy lifestyle can lead to lower premiums.

Influence of Various Factors on Premium Amounts

| Factor | Low Risk | Medium Risk | High Risk |

|---|---|---|---|

| Age | 25-35 | 36-45 | 46+ |

| Health History | No significant medical issues | Minor health issues, well-managed | Major health issues, poorly managed |

| Policy Type | Term Life (10-year) | Term Life (20-year) | Whole Life |

| Lifestyle | Non-smoker, healthy diet, regular exercise | Occasional smoker, moderate alcohol consumption | Heavy smoker, unhealthy diet, sedentary lifestyle |

Understanding Premium Structures and Components

Long-term insurance premiums are not a single, monolithic figure; rather, they are comprised of several key components, each reflecting a different aspect of the risk the insurer undertakes. Understanding these components is crucial for making informed decisions about your insurance coverage.

The total premium you pay is a carefully calculated sum designed to cover the insurer’s expected costs and maintain profitability. This calculation considers various factors, including your age, health status, chosen coverage level, and the insurer’s own operational expenses. Let’s delve into the specific elements that contribute to your final premium.

Premium Components

Several factors contribute to the overall premium cost. A simplified breakdown typically includes mortality costs, expense loadings, and profit margins. Mortality costs represent the insurer’s estimation of payouts for death benefits. Expense loadings cover administrative costs, claims processing, and marketing. Profit margins ensure the insurer’s financial health and sustainability. Additionally, riders and optional benefits significantly influence the premium.

Base Premium Calculation

Insurers employ actuarial models to determine the base premium. These models analyze vast datasets of mortality rates, morbidity rates (for critical illness or disability cover), and other relevant statistics to predict the likelihood of claims. For example, a younger, healthier individual will generally have a lower base premium than an older person with pre-existing health conditions. The calculation often involves complex statistical formulas and projections, considering factors like life expectancy and the probability of specific events occurring within the policy term.

Impact of Riders and Additional Benefits

Adding riders or optional benefits, such as critical illness cover, disability income protection, or accidental death benefits, increases the overall premium. Each rider adds another layer of risk for the insurer, necessitating a higher premium to compensate for the increased potential payouts. For instance, adding critical illness coverage to a life insurance policy will increase the premium because the insurer is now covering another potential payout scenario.

Premium Adjustments Over Time

Insurers may adjust premiums over time, typically due to changes in claims experience, mortality rates, or operational costs. These adjustments can be applied annually or at specific policy anniversaries. In some cases, premiums may increase based on the policyholder’s age or changes in their health status, while in other cases, they might remain level throughout the policy’s duration, depending on the policy type.

Sample Premium Calculation

The following is a simplified example illustrating the components of a premium calculation. Remember that actual calculations are far more complex and involve sophisticated actuarial models.

- Mortality Cost: $500 (Based on age, health, and coverage amount)

- Expense Loading: $150 (Covers administrative costs, claims processing, etc.)

- Profit Margin: $50 (Ensures insurer profitability)

- Critical Illness Rider: $100 (Additional cost for added benefit)

- Total Premium: $800

Strategies for Managing Long-Term Insurance Premiums

Managing the cost of long-term insurance is a crucial aspect of financial planning. Understanding the various strategies available to reduce premiums and optimize payment options can significantly impact your overall financial health. This section Artikels practical approaches to effectively manage your long-term insurance premium payments.

Reducing Premium Costs

Several strategies can help lower your long-term insurance premiums. These strategies often involve a combination of lifestyle changes, policy adjustments, and careful shopping around.

- Improve your health: Maintaining a healthy lifestyle through regular exercise, a balanced diet, and avoiding risky behaviors can lead to lower premiums. Insurers often offer discounts for non-smokers and individuals who maintain a healthy weight.

- Increase your deductible: Opting for a higher deductible can reduce your monthly premiums. This requires you to pay more out-of-pocket in case of a claim, but the savings on premiums can be substantial over the long term. Consider your risk tolerance and financial capacity before increasing your deductible.

- Bundle your insurance policies: Many insurers offer discounts for bundling multiple insurance policies, such as home, auto, and life insurance, with the same provider. This can result in significant savings on your overall insurance costs.

- Shop around and compare quotes: Don’t be afraid to compare quotes from multiple insurers. Use online comparison tools or contact insurers directly to obtain quotes and find the best rates for your needs. Remember to compare policies with similar coverage levels to ensure a fair comparison.

- Consider a less comprehensive policy: Evaluate your coverage needs carefully. If you can tolerate a slightly higher risk, a less comprehensive policy may offer lower premiums. However, ensure the reduced coverage still meets your essential needs.

Long-Term Insurance Payment Options

Choosing the right payment option is crucial for effective premium management. Different options offer varying levels of convenience and financial implications.

- Monthly Payments: This option offers convenience but may result in slightly higher overall costs due to potential interest charges. It is ideal for those who prefer regular, manageable payments.

- Annual Payments: Paying annually often results in lower overall costs due to the absence of interest charges. However, it requires a larger upfront payment, which might not be suitable for everyone.

- Semi-Annual Payments: This option provides a balance between convenience and cost-effectiveness, offering a compromise between monthly and annual payments.

Negotiating Lower Premiums

Negotiating lower premiums is possible, but requires preparation and a clear understanding of your policy and market rates.

Before contacting your insurer, gather quotes from competing companies. This provides leverage for negotiation. Clearly articulate your reasons for seeking a lower premium, such as improved health or bundling other policies. Be polite and professional throughout the negotiation process. Highlight your loyalty if you’ve been a long-term customer. Remember that insurers are often willing to negotiate, particularly with loyal customers with a clean claims history.

Impact of Policy Adjustments

Adjusting your policy can significantly impact your long-term premium payments. Changes such as increasing the deductible or reducing coverage will typically lower your premiums, while adding benefits or increasing coverage will increase them. Carefully weigh the trade-offs between premium costs and coverage levels before making any adjustments.

Long-Term Cost Implications of Different Policy Choices

A line graph illustrating the long-term cost implications of different policy choices would show several lines, each representing a different policy option (e.g., high deductible, low coverage; low deductible, high coverage; bundled policies). The x-axis would represent the time period (e.g., in years), and the y-axis would represent the cumulative premium cost. The line representing the high-deductible, low-coverage policy would have the lowest overall cost, but would potentially have a steeper increase in cost if a claim were filed. Conversely, the line representing the low-deductible, high-coverage policy would have the highest overall cost but a flatter curve over time. The line representing bundled policies would likely fall somewhere in between, demonstrating the cost savings from bundling. The graph visually demonstrates that while higher initial premiums might seem daunting, they can potentially lead to lower overall costs in the long run, depending on the frequency and severity of claims.

Last Recap

Navigating the world of long-term insurance premiums requires careful consideration of numerous factors. This guide has provided a framework for understanding the complexities of premium calculations, strategies for cost management, and the influence of economic trends. By understanding these elements, you can make informed decisions that align with your financial goals and secure a more stable future. Remember to consult with a financial advisor for personalized guidance tailored to your specific circumstances.

FAQ

What is the difference between term life and whole life insurance premiums?

Term life insurance premiums are generally lower than whole life insurance premiums because term life insurance provides coverage for a specific period, while whole life insurance offers lifelong coverage and a cash value component.

Can I negotiate my long-term insurance premiums?

While not always guaranteed, you can sometimes negotiate lower premiums by comparing quotes from multiple insurers, demonstrating a healthy lifestyle, or bundling policies.

How often do long-term insurance premiums typically adjust?

Premium adjustments vary depending on the policy type and insurer. Some policies have fixed premiums, while others may adjust annually or at other intervals based on factors like age and claims experience.

What impact does smoking have on my long-term insurance premiums?

Smoking significantly increases long-term insurance premiums due to the higher risk of health problems associated with smoking. Insurers consider this a major risk factor.