Securing your future well-being often involves navigating the complexities of long-term health care insurance. Understanding the factors that influence premiums is crucial for making informed decisions and ensuring adequate coverage when you need it most. This guide delves into the intricacies of long-term health care insurance premiums, providing a clear picture of what shapes their costs and how to make the best choices for your individual circumstances.

From age and health status to policy features and payment options, we’ll explore the key elements that impact your premium payments. We’ll also examine how to predict future premium increases and illustrate the differences between various premium structures. Ultimately, our goal is to empower you with the knowledge necessary to navigate this crucial aspect of financial planning.

Factors Influencing Premium Costs

Several key factors interact to determine the cost of long-term health care insurance premiums. Understanding these factors allows individuals to make informed decisions when selecting a policy that best suits their needs and budget. These factors are dynamic and can significantly impact the overall cost over the life of the policy.

Age’s Impact on Premiums

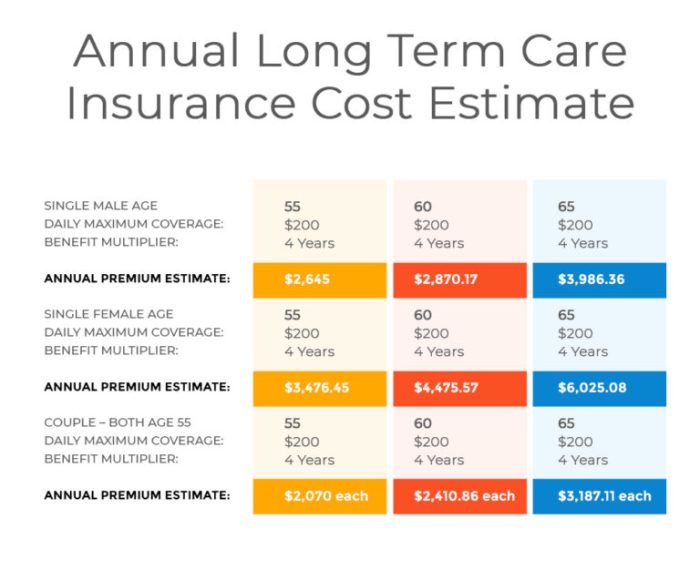

Age is a primary determinant of long-term care insurance premiums. Older applicants generally pay significantly higher premiums than younger applicants. This is because the risk of needing long-term care increases substantially with age. Insurers base their pricing models on actuarial data showing a strong correlation between age and the likelihood of requiring long-term care services. A 50-year-old will typically pay far less than a 70-year-old for the same coverage. This reflects the increased probability of a claim being filed by the older applicant.

Health Status and Premium Calculations

An applicant’s current health status plays a crucial role in premium calculations. Individuals with pre-existing conditions or a family history of conditions that often necessitate long-term care (like Alzheimer’s disease or Parkinson’s disease) will generally face higher premiums. Insurers conduct thorough medical underwriting to assess the risk associated with each applicant. This process may involve reviewing medical records, conducting interviews, and requiring medical examinations. Applicants in excellent health with no significant health history are typically eligible for lower premiums.

Premium Costs Across Policy Types

Different types of long-term care insurance policies carry varying premium structures. Traditional policies offer comprehensive coverage for a wide range of care services, typically resulting in higher premiums. Hybrid policies, which combine long-term care benefits with life insurance, may offer lower premiums initially but may have limitations on the long-term care benefits available. The specific features and benefits offered by each policy type significantly influence the overall cost. For instance, a policy with a higher daily benefit amount will usually command a higher premium.

Geographic Location and Premium Rates

The geographic location of the insured also affects premium costs. Areas with higher costs of living, particularly for healthcare services, tend to have higher premiums. This reflects the insurer’s need to cover the increased expenses associated with providing care in those regions. For example, premiums in major metropolitan areas with high healthcare costs will generally be higher than those in rural areas with lower healthcare expenses.

Inflation’s Role in Long-Term Premium Projections

Inflation significantly impacts long-term premium projections. The cost of healthcare services tends to rise over time, leading to increased premiums. Many policies include an inflation protection rider to help offset the effects of inflation, but this rider usually increases the premium. Ignoring the potential impact of inflation can lead to significant underestimation of future costs. For example, a policy with a fixed benefit may not adequately cover the costs of care in the future if inflation significantly outpaces the policy’s benefit amount.

Premium Comparison Table

| Coverage Level | Age 55 | Age 65 | Age 75 |

|---|---|---|---|

| Basic | $1,000 | $2,500 | $5,000 |

| Standard | $1,500 | $3,750 | $7,500 |

| Comprehensive | $2,000 | $5,000 | $10,000 |

Policy Features and Their Impact on Premiums

Long-term care insurance premiums are significantly influenced by the specific features included in a policy. Understanding these features and their associated costs is crucial for making an informed decision. The level of coverage, duration of benefits, and additional riders all play a vital role in determining the overall premium.

Benefit Periods and Premium Costs

The length of time benefits are paid under a long-term care insurance policy, known as the benefit period, directly impacts the premium. Longer benefit periods, offering coverage for several years, naturally result in higher premiums compared to shorter benefit periods. For example, a policy with a 2-year benefit period will generally be less expensive than a policy with a 5-year benefit period, all other factors being equal. This is because the insurer is assuming a greater financial risk with longer benefit periods. The longer the potential payout, the higher the premium needed to cover that risk.

Policy Riders and Premium Increases

Policy riders add supplemental benefits to the core policy, increasing its cost. Common riders include inflation protection, which adjusts benefits upward to account for inflation over time; home healthcare rider, which provides coverage for in-home care services; and spousal or partner coverage, which extends benefits to a spouse or partner. For instance, adding an inflation protection rider might increase premiums by 10-20%, depending on the specific terms of the rider and the insurer. A home healthcare rider might add another 5-10%, while spousal coverage could add a substantial percentage, potentially doubling the premium in some cases. These increases reflect the added risk and potential payout the insurer undertakes.

Impact of Inflation Protection Riders on Premiums

Inflation protection riders are designed to safeguard the purchasing power of benefits over time. Without inflation protection, the benefits received might not cover the actual cost of care years later. While these riders offer crucial protection, they significantly increase premiums. The extent of the premium increase depends on the type of inflation protection (e.g., compound vs. simple) and the rate of inflation assumed by the insurer. For example, a policy with a compound inflation protection rider might have premiums 20-30% higher than an identical policy without this feature. This reflects the insurer’s need to account for the increasing cost of care over the life of the policy.

Premiums for Policies with Different Benefit Triggers

The specific events triggering benefits also affect premium costs. Policies triggered by a broader range of needs, such as cognitive impairment or a general need for assistance with activities of daily living (ADLs), tend to have higher premiums than those triggered only by severe conditions requiring extensive care. A policy covering cognitive impairment, for example, might have a higher premium than one requiring only a complete inability to perform ADLs. This is because a wider range of circumstances increases the likelihood of a claim and, consequently, the insurer’s payout.

Hypothetical Policy Structure: Benefits and Premiums

Let’s consider a hypothetical policy structure to illustrate the relationship between benefits and premiums:

| Policy Feature | Annual Premium |

|---|---|

| Basic Policy (2-year benefit period, ADL trigger only) | $1,500 |

| Basic Policy + Inflation Protection Rider | $1,800 |

| Basic Policy + Inflation Protection + Home Healthcare Rider | $2,100 |

| Enhanced Policy (5-year benefit period, ADL and Cognitive Impairment trigger) + Inflation Protection + Home Healthcare Rider | $3,500 |

This table shows how the addition of benefits and riders directly increases the annual premium. The enhanced policy with a longer benefit period and broader trigger events is considerably more expensive, reflecting the higher risk assumed by the insurer.

Understanding Premium Payment Options

Choosing the right payment schedule for your long-term health care insurance premiums is a crucial decision impacting your budget and overall cost. Understanding the various options available and their associated advantages and disadvantages can significantly influence your financial planning. This section details different payment methods and their implications.

Premium Payment Methods

Long-term care insurance premiums can typically be paid using several methods, each with its own set of benefits and drawbacks. Common options include monthly, quarterly, semi-annual, and annual payments.

Monthly Payments

Monthly payments offer flexibility and ease of budgeting. They allow for smaller, more manageable payments spread throughout the year. However, this convenience often comes at a slightly higher overall cost due to administrative fees associated with processing more frequent payments.

Annual Payments

Paying annually typically results in the lowest overall cost, as insurers often offer discounts for lump-sum payments. This option requires a larger upfront capital outlay, potentially impacting short-term cash flow. It also carries the risk of unforeseen circumstances disrupting the ability to make the full annual payment.

Quarterly and Semi-Annual Payments

These options represent a compromise between monthly and annual payments. Quarterly payments offer a balance between manageable payments and reduced administrative fees compared to monthly payments. Semi-annual payments offer a similar balance but with fewer payments per year.

Impact of Payment Schedules on Overall Cost

The chosen payment schedule directly affects the total premium cost over the policy’s lifespan. While annual payments generally result in the lowest total cost due to potential discounts, monthly payments incur higher administrative fees, leading to a greater overall expense. Quarterly and semi-annual payments fall somewhere in between.

Comparison of Total Premium Costs Over 10 Years

The following table illustrates a hypothetical example of total premium costs over a 10-year period for different payment options, assuming an annual premium of $2,400 and a 2% administrative fee for monthly payments and 1% for quarterly payments. Note that these are illustrative figures and actual costs may vary based on the insurer and specific policy.

| Payment Schedule | Annual Cost | 10-Year Cost |

|---|---|---|

| Monthly | $2,448 ($2,400 + 2% fee) | $24,480 |

| Quarterly | $2,424 ($2,400 + 1% fee) | $24,240 |

| Semi-Annually | $2,400 | $24,000 |

| Annually | $2,400 | $24,000 |

Predicting Future Premium Increases

Accurately predicting future long-term health care insurance premiums is complex, involving a blend of statistical analysis, actuarial modeling, and consideration of external factors. Understanding these predictive methods empowers consumers to better plan for their future healthcare costs.

Predicting premium growth requires a multifaceted approach. While no method guarantees perfect accuracy, combining various techniques provides a more robust estimate.

Methods for Estimating Future Premium Growth

Several methods leverage historical data to estimate future premium increases. One common approach involves analyzing the historical trend of premium increases, identifying patterns, and extrapolating these patterns into the future. This might involve simple linear regression or more sophisticated time series analysis to account for potential fluctuations. Another approach uses a compound annual growth rate (CAGR) calculation to determine the average annual increase over a specific period, then projects this rate forward. However, these methods assume a consistent growth pattern, which may not always hold true due to external influences.

The Role of Actuarial Assumptions in Premium Projections

Actuarial assumptions are crucial in premium projections. Actuaries, trained professionals who assess and manage risk, use various assumptions to model future claims costs, including factors like life expectancy, healthcare utilization rates, and inflation in medical services. For instance, an assumption of higher-than-expected inflation in medical costs would lead to a projection of higher premium increases. The accuracy of these projections hinges heavily on the validity of these assumptions, which are regularly reviewed and updated based on new data and changing market conditions. A shift in assumptions, even seemingly small, can significantly impact the projected premium increases. For example, an underestimated increase in the cost of prescription drugs could lead to a substantial underestimation of future premium increases.

The Potential Impact of Healthcare Reform on Future Premiums

Healthcare reform initiatives significantly influence future premium projections. Government regulations, changes in reimbursement policies, and the introduction of new healthcare technologies all play a role. For instance, the Affordable Care Act (ACA) in the United States, while aiming to increase access to healthcare, has had a complex impact on premiums, with some arguing it has led to increased costs in certain areas while others believe it has resulted in greater affordability and stability. Similarly, government-mandated coverage expansions or changes in drug pricing policies can drastically alter the projected trajectory of premium increases. Conversely, policies aimed at cost containment or increased efficiency in the healthcare system could lead to lower premium increases than initially projected.

Hypothetical Scenario: Premium Increases Over 20 Years

Let’s consider a hypothetical scenario. Suppose a long-term care insurance policy has an initial annual premium of $3,000. Assuming a conservative annual premium increase of 5%, based on historical trends and actuarial assumptions, the projected premiums over 20 years would be as follows:

| Year | Annual Premium |

|---|---|

| 1 | $3,000 |

| 5 | $3,828.84 |

| 10 | $4,886.68 |

| 15 | $7,776.37 |

| 20 | $12,417.23 |

This hypothetical scenario demonstrates the significant cumulative effect of even a moderate annual increase over an extended period. It highlights the importance of planning for long-term care costs well in advance. It is crucial to remember that this is a simplified illustration and actual premium increases could vary considerably based on numerous factors.

Illustrative Examples of Premium Structures

Understanding long-term care insurance premiums requires examining real-world examples. Premium calculations are complex, factoring in age, health status, policy benefits, and other variables. The following examples illustrate the potential variations in premium structures.

Premium Structure for a 60-Year-Old in Good Health

A 60-year-old individual in good health might find a policy with a monthly premium around $150. This policy could offer a daily benefit of $150, covering a range of services including skilled nursing care, home health care, and assisted living. The policy might have a benefit period of three years, meaning the insurance will pay benefits for up to three years. This particular premium reflects a relatively low level of coverage; a higher daily benefit and longer benefit period would naturally increase the monthly cost. The absence of pre-existing conditions significantly lowers the risk for the insurance provider, thus reducing the premium.

Premium Structure for a 75-Year-Old with Pre-existing Conditions

A 75-year-old with pre-existing conditions, such as diabetes or heart disease, would likely face significantly higher premiums. For a comparable policy offering a daily benefit of $150 and a three-year benefit period, the monthly premium could be $500 or more. The increased cost reflects the higher likelihood of needing long-term care services due to pre-existing health issues. The insurance company assesses a greater risk and adjusts the premium accordingly. The impact of pre-existing conditions is substantial, increasing the cost by several hundred dollars per month.

Comparison of Premium Structures

The key difference between these two examples is the substantial premium increase associated with age and pre-existing conditions. The 75-year-old with pre-existing conditions pays over three times more than the 60-year-old in good health. This highlights the importance of purchasing long-term care insurance earlier in life, when premiums are lower and the likelihood of developing health problems is reduced. The difference underscores the actuarial calculations underlying insurance pricing – a higher risk profile translates directly into a higher premium.

Impact of Different Benefit Levels on Premium Costs

The cost of long-term care insurance is directly tied to the benefits it provides. Let’s illustrate this with hypothetical scenarios:

The following bullet points demonstrate how varying benefit levels affect premium costs:

- Scenario 1: A basic policy with a $100 daily benefit and a two-year benefit period might cost $75 per month.

- Scenario 2: An enhanced policy with a $200 daily benefit and a five-year benefit period could cost $250 per month.

- Scenario 3: A comprehensive policy with a $300 daily benefit, a lifetime benefit period, and inflation protection might cost $500 or more per month.

These scenarios demonstrate a clear correlation: higher daily benefits and longer benefit periods result in substantially higher premiums. The inclusion of additional features, such as inflation protection, further increases the cost. Choosing the appropriate benefit level involves balancing the desired level of coverage with the affordability of the premiums.

Last Point

Planning for long-term health care is a significant financial undertaking, and understanding the dynamics of long-term health care insurance premiums is paramount. By considering factors like age, health status, policy features, and payment options, you can make informed choices that align with your budget and future needs. Remember to carefully evaluate different policies and seek professional advice to ensure you select a plan that provides comprehensive coverage and financial security for the long term.

Query Resolution

What happens if I miss a premium payment?

Missing a premium payment may result in a lapse in coverage, leaving you responsible for any healthcare expenses incurred. Grace periods vary by insurer, but contacting your provider immediately is crucial to avoid disruption of coverage.

Can I change my payment plan after the policy is in effect?

Most insurers allow for adjustments to payment plans, but there may be limitations or fees involved. Contacting your insurer directly to discuss your options is recommended.

Are there tax advantages to paying long-term care insurance premiums?

Tax benefits related to long-term care insurance premiums can vary depending on your location and specific policy. Consulting a tax professional is advisable to understand potential deductions or credits.

How often are premiums typically reviewed and adjusted?

Premium adjustments are common and the frequency varies by insurer and policy type. Some policies have annual reviews, while others may adjust premiums less frequently.